2 0 1 5 Schroder & Co Bank AG |

advertisement

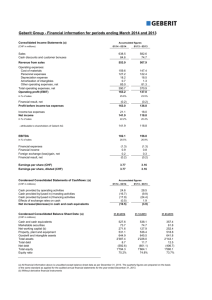

Schroder & Co Bank AG | Annual Report 2015 2015 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 Content Management report 5 1 Balance sheet 6 2 Income statement 7 3 Statement of changes in equity 8 4Notes 9 4.8 Information on the balance sheet 16 4.9 26 4.10 Information on the income statement Information on the off-balance-sheet business 27 5 Disclosures regarding capital adequacy 29 Report of the statutory auditor on the financial statements 31 3 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 Management report 2015 was a challenging year marked by the volatile perfor- The Board of Directors proposes to the General Meeting mance of financial markets. The Swiss National Bank’s the distribution of an ordinary dividend of CHF 5 million. unexpected decision to abandon the minimum exchange It also proposes the allocation of CHF 0.2 million to the rate of the Swiss franc to the euro in January took the mar- “Statutory retained earnings reserve”, CHF 10.2 million to kets by surprise. At the same time, the Greek crisis, the “Voluntary retained earnings reserves” and that the profit performance of the emerging markets and the slowdown in remaining of CHF 66.157 be carried forward. As a result, Chinese growth weighed down further on the stock markets. the Bank’s reported equity capital after payment of the divi- Investor sentiment was additionally clouded by geopolitical dend will rise to CHF 138.2 million. problems in the Middle East and Russia. Although low interest rates and quantitative easing programmes of the central The Board of Directors of Schroder & Co Bank AG has the banks helped to mask the slowdown of the global economy, ultimate responsibility for the Bank’s risk framework, risk it still remains necessary to address the fundamental chal- assessment and internal controls. It approves the risk policy lenges. and is responsible for supervising its implementation. The duty to implement the risk policy sits with the Executive In this challenging environment, Schroder & Co Bank AG Board. The independent risk control function monitors the continued to develop results-oriented investment and IT risk profile of the Bank. Further detailed information on the solutions to better serve its clients and business partners. risk management of the Bank is available in the section “Risk Management” (pages 13 – 14). In 2015, the bank’s assets under management declined from CHF 6.8 billion in the previous year to CHF 6.1 billion. This Barring unforeseen circumstances, we are well positioned was due to outflows and to the negative foreign currency to grow our business in 2016 thanks to our focus on core effect which resulted from the aforementioned Swiss Na­ markets, our long-term business approach and our financial tional Bank’s decision taken in January 2015. The decreased stability. level of assets under management had an adverse impact on the bank’s revenues. Income from the Bank’s insourcing On behalf of the entire Board of Directors, I would like to activities developed positively and grew from CHF 30.1 mil- express my sincere thanks to our clients for the trust they lion in the previous year to CHF 33.7 million. place in us and to our employees for their efforts and personal commitment. The profit after tax for the year was CHF 15.5 million – nearly 5% up on the previous year. This was partially due to the release of the provision made in the previous years with regard to the U.S. Department of Justice’s Program for Swiss banks. In September 2015, the Bank reached an agree- Philip Mallinckrodt ment with the U.S. Department of Justice and paid a fine of Chairman of the Board of Directors USD 10.354 million. Year-on-year, oper­a ting and personnel expenses were lower although the number of employees increased slightly to an average of 219.2 full time equivalent employees (including trainees, interns and temporary employees). At CHF 65.8 million, total expenses were 3.5% lower than in the previous year (CHF 68.1 million). 5 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 1 Balance sheet as at 31 December 2015 CHFNote20152014 Assets Liquid assets 691 077 806 909 585 517 Amounts due from banks 439 574 231 563 315 961 Amounts due from securities financing transactions 4.8.1 329 233 275 303 032 750 Amounts due from customers 4.8.2 159 649 863 169 370 330 Positive replacement values of derivative financial instruments 4.8.3 14 314 605 25 997 320 Financial investments 4.8.4, 4.8.8 36 494 621 69 095 808 Accrued income and prepaid expenses 12 170 305 13 349 441 Participations 4.8.5 1 100 000 1 100 000 Tangible fixed assets 4.8.6 1 62 040 Intangible assets10 Other assets 4.8.7 395 472 861 070 Total assets 1 684 010 180 2 055 770 237 Liabilities Amounts due to banks Amounts due to customers Negative replacement values of derivative financial instruments 4.8.3 Accrued expenses and deferred income Other liabilities 4.8.7 Provisions 4.8.11 Share capital 3, 4.8.12 Statutory retained earnings reserve 3 Voluntary retained earnings reserves 3 Profit carried forward 3 Profit Total liabilities 12 377 728 1 498 627 979 4 896 821 18 290 412 1 318 221 5 332 862 60 000 000 29 100 000 38 600 000 10 290 15 455 867 1 684 010 180 27 913 349 1 828 997 744 9 289 838 20 936 877 2 950 738 30 971 401 60 000 000 28 700 000 28 100 000 3 172 226 14 738 064 2 055 770 237 Off-balance-sheet transactions Contingent liabilities Irrevocable committments 6 4.8.2, 4.9.1 4.8.2 12 632 706 2 546 000 15 381 519 2 848 000 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 2 Income statement for the period from 1 Januar y to 31 December 2015 CHFNote20152014 Result from interest operations Interest and discount income 4.10.2 Interest and dividend income from financial investments Interest expense 4.10.2 Gross result from interest operations Changes in value adjustments for default risks and losses from interest operations 4.8.11 Subtotal net result from interest operations Result from commission business and services Commission income from securities trading and investment activities Commission income from lending activities Commission income from other services Commission expense Subtotal result from commission business and services Result from trading activities and the fair value option 4.10.1 Other