Schroders Portfolio Solutions Monthly

advertisement

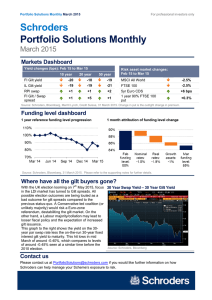

Portfolio Solutions Monthly March 2014 For professional investors only Schroders Portfolio Solutions Monthly March 2014 Markets Dashboard Yield changes (bps): February 2014 to March 2014 10 year 20 year 50 year Risk asset market changes: February 2014 to March 2014 FI Gilt yield +4 +0 +2 MSCI All World +1.3% IL Gilt yield -5 -6 -7 FTSE 100 -3.1% RPI swap +4 +4 +6 5yr Euro CDS +5 bps FI Gilt / Swap spread +2 +2 +3 1 year 90% FTSE 100 put - Source: Schroders, Bloomberg, Merrill Lynch, Credit Suisse, 31 March 2014. Change in put is the outright change in premium. Source: Schroders, 31 March 2014. Funding level dashboard 1 year reference funding level progression 1 month attribution of funding level change 122% 130% 120% 121% 110% 120% 100% 90% Mar 13 Jun 13 Sep 13 Dec 13 Mar 14 Feb funding level: 121% Nominal rates: +0.1% Real rates: -0.8% Growth assets: +0.4% Mar funding level: 121% Source: Schroders, Bloomberg, 31 March 2014. Please refer to the supporting notes section on page 4. Budget and gilt issuance calendar commentary Below we set out our thoughts on the key LDI developments from the 2014 Budget: — Overall Gilt issuance expected for 2014-2015 is predicted to be £128.4 billion. This was lower than many observers had predicted and would represent the lowest level of gross issuance since 2007-08. — Index-linked gilt supply for the year will be c£31 billion, down from c£37 billion for 2013-14. This somewhat limited supply in the face of continuing LDI demand could pose a headwind for real yields in the short-term. — The budget also contained a radical overhaul of retirement options for DC members, removing the requirement for the purchase of annuities. Whilst this could reduce demand for annuities and therefore long dated gilts it is far from certain that this reduced demand will represent a significant upward pressure on long dated gilt yields. Given the first wave of an aging DC population, continued DB pension scheme demand and the expected innovation in retirement products it is far from certain that demand will reduce and contribute to a significant upward pressure on long dated gilt yields. Contact us The Schroders Portfolio Solutions team partners with investors to provide risk management strategies across all major financial markets. Please contact us at PortfolioSolutions@schroders.com if you would like further information on how Schroders can help manage your Scheme’s exposure to risk. Portfolio Solutions Monthly March 2014 For professional investors only Market data: LDI markets One year range •L H• Month end 31 Mar 2014 One Three One Month Months Year 28 Feb 31 Dec 31 Mar 2014 2013 2013 Month end curve (LHS): Nominal rates - Gilt markets 5 Year 1.91% 1.84% 2.07% 0.75% 10 Year 2.92% 2.89% 3.20% 1.94% 20 Year 3.62% 3.62% 3.78% 3.13% 30 Year 3.72% 3.72% 3.85% 3.54% 50 Year 3.57% 3.54% 3.65% 3.45% 1 Month change (RHS, Bps): 5.0% 40 2.5% 0 0 10 20 30 40 50 0.0% -40 Real rates - Index-linked gilt markets 5 Year -0.99% -0.99% -0.96% -2.27% 10 Year -0.24% -0.20% -0.07% -1.38% 20 Year 0.01% 0.07% 0.11% -0.44% 30 Year -0.01% 0.05% 0.10% -0.19% 50 Year -0.07% 0.00% 0.02% -0.16% 5 Year 3.11% 3.03% 3.16% 3.40% 10 Year 3.29% 3.25% 3.37% 3.53% 20 Year 3.61% 3.57% 3.70% 3.68% 30 Year 3.67% 3.64% 3.74% 3.73% 50 Year 3.67% 3.62% 3.73% 3.76% 2.0% 10 0.0% 0 -2.0% -10 0 10 20 30 40 50 Inflation rates - RPI swap market 5.0% 15 2.5% 0 0.0% -15 0 10 20 30 40 50 Nominal gilt curve vs swap curve 5 Year -0.16% -0.14% -0.10% -0.22% 10 Year 0.03% 0.01% 0.10% -0.02% 20 Year 0.22% 0.20% 0.21% 0.17% 30 Year 0.31% 0.30% 0.30% 0.28% 50 Year 0.25% 0.22% 0.24% 0.14% Global bond markets 0.5% 10 0.0% 0 -0.5% -10 0 10 20 30 50 Forward gilt curves 10 Year Bund 1.57% 1.62% 1.93% 1.29% 10 Yr Gilt / Bund Spread 1.15% 1.08% 1.07% 0.47% 10 Year US Treasury 2.72% 2.65% 3.03% 1.85% 10 Yr Gilt / US Spread 0.02% 0.07% -0.01% -0.08% 5 year IG CDS - Euro 76 71 70 126 5 year IG CDS - US 69 64 62 91 Money markets 5.0% 2.5% Gilt curve 3 yrs fwd 1 yr fwd 5 yrs fwd 0.0% 0 Currency rates 10 20 31 Mar 2014 30 40 50 28 Feb 31 Dec 31 Mar 2014 2013 2013 Bank of England base 0.50% 0.50% 0.50% 0.50% GBP / USD 1.67 1.67 1.66 SONIA 0.42% 0.42% 0.43% 0.41% GBP / EUR 1.21 1.21 1.20 1.18 3m Libor 0.52% 0.52% 0.53% 0.51% GBP / JPY 171.9 170.4 174.4 142.9 3y20y 5y20y 3y30y 5y30y Interest rate swaptions as at month end: 1y20y ATM* Forward Par swap rate 3.42% 3.66% 3.75% 3.58% 3.63% ATM* Implied volatility 65.5 69.7 67.6 61.8 61.8 Source: Schroders, Bloomberg, 31 March 2014. *At the money. All data as at month end allowing for UK trading days. 2 40 1.52 Portfolio Solutions Monthly March 2014 For professional investors only Market data: Risk management strategies