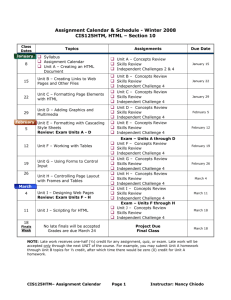

Employment

advertisement