result from ordinary activities Result from the Bank’s insourcing activities Other ordinary expenses Subtotal other result from ordinary activities Operating expenses Personnel expenses 4.10.3 General and administrative expenses 4.10.4 Subtotal operating expenses Value adjustments on participations and depreciation and amortisation of tangible fixed assets and intangible assets 4.8.5, 4.8.6 Changes to provisions and other value adjustments, and losses 4.8.11 Operating result Extraordinary income 4.10.5 Taxes 4.10.6 Profit (result of the period) 4 924 616 843 466 (1 175 440) 4 592 642 5 496 406 1 428 841 (1 644 928) 5 280 319 0 4 592 642 11 401 661 16 681 980 39 598 882 236 041 883 331 (12 280 138) 28 438 116 5 936 731 47 229 677 464 036 1 021 069 (10 648 455) 38 066 327 7 414 273 33 707 758 (7 580) 33 700 178 30 079 402 (13 760) 30 065 642 (48 889 770) (16 878 492) (65 768 262) (50 699 949) (17 439 697) (68 139 646) (17 043) (99 996) 10 431 699 17 314 061 17 302 (1 875 496) 15 455 867 (4 519 038) 19 469 542 56 379 (4 787 858) 14 738 064 15 455 867 10 290 15 466 157 14 738 064 3 172 226 17 910 290 (200 000) (10 200 000) (5 000 000) 66 157 (400 000) (10 500 000) (7 000 000) 10 290 Appropriation of profit Profit Profit carried forward Distributable profit at the disposal of the General Meeting 3 Appropriation of profit Allocation to statutory retained earnings reserve Allocation to voluntary retained earnings reserves Distributions from distributable profit New amount carried forward 7 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 3 Statement of changes in equity CHF 1000 Share capital Statutory Voluntary Result retainedretained of the earningsearnings period reserve reserves and profit carried forward Equity at the beginning of 2015 60 000 28 700 31 272 14 738 Total 134 710 Allocations to the voluntary retained earnings reserves 0 0 7 338 (7 338) 0 Allocations to the statutory retained earnings reserve 0 400 0 (400) 0 Dividends000 (7 000) (7 000) Profit 2015 0 0 0 15 456 15 456 Equity at the end of 2015 60 000 8 29 100 38 610 15 456 143 166 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4Notes 4.1 General Outsourcing Schroder & Co Bank AG is a wholly owned subsidiary of The Bank has an outsourcing agreement with the company Schroder Wealth Holdings Limited, London, whose parent D + H Financial Technologies (D + H) for running the interbank company is a wholly owned subsidiary of Schroders plc, applications SIC, EuroSIC, Swift and Secom. D + H’s role London. In addition to the head office in Zurich, the Bank is limited to providing electronic access to the above-men- has a branch office in Geneva. tioned interbank services. The business activities of the Bank are described below. Staff There are no further business activities that would At the end of the business year, the Bank had 193 full- and significantly impact the Bank’s risk and income situation. 36 part-time employees, plus 6 trainees/interns, for a total of 235 (or 226.6 full-time equivalent positions; prior year: Fee and commission business 199 plus 9 trainees/interns and 4.4 temporary employees). The Bank’s principal line of business is investment manage4.2 Accounting and valuation policies ment for both domestic and foreign clients. General principles Asset management, trustee, custodian and credit operations The accounting and valuation principles are based on the are the main contributors to commission and service fee Code of Obligations, the Banking Act and its related Ordi- revenues. nance as well as the accounting rules for banks, securities dealers, financial groups and conglomerates according to Banking activities FINMA circular 2015/1 applied by Schroder & Co Bank AG The Bank’s main balance-sheet activities are the client- beginning with the year 2015 with reclassification of 2014 lending business and interbank operations. comparative figures. The accompanying reliable assessment statutory single-entity financial statements present the eco- Loans to clients are mainly granted on the basis of Lombard nomic situation of the Bank such that a third party can form coverage. a reliable opinion. The financial statements are allowed to include hidden reserves. Trading activities Trading comprises mainly trading for the accounts of clients In the notes, the individual figures are rounded for publica- in interest rate products, securities and foreign exchange tion, but the calculations are based on the non-rounded and to a limited extent proprietary trading. figures, thus small rounding differences can arise. Insourcing business As allowed by Article 35 of the Swiss Banking Ordinance, The Bank renders securities administration, funds transfer, consolidated financial statements have not been prepared. accounting and IT services centrally. These services are being offered to other Schroder Group companies (currently Accounting and valuation policies Schroder & Co. Limited, London, Schroders (C.I.) Limited, The financial statements are prepared on the assumption of Guernsey, Schroder & Co. (Asia) Limited, Singapore and an ongoing concern. The accounting is, therefore, based on Schroder Investment Management (Switzerland) AG, Zurich). going-concern values. These services are charged at market rates. 9 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 The disclosed balance sheet items are valued individual- Securities received and delivered are not recognised or ly. The transitional provision, which requires the individual derecognised in the balance sheet until the economic con- valuation of equity participations, tangible fixed assets and trol of the contractual rights comprised in the securities is intangible assets as of 1 January 2020, is not applied. transferred. Interest amounts collected or paid are recorded in the corresponding lines of the income statement. There has not been any offsetting or netting of assets and liabilities or income and expenses with the exception of c) Amounts due from banks and due from customers the deduction of value adjustments from the corresponding Amounts due from banks and amounts due from customers asset item. are recognised at their nominal value less any value adjustments required. Business risks are covered by adequate provisions. Amounts due in respect of precious metal account deposits Recording of transactions are valued at fair value if