The University of South Carolina Development Foundation and Subsidiaries

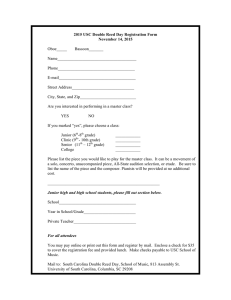

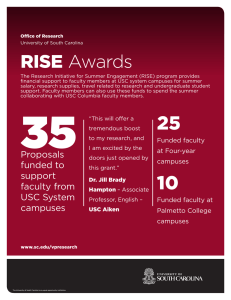

advertisement

The University of South Carolina Development Foundation and Subsidiaries Report on Consolidated Financial Statements For the years ended June 30, 2015 and 2014 The University of South Carolina Development Foundation and Subsidiaries Contents Page Independent Auditor’s Report .............................................................................................................................. 1-2 Financial Statements Consolidated Statements of Financial Position ................................................................................................... 3 Consolidated Statement of Activities for the Year Ended June 30, 2015 ........................................................... 4 Consolidated Statement of Activities for the Year Ended June 30, 2014 ........................................................... 5 Consolidated Statements of Net Assets .............................................................................................................. 6 Consolidated Statements of Cash Flows ............................................................................................................. 7 Notes to Consolidated Financial Statements ................................................................................................ 8-25 Supplemental Schedules 1 - Consolidating Schedule of Assets, Liabilities and Net Assets/Members’ Deficit - June 30, 2015 ................26 2 - Consolidating Schedule of Revenues, Expenses and Changes in Net Assets/Members’ Deficit For the Year Ended June 30, 2015 ................................................................................................................27 3 - Consolidating Schedule of Assets, Liabilities and Net Assets/Members’ Deficit - June 30, 2014 ................28 4 - Consolidating Schedule of Revenues, Expenses and Changes in Net Assets/Members’ Deficit For the Year Ended June 30, 2014 ................................................................................................................29 Independent Auditor’s Report Board of Directors The University of South Carolina Development Foundation and Subsidiaries Columbia, South Carolina Report on the Consolidated Financial Statements We have audited the accompanying consolidated financial statements of The University of South Carolina Development Foundation and Subsidiaries (the “Foundation”) which comprise the consolidated statements of financial position as of June 30, 2015 and 2014, and the related consolidated statements of activities, changes in net assets and cash flows for the years then ended and the related notes to the consolidated financial statements. Management’s Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free from material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion. Elliott Davis Decosimo | www.elliottdavis.com Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of The University of South Carolina Development Foundation and Subsidiaries as of June 30, 2015 and 2014, and the changes in its net assets and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America. Report on Supplementary Information Our audits were conducted for the purpose of forming an opinion on the consolidated financial statements taken as a whole. The accompanying supplementary information is presented for purposes of additional analysis and is not a required part of the consolidated financial statements. Such information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the consolidated financial statements. The information has been subjected to the auditing procedures applied in the audits of the consolidated financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the consolidated financial statements or to the consolidated financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the information is fairly stated in all material respect in relation to the consolidated financial statements as a whole. Columbia, South Carolina October 16, 2015 2 The University of South Carolina Development Foundation and Subsidiaries Consolidated Statements of Financial Position As of June 30, 2015 and 2014 2015 Assets Cash and cash equivalents Investments in securities Contributions receivable, net Other receivables Prepaid expenses Property and equipment, net Real estate held for investment Other assets Total assets $ $ 2014 2,104,221 35,897,932 2,280,315 163,229 26,428 67,998,678 25,305,723 487,003 134,263,529 $ 6,820,850 21,250,076 8,513,600 54,957,967 4,977,137 442,682 296,708 20,000 97,279,020 $ $ 3,226,414 31,387,655 2,183,627 332,739 21,857 21,706,986 28,631,363 172,735 87,663,376 Liabilities and Net Assets Liabilities Accounts payable and accrued expenses Lines-of-credit Notes payable Bonds payable Interest rate swaps Funds held for others Deferred revenue Advances from members Total liabilities $ 3,238,248 19,563,616 8,969,734 11,596,180 2,417,379 17,866 45,803,023 Net assets Unrestricted net assets Board designated for investments Undesignated Total unrestricted net assets 23,730,673 (14,538,154) 9,192,519 22,905,198 (7,270,099) 15,635,099 Temporarily restricted net assets Permanently restricted net assets Total Foundation net assets Noncontrolling interest Total net assets Total liabilities and net assets 24,828,012 3,365,928 37,386,459 (401,950) 36,984,509 134,263,529 23,317,790 3,365,928 42,318,817 (458,464) 41,860,353 87,663,376 $ See Notes to Consolidated Financial Statements 3 $ The University of South Carolina Development Foundation and Subsidiaries Consolidated Statement of Activities For the year ended June 30, 2015 Temporarily Restricted Unrestricted Revenues and support Investment returns Rental income Room revenue Other Support Net assets released from restrictions Total revenues and support $ 1,089,563 782,391 3,783,140 462,939 13,475 217,045 6,348,553 $ 445,719 11,498 1,270,050 (217,045) 1,510,222 Permanently Restricted $ - Total $ 1,535,282 782,391 3,783,140 474,437 1,283,525 7,858,775 Expenses Supporting services Management and general USC Hotel Associates Program services Investment services Property services Unrealized loss on interest rate swaps Loss on sale of real estate held for investment Total expenses 439,408 3,940,575 - - 439,408 3,940,575 423,018 705,626 2,559,758 4,666,234 12,734,619 - - 423,018 705,626 2,559,758 4,666,234 12,734,619 Change in net assets (6,386,066) - (4,875,844) - (56,514) Net change attributable to noncontrolling interest in USC Hotel Associates, LLC Change in net assets attributable to the Foundation 1,510,222 (56,514) $ (6,442,580) See Notes to Consolidated Financial Statements 4 - $ 1,510,222 $ - $ (4,932,358) The University of South Carolina Development Foundation and Subsidiaries Consolidated Statement of Activities For the year ended June 30, 2014 Unrestricted Revenues and support Investment returns Rental income Room revenue Gain on sale of real estate held for investment Other Support Net assets released from restrictions Total revenues and support $ $ 2,121,424 385,711 20,203 374,468 11,692,260 Expenses Supporting services Management and general USC Hotel Associates Program services Investment services Property services Unrealized loss on interest rate swaps Total expenses Change in net assets $ - Total $ 5,073,460 779,335 3,472,989 - 2,121,424 511,759 846,898 12,805,865 512,802 3,666,552 - - 512,802 3,666,552 405,341 1,042,472 1,206,717 6,833,884 - - 405,341 1,042,472 1,206,717 6,833,884 - 5,971,981 1,113,605 (42,774) $ 535,330 - Permanently Restricted 126,048 826,695 (374,468) 1,113,605 4,858,376 Net change attributable to noncontrolling interest in USC Hotel Associates, LLC Change in net assets attributable to the Foundation 4,538,130 779,335 3,472,989 Temporarily Restricted 4,815,602 See Notes to Consolidated