Document 14271204

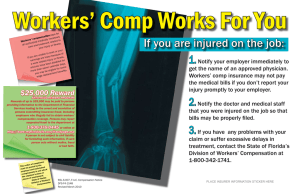

advertisement