the precious metal concerned is All business transactions concluded up to the balance sheet traded on a price-efficient, liquid market. date are recorded as of their trade date (trade date accounting) and valued according to the above-mentioned princi- Doubtful receivables, i.e. obligations entered into with clients ples. Any money market, foreign exchange spot transactions for whom the debtor is unlikely to meet its future obligations, and foreign exchange forwards entered into but not yet are valued individually and depreciated by means of individ- fulfilled are recorded in accordance with the settlement date ual value adjustments. The depreciation of doubtful receiva- accounting method. Between the trade date and the settle- bles is determined by the difference between the book value ment date, these transactions are disclosed at replacement of the receivable and the anticipated recoverable amount. value via the item “Positive replacement values of derivative The anticipated recoverable amount is the liquidation value financial instruments” or “Negative replacement values of (estimated net realisable value minus the costs of retention derivative financial instruments”. and liquidation). Valuation principles Impaired loans, i.e. loans that are unlikely to be repaid by the The most important accounting policies and valuation princi- debtor, are valued individually. A specific value adjustment ples are shown below. is made for the estimated shortfall against nominal value in capital and interest. Loans are considered as impaired at a) Liquid assets the latest when the contractual payments for capital and/or Liquid assets are recognized at their nominal value. interest are overdue for more than 90 days. Interest accrual is suspended if recovering interest is so unlikely that an accrual no longer makes sense. b) Securities financing transactions Repurchase transactions (repos) are recorded as cash deposits with own securities as collateral. Reverse-repurchase If a receivable is classed as entirely or partially irrecoverable transactions (reverse repos) are treated as receivables or a receivable is waived, the receivable is derecognised by against collateral in the form of securities. The exchanged booking it against the corresponding value adjustment. cash amounts are recorded at nominal value on the balance If recovered amounts from receivables written off in earlier sheet. periods cannot be used immediately for other value adjust- 10 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 ments of the same type, they are recognised in “Change in f) Tangible fixed assets value adjustments for default risk and losses from interest Tangible fixed assets are recognised at cost less accu- operations” in the income statement. mulated depreciation. Depreciation is calculated using the straight-line method over the useful life. Doubtful receivables are reclassified as performing if the outstanding amount of capital and interest are paid again Each tangible fixed asset is tested for impairment as of on time according to the contractual agreements and other the balance sheet date. This test is based on indicators creditworthiness criteria. Value adjustments are released reflecting a possible impairment of individual assets im- with an effect on income via the item “Change in value paired. If any such indicators exist, the recoverable amount adjustments for default risk and losses from interest opera- is calculated. The recoverable amount is calculated for each tions”. individual asset. An asset is impaired if its carrying amount exceeds its recoverable amount. d) Financial investments Debt securities to be held until maturity are valued at amor- If the asset is impaired, the book value is reduced to match tised cost. Any premium or discount is amortised over the the recoverable value and the impairment is charged via the life of the security. The valuation is based on the acquisition item “Value adjustments on participations and amortisation cost principle with the agio/disagio (premium/discount) of tangible fixed assets and intangible assets”. accrued/deferred over the residual term to maturity (accrual method) via the position “Financial Investments”. Value If the impairment test shows that the operating life of an adjustments for default risk are recorded immediately under intangible asset has changed, the residual carrying amount “Changes in value adjustments for default risk and losses should be depreciated systematically over the newly estimat- from interest operations”. ed useful life. If held-to-maturity financial investments are sold or reim- Realised gains from the sale of tangible fixed assets are bursed early, the realised gains and losses, which corre- recorded via the item “Extraordinary income” and realised spond to the interest component, are accrued/deferred losses are recorded via the item “Extraordinary expense”. over the residual term to maturity of the transaction. Useful life of the various fixed assets: Own physical stocks of precious metals that serve as collat- Information technology (hardware and software): 3 years eral for liabilities from precious metals trading accounts Cars:4 years are valued at fair value. The value adjustments arising from a subsequent valuation are recorded for each balance g) Amounts due to banks and amounts due to customers via the item “Other ordinary expenses” or “Other ordinary Amounts due to banks are valued at their nominal value. income”. Precious metals customer accounts are valued at fair value if the precious metal concerned is traded on a price-efficient, liquid market. e)Participations Participations are valued at historical cost less any impairment. Realised gains from the sale of participations are h) Foreign currencies recorded via the item “Extraordinary income” and realised Transactions in foreign currencies are converted at the mid losses are recorded via the item “Extraordinary expense”. exchange rates ruling at the daily balance sheet date. For- 11 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 eign exchange positions in the balance sheet are translated exchange dealing. They are used both for proprietary trading at the closing exchange rates at the balance sheet date and for trading for the accounts of clients. Valuation is in and revalued against the income statement. Forward foreign accordance with the purposes for which they were originally exchange transactions are valued at the forward market acquired. rates prevailing at the balance sheet date. The result of the revaluation is taken to the income statement. Derivatives for trading purposes The main conversion rates applied are listed below: ative replacement values are included within “Positive / Neg- These derivatives are valued at fair value. Positive and neg EUR 2014 ative replacement values of derivative financial instruments”. 