Financial Statements 5 - $ 1,113,605 - $ - (42,774) $ 5,929,207 The University of South Carolina Development Foundation and Subsidiaries Consolidated Statements of Net Assets For the years ended June 30, 2015 and 2014 Net Assets Unrestricted Temporarily Board Designated Undesignated Restricted Balance, July 1, 2013 Change in net assets Balance, June 30, 2014 Change in net assets Balance, June 30, 2015 $ $ 18,765,388 4,139,810 22,905,198 825,475 23,730,673 $ $ (7,945,891) 675,792 (7,270,099) (7,268,055) (14,538,154) $ 22,204,185 1,113,605 23,317,790 1,510,222 24,828,012 $ See Notes to Consolidated Financial Statements 6 Permanently Restricted $ $ 3,365,928 3,365,928 3,365,928 Noncontrolling Interest $ $ (501,238) 42,774 (458,464) 56,514 (401,950) Total $ $ 35,888,372 5,971,981 41,860,353 (4,875,844) 36,984,509 The University of South Carolina Development Foundation and Subsidiaries Consolidated Statements of Cash Flows For the years ended June 30, 2015 and 2014 2015 Cash flows from operating activities Change in net assets Adjustments to reconcile change in net assets to net cash provided by operating activities Provision for uncollectible contributions receivable Discount on contributions receivable Net realized and unrealized gains on investments Loss on sale/disposal of property and equipment Loss (gain) on sale of real estate held for investment Net unrealized loss on interest rate swaps Depreciation expense Forgiveness of notes payable Changes in deferred and accrued amounts Decrease in other receivables Decrease (increase) in contributions receivable Decrease (increase) in prepaid expenses Increase (decrease) in funds held for others Decrease (increase) in other assets Increase in accounts payable and accrued expenses Increase in deferred revenue Net cash provided by operating activities $ (4,875,844) 2014 $ 5,971,981 299,052 38,037 (1,535,282) 68,087 4,666,234 2,559,758 551,300 (13,333) (148,546) 14,699 (4,897,900) 2,837 (2,121,424) 1,206,717 486,787 (13,333) 169,510 (433,777) (4,571) 424,816 (314,268) 3,582,602 296,708 5,479,029 242,391 105,060 27,266 (437) 78,234 1,938,546 2,892,878 Cash flows from investing activities Proceeds from sales of real estate held for investment Purchases of real estate held for investment Net purchases of investment securities Increase in construction in progress Purchases of property and equipment Net cash used for investing activities 3,725,785 (5,066,379) (2,974,995) (46,430,594) (480,486) (51,226,669) 4,175,000 (350,426) (467,404) (5,461,923) (815,160) (2,919,913) Cash flows from financing activities Net borrowings on line-of-credit agreements Proceeds on bonds payable Advances from members Principal payments on bonds payable Principal payments on notes payable Net cash provided by financing activities Net change in cash and cash equivalents 1,686,460 43,691,893 20,000 (330,106) (442,800) 44,625,447 (1,122,193) 3,136,337 (1,713,409) (419,200) 1,003,728 976,693 Cash and cash equivalents, beginning of year Cash and cash equivalents, end of year $ 3,226,414 2,104,221 $ 2,249,721 3,226,414 Supplemental disclosures Interest paid $ 850,799 $ 902,068 Noncash investing and financing activities Net unrealized loss on interest rate swaps Forgiveness of notes payable $ $ See Notes to Consolidated Financial Statements 7 (2,559,758) 13,333 $ $ (1,206,717) 13,333 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 1. Nature of Business and Significant Accounting Policies Nature of business: The University of South Carolina Development Foundation and Subsidiaries (the Foundation) was organized on May 17, 1965, under the laws of South Carolina as an eleemosynary corporation. The primary purposes of the Foundation are to acquire real and personal property; and to hold, rent, sell, or transfer such property in accordance with the needs and demands of the University of South Carolina (the University). Because the primary purpose of the Foundation is for the benefit of the University, the Foundation is considered a component unit of the University and is thus included in the University's financial statements. Principles of consolidation: The consolidated financial statements include the accounts of The University of South Carolina Development Foundation, and its wholly owned subsidiaries, Inn at USC, LLC; CDRC, LLC; Wheeler Hill Development, LLC; AdessoDF, LLC; Williams At Blossom, LLC; USC DF-West Campus, LLC; USC Innovation, LLC; and its 80% owned subsidiary USC Hotel Associates, LLC. Significant intercompany accounts and transactions have been eliminated. Basis of accounting: The accompanying consolidated financial statements have been prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America. Financial statement presentation follows the recommendations of the Financial Accounting Standards Board Accounting Standards Codification (ASC). Under the ASC, the Foundation is required to report information regarding its financial position and activities according to three classes of net assets: unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets. Cash and cash equivalents: For financial reporting purposes, cash and cash equivalents are defined as cash and short-term highly liquid investments that are readily convertible into cash and present an insignificant risk of change in value due to interest rate changes because of their short-term maturity. Investments in securities: The Foundation's investments in securities are stated at fair market value in accordance with the ASC. Under the ASC, investments in marketable securities with readily determinable fair values and all investments in debt securities are valued at their fair values in the consolidated statement of financial position. Unrealized gains and losses are included in the change in net assets in investment returns. 8 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 1. Nature of Business and Significant Accounting Policies, Continued Derivative financial instruments: The Foundation recognizes all derivative financial instruments on the consolidated statement of financial position at fair value in accordance with the ASC. The fair value is obtained from the financial institution issuing the instrument. Changes in the value of derivative financial instruments are recorded each period in current earnings. The Foundation entered into interest rate swap agreements, which effectively exchange variable interest rate debt for fixed interest rate debt. These agreements are used to reduce the exposure to possible increases in interest rates and are accounted for as a cash flow hedge. The Foundation entered into these swap agreements with major financial institutions. Interest rate swap settlements are recognized as adjustments to interest expense in the consolidated statements of activities. Management believes that the derivative financial instruments are effective in protecting the Foundation from interest fluctuations. Contributions receivable: The Foundation has adopted the provisions of the ASC for the accounting of contributions received and contributions made. Under the ASC, contributions are required to be recognized when the donor makes a promise to give that, in substance, is unconditional. All contributions are available for unrestricted use unless specifically restricted by the donor. Contributions that are restricted by the donor are reported as increases in temporarily restricted net assets or permanently restricted net assets depending on the nature of the restrictions. Unconditional promises to give (pledges) are stated net of an allowance for doubtful accounts. Pledges are periodically evaluated for collectability based on management’s assessment of the collectability of each pledge. Unconditional promises to give due in the next year are recorded at their net realizable value. Unconditional promises to give due in subsequent years are reported at the present value of their net