Siliconix Guhan Subramanian Harvard Law School

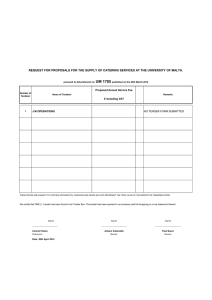

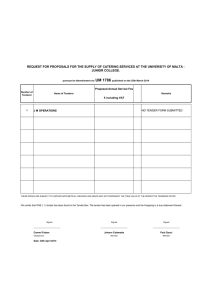

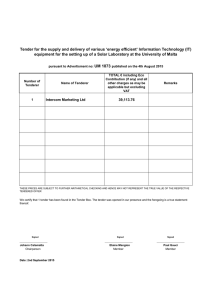

advertisement