1.08791.2024 Gains/losses are included within “Result from trading activities and the fair value option”. 2015 GBP 1.47721.5478 USD 1.00190.9936 JPY 0.83310.8289 Derivatives for hedging purposes The Bank may use derivatives for hedging purposes in the i)Provisions Asset & Liability Management process in order to protect Legal and factual obligations are valued regularly. If an itself against interest and foreign exchange risks. Hedging outflow of resources is likely and can be reliably estimated, transactions are valued in the same way as the hedged item. a corresponding provision must be created. The gain/loss of the hedging transaction is booked in the same income statement account as the hedged item’s Existing provisions are reassessed at each balance sheet result. The result of the hedging transaction is booked date. Based on this reassessment, the provisions are in- against the compensation account, in case that the hedged creased, left unchanged or released. Positions are recorded item should not be revalued during the lifetime, of the hedg- via the account “Changes to provisions and other value ing contract. The net balance of the compensation account adjustments, and losses”. is included in “Other assets/liabilities”. Based on the principle of prudence, the Bank establishes Hedges and the goals and strategies of hedging operations provisions within liabilities for contingent risks. The provi- are documented by the Bank at the conclusion of a deriv- sions may contain hidden reserves. ative hedging transaction. The effectiveness of the hedge is regularly reviewed. If the hedge is no longer or only par- j)Taxes tially effective, the part of the hedging transaction that is no Current income taxes are recurring, usually annual, taxes longer effective is treated like a trading operation. on profits and capital. Transaction-related taxes are not included in current taxes. l) Pension benefit obligations The employees of Schroder & Co Bank AG benefit from two Liabilities from current income and capital tax are disclosed pension plans. The BVG pension fund provides the minimum via the item “Accrued liabilities and deferred income”. benefits mandated by law. The Pension Plan Foundation (Vorsorgestiftung) of Schroder & Co Bank AG grants benefits k) Derivative financial instruments for that part of the salary above the requirements set out in Derivative financial instruments are used by the Bank for the BVG law. asset and liability management and for securities and foreign 12 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 The pension fund liabilities and the assets serving as cover- The Equity Incentive Plan (EIP) is an additional deferred re- age are separated out into legally independent foundations. muneration plan, used to recognise exceptional performance The organisation, management and financing of the pension and potential. EIP awards do not give rise to any immediate funds comply with the legal requirements, the deeds of foun- entitlement and require the participant to be employed dation and the current pension fund regulations. The Bank’s continuously by the Group until the fifth anniversary of grant. pension funds are defined contribution plans. Malus and clawback terms apply in a similar way to ECP and EIP. The employer contributions arising from the pension funds are included in “Personnel expenses” on an accrual basis. These deferred remuneration plans are centrally adminis- The Bank assesses whether there is an economic benefit tered and settled by the Schroder Group. These liabilities or economic obligation arising from the pension funds as are valued at their fair value at the grant date. Schroder & of the balance sheet date. The assessment is based on the Co Bank AG then records them in the items “Personnel contracts and the most recent financial statements of the ex­p enses” and “Accrued expenses and deferred income” pension funds (established under Swiss GAAP FER 26) as over the vesting period. As the market risk is borne by the well as the actual over- or underfunding for each pension employee and the total amount is known and hedged, the fund. Bank does not revalue the liability. Any adjustments (termination of employment etc.) are recorded through income. Should a pension plan be underfunded, an economic obliga- Comprehensive details of the design of the equity-based tion would arise where the conditions exist for the creation compensation scheme can be found in the Schroder Group’s of a provision. The Bank refers to a pension fund expert to Financial Statement. assess whether a benefit or an obligation exists for each 4.3 Risk management pension fund. Risk assessment The BVG pension fund of Schroder & Co Bank AG has in­ The Board of Directors reassesses the Bank’s risks each surance to cover the longevity risk of its members. Further- year (in particular with respect to credit, market, liquidity and more, the BVG pension fund of Schroder & Co Bank AG operational risks). The effectiveness of the limit system and has received a guarantee from the Pension Plan Foundation the controls are also evaluated. The Organisation and Man- (Vorsorgestiftung) of Schroder & Co Bank AG in order to agement Regulations ensure that the Board of Directors is protect itself against any possible underfunding. always adequately informed of the risk situation and that the authority for decisions in this area remains within the Board of Directors’ responsibility. m) Equity-based compensation schemes The Equity Compensation Plan (ECP) is the Group’s main deferral arrangement for annual bonus awards. ECP awards Details on risk management relate to the past year’s performance and are not subject to The risk management procedures and the ongoing moni- any further performance conditions. In order to provide an toring are delegated to committees. The Asset & Liability incentive to stay at Schroders, ECP awards do not give rise Management Committee is responsible for monitoring mar- to any immediate entitlement and normally require the par- ket risk, interest rate risk and liquidity risk. This includes the ticipant to be employed continuously by the Group until the selection and monitoring of banks, brokers and custodians. third anniversary of grant in order to vest in full. In addition it monitors the adherence to the capital and large exposure regulations. 