realizable value, using discount rates applicable to the years in which the promises are to be received. Other receivables: Management considers all other receivables balances to be fully collectible; therefore, no allowance for uncollectible accounts is included in the consolidated financial statements. Property and equipment: Property and equipment are stated at cost. Donated property is stated at estimated fair value at the date of the donation. Depreciation is computed principally by the straight-line method for financial reporting purposes over estimated useful lives ranging from five to forty years. The Foundation reviews the carrying values of its long-lived assets for possible impairment whenever events or changes in circumstances indicate the carrying amount of the assets may not be recoverable. Any long-lived assets held for sale are reported at the lower of their carrying amounts or fair value less estimated costs to sell. 9 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 1. Nature of Business and Significant Accounting Policies, Continued Deferred revenue: Deferred revenue represents lease payments received by USC DF – West Campus, LLC relating to future lease periods. Income taxes: The Foundation is exempt from income taxes under Section 501(c)(3) of the Internal Revenue Code. Further, it is exempt from excise taxes and other restrictions because it has been determined by the Internal Revenue Service that the Foundation is not a private foundation within the meaning of the Internal Revenue Code Section 509(a). The Foundation recognizes income tax on certain unrelated business income under rules of the Internal Revenue Service for nonprofit organizations, except as exempted by Section 514, for activities related to its mission to support the University. Accounting principles generally accepted in the United States of America require management to evaluate tax positions taken by the Foundation and recognize a tax liability (or asset) if the Foundation has taken an uncertain position that more likely than not would not be substantiated upon examination by the IRS. Management has analyzed the tax positions taken by the Foundation, and has concluded that as of June 30, 2015 and 2014, there are no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the consolidated financial statements. The Foundation is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. Management believes it is no longer subject to income tax examinations for the years prior to 2012. Use of estimates: The preparation of consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are particularly susceptible to significant change relate to the determination of the allowance for uncollectible contributions receivable. It is at least reasonably possible that a change in this estimate will occur in the near term. Reclassifications: Certain reclassifications have been made to the 2014 consolidated financial statement presentation to correspond to the 2015 consolidated financial statement presentation. Subsequent events: In preparing these consolidated financial statements, the Foundation has evaluated events and transactions for potential recognition or disclosure through October 16, 2015, the date the consolidated financial statements were available to be issued. 10 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 2. Concentrations of Credit Risks Financial instruments that potentially expose the Foundation to concentrations of credit and market risk consist primarily of cash and cash equivalents and investments. Cash and cash equivalents are maintained at high-quality financial institutions and credit exposure to any one institution is limited. The Foundation has not experienced any losses on its cash and cash equivalents. The Foundation’s management believes that its investments do not represent significant concentrations of market risk because the Foundation’s investment portfolio is adequately diversified among issuers. Note 3. Fair Value Measurements The framework for measuring fair value provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of the fair value hierarchy are described as follows: Level 1 Inputs to the valuation methodology are unadjusted quoted prices for identical assets or liabilities in active markets that the Foundation has the ability to access. Level 2 Inputs to the valuation methodology include: Quoted prices for similar assets or liabilities in active markets; Quoted prices for identical or similar assets or liabilities in inactive markets; Inputs other than quoted prices that are observable for the asset or liability; Inputs that are derived principally from or corroborated by observable market data by correlation or other means. If the asset or liability has a specific (contractual) term, the Level 2 input must be observable for substantially the full term of the asset or liability. Level 3 Inputs to the valuation methodology are unobservable and significant to the fair value measurement. The asset or liability’s fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used need to maximize the use of observable inputs and minimize the use of unobservable inputs. Following is a description of the valuation methodologies used for assets measured at fair value. There have been no changes in the methodologies used at June 30, 3015 and 2014. Money market funds: Valued on the active market on which it is traded, at amortized cost, which approximates fair value. Mutual and equity funds: Valued at the closing price reported on the active market on which the individual securities are traded. Hedge funds and private equity funds: Valued at fair market value, as determined by the managers of the private equity funds or hedge funds as reported to them by the general partner of the underlying funds or partnerships. Interest rate swap: Valued at the carrying value of the interest rate swap, based on the interest rate spread between the underlying contracts and current market interest rates. 11 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 3. Fair Value Measurements, Continued The Foundation had the following levels of investments as defined in the framework measured on a recurring basis: June 30, 2015 Level 1 Level 2 Level 3 Total Investments in securities: Active Manager Equities Large Cap Value Small Cap Value Small Cap Growth Large Cap Growth ETF Index Equities Mutual Fund Equities International Equities Money Market Mutual Fund Hedge Funds Private Equities Total investment in securities Interest rate swap $ 6,527,090 $ - $ 2,177,531 1,536,287 1,732,322 4,813,339 1,995,764 5,633,006 6,740,019 $ 31,155,358 $ - $ $ $ (4,977,137) $ Hedge Funds Beginning balance Unrealized gains (losses) Purchases, issuances, settlements Realized gains Cash distributions Ending balance $ $ Level 1 Investments in securities: Active Manager Equities Large Cap Value Small Cap Growth Large Cap Growth ETF Index Equities Mutual Fund Equities International Equities Money Market Mutual Fund Hedge Funds Private Equities Total investment in securities Interest rate swap $ 3,909,219 $ 159,833 4,069,052 $ Level 3 Private Equities 701,825 $ (77,185) 176,380 122,510 (250,008) 673,522 $ June 30, 2014 Level 2 Level 3 5,984,089 $ - $ 2,323,062 1,609,027 5,598,574 1,746,382 5,783,781 3,731,696 $ 26,776,611 $ - $ $ $ (2,417,379) $ 12 - $ 6,527,090 2,177,531 1,536,287 1,732,322 4,813,339 1,995,764 5,633,006 6,740,019 4,069,052 4,069,052 673,522 673,522 4,742,574 $ 35,897,932 - $ (4,977,137) Total 4,611,044 82,648 176,380 122,510 (250,008) 4,742,574 Total - $ 5,984,089 2,323,062 1,609,027 5,598,574 1,746,382 5,783,781 3,731,696 3,909,219 3,909,219 701,825 701,825 4,611,044 $ 31,387,655 - $ (2,417,379) University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 3. Fair Value Measurements, Continued Hedge Funds Beginning balance Unrealized gains Purchases, issuances, settlements Realized gains Cash distributions