Document 14328281

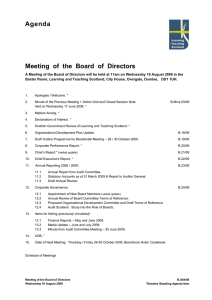

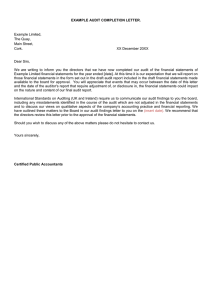

advertisement