13 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 The interest rate risk arising out of the balance sheet and In connection with the local capital adequacy calculation off-balance sheet positions is monitored and managed cen- and reporting, the Bank applies the Basis Indicator Ap- trally. It is managed using calculations of the net present val- proach and holds relevant capital to cover operational risks ue effect on shareholders equity and the net income effect closely linked to the revenues generated by the Bank. The under various interest rate assumptions. The ability to meet Bank uses a variety of instruments for identification, meas- obligations is monitored and ensured within the framework urement and management with the following being the main defined in the bank law and by the Group. Internal audit instruments: Internal Capital Adequacy Process (ICAAP), regularly audits internal controls and issues reports to the Risk Control Assessments (RCA), Fraud Risk Assessments, Board of Directors. Risk Event Policy, Business Continuity Concept, International Standards on Assurance Engagement 3402 reporting (ISAE 3402 Type II). Credit risks are subject to specific monitoring by the Credit Committee and the Credit Department. Loan collateral is valued at fair value. The collateral rates are set forth in pre- The Bank has defined procedures, responsibilities and im- defined procedures. plementation in the policy “Operational Risk Management Framework”. Operational risk Operational risks are defined as the risks of losses due to Liquidity risk the inadequacy or failure of internal policies, people and sys- Liquidity risk is the risk that the Bank might not be able to tems or due to external events. The Bank identifies, meas- meet its present and future payment obligations on a timely ures and manages the following categories of operational basis under either normal or stressed conditions or fails to risk: Internal/External Fraud; Clients, Products and Business meet the liquidity requirements imposed by banking regula- Practice; Execution, Delivery and Process Management; tions. Business Disruption and System Failures; Employment PracThe Bank and its subsidiaries take a prudent approach to tices and Workplace Safety. cash management by choosing first-class counterparties. The Bank employs a “three lines of defence model” to direct Our emphasis is on safeguarding our commitments to cli- its internal control framework, ensure its effective operation ents, in normal and stress situations alike. We moreover and facilitate appropriate escalation. seek to match resources to their use, in terms of both duration and maturities. As the first line of defence, the Executive Board and all levels of management take the lead role with respect to The Bank has a “Treasury Liquidity and Dealing Policy” as implementing appropriate controls across the business to well as a “Business & Risk Policy” which define the risk maintain the quality standards expected by clients and reg- governance principles, the calculation methodology and ulators. Line management is supplemented by internal or the respective limits which take account of the qualitative Group-internal oversight functions (i. e. Risk, Financial Con- and quantitative requirements of Basel III and FINMA. Man- trol, Compliance and Legal both at local and Group level) agement conducts a yearly Individual Liquidity Adequacy that provide a second line of defence. Finally, Group Internal Assessment (ILAA) which covers different aspects of quali- Audit has a dedicated audit team for the Wealth Manage- tative and quantitative liquidity risk. ment Division as a third line of defence. 14 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 The Bank also calculates the standardized Liquidity Cover- 4.6 Business policy regarding the use of derivative age Ratio (LCR) on a daily basis and additionally runs a set financial instruments of liquidity stress test scenarios. The results of these tests Derivative financial instruments are used for trading and are are reported regularly to the Asset Liability Management traded exclusively by specially trained traders. The Bank Committee (ALMC). does not have any market-making activities. Standardised and OTC instruments are traded on behalf of clients, es- 4.4 Methods used for measuring Counterparty pecially interest-, currency- and equity/index-based instru- risks and assessment of required loan value ments and, to a limited extent, those based on commodities. adjustments There is no trading in credit derivatives. Lombard loans Credit exposures and the value of related collaterals are Derivative financial instruments can be used by the Bank for monitored daily. Should any loan value fall below its col- risk management purposes, mainly to hedge against interest lateral value, further collateral or a reduction of the loan is rate and foreign currency risks. Hedging transactions are required. Should net exposure increase or market conditions concluded exclusively with external counterparties. in collateral markets deteriorate significantly, collaterals will 4.7 Material events after the balance sheet date be realised and the loan will be recovered. No events occurred after the balance sheet date that could Process for determining value adjustments have a material impact on the financial position of the Bank Loans deemed to be non-performing are valued individually as of 31 December 2015. and specific loan value adjustments are established based on the above mentioned procedures. Existing value adjustments are subjected to a reassessment on each balance sheet date. Based on this assessment, they are increased, remain unchanged or released. The Credit Committee assesses and approves the value adjustments. In accordance with the approval hierarchy, value adjustments are approved by the Executive Directors or the Board of Directors. 