Ending balance $ $ June 30, 2014 Level 3 Hedge Fund Private of Funds Equities 2,103,885 $ 1,687,468 $ 176,768 108,496 1,628,566 (1,795,964) 3,909,219 $ - $ Total 695,729 $ 6,660 181,989 92,546 (275,099) 701,825 $ 4,487,082 291,924 14,591 92,546 (275,099) 4,611,044 The following tables for June 30, 2015 and 2014 set forth a summary of the Foundation’s Level 3 investments at NAV: Investment Hedge Funds Och-Ziff Overseas Fund II, Ltd. HBK Offshore Fund Ltd. Claren Road Credit Fund, Ltd. Fir Tree International Value Fund Graham Global Investment Fund II SPC, Ltd. Proprietary Matrix Segregated Portfolio MKP Opportunity Offshore, Ltd. Fair value $ Private Equity Siguler Guff Distressed Opportunity Funds III, LP Kayne Anderson Energy Fund VI, L.P. Venture Investment Association NGP Natural Resources XI $ Investment Hedge Funds Och-Ziff Overseas Fund II, Ltd. HBK Offshore Fund Ltd. Claren Road Credit Fund, Ltd. Fir Tree International Value Fund Graham Global Investment Fund II SPC, Ltd. Proprietary Matrix Segregated Portfolio MKP Opportunity Offshore, Ltd. 1,306,540 $ 1,080,716 337,962 417,264 - 497,422 429,148 4,069,052 - 441,515 161,643 57,248 13,116 673,522 4,742,574 $ Fair value $ Private Equity Siguler Guff Distressed Opportunity Funds III, LP Kayne Anderson Energy Fund VI, L.P. $ June 30, 2015 Unfunded Redemption commitment frequency 26,561 103,982 247,823 294,000 672,366 672,366 Redemption notice period (a) (b) (c) (d) (e) (a) (b) (c) (d) (e) (f) (f) (g) (g) (g) (g) (g) (g) (g) (g) June 30, 2014 Unfunded Redemption commitment frequency Redemption notice period 1,216,772 $ 1,070,631 407,075 414,970 402,621 - (a) (b) (c) (d) (e) (a) (b) (c) (d) (e) 397,150 3,909,219 - (f) (f) (g) (g) (g) (g) 623,931 77,894 701,825 4,611,044 $ 13 61,977 166,855 228,832 228,832 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 3. Fair Value Measurements, Continued (a) Redemptions from the Och-Ziff Overseas Fund II, Ltd. may occur on the last day of any fiscal quarter. The fund requires written notice of intent to withdraw assets 30 days prior to the redemption date and the minimum redemption amount is $50,000. (b) The HBK Offshore Fund, Ltd. requires written notice of intent to withdraw assets 90 to 120 days prior to the redemption date. The minimum redemption amount is $250,000, however, the Foundation may redeem up to 25% of its interest, measured by net asset value, on any redemption date. (c) The Claren Road Credit Fund, Ltd. requires written notice of intent to withdraw assets 45 to 60 days prior to the redemption date. Redemptions may occur on the last day of any month, however, when the redemption is not at the end of a quarter, the redemption is subject to a 4% liquidation fee. This fund reserves the right to withhold 5% of the investment value if the Foundation liquidates 95% or more of the investment. The remaining 5% would be available to the Foundation upon completion of the annual audit of this fund. (d) Following the two year anniversary of capital contributed to the Fir Tree International Value Fund, the Foundation may make withdrawals from this fund upon providing written notification 90 days prior to the redemption. The Foundation will be eligible for subsequent redemptions from this fund on the two year anniversary of the initial redemption date. (e) There is no minimum holding period for the Foundation’s interest in Graham Global Investment Fund II SPC, Ltd. Proprietary Matrix Segregated Portfolio. This fund may be redeemed on the last day of each month upon written notice of intent to withdraw assets three days prior to the redemption date. (f) Redemptions from the MKP Opportunity Offshore, Ltd. require notification 60 days prior to the redemption date, which may be the last business day of any calendar month. This fund reserves the right to withhold 5% of the investment balance until year-end. (g) The fund manager determines the amount, timing and form of all distributions made by this fund. Note 4. Investments in Securities Investments purchased are recorded at cost. Securities or other investments donated are recorded at their fair value at the date of the gift. Investments are carried at fair value with gains or losses being recognized and reported in the consolidated statement of activities in the appropriate classes as prescribed by the ASC. The Foundation pooled substantially all of their endowment funds along with funds of the USC Educational Foundation, USC Business Partnership Foundation and the USC Alumni Association into one investment pool. The funds of the Foundation in the investment pool are spread among twenty-three different funds and of those, six are hedge funds, four are private equity funds, one is an index fund, five are active manager funds, and seven are mutual funds. The Foundation has presented its pro rata share of these individual investments within these consolidated financial statements, however all pooled investments are held in the name of the USC Educational Foundation. Note 5. Contributions Receivable, net The Foundation recognized unconditional promises to give as contributions receivable due to be collected as follows as of June 30: 2015 2014 Less than one year One to five years Six or more years $ Less allowance for uncollectible pledges Less 8% discount for time value of money $ 14 1,528,099 2,859,402 195,748 4,583,249 1,664,271 638,663 2,280,315 $ $ 1,273,908 2,610,034 265,530 4,149,472 1,365,219 600,626 2,183,627 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 6. Endowments The Foundation’s endowments consist of approximately seven individual funds established for various purposes. Its endowments include both donor-restricted funds and funds designated by the Board of Directors to function as endowments. As required by GAAP, net assets associated with endowment funds, including funds designated by the Board of Directors to function as endowments, are classified and reported based on the existence or absence of donor-imposed restrictions. Interpretation of relevant law The Board of Directors of the Foundation has interpreted the South Carolina Uniform Prudent Management of Institutional Funds Act (SCUPMIFA) as requiring the preservation of the fair value of the original gift as of the gift date of the donor-restricted endowment funds. As a result of this interpretation, the Foundation classifies as permanently restricted net assets (a) the original value of gifts donated to the permanent endowment, (b) the original value of subsequent gifts to the permanent endowment, and (c) accumulations to the permanent endowment made in accordance with the direction of the applicable donor gift instrument at the time the accumulation is added to the fund. The remaining portion of the donor-restricted endowment fund that is not classified in permanently restricted net assets is classified as temporarily restricted net assets until those amounts are appropriated for expenditure by the Foundation in a manner consistent with the standard of prudence prescribed by SCUPMIFA. In accordance with SCUPMIFA, the Foundation considers the following factors in making a determination to appropriate or accumulate donor-restricted endowment funds: 1) 2) 3) 4) 5) 6) 7) The duration and preservation of the various funds The purposes of the donor-restricted endowment funds General economic conditions The possible effect of inflation and deflation The expected total return from income and the appreciation of investments Other resources of the Foundation The Foundation’s investment policies. Endowment Net Asset Composition by Type of Fund as of June 30, 2015 Unrestricted Donor-restricted endowment funds Board-restricted endowment funds $ Temporarily Restricted - $ 23,730,673 $ 23,730,673 $ 15 Permanently Restricted 731,953 $ 731,953 $ Total 3,365,928 $ 4,097,881 23,730,673 3,365,928 $ 27,828,554 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 6. Endowments, Continued