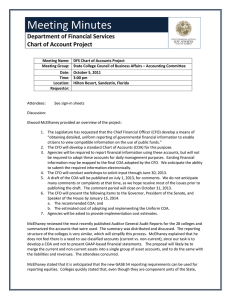

Meeting Agenda Department of Financial Services Charts of Account Project

advertisement

Meeting Agenda Department of Financial Services Charts of Account Project Meeting Name: Meeting Group: Date: Time: Location: Requestor: DFS Chart of Accounts Project State College Council of Business Affairs – Accounting Committee October 5, 2011 3 pm Hilton Resort, Sandestin, Florida Agenda: I. II. III. IV. V. VI. Introductions Overview of Section 215.89, Florida Statutes Charts of Account Development Plans Discussion of Research Questions & Answers Contact Information Meeting Minutes Department of Financial Services Chart of Account Project Meeting Name: DFS Chart of Accounts Project Meeting Group: State College Council of Business Affairs – Accounting Committee Date: October 5, 2011 Time: 3:00 pm Location: Hilton Resort, Sandestin, Florida Requestor: Attendees: See sign-in sheets Discussion: Elwood McElhaney provided an overview of the project: 1. The Legislature has requested that the Chief Financial Officer (CFO) develop a means of “obtaining detailed, uniform reporting of governmental financial information to enable citizens to view compatible information on the use of public funds.” 2. The CFO will develop a standard Chart of Accounts (COA) for this purpose. 3. Agencies will be required to report financial information using these accounts, but will not be required to adopt these accounts for daily management purposes. Existing financial information may be mapped to the final COA adopted by the CFO. We anticipate the ability to submit the required information electronically. 4. The CFO will conduct workshops to solicit input through June 30, 2013. 5. A draft of the COA will be published on July 1, 2013, for comments. We do not anticipate many comments or complaints at that time, as we hope resolve most of the issues prior to publishing the draft. The comment period will close on October 31, 2013. 6. The CFO will present the following items to the Governor, President of the Senate, and Speaker of the House by January 15, 2014. a. The recommended COA; and b. The estimated cost of adopting and implementing the Uniform COA. 7. Agencies will be asked to provide implementation cost estimates. McElhaney reviewed the most recently published Auditor General Audit Reports for the 28 colleges and summarized the accounts that were used. The summary was distributed and discussed. The reporting structure of the colleges is very similar, which will simplify this process. McElhaney explained that he does not feel there is a need to use classified accounts (current vs. non-current), since our task is to develop a COA and not to present GAAP-based financial statements. The proposal will likely be to merge the current and non-current assets into a single group of asset accounts, and to do the same with the liabilities and revenues. The attendees concurred. McElhaney stated that it is anticipated that the new GASB 54 reporting requirements can be used for reporting equities. Colleges quickly stated that, even though they are component units of the State, they are not required to report using GASB 54. McElhaney stated that GASB 54 requirements give the Legislature a single ‘Unassigned’ Net Assets figure, which is exactly what they want to see. The team is open to other reporting models for the colleges, and look forward to their recommendations. McElhaney further stated that he believes the difficult part of this process will be to develop recommendations for reporting expenditures. Guidance received so far from Legislative staffers is to include fund, organization structures under the agency level, and details regarding the types of expenditures that were made. McElhaney distributed an example of the object code classifications that are used by the State. This is a starting point, and was provided for discussion purposes only. The project team is open to other recommendations. The colleges have a standard expenditure classification methodology that they will provide for review and consideration. The colleges annually report expenditures by function – direct instruction, academic support, student services, institutional support, physical plant, and other. That would be an acceptable proposal for reporting costs, as long as they could break it down by object code or some other ‘type’ of expenditure. The colleges assured McElhaney that it could be done. Unfortunately, this exercise is only done annually for presentation in the CAFR. The reporting frequency will have to be addressed by the Legislature when, and if, they pass an implementing law. Initial discussions have centered on monthly reporting of balances. 