4.5 Valuation of collateral of Lombard loans Primarily, transferable financial instruments that are liquid and actively traded are used for Lombard loans. Transferable structured products, for which there is regular market information and a market maker, are also accepted. The Bank applies a discount to the market value in order to cover the market risk relating to marketable liquid securities and to calculate the value of the collateral. For structured products and products with long residual terms to maturity, the closing out period can be significantly longer, hence, higher discounts are applied to them than those applied to liquid instruments. 15 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8 Information on the balance sheet 4.8.1 Securities financing transactions (assets and liabilities) CHF 1000 2015 Book value of receivables from cash collateral delivered in connection with reverse repurchase transactions 329 233 Fair value of securities received and serving as collateral in connection with reverse repurchase agreements with an unrestricted right to resell or re-pledge 329 378 – of which, re-pledged securities0 – of which, resold securities0 4.8.2 Collateral for loans and off-balance-sheet transactions, as well as impaired loans Collateral for loans and off-balance-sheet transactions Type of collateral CHF 1000 Secured by Other Unsecured Total mortage collateral Loans (before netting with value adjustments) Amounts due from customers 0 158 788 1 070 159 858 Total loans (before netting with value adjustments) 31.12.15 31.12.14 0 0 158 788 164 814 1 070 4 765 159 858 169 579 Total loans (after netting with value adjustments) 31.12.15 31.12.14 0 0 158 788 164 814 862 4 556 159 650 169 370 0 0 0 0 12 625 0 12 625 15 378 8 2 546 2 554 2 852 Off-balance sheet Contingent liabilities Irrevocable commitments Total 31.12.15 31.12.14 12 633 2 546 15 179 18 230 CHF 1000 Gross debt Estimated Net debt Individual amount liquidationamount value value of adjustments collateral Impaired loans 31.12.15 31.12.14 16 208 211 0 3 208 208 208 208 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.3 Derivative financial instruments (assets and liabilities) CHF 1000 Positive Negative Contract replacement replacement volume values values Foreign exchange/precious metals Forward contracts 14 185 4 767 880 246 Options (OTC) 130 130 6 008 Total 31.12.15 14 315 4 897 886 254 31.12.14 25 997 9 290 1 516 860 The above outstanding derivative instruments are held for trading purposes. Market/counterparties’ prices are used for valuation purposes. External OTC derivative financial instruments’ valuations are periodically checked against own valuations. No netting agreements are in place. Breakdown by counterparty CHF 1000 Banks and Other Total securities dealers customers Positive replacement values 10 490 3 825 14 315 4.8.4 Financial investments Breakdown of financial investments CHF 1000 Book value Book value Fair Value Fair Value 2015201420152014 Debt securities 15 077 45 389 – of which, intended to be held to maturity 15 077 45 389 Precious metals 21 418 23 707 Total 36 495 69 096 of which, securities eligible for repo transactions in accordance with liquidity requirements 15 093 15 093 21 418 36 511 45 437 45 437 23 707 69 144 15 093 45 437 Unrated Total Breakdown of counterparties by rating CHF 1000 AAA to AA– A+ to A– BBB+ to BBB– BB+ to BB– Below B– Debt securities (book value) 15 07700000 15 077 The Bank applies a combination of three major rating companies’ ratings and displays them using the Standard & Poor’s nomenclature. 17 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.5 Participations 31.12.14 31.12.15 CHF 1000 Acquisition Accumulated Book Additions Disposals Value Book costvaluevalue adjustmentsvalue adjustments Participations without market value 1 100 0 1 100 0 0 0 1 100 Total 1 1000 1 100000 1 100 Additional information on significant participations Company Name Business activities Share Share of Share of capital capital votes Schroder Trust AG, Geneva Trust and offshore company administrationCHF 100 000 Schroder Cayman BankBanking services, and Trust Company Ltd., trust and offshore Cayman Islands company administrationUSD 633 714 100% 100% 100% 100% Both companies are being liquidated and are therefore not consolidated based on Art. 35 Bank Ordinance. Both are directly held subsidiaries. Recognition on Schroder & Co Bank AG’s balance sheet is based on liquidation value. Unwinding costs have been charged and adequate provisions have been created in the individual balance sheets. 4.8.6 Tangible fixed assets 31.12.14 31.12.15 CHF 1000 Acquisition Accumulated Book Additions Disposals Depreciation Book value cost depreciation value Other tangible fixed assets Total 3 135 3 135 (3 073) (3 073) 62 62 0 0 (45) (45) (17) (17) 0 0 The depreciation method applied and the range used for the expected useful lives are explained in the accounting and valuation policies. The bank currently does not have any intangible assets. Operating lease contracts maturities CHF 1000 3 to 12 months 12 months up to 3 years 3 years to 5 years over 5 years Total 31.12.15 of which, may be terminated within one year 31.12.14 0 0 0 274 0 303 7 750 485 9 325 6 727 0 7 991 14 751 485 17 619 18 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.7 Other assets and other liabilities CHF 1000 Other assets Other assets Other liabilities Other liabilities 2015201420152014 Indirect taxes and stock exchange fees Other assets and liabilities Total 179 216 395 503 358 861 1 255 63 1 318 2 566 385 2 951 4.8.8 Assets pledged or ceded to secure own liabilities and assets subject to ownership reservation Assets pledged or ceded 2015 2014 CHF 1000 Assets pledged Effective Assets pledged Effective (Book value) liability (Book value) liability Liquid assets Financial investments 21 238 12 910 2 030 0 0 37 259 0 16 230 4.8.9 Liabilities relating to own pension schemes, and number and nature of equity instruments of the Bank held by own pension schemes CHF 1000 2015 2014 Amounts due to customers Negative replacement values of derivative financial instruments Total liabilities relating to own pension schemes The Bank’s pension funds did not hold any shares of the Bank in 2015 or 2014. 