Changes in Endowment Net Assets for the Fiscal Year Ended June 30, 2015 Unrestricted Endowment net assets, Beginning of year Investment return: Investment income Net appreciation (realized and unrealized) Total investment return Contributions/additions Appropriation of endowment assets for expenditure Endowment net assets, end of year Temporarily Restricted $ 22,905,198 $ Permanently Restricted 686,468 $ Total 3,365,928 $ 26,957,594 266,771 9,677 - 276,448 789,668 1,056,439 - 42,991 52,668 1,200 - 832,659 1,109,107 1,200 (230,964) $ 23,730,673 $ (8,383) 731,953 $ (239,347) 3,365,928 $ 27,828,554 Endowment Net Asset Composition by Type of Fund as of June 30, 2014 Unrestricted Donor-restricted endowment funds Board-restricted endowment funds Temporarily Restricted $ - $ 22,905,198 $ 22,905,198 $ Permanently Restricted 686,468 $ 686,468 $ Total 3,365,928 $ 4,052,396 22,905,198 3,365,928 $ 26,957,594 Changes in Endowment Net Assets for the Fiscal Year Ended June 30, 2014 Unrestricted Endowment net assets, Beginning of year Investment return: Investment income Net appreciation (realized and unrealized) Total investment return Contributions/additions Appropriation of endowment assets for expenditure Endowment net assets, end of year Temporarily Restricted $ 18,765,388 $ Permanently Restricted 524,352 $ Total 3,365,928 $ 22,655,668 247,987 8,825 - 256,812 4,481,609 4,729,596 - 159,479 168,304 1,200 - 4,641,088 4,897,900 1,200 (589,786) $ 22,905,198 $ (7,388) 686,468 $ (597,174) 3,365,928 $ 26,957,594 Funds with deficiencies From time to time, the fair value of assets associated with individual donor-restricted endowment funds may fall below the level that the donor or SCUPMIFA requires the Foundation to retain as a fund of perpetual duration. There were no such deficiencies as of June 30, 2015 and 2014. 16 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 6. Endowments, Continued Investment Return Objectives, Risk Parameters, and Strategies The Foundation has adopted investment and spending policies, approved by the Board of Directors, for endowment assets. These policies attempt to provide a predictable stream of funding to programs supported by its endowment funds while also maintaining the purchasing power of those endowment assets over the long-term. Endowment assets include those assets of donor-restricted funds that the Foundation must hold in perpetuity or for donor-specified periods. Under this policy, as approved by the Board of Directors, the endowment assets are invested in a manner that is intended to produce investment returns at least equal to inflation (as measured by the Consumer Price Index) plus a 4.50% payout and 1% for associated fees while assuming a moderate level of investment risk. Actual returns in any given year may vary from this amount. To satisfy its long-term rate-of-return objectives, the Foundation relies on a total return strategy in which investment returns are achieved through both capital appreciation (realized and unrealized) and current yield (interest and dividends). The Foundation targets a diversified asset allocation that places a greater emphasis on equity-based investments to achieve its long-term return objectives within prudent risk constraints. Spending Policy The Foundation has a policy of appropriating for distribution each year 4.50% of its endowment fund’s average fair value over the prior five quarters through the calendar year-end proceeding the fiscal year in which the distribution is planned. In establishing this policy, the Foundation considered the long-term expected return on its investment assets, the nature and duration of the individual endowment funds, many of which must be maintained in perpetuity because of donor-restrictions, and the possible effects of inflation. The Foundation expects the current spending policy to allow its endowment funds to grow at an average of 7% to 8% annually. This is consistent with the Foundation’s objective to maintain the purchasing power of the endowment assets held in perpetuity or for a specified term, as well as to provide additional real growth through new gifts and investment return. Note 7. Endowment Fund A quasi-endowment fund was established in 1985 by the Board whereby the earnings generated by the fund would be used for certain projects at the University. In a quasi-endowment fund, any portion of the fund may be expended, and since 1985, the fund has been supplemented and used for various projects at the discretion of the Board. The fund is managed by various investment management firms and is held in short-term government money-market accounts, corporate stocks and equity mutual funds. Investment gains or losses increase or decrease the fund. Note 8. Real Estate Held for Investment Real estate held for investment is acquired by purchase or donation and is reported at either cost if purchased or fair value at the time of the donation. Real estate purchased and unrestricted donated real estate is held for subsequent lease or transfer to the University. This real estate is reviewed on an ongoing basis for impairment based on comparison of carrying value against fair value. If a permanent impairment is identified, the assets carrying amounts are adjusted to fair value in the year identified. Included in real estate held is property on the South Carolina coast known as Pritchard’s Island (the Island) valued at $3,100,000. The donor placed a restriction on the property which requires the Island to be maintained in its wilderness state. The property is presently being used by the University as a research environment for the study of various types of animals. The remaining balance of real estate held primarily includes property located throughout the state of South Carolina. 17 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 9. Property and Equipment, net Property and equipment consists of the following as of June 30: 2015 Construction-in-progress (See Note 17) Land Land improvements Buildings Furniture, fixtures and equipment 2014 $ 51,892,517 $ 5,461,923 3,653,392 3,721,482 626,616 626,616 14,963,217 14,963,217 2,967,518 2,487,030 74,103,260 27,260,268 6,104,582 5,553,282 $ 67,998,678 $ 21,706,986 Less accumulated depreciation Construction-in-progress includes capitalized interest and guarantee fee totaling $1,019,538 as of June 30, 2015. Depreciation expense in the amount of $551,300 and $486,787 was included in total expenses for the years ended June 30, 2015 and 2014, respectively. Note 10. Lines-of-Credit Lines-of-credit consist of the following at June 30: On January 9, 2012, an unsecured line-of-credit with a bank was entered into, in the amount of $8,500,000, interest at 30-day LIBOR (.18% at June 30, 2015) plus 1.20%. The lineof-credit matures on February 3, 2016. On January 13, 2012, an unsecured line-of-credit with a bank was entered into, in the amount of $15,000,000, interest at 30-day LIBOR (.18% at June 30, 2015) plus 1.20%. The line-ofcredit matures on January 13, 2016. On June 11, 2014, an unsecured line-of-credit with a bank was entered into, in the amount of $15,000,000, interest at 30-day LIBOR (.18% at June 30, 2015) plus 1.65%. The lineof-credit matured September 30, 2014 and was not renewed. $ 2015 2014 8,075,000 $ 8,075,000 13,175,076 - 8,987,943 2,500,673 $ 21,250,076 $ 19,563,616 18 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 11. Notes Payable Notes payable consist of the following at June 30: A note in the amount of $11,100,000; accrues interest at 30-day LIBOR (.18% at June 30, 2015) plus 1%, due in monthly principal payments ranging from $25,900 to $42,900 plus interest and a balloon payment of $7,092,900 plus accrued interest due February 4, 2018, collateralized by the leasehold interest, building and personal property at Pendleton Street, Columbia, South Carolina. The effective interest rate for this note is fixed at 5.47% per the interest rate swap agreement as noted below. 