Investments in Noncurrent Operating Assets--

advertisement

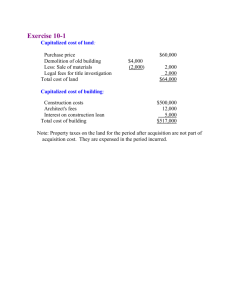

1 Investments in Noncurrent Operating Assets-Acquisitions Learning Objectives Identify those costs to be included in the acquisition cost of different types of noncurrent operating assets. Properly account for noncurrent operating asset acquisitions using various special arrangements, including deferred payment, self-construction, and acquisition of an entire company. 2 Learning Objectives Separate costs into those that should be expensed immediately and those that should be capitalized, and understand the accounting standards for research and development and oil and gas exploration costs. Discuss the pros and cons of recording noncurrent operating assets at their current value. 3 Learning Objectives Use the fixed asset turnover ratio as a general measure of how efficiently a company is using its property, plant, and equipment. EXPANDED MATERIAL Evaluate the different ways to compute capitalized interest and properly incorporate midyear loans into the capitalized interest calculations. 4 5 Time Line of Business and Accounting Issues Involved With Long-Term Operating Assets 6 EVALUATE possible acquisition of long-term operating items 7 ACQUIRE long-term operating assets 8 DISTINGUISH between those items to be expensed and those to be capitalized 9 RECORD long-term operating assets at appropriate amount 10 ESTIMATE and RECOGNIZE periodic depreciation 11 MONITOR asset value for possible decline 12 DISPOSE of asset Valuation at Acquisition • Initially record asset at cost; cost is actual cash price. • Cost includes all expenditures required to obtain asset and place it in use. 13 Acquisition Costs of Tangible Noncurrent Operating Assets • Purchase price, commissions, legal fees, and escrow fees. • Clearing and grading costs. • Cost of removing unwanted structures. • Assessments for water lines, sewers, and roads. 14 Acquisition Costs of Tangible Noncurrent Operating Assets • Landscaping. • Parking lots. • Interior sidewalks. • Light structures (for parking and sidewalks). • Fencing. 15 Acquisition Costs of Tangible Noncurrent Operating Assets • Purchase price. • Taxes, freight, and insurance during shipping and installation. • Special foundations or reinforcing of floors. • Installation and testing. Note: Any expenditure incurred in preparing the asset for its intended use is charged to Equipment. 16 Acquisition Costs of Tangible Noncurrent Operating Assets If a building is selfconstructed, the cost of If ready for use: materials, labor, and overhead establishes the • Purchase price. cost of the asset. • Commissions, legal fees, escrow fees, survey fees. If newly constructed by outsider: • Contract price. • Legal fees 17 Acquisition Costs of Intangible Noncurrent Operating Assets • Patent: Purchase price, filing and registry fees, cost of subsequent litigation to protect right. Does not include internal research and development costs. • Copyright: Same as Patent. • Trademark and Trade Name: Same as Patent. • Franchise: Expenditures made to purchase the franchise. Legal fees and other costs incurred in obtaining the franchise. • Organization Costs: Expenditures to organize the corporation--cost of stock certificates, underwriting costs, state incorporation fees, legal fees. continued 18 Acquisition Costs of Intangible Noncurrent Operating Assets • Software Development Costs: Expenditures made after software is determined to be technologically feasible but before it is ready for commercial production. • Goodwill: Portion of purchase price that exceeds the sum of the current market value for all identifiable net assets. 19 Acquisition Other Than Simple Cash Transactions Basket purchase Deferred payment Leasing Exchange of nonmonetary assets Issuance of securities Self-construction Donation or discovery Acquisition of an entire company 20 Methods of Acquisition Basket purchase: Allocate cash price to individual assets based on percentage of appraised or fair market value. Land, buildings, and equipment are acquired for $160,000. The appraisal values at the acquisition date are: land, $28,000; buildings, $60,000; equipment, $12,000. 21 Methods of Acquisition Basket purchase: Allocate cash price to individual assets based on percentage of appraised or fair market value. Land $ 28,000 $28/$100 x $160,000 = $ 44,800 Buildings 60,000 $60/$100 x $160,000 = 96,000 Equipment 12,000 $12/$100 x $160,000 = 19,200 $160,000 $100,000 22 Methods of Acquisition Deferred payment Record asset at face value of note, plus any cash paid. Land is acquired on January 2, 2002 for Record note at fair market value of $100,0000; $35,000 is paid at the time acquired asset if note’s value is not of purchase, and the balance is to be determinable or is unreasonable. paid in semiannual installments of $5,000 plus interest on the unpaid principal at an annual rate of 10%. 23 Methods of Acquisition June 30, 2002 Interest Expense Notes Payable Cash 3,250 5,000 8,250 $65,000 x 0.05% Deferred Payment Illustration 24 Methods of Acquisition • Leasing: A capital lease is economically the same as a purchase. The acquiring company records the asset and liability at the present value of future lease payments. • Exchange of nonmonetary assets: The new asset is valued at its fair market value or at the fair market value of the asset given up, whichever is more clearly determinable. 25 Methods of Acquisition • Issuance of securities: Record the asset at the fair market value of the securities issued. • Self-construction: Recorded at cost, including all expenditures incurred to build the asset and make it ready for its intended use. 26 Interest Capitalization Interest should not be capitalized for inventories Capitalization of interest is required manufactured or produced for assets that are being selfon a repetitive basis. constructed for an enterprise’s own use and assets that are intended to be leased or sold to others that can be identified as discrete projects. 