One year range •L H• Month end 31 Mar 2014 One Three One Month Months Year 28 Feb 31 Dec 31 Mar 2014 2013 2013 Equity indices MSCI All World 196 194 194 172 FTSE 100 6,598 6,810 6,749 6,412 S&P 500 1,872 1,859 1,848 1,569 Euro Stoxx 50 3,162 3,149 3,109 2,624 Nikkei 225 14,828 14,841 16,291 12,336 MSCI All World Total Return (re-based to 100) 120 100 80 Mar 13 Jun 13 Sep 13 Dec 13 Mar 14 Equity option market indicators (FTSE 100, 1 year) ATM* Implied volatility 13.6% 13.6% 14.0% 14.0% Skew (110 - 90) 4.3% 4.1% 3.9% 4.6% ATM implied 1 year volatility 20.0% Skew (110 vol - 90 vol) 5.0% 15.0% 4.0% 10.0% Mar 13 Jun 13 Sep 13 Dec 13 Mar 14 3.0% Mar 13 Jun 13 Sep 13 Dec 13 Mar 14 Equity risk management strategy indicators (FTSE 100 total return, spot prices) Zero cost put spread collar call strike (70% / 90%) 109.3% 90% Put Zero cost collar call strike (90% Put) 1 yr 2.2% 107.9% 3 yr 5.5% 116.5% 123.8% 95% Put Zero cost collar call strike (95% Put) Zero cost put spread collar call strike (70% / 95%) 1 yr 3.3% 104.7% 105.6% 3 yr 7.0% 112.5% 117.9% NB - one year range indicators for equity risk management strategies are based on month end values for the past 8 months. Source: Schroders, Bloomberg, Merrill Lynch, Credit Suisse, 31 March 2014. *At the money. All data as at month end allowing for UK trading days. About us The Schroders Portfolio Solutions Team partners with investors to provide risk management strategies across all major financial markets. The team structures and executes physical and derivative based strategies to manage the exposure to global equity and fixed income markets. These solutions draw on the full opportunity set of exchange traded and OverThe-Counter derivatives. To help manage interest and inflation rate risk, Schroders Portfolio Solutions offers a comprehensive and fully flexible solution utilising segregated solutions (encompassing physical bonds, swaps, swaption and synthetic gilt based strategies), as well as the Schroder Matching Plus pooled fund solution. We also provide funding level and market based trigger monitoring and execution for both pooled and segregated solutions. Clients can access these solutions under directed or discretionary mandates. 3 Portfolio Solutions Monthly March 2014 For professional investors only Notes The funding level dashboard shows the funding level progression and attribution of funding level change of a Reference Pension Scheme. This Reference Pension Scheme has a liability duration of around 20 years and assumes the liability is linked 50% to real interest rates and 50% to nominal rates. The assets are assumed to have a beta of 0.75 to global equity markets. This enables the reader to observe the scale of component changes. No allowance for the impact of the progression of time on liabilities is included in the funding level dashboard. Funding level progression is presented on a rolling 12 month basis, indexed to an initial funding level of 100%. Important Information For professional investors only. The views and opinions contained herein are those of the Portfolio Solutions Team at Schroders, and do not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This newsletter is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The material is not intended to provide, and should not be relied on for, accounting, legal or tax advice, or investment recommendations. Information herein is believed to be reliable but Schroder Investment Management Limited (SIM) does not warrant its completeness or accuracy. Reliance should not be placed on the views and information in the document when taking individual investment and/or strategic decisions. Past performance is not a guide to future performance and may not be repeated. The value of investments and the income from them may go down as well as up and investors may not get back the amounts originally invested. The forecasts stated in the newsletter are the result of statistical modelling, based on a number of assumptions. Forecasts are subject to a high level of uncertainty regarding future economic and market factors that may affect actual future performance. The forecasts are provided to you for information purposes as at today's date. Our assumptions may change materially with changes in underlying assumptions that may occur, among other things, as economic and market conditions change. We assume no obligation to provide you with updates or changes to this data as assumptions, economic and market conditions, models or other matters change. For your security, communications may be taped or monitored. Issued in April 2014 by Schroder Investment Management Limited, 31 Gresham Street, London EC2V 7QA. Registration No. 1893220 England. Authorised and regulated by the Financial Conduct Authority. INS02896 4