19 5 235 79 5 315 10 492 469 10 961 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.10 Economic situation of own pension schemes Employer contribution reserves (ECR) Schroder & Co Bank AG’s employees participate in two defined contribution pension funds. The BVG pension fund provides the minimum benefits required by the law. The Pension Plan Foundation (Vorsorgestiftung) provides benefits on that portion of the salaries that exceed the BVG legal minimum. Due to the external insurance and the guarantee from the Pension Plan Foundation (Vorsorgestiftung), there are neither employer contribution reserves nor fluctuation reserves nor an under- or overfunding. Economic benefit / obligation and pension expenses As neither under- nor overfunding exist, the Bank, according to RS FINMA 15/1 margin 496, has neither an economic benefit nor an obligation towards the pension funds or their members. CHF 1000 Contributions paid Pension expenses Pension expenses in personnel in personnel expenses expenses 201520152014 Pension plans without over-/underfunding 5 200 7 425 6 697 According to the pension fund regulations, the employer pays total contributions and benefits equivalent to 15 % of the relevant salary whereas the employees contribute 5 % of that salary. The column “Contributions paid” includes the Bank’s total contributions to both pension plans for the year. The columns “Pension expenses in personnel expenses” include the Bank’s total pension and related benefit expenses (including old age and survivors’ insurance, disability insurance, unemployment insurance and other mandatory contributions). 4.8.11 Valuation adjustments, provisions and reserves for general banking risks CHF 1000 Balance Use in confor- Recoveries, New creations Releases Balance 31.12.14 mity with desig- overdue charged to to income 31.12.15 nated purpose interest income Other provisions Total provisions Value adj. for default and country risks 30 972 30 972 208 (15 191) (15 191) (12) (15) (15) 12 345 345 0 (10 778) (10 778) 0 5 333 5 333 208 In September 2015, the Bank signed a non-prosecution agreement with the U. S. Department of Justice in connection with the U. S. Program and paid a penalty of USD 10.354 m. As per 31 December 2015, CHF 1.4 m remain as other provision for further legal fees in connection with the U. S. Program. The remainder of CHF 10.625 m was released to the income statement. 20 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.12 Capital structure and shareholders The share capital amounts to CHF 60 m and is split into 60 000 registered shares of CHF 1000 nominal value each. The company’s share capital is fully paid in. No special rights are conferred by the share capital. The distributable profit of CHF 15 466 157 is available for distribution by the shareholders, subject to legal requirements. The non-distributable “Statutory retained earnings reserve” amounts to CHF 29 100 000; distributable “Voluntary retained earnings reserves” amount to CHF 38 600 000, subject to legal requirements. As at 8 December 2015, all shares of Schroder & Co Bank AG have been transferred from Schroder Finance Netherland B. V. to Schroder Wealth Holdings Limited, London, which is a 100 % subsidiary of Schroders Plc. As at 4 March 2015, Schroders plc had received notifications, in accordance with rule 5.1.2 R of the Disclosure and Transparency Rules, of interests in three per cent. or more of the voting rights attaching to the Company’s issued share capital, as set out in the table below. There had been no changes to these notifications as at the date of this report. 04.03.15 05.03.14 Schroder shares Percent Schroder shares Percent Vincitas Limited Veritas Limited Flavida Limited Fervida Limited Harris Associates L.P. 60 724 609 36 795 041 60 951 886 40 188 706 15 969 200 26.87 % 16.28 % 26.97 % 17.78 % 7.07 % 60 724 609 36 795 041 60 951 886 40 188 706 15 969 200 26.87 % 16.28 % 26.97 % 17.78 % 7.07 % Vincitas Limited and Veritas Limited act as trustees of certain settlements made by members of the Schroder family and are party to the Relationship Agreement. The interests of Flavida Limited and Fervida Limited include interests in voting rights in respect of all the shares in which Vincitas Limited and Veritas Limited are interested as trustees. Flavida Limited and Fervida Limited are party to the Relationship Agreement. 4.8.13 Amounts due from / to related parties CHF 1000 Amounts due from Amounts due from Amounts due to Amounts due to 2015201420152014 Holders of qualified participations 0 10 214 12 844 465 Group companies 0 0 2 362 8 624 Linked companies 8 961 2 590 2 663 4 667 Transactions with members of governing bodies 1 4 1 597 0 Other related parties0000 With related parties, the Bank engages in securities and money market transactions and applies interest rates at conditions applicable to third parties. Members of the Executive Board and of the Board of Directors generally are granted the conditions and tariffs applicable to staff members of the Bank. 21 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.14 Employee participation schemes Equity Compensation Plan (ECP) The ECP is the Group’s main deferral arrangement for annual bonus awards. Comprehensive details of the design of the ECP scheme can be found in the Schroders plc Group Financial Statements. Equity Incentive Plan (EIP) The EIP is an additional deferred remuneration plan used to recognise exceptional performance and potential. Comprehensive details of the design of the EIP scheme can be found in the Schroders plc Group Financial Statements. Please refer to the notes “Accounting and valuation policies” for further details. 