2015 2014 $ 8,353,600 $ 8,796,400 $ 160,000 8,513,600 480,533 8,033,067 $ 173,334 8,969,734 456,133 8,513,601 A $200,000 development incentive note with Wyndham Hotels and Resorts, LLC. The note bears no interest unless it is defaulted upon or is accelerated. Each year one-fifteenth of the original principal amount is forgiven without payment, and the obligation to repay the note is cancelled and discharged when the principal is completely forgiven. Less current maturities Future scheduled maturities of notes payable are as follows for the years ending June 30: 2016 2017 2018 2019 2020 Thereafter $ $ 480,533 506,533 7,406,533 13,333 13,333 93,335 8,513,600 The floating interest rate for the $8,353,600 note payable above at June 30, 2015 varies based on 30-day LIBOR plus 1%. The Foundation utilizes an interest rate swap agreement to reduce the impact of changes in interest rates on its floating rate debt. The swap agreement is a contract to exchange floating rates for fixed rate payments periodically over the life of the agreement without the exchange of the underlying notional amount. The swap agreement effectively fixed the interest rate applicable to the note described above at a rate of 5.47%. 19 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 12. Bonds Payable During December 2010, the Foundation issued $19,135,000 of Economic Development Revenue Bonds (Series 2010 JEDA Bonds). The Series 2010 JEDA Bonds were issued for the purpose of purchasing real estate for the University of South Carolina and to refinance certain notes payable incurred by the Foundation. During fiscal year 2014, in addition to the Foundation’s scheduled bond principal payment, an early payment of bond principal was made in the amount of $1,359,217. Series 2010 JEDA Bonds payable at June 30, 2015 and 2014 were $11,266,074 and $11,596,180, respectively. The annual debt service to maturity for these bonds outstanding at June 30, 2015, includes variable interest at 67% of 30-day LIBOR (.18% at June 30, 2015) plus .85%. The bond agreement requires the Foundation and USC Educational Foundation, the guarantor, to maintain certain minimum financial ratios and to perform or not perform certain actions. Future scheduled maturities of these bonds payable are as follows for the years ending June 30: 2016 2017 2018 2019 2020 2021 - 2025 2026 - 2030 2031 - 2036 $ 343,179 359,521 372,594 388,936 405,278 2,300,934 2,830,408 4,265,224 $ 11,266,074 During July 2014, USC DF - West Campus LLC issued $88,065,000 in tax exempt bonds (Series 2014A) with a maturity date of August 1, 2046 and $4,635,000 in taxable bonds (Series 2014B) with a bond maturity date of August 1, 2019 in order to finance the construction of a dormitory project (See Note 17). Notwithstanding the maturity date, the lender has an option to call the tax exempt bonds on August 1, 2024. The tax exempt bonds have a variable interest rate of 67% of the sum of 30-day LIBOR (.18% at June 30, 2015) plus 1.65%. The taxable bonds have a variable bond rate of 30-day LIBOR plus 1.65%. Interest only payments are due during the construction phase. Principal payments will begin after all construction is scheduled to be completed, with the first principal payment due on August 1, 2016. For the USC Development Foundation, a guaranty of $15,000,000 is in effect with lender until the put option date of August 1, 2024. The bond agreement requires the Foundation to maintain certain minimum financial ratios and to perform or not perform certain actions. USC DF – West Campus, LLC is currently receiving advances from this bond issuance to fund the construction of the dormitory project. As of June 30, 2015, USC DF - West Campus, LLC has received bond proceeds totaling $43,691,893. Inter-foundation Agreement In conjunction with issuance of the Series 2014A and 2014B bonds to finance the student housing facility, in July 2014, the USC Development Foundation entered into an agreement with the USC Educational Foundation to provide a guaranty to the lender. The USC Educational Foundation will receive fees from the USC Development Foundation for the guaranty provided. The guaranty begins with a $75,000,000 contingent liability for the USC Educational Foundation and could decrease to $0 over four years if certain obligations are met as presented in the table below. 20 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 12. Bonds Payable, Continued Milestone Events Amount of Guaranty 1% Fee Begins at closing of Credit Facility (August 1, 2014 – July 31, 2015) $75,000,000 $ 750,000 At delivery of Phase 1 (July 31, 2015) $50,000,000 500,000 At delivery of Phase 1A (Estimated to be July 31, 2016) $25,000,000 250,000 After Year 1 of stabilization (Estimated to be July 31, 2017) $15,000,000 150,000 After Year 2 of stabilization (Estimated to be July 31, 2018) $10,000,000 100,000 After Year 3 of stabilization Guaranty decreases to $ 0 - Total fees $ 1,750,000 During June 2014, USC DF - West Campus, LLC, entered into an interest rate swap agreement that will begin on July 1, 2015 with an initial notional amount of $60,000,000, which will effectively fix the rate of this debt at a rate of 3.25%. This notional amount will increase by $32,700,000 on July 1, 2016. Under the terms of this second interest rate swap agreement, this remaining debt from this bond issuance will also become fixed at 3.25% on July 1, 2016. This fixed rate will be effective until the put option date of August 1, 2024. Once all bond proceeds have been advanced to USC DF – West Campus, LLC, future scheduled maturities of these bonds payable will be due as follows for the years ending June 30: 2016 2017 2018 2019 2020 2021 - 2025 2026 - 2030 2031 - 2035 2036 - 2040 2041 - 2045 2046 - 2047 $ 1,855,969 1,917,195 1,980,440 2,045,772 11,286,808 13,275,429 15,614,427 18,365,531 21,601,353 4,757,076 $ 92,700,000 21 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 13. Related Party Transactions The Foundation has engaged in a significant volume of transactions with the University and its various departments and related organizations. For the years ended June 30, 2015 and 2014, the following amounts were paid to or received from the University: The Foundation leases parking spaces for Senate Plaza residents from the University at an annual cost of $28,440. As the lease agreement for the parking spaces does not have a specific expiration date, the minimum annual lease commitments for the next five years are as follows for the years ending June 30: 2016 2017 2018 2019 2020 $ $ 28,440 28,440 28,440 28,440 28,440 142,200 The Foundation allows the University to use a Cockaboose during football season, to host donor events. The Foundation provides the use of the Cockaboose free of charge to the University. The Foundation (CDRC, LLC) leases floor space on the first floor of 1530 Wheat Street to the Children’s Center at USC for child development at a rate of $12,420 per month. The minimum annual lease commitments for the next five years are as follows for the years ending June 30: 2016 2017 2018 2019 2020 $ $ 149,040 149,040 149,040 149,040 149,040 745,200 The Foundation leases floor space on the second floor of 1530 Wheat Street to the University at a rate of $2,080 per month, which expired June 30, 2013. This lease is still being operated on a month-to-month basis. During 2012, the Foundation entered into a lease with the University for additional space on the second floor of 1530 Wheat Street at a rate of $1,360 per month, which expires on June 30, 2016. The lease provides the option to be renewed annually for the following five years. The Foundation leases space at 1027 Barnwell Street, on a month-to-month basis, to the University of South Carolina Educational Foundation at a rate of $15,500 per month. Rental income for this lease totaled $186,000 and $170,500 for the years ending June 30, 2015 and 2014, respectively. The Foundation paid the University of South Carolina Educational Foundation $276,991 and $232,105 for various operational cost including salaries, equipment and investment fees for the years ended June 30, 2015 and 2014, respectively. 