1. Colleges do not go through a monthly closing process. If a monthly reporting cycle were adopted, the colleges would be required to extract data on a monthly basis and submit it, even if they do not actually run a closing process. 2. There was general discussion around the idea that most balance sheet account balances are only trued up as of the balance sheet date. Interim balance sheet balances will be relatively useless. The colleges will form a committee to develop recommendations for reporting their financial information, and present them to McElhaney sometime after their next meeting in May 2012. The CFO will take all proposals to the Legislative staff for review and comments. The reporting requirements include component units of the colleges. This caused some concern in both obtaining the information and reporting on it. McElhaney reinforced that this is a requirement in the law and must be addressed. There was discussion about the costs of implementation. The colleges will be asked to provide McElhaney with estimates, but it will be very difficult to audit or verify the estimates. The colleges should be prepared to justify their estimates to Legislative inquiries. The implementation costs will vary based on other decisions that are made regarding the level of reporting. The cost will increase as we go deeper into the organization structure. The project team will work to clarify the levels of reporting once the recommendations of the colleges are received. It is anticipated that the CFO would not be opposed to receiving multiple cost estimates based on different reporting structures. The presentation ended at approximately 3:50 PM. Florida State Colleges Financial Statement Accounts Used Current Assets Cash and Equivalents Restricted Cash and Equivalents Cash Collateral Securities Lending Investments Restricted Investments Accounts Receivable Contributions Receivable Notes Receivable Due From Other Governments Due From Component Units/College Inventories Prepaid Expenses Deposits Prepaid Tuition Other Assets 28 27 1 17 9 28 2 16 28 21 22 24 6 1 14 Non-Current Assets Restricted Cash Investments Restricted Investments Investment in Joint Venture Endowment Investments Prepaid Scholarships Due From Other Governments Due From Component Units Notes Receivable Contributions Receivable Depreciable Capital Assets Non-depreciable Capital assets Prepaid Expenses Assets Held for Resale Other Assets 27 17 25 1 4 1 2 1 6 3 28 27 1 3 13 Current Liabilities Cash Overdraft Accounts Payable Salary and Payroll Taxes Payable Construction Contracts Payable Construction Contracts - Retainage Payable Due To Other Governments Due to Component Unit Deferred Revenue Accrued Loss on Interest Rate Collar Estimated Claims Payable Deposits Line of Credit Payable 1 28 28 3 24 19 12 24 1 5 28 1 Page 1 Florida State Colleges Financial Statement Accounts Used Liability for Cash Collateral Securities Lending Bonds Payable - Current Notes Payable - Current Loans Payable - Current Capital Leases/ Installment Purchases Payable - current Compensated Absences Payable - Current Special Termination Benefits Payable Other Long-term Liabilities 1 22 5 3 9 26 6 2 Non-Current Liabilities Bonds Payable Notes Payable Loans Payable Capital Leases Payable Special Termination Benefits Payable Deposits Compensated Absences Payable Other Post Employment Benefits Payable Estimated Arbitrage Rebate Payable Other Non-Current Liabilities 22 8 3 10 8 4 27 27 3 4 Operating Revenues Tuition and Fees Federal Grants and contracts State and Local Grants and Contracts Non-Governmental Grants and Contracts Sales and Services Auxiliary Enterprises Other Revenues 28 28 25 28 26 28 28 Non-Operating Revenues/Expenses State Appropriations Gifts and Grants Investment Income Other Non-Operating Revenue Net Gain/Loss on Investments Interest on Capital Asset-Related Debt Other Non-Operating Expenses Gain/Loss on Disposal of Capital assets 28 28 28 20 12 25 11 3 Other Revenues Capital Appropriations Capital Grants, Contracts, Gifts and Fees Additions to Permanent Endowments Other Expenses 28 28 14 2 Page 2