27 Interest Capitalization-Qualification When assets are acquired by self-construction, interest incurred on funds borrowed to finance construction can be capitalized if the following conditions are met: Projects are discrete. Costs are separately accumulated. Construction covers an extended period of time. Construction costs are substantial. 28 Interest Capitalization-Requirements Maximum capitalization equals actual interest incurred during the period. Interest capitalization is calculated on average amount of accumulated expenditures. Interest rate used is (1) actual rate on debt incurred specifically for the project, then (2) weighted average interest rate on all borrowings not specifically for the project. If the construction period covers more than one fiscal period, accumulated expenditures include prior years’ capitalized interest. 29 Interest Capitalization-Example: Scenario Bee Wood, Inc., a construction company, decides to build a new warehouse. The following information is applicable to the project: 30 Interest Capitalization-Example: Scenario • Construction will begin January 1, 2001, and is expected to end December 31, 2002. • Construction costs are estimated at $640,000. • A 12%, 2-year loan of $200,000 has been obtained and will become effective on January 1, 2001. 31 Interest Capitalization-Example: Scenario • Bee Wood, Inc.’s other debts are: – 5-year, 10% notes payable $ 75,000 – 9% mortgage 120,000 • 2001 Expenditures were: – January 1: $ 100,000 – July 1: 100,000 – October 1: 100,000 • In 2002, expenditures of $340,000 occurred evenly throughout the year. 32 Interest Capitalization-Example: Solution Maximum Interest Capitalization Debt Amount Rate Loan $ 200,000 12% Note 75,000 10% Mortgage 120,000 9% Maximum interest capitalization Interest $24,000 7,500 10,800 $42,300 33 Interest Capitalization-Example: Solution Weighted Average Rate: Debt Amount Note $ 75,000 Mortgage 120,000 $195,000 Rate 10% 9% Interest $ 7,500 10,800 $18,300 Weighted Average Rate = 9.4% ($ 18,300 ÷ $195,000 = 0.0938) 34 Interest Capitalization-Example: Solution Weighted Average Expenditures--2001: Interest Capitalization--2001: Weighted $ 175,000 x 12% (loan) = $ 21,000 Date Amount Ratio Average 1/1/01 7/1/01 10/1/01 . $100,000 100,000 100,000 $300,000 12/12 6/12 3/12 $100,000 50,000 25,000 $175,000 35 Interest Capitalization-Example: Solution Weighted Average Expenditures--2002 Acc. exp. 12/31/01 $300,000 2001 interest capitalized 21,000 Adjusted acc. exp. 12/31/01 $321,000 2002 expenditures 340,000 Acc. exp. 12/31/02 $661,000 Weighted average expenditures, 2002 $491,000 ($321,000 + [$340,000 ÷ 2]) 36 Interest Capitalization-Example: Solution Interest Capitalization--2002: $200,000 x 12% = $24,000 $291,000 x 9.4% = 27,400 Total interest $51,400 Maximum interest $42,300 Interest Capitalized, $42,300 37 Acquisition of an Entire Company 38 --Business Combination There are two ways to account for a business combination-The purchase method raises a pooling of interest and problem in how to allocate the purchase. Compared of interest, purchase pricetotopooling the various theassets purchase method records acquired. assets at their fair market value, which Despite results inopposition lower earnings in from the subsequent due to higher businessyears community, the FASB depreciation has taken stepscharges. to eliminate the pooling of interest method. Goodwill • Defined: “The excess amount paid for a company in a business combination over the fair market value of the company’s identifiable assets.” • Recording Goodwill 1. Write identifiable assets up to FMV. 2. Record excess purchase price over net assets at FMV as goodwill. 3. Amortize goodwill over its economic useful life -- not to exceed 40 years. 39 Expense/Asset Continuum Expense Asset Research and Repairs Development Software Land and Supplies Development Buildings Used Oil and Gas Exploration 40 Postacquisition Expenditures Expenditures to keep plant and equipment in good operating condition are referred to as maintenance. Expense as incurred 41 Postacquisition Expenditures What about expenditures that do not extend the useful life or increase future cash flows? Expense as incurred 42 Postacquisition Expenditures If the cost of the old Next, record cost of the component is known, remove new component and its cost and accumulated recognize a gain or loss. depreciation. 43 Postacquisition Expenditures What if the cost of the old component is not known? 44 Postacquisition Expenditures Then the cost of the new component is deducted from accumulated depreciation. 45 Research and Development Research and development costs include those costs of materials, equipment, facilities, personnel, purchased intangibles, contract services, and a reasonable allocation of indirect costs that are specifically related to R & D activities and that have no alternative future use. 46 Research and Development Examples Research aimed at discovery of new knowledge. Search for applications of research findings. Search for possible product or process alternatives. Design, construction, and testing of preproduction prototypes. Design, construction, and operation of a pilot plant. 47 Development of Successful Software R & D Costs (Expense) Software project initiated Deferred Costs (Intangible Assets) Technological feasibility established 48 Inventory Costs Software available for commercial production Software sold Fixed Asset Turnover Lamberson Company’s sales for 2001 totaled $46,381,530. Its beginning and ending Property, Plant, and Equipment balances were $9,678,233 and $10,088,997, respectively. Average fixed assets = ($9,678,233 + $10,088,997) 2 Average fixed assets = $9,883,615 Fixed asset turnover = $46,381,530 Sales = 4.69 $9,883,615 Average Fixed Assets 49 50 The End