22 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 13. Related Party Transactions, Continued The Foundation owns thirty-five parking spaces at Stadium Place near the University football stadium. The Foundation allows the University to use twenty-six of these spaces in exchange for reimbursement of the Foundation’s assessments and property taxes on these spaces. The agreement between the Foundation and the University commenced on November 5, 1997 for one year, and has since been renewed each year with the University. The agreement has no specific expiration date. During the year ended June 30, 2010, the Foundation entered into a lease with the University for Williams at Blossom, LLC, for the property to be used for baseball parking. The Foundation received rental revenue of $86,718 and $80,827 from the University for the years ended June 30, 2015 and 2014, respectively. The Foundation is currently leasing property at 707 Catawba Street to the University at a rate of $9,762 per month. The lease expired September 30, 2010 with an option to extend as month-to-month for five years. As of June 30, 2015, the lease is still operating as a month-to-month agreement. The Foundation received rental revenue of $117,144 for years ended June 30, 2015 and 2014. On September 1, 2012, the Foundation entered into a lease with the University for property at 350 Wayne Street for a period of twelve months to be used for general office and storage space. The University has continued to lease the property on a month-to-month basis. The Foundation received rental revenue of $99,600 for the years ended June 30, 2015 and 2014. The Foundation has entered into a lease with the University for property at 737 Gadsden Street to be used for playing fields or general parking. The lease commenced on April 1, 2013 for twelve months, at a rate of $8,084 per month. The University has continued to lease the property on a month-to-month basis. The Foundation received rental revenue of $97,008 for the years ended June 30, 2015 and 2014. The Foundation purchased property at 807 Whaley Street in March 2014. The Foundation has entered into an agreement with the University of South Carolina Educational Foundation whereby the Education Foundation will purchase the property at 807 Whaley from the Development Foundation for the benefit of the University. The purchase will take place over a three year period. The initial payment was made to the Foundation on June 30, 2014. Title will not be transferred until the final payment is made on June 30, 2016. Note 14. Child Development/Research Center CDRC, LLC, a Limited Liability Corporation (100% owned by the Foundation) constructed a Child Development Research Center that is devoted to research in matters related to early childhood education. The Research Center is built on land owned by CDRC, LLC and consists of two floors. The first floor of the Center is leased to the Children’s Center at USC, for child development and the second floor of the Center is used by the University of South Carolina. 23 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 15. Derivatives and Off-Balance Sheet Risk The Foundation has investments in hedge funds, which are fair value hedging instruments as defined in the ASC. The Foundation does not engage in speculation. The effect of this practice is to help protect the Foundation from losses which would result from price fluctuations of their traditional investments. As of June 30, 2015 and 2014, the Foundation had cumulative unrealized net gains in its hedge funds of $880,896 and $727,813, respectively. Note 16. The Inn at USC, LLC On August 2, 2004, the Foundation participated with USC Hotel Investments, LLC to form a Limited Liability Company named USC Hotel Associates, LLC. The Foundation has an eighty percent ownership interest in USC Hotel Associates, LLC. Its purpose is to develop, own and operate “The Inn at USC”, a 117 room hotel located on Pendleton Street adjacent to the Columbia, South Carolina campus. In connection with the above development, the Foundation’s wholly owned LLC, Inn at USC, LLC, entered into a ground lease with USC Hotel Associates, LLC, for the property it owns on Pendleton Street in Columbia, South Carolina. The initial term of the ground lease was 40 years, with an annual rent of $303,000. During the fiscal year ended June 30, 2011, the Foundation wrote-off all the rent receivable related to the ground lease and no additional rental income or receivable was recognized while a new agreement was being negotiated. On July 1, 2013, the Foundation and USC Hotel Investments, LLC approved amendments to the terms of their original agreement. Under terms of the amended agreement, the annual rental income since August 1, 2005 was recalculated at an annual rent of $160,000 (minimum rental amount). Additional rent may also be due at the end of each year if certain revenue levels are achieved by USC Hotel Associates, LLC. The amended agreement also called for a required capital contribution from the Foundation to USC Hotel Associates, LLC, in the amount of $2,020,000. This required capital contribution was made by the Foundation in 2014. All material transactions between USC Hotel Associates, LLC and the Foundation and subsidiaries have been eliminated during consolidation. On February 4, 2008, USC Hotel Associates, LLC refinanced their initial loan used to develop "The Inn at USC." The loan amount at June 30, 2015 and 2014 is $8,353,600 and $8,796,400, respectively, and is secured by the leasehold interest, building, and personal property. The Foundation has also guaranteed $2,000,000 of the debt. Note 17. USC DF-West Campus, LLC and USCInnovation, LLC USC DF - West Campus, LLC Project During 2014, the Foundation formed USC DF - West Campus, LLC to build an 878 bed dormitory project including related parking and ground floor retail facilities on the campus of the University of South Carolina. On May 13, 2014, the Foundation entered into a lump sum contract totaling $92,691,623, with a development manager to develop this multi-phase mixed use student housing project. As of June 30, 2015 and 2014, progress payments of $44,465,637 and $4,616,464, respectively, have been made related to this contract and are included within construction-in-progress. 24 University of South Carolina Development Foundation and Subsidiaries Notes to Consolidated Financial Statements June 30, 2015 and 2014 Note 17. USC DF-West Campus, LLC and USCInnovation, LLC, Continued USCInnovation, LLC Project On May 2, 2014, the Foundation formed USCInnovation, LLC to build an office building. The project is planned to have 110,000 square feet and will be a taxable entity. When formed, the USC Development Foundation owned 49% of this entity and had an option to obtain the remaining 51%. During 2015, the Foundation executed its option to obtain full ownership of USC Innovation, LLC. On May 13, 2014, the Foundation entered into a lump sum contract totaling $20,471,351 with a development manager to develop this office building. As of June 30, 2015 and 2014, progress payments of $1,964,957 and $608,425, respectively, have been made related to this contract and are included within construction-in-progress. USCInnovation, LLC has executed long-term leases for approximately 55% of the available space in this building. 