Talking Point Schroders What does increased volatility mean for investors?

advertisement

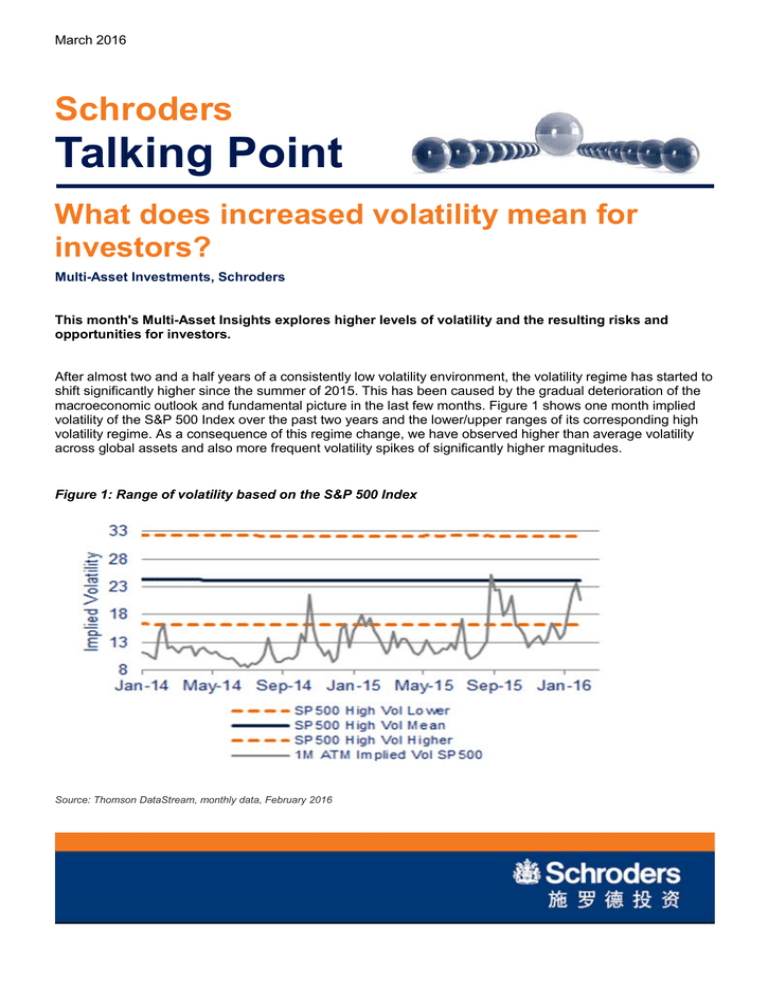

March 2016 Schroders Talking Point What does increased volatility mean for investors? Multi-Asset Investments, Schroders This month's Multi-Asset Insights explores higher levels of volatility and the resulting risks and opportunities for investors. After almost two and a half years of a consistently low volatility environment, the volatility regime has started to shift significantly higher since the summer of 2015. This has been caused by the gradual deterioration of the macroeconomic outlook and fundamental picture in the last few months. Figure 1 shows one month implied volatility of the S&P 500 Index over the past two years and the lower/upper ranges of its corresponding high volatility regime. As a consequence of this regime change, we have observed higher than average volatility across global assets and also more frequent volatility spikes of significantly higher magnitudes. Figure 1: Range of volatility based on the S&P 500 Index Source: Thomson DataStream, monthly data, February 2016 SchrodersTalking Point Page 2 In this environment, it is worth highlighting several dynamics of high volatility regimes. Increased contagion risks While there is still evidence of differences in regional growth outlooks, a high volatility environment is typically associated with highly sentiment-driven market moves. As a result, the contagion effects are expected to be stronger than we typically experience. As shown in Figure 2, despite the different underlying economic cycles, volatility across different regional equity markets has moved more closely in tandem in the recent sell-off compared to the last few years. Use appropriate comparators When looking at the valuation of volatility, many investors focus on the absolute level of volatility within one market and compare this to other markets. However, this misses the idiosyncratic differences between markets. For example, in the second week of January, the S&P 500 Index had already moved into a high volatility regime, but the Nikkei 225 Index was still in a low volatility regime. As a result, it is important to assess the attractiveness of each volatility market relative to its own history. Figure 2: Current levels of implied volatility against respective ranges of volatility regimes of each index Source: Bloomberg, Schroders calculations, 1 February 2016 Potential opportunities to take advantage of delayed effects Given the greater contagion risks associated with high volatility regimes, the lead lag phenomenon could offer opportunities for potentially cheaper hedges. For example the S&P 500 Index and DAX Index moved into a high volatility regime in the first two weeks of January while the volatility in the Nikkei Index was relatively more subdued. However, Japanese volatility then quickly caught up with the other markets. Such reactions offer opportunities for investors. Place more emphasis on higher frequency data Based on our research in 2013, we concluded that high frequency macroeconomic data or indicators are SchrodersTalking Point Page 3 particularly valuable during high volatility regimes as they can capture more of the market dynamics driven by investor sentiment. As a result, we would suggest paying more attention to the faster moving indicators currently when managing our option strategies. Current positioning Our analysis suggests that the current market weakness is based on weak investor sentiment rather than representing the beginning of a prolonged bear market or recession. However, we are mindful that there is some complacency in terms of positioning in volatility markets, with investors expecting central banks to act as shock absorbers again, while fundamentals remain weak. We therefore think it is sensible to remain cautiously positioned, and our bias is towards using lower implied volatility levels as an opportunity to add defensive positions to our portfolios. Important Information Any security(s) mentioned above is for illustrative purpose only, not a recommendation to invest or divest. This document is intended to be for information purposes only and it is not intended as promotional material in any respect. The material is not intended to provide, and should not be relied on for investment advice or recommendation. Opinions stated are matters of judgment, which may change. Information herein is believed to be reliable, but Schroder Investment Management (Hong Kong) Limited does not warrant its completeness or accuracy. Investment involves risks. Past performance and any forecasts are not necessarily a guide to future or likely performance. You should remember that the value of investments can go down as well as up and is not guaranteed. Exchange rate changes may cause the value of the overseas investments to rise or fall. For risks associated with investment in securities in emerging and less developed markets, please refer to the relevant offering document. The information contained in this document is provided for information purpose only and does not constitute any solicitation and offering of investment products. Potential investors should be aware that such investments involve market risk and should be regarded as long-term investments. Derivatives carry a high degree of risk and should only be considered by sophisticated investors. The fund is authorized by the SFC but such authorization does not imply official approval or recommendation. Schroder does not provide any securities or investment products for offer, solicitation or trading within The People’s Republic of China (PRC). Should illegitimacy arise thereof, contents of this document shall not be construed as an offer or solicitation or trading for such securities or products. All items mentioned herein are sold through financial products issued by commercial bankers in the PRC under regulations by the China Banking Regulatory Commission (CBRC). Investors should read the relevant documents clearly before invest in the mentioned funds. Please consult the relevant commercial bankers in the PRC and/or professional consultants if necessary. This material including the website has not been reviewed by the SFC. Issued by Schroder Investment Management (Hong Kong) Limited. Schroder Investment Management (Hong Kong) Limited Level 33, Two Pacific Place, 88 Queensway, Hong Kong Telephone +852 2521 1633 Fax +852 2530 9095

![[These nine clues] are noteworthy not so much because they foretell](http://s3.studylib.net/store/data/007474937_1-e53aa8c533cc905a5dc2eeb5aef2d7bb-300x300.png)