Through bull and bear

advertisement

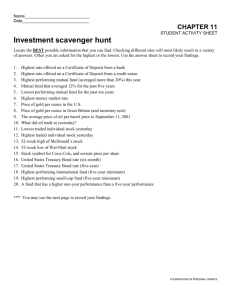

Through bull and bear Peter Verberg. Canadian Business. Toronto: Mar 31, 2003.Vol.76, Iss. 6; pg. 18, 1 pgs http://proquest.umi.com/pqdweb?did=321402181&sid=2&Fmt=3&clientId=68814&RQT= 309&VName=PQD Abstract (Document Summary) When the prospects for the market are hard to discern, people sit on the sidelines. Money market funds now make up seven of the 20 biggest mutual funds in Canada in terms of total assets. Many investors will stay in cash longer than they should paralyzed by the three-year bear market. The investment environment is especially disheartening for those who first entered the market in the late 1990s, put their faith in professional fund managers - and discovered their money would have been safer tucked in a mattress. The average annual return for Canada's 12 largest equity mutual funds since 1998 ranges from 5.6% down to -4.9%. Half of the funds returned less than a money market fund over the five-year period. Full Text (740 words) 12 largest mutual funds in Canada* Confusion reigned supreme this RRSP season. Canadians rushed to top up their contributions before the March 3 deadline, but now lay awake wondering what to do with all the new cash in their investment accounts. The markets are depressed, the US economy seems headed for a double-dip recession, and the world is on edge over Iraq. Contrarian money managers say it's a great time to buy, but their opinions are suspect. Investment superhero Warren Buffett wrote in his annual letter to Berkshire Hathaway shareholders at the end of February that despite three years of falling stock prices he could find very few issues that even mildly interested him. "That dismal fact is testimony to the insanity of valuations reached during The Great Bubble," observed Buffett. "Unfortunately, the hangover may prove to be proportional to the binge." When the prospects for the market are hard to discern, people sit on the sidelines. Money market funds now make up seven of the 20 biggest mutual funds in Canada in terms of total assets. Many investors will stay in cash longer than they should-paralyzed by the three-year bear market. The investment environment is especially disheartening for those who first entered the market in the late 1990s, put their faith in professional fund managers-and discovered their money would have been safer tucked in a mattress. As the table on this page shows, the average annual return for Canada's 12 largest equity mutual funds since 1998 ranges from 5.6% down to -4.9%. Half of the funds returned less than a money market fund over the five-year period. It's not surprising, therefore, that many mutual fund investors simply gave up on the stock market in 2002. Those who stuck around face some difficult choices in the year ahead. The industry would have you believe otherwise, of course. Funds are often portrayed in advertisements as the ultimate stress-free approach to investing, but that only works if you're lucky enough to find a good fund manager who can navigate the market to produce better-than-average returns at a reasonable price. Too many money managers deliver inferior results-and get paid handsomely for it. They get rich; their unitholders get squat. How does a person find a capable fund manager? One method is to look at past performance-the assumption being that a manager who beat the average in the past is likely to keep doing so in the future. Intuitively, it seems like a good approach, but the evidence can be somewhat contradictory. To test the theory, I looked at the average annual return for Canada's largest equity funds, over two consecutive five-year periods, starting in 1993. Four of the top six performers from 1993 to 1998 also made it into the top six in the past five years. Those four included two Trimark funds (Select Growth and Trimark SC), Fidelity Canadian Asset Allocation and AGF International Value. Interestingly, the four funds managed to outperform their peers in two distinct market cycles-a speculative bull and a take-no-prisoners bear. However, past performance was not a reliable guide in the case of the two Templeton funds. They came in first and fourth in the 1993-1998 period, but were at the very bottom of the heap in the five years that followed. In fact, Templeton International Stock fund went from first place to twelfth under fund manager Don Reed. It's also instructive to look at more recent data-the last three years-to see how each of the fund managers performed during the bear market. All three Trimark funds did well compared to the average, posting annual returns ranging from 4.1% to 6%. However, both Fidelity Canadian Asset Allocation and ACF International Value have taken a turn for the worse, posting three-year returns of 0.5% and -0.2%, respectively. AGF's onetime star fund's fallen on hard times since its former manager, Brandes Investment Partners, was replaced by Harris Associates. Among the top 12 funds mentioned here, Trimark's look the most compelling. However, the universe of smaller funds will have other examples of consistently strong performers; I merely looked at the 12 biggest for convenience. Past performance can't guarantee future returns-but it's more reliable than a blind guess. [Sidebar] How do you find a capable fund manager? Past performance can't guarantee future returns-but it's more reliable than a blind guess