25 Supplemental Schedule 1 The University of South Carolina Development Foundation and Select Subsidiaries Consolidating Schedule of Assets, Liabilities and Net Assets/Members' Deficit As of June 30, 2015 The USC Development Foundation Assets Cash and cash equivalents Investments in securities Contributions receivable, net Other receivables Prepaid expenses Property and equipment, net Real estate held for investment Other assets Investment in subsidiary Advances to USC Hotel Associates, LLC Total assets $ $ USC Hotel Associates, LLC 1,583,278 34,412,885 2,280,315 204,709 4,674 8,585,355 25,305,723 122,756 3,595,632 80,000 76,175,327 $ 429,837 20,650,076 11,266,074 6,000,199 442,682 38,788,868 $ $ USC DF - West Campus, LLC USCInnovation, LLC 205,278 57,519 21,754 7,520,806 32,887 7,838,244 $ 520,008 8,513,600 714,328 100,000 9,847,936 $ $ 137,203 1,485,047 2,573,382 4,195,632 $ 600,000 600,000 $ $ Eliminations 178,462 49,319,135 331,360 49,828,957 $ 5,970,004 43,691,893 4,262,809 296,708 54,221,414 $ $ Consolidated (98,999) (3,595,632) (80,000) (3,774,631) $ (98,999) (6,000,199) (80,000) (6,179,198) $ $ 2,104,221 35,897,932 2,280,315 163,229 26,428 67,998,678 25,305,723 487,003 134,263,529 Liabilities and net assets/members' deficit Liabilities Accounts payable and accrued expenses Lines-of-credit Notes payable Bonds payable Interest rate swaps Deficit in investments in subsidiaries Funds held for others Deferred revenue Advances from members Total liabilities $ Net assets/members' deficit USC Development Foundation net assets Net assets Unrestricted Board designated for investments Undesignated Temporarily restricted Permanently restricted USC Hotel Associates, LLC members' deficit Members' deficit Total Foundation net assets/members' deficit Noncontrolling interest Total net assets/members' deficit Total liabilities and net assets/members' deficit 23,730,673 (14,538,154) 9,192,519 24,828,012 3,365,928 $ 37,386,459 37,386,459 76,175,327 - $ (2,009,692) (2,009,692) (2,009,692) 7,838,244 26 $ 3,595,632 3,595,632 - (4,392,457) (4,392,457) - 3,595,632 3,595,632 4,195,632 (4,392,457) (4,392,457) 49,828,957 $ 796,825 796,825 - $ 2,009,692 2,806,517 (401,950) 2,404,567 (3,774,631) 6,820,850 21,250,076 8,513,600 54,957,967 4,977,137 442,682 296,708 20,000 97,279,020 23,730,673 (14,538,154) 9,192,519 24,828,012 3,365,928 $ 37,386,459 (401,950) 36,984,509 134,263,529 Supplemental Schedule 2 The University of South Carolina Development Foundation and Select Subsidiaries Consolidating Schedule of Revenues, Expenses and Changes in Net Assets/Members' Deficit For the year ended June 30, 2015 The USC Development Foundation USC Hotel Associates, LLC USC DF - West Campus, LLC USCInnovation, LLC Eliminations Consolidated Unrestricted net assets Revenues and support Investment returns Rental income Room revenue Other Support Net assets released from restrictions Total revenues and support $ Expenses Supporting services Management and general USC Hotel Associates Program services Investment services Property services Loss (gain) on investments in subsidiaries Unrealized (gain) loss on interest rate swaps Loss on real estate held for investment Total expenses Change in unrestricted net assets 1,089,563 990,701 19,275 13,475 217,045 2,330,059 $ 3,783,140 383,064 4,166,204 $ - 439,408 - 4,148,885 - 329,031 705,626 2,632,340 4,666,234 8,772,639 (265,249) 3,883,636 54 54 (6,442,580) 282,568 (54) $ 60,600 60,600 $ - (208,310) (208,310) $ 1,089,563 782,391 3,783,140 462,939 13,475 217,045 6,348,553 (208,310) 439,408 3,940,575 93,933 2,825,007 2,918,940 (2,632,340) (2,840,650) 423,018 705,626 2,559,758 4,666,234 12,734,619 (2,858,340) 2,632,340 (6,386,066) Temporarily restricted net assets Investment income Support Other Net assets released from restrictions 445,719 1,270,050 11,498 (217,045) - - - - 445,719 1,270,050 11,498 (217,045) Change in temporarily restricted net assets 1,510,222 - - - - 1,510,222 Change in net assets/ members' deficit (4,932,358) Net change attributable to noncontrolling interest in USC Hotel Associates, LLC Change in net assets/ members' deficit 282,568 - $ (4,932,358) (54) - $ (2,858,340) - 282,568 27 $ (54) - $ (2,858,340) $ 2,632,340 (4,875,844) (56,514) (56,514) 2,575,826 $ (4,932,358) Supplemental Schedule 3 The University of South Carolina Development Foundation and Select Subsidiaries Consolidating Schedule of Assets, Liabilities and Net Assets/Members' Deficit As of June 30, 2014 The USC Development Foundation USC Hotel Associates, LLC USC DF - West Campus, LLC USCInnovation, LLC Eliminations Consolidated Assets Cash and cash equivalents Investments in securities Contributions receivable, net Other receivables Prepaid expenses Property and equipment, net Real estate held for investment Other assets Total assets $ $ 2,639,662 31,387,655 2,183,627 341,707 8,801,976 28,631,363 128,817 74,114,807 $ 350,988 16,462,943 11,596,180 3,368,013 17,866 31,795,990 $ $ 586,752 103,101 21,857 7,443,087 43,918 8,198,715 $ 541,664 8,969,734 979,577 10,490,975 $ $ 608,425 608,425 $ 8,525 600,000 608,525 $ $ 4,853,498 4,853,498 $ 2,449,140 2,500,673 1,437,802 6,387,615 $ $ (112,069) (112,069) $ (112,069) (3,368,013) (3,480,082) $ $ 3,226,414 31,387,655 2,183,627 332,739 21,857 21,706,986 28,631,363 172,735 87,663,376 Liabilities and net assets/members' deficit Liabilities Accounts payable and accrued expenses Lines-of-credit Notes payable Bonds payable Interest rate swaps Deficit in investments in subsidiaries Funds held for others Total liabilities $ Net assets/members' deficit USC Development Foundation net assets Net assets Unrestricted Board designated for investments Undesignated Temporarily restricted Permanently restricted USC Hotel Associates, LLC members' deficit Total Foundation net assets/members' deficit Noncontrolling interest Total net assets/members' deficit Total liabilities and net assets/members' deficit $ 22,905,198 (7,270,099) 15,635,099 23,317,790 3,365,928 42,318,817 42,318,817 74,114,807 $ (2,292,260) (2,292,260) (2,292,260) 8,198,715 28 $ (100) (100) (100) (100) 608,425 $ (1,534,117) (1,534,117) (1,534,117) (1,534,117) 4,853,498 $ 1,534,217 1,534,217 2,292,260 3,826,477 (458,464) 3,368,013 (112,069) $ 3,238,248 19,563,616 8,969,734 11,596,180 2,417,379 17,866 45,803,023 22,905,198 (7,270,099) 15,635,099 23,317,790 3,365,928 42,318,817 (458,464) 41,860,353 87,663,376 Supplemental Schedule 4 The University of South Carolina Development Foundation and Select Subsidiaries Consolidating Schedule of Revenues, Expenses and Changes in Net Assets/Members' Deficit For the year ended June 30, 2014 The USC Development Foundation USC Hotel Associates, LLC USC DF - West Campus, LLC USCInnovation, LLC Eliminations Consolidated Unrestricted net assets Revenues and support Investment returns Rental income Room revenue Gain on sale of real estate held for investment Other Support Net assets released from restrictions Total revenues and support Expenses Supporting services Management and general USC Hotel Associates Program services Investment services Property services Loss on investments in subsidiaries Unrealized (gain) loss on interest rate swaps Total expenses Change in unrestricted net assets $ 4,538,130 971,405 2,121,424 17,291 20,203 374,468 8,042,921 512,802 - Temporarily restricted net assets Investment returns Support Other Net assets released from restrictions - 308,926 1,042,472 1,363,119 3,227,319 (231,085) 3,627,537 100 100 4,815,602 213,872 (100) 1,113,605 Change in net assets/ members' deficit 5,929,207 5,929,207 - $ - (192,070) (192,070) 96,315 1,437,802 1,534,117 (1,363,119) (1,555,189) 405,341 1,042,472 1,206,717 6,833,884 (1,534,117) 1,363,119 4,858,376 - - - - - (1,534,117) - 213,872 29 $ (100) (1,534,117) 535,330 826,695 126,048 (374,468) 1,113,605 1,363,119 - $ 4,538,130 779,335 3,472,989 2,121,424 385,711 20,203 374,468 11,692,260 512,802 3,666,552 - (100) $ (192,070) - - $ $ - 213,872 - $ $ - 535,330 826,695 126,048 (374,468) Net change attributable to noncontrolling interest in USC Hotel Associates, LLC 3,472,989 368,420 3,841,409 3,858,622 Change in temporarily restricted net assets Change in net assets/ members' deficit $ 5,971,981 (42,774) $ 1,320,345 (42,774) $ 5,929,207