4.8.15 Maturity structure of financial instruments At sight CancellableDueDueDueTotal CHF 1000withinwithinwithin 3 months 3 to 12 12 months months to 5 years Assets / financial instruments Liquid assets 691 0770000 691 077 Amounts due from banks 87 120 0 199 782 152 672 0 439 574 Amounts due from securities financing transactions 0 0 314 204 15 029 0 329 233 Amounts due from customers 2 31 494 90 293 36 862 1 000 159 651 Positive replacement values of derivative financial instruments 0 0 11 673 2 641 0 14 314 Financial investments 21 418 0 15 077 0 0 36 495 Total 31.12.15 799 617 31 494 631 029 207 204 1 000 1 670 344 31.12.14 1 067 209 66 351 616 364 274 008 16 466 2 040 398 Debt capital / financial instruments Amounts due to banks Amounts due to customers Negative replacement values of derivative financial instruments Total 31.12.15 31.12.14 12 378 1 498 533 0 0 0 95 0 0 0 0 12 378 1 498 628 0 1 510 911 1 838 762 0 0 357 3 312 3 407 24 411 1 585 1 585 2 671 0 0 0 4 897 1 515 903 1 866 201 22 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.16 Assets and liabilities by domestic and foreign origin in accordance with the domicile principle CHF 1000 2015 2014 Domestic ForeignDomestic Foreign Assets Liquid assets Amounts due from banks Amounts due from securities financing transactions Amounts due from customers Positive replacement values of derivative financial instruments Financial investments Accrued income and prepaid expenses Participations Tangible fixed assets Other assets Total 691 078 274 635 178 085 20 714 0 164 939 151 148 138 936 909 586 227 078 178 839 24 702 0 336 238 124 194 144 668 4 886 36 495 11 768 100 0 395 1 218 156 9 429 0 402 1 000 0 0 465 854 8 222 69 096 12 830 100 62 861 1 431 376 17 775 0 519 1 000 0 0 624 394 874 246 866 11 504 1 251 762 717 313 766 27 197 1 515 231 545 18 290 1 318 5 333 60 000 29 100 38 600 10 15 456 416 392 4 352 0 0 0 0 0 0 0 0 1 267 618 3 895 20 936 2 951 30 971 60 000 28 700 28 100 3 172 14 738 507 946 5 395 1 0 0 0 0 0 0 0 1 547 824 Liabilities Amounts due to banks Amounts due to customers Negative replacement values of derivative financial instruments Accrued expenses and deferred income Other liabilities Provisions Share capital Statutory retained earnings reserve Voluntary retained earnings reserves Profit carried forward / loss carried forward Profit / loss (result of period) Total 23 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.17 Assets by country / country groups 2015 2014 CHF 1000 in % CHF 1000 in % Assets Europe – Germany 54 718 3.3 % 34 186 1.7 % – United Kingdom 38 803 2.3 % 159 320 7.7 % – Switzerland 1 218 157 72.3 % 1 431 375 69.6 % – Rest of Europe 273 645 16.3 % 285 157 13.9 % Total Europe 1 585 323 94.1 % 1 910 038 92.9 % North America 4 350 0.3 % 6 060 0.3 % Asia 20 989 1.3% 18 438 0.9 % Other countries 73 348 4.4 % 121 234 5.9 % Total 1 684 010 100.0 % 2 055 770 100.0 % 4.8.18 Assets by credit rating of country groups The breakdown of assets by credit rating of country groups is based on the risk relating to the underlying asset and not the domicile of the debtor. For secured assets, the risk domicile is determined by taking into consideration the respective collateral (due from customers, reverse repos). The Bank applies a combination of three major rating companies’ ratings and displays them using the Standard & Poor’s nomenclature. Standard & Poor’s Net foreign exposure / 31.12.15 CHF 1000 Share as % AAA to AA– 580 023 98.5 % A+ to A– 2 102 0.4 % BBB+ to BBB– 4 744 0.8 % BB+ to B– 20 0.0 % Lower than B– 13 0.0 % No rating available 1 963 0.3 % Total 588 865 100.0 % 24 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.8.19 Assets and liabilities by the most significant currencies 2015 CHF 1000 CHF EUR USD Precious metals Other Total Assets Liquid assets 690 286 609 107 0 76 691 078 Amounts due from banks 75 379 153 483 112 476 8 184 90 052 439 574 Amounts due from securities financing transactions 0 10 879 303 583 0 14 772 329 234 Amounts due from customers 20 360 45 848 51 869 0 41 571 159 648 Positive replacement values of derivative financial instruments 14 184 0 130 0 0 14 314 Financial investments 15 077 0 0 21 418 0 36 495 Accrued income and prepaid expenses 11 310 92 344 0 425 12 171 Participations 1 1000000 1 100 Other assets 37761300 396 Total assets shown in balance sheet 828 073 210 917 468 522 29 602 146 896 1 684 010 Delivery entitlements from spot exchange, forward forex and forex options transactions Total assets 59 022 887 095 256 612 467 529 417 580 886 102 0 29 602 153 041 299 937 886 255 2 570 265 Liabilities and shareholders’ equity Amounts due to banks 526 4 687 1 932 0 5 233 12 378 Amounts due to customers 174 713 383 578 731 468 29 602 179 269 1 498 630 Negative replacement values of derivative financial instruments 4 766 0 130 0 0 4 896 Accrued expenses and deferred income 18 165 5 93 0 27 18 290 Other liabilities 1 3150003 1 318 Provisions 4 819 0 240 0 273 5 332 Share capital 60 0000000 60 000 Statutory retained earnings reserve 29 100 0 0 0 0 29 100 Voluntary retained earnings reserves 38 600 0 0 0 0 38 600 Profit carried forward10000010 Profit 15 4560000 15 456 Total liabilities shown in balance sheet 347 470 388 270 733 863 29 602 184 805 1 684 010 Delivery obligations from spot exchange, forward forex and forex options transactions Total liabilities Net position per currency 529 408 876 878 10 217 79 237 467 507 22 25 152 185 886 048 54 0 29 602 0 115 107 299 912 25 875 937 2 559 947 10 318 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.9 Information on the off-balance-sheet business 4.9.1 Contingent liabilities and assets CHF 1000 2015 2014 Credit guarantees Irrevocable commitments arising from documentary letters of credit Total 11 631 1 002 12 633 15 382 0 15 382 4.9.2 Fiduciary transactions CHF 1000 2015 2014 Fiduciary placements with third-parties Fiduciary loans Total 229 880 0 229 880 530 848 2 881 533 729 4.9.3 Funds Under Management Private Banking CHF 1000 2015 2014 Assets in collective investment schemes managed by the Bank Assets under discretionary asset management agreements Other managed assets Total Private Banking Funds Under Management (including double counting) of which double counting 7 355 1 262 945 4 823 402 6 093 702 7 355 10 288 1 535 333 5 219 466 6 765 087 10 288 Total managed assets (including double counting) at beginning +/– Net new money inflow or net new money outflow +/– Price gains / losses, interest, dividends and currency gains / losses Total managed assets (including double counting) at end 6 765 087 (462 196) (209 189) 6 093 702 6 450 285 (125 886) 440 688 6 765 087 The Bank does not hold any custody-only assets. Debit interest on current account overdrafts is treated as negative performance, while interest charged on Lombard loans is a cash outflow. The Bank calculates performance according to the direct method. 4.9.4 Funds administered by the Bank CHF 1000 2015 2014 Assets administered banking activities (see 4.9.3) Assets administered in connection with the insourcing for Schroder Group’s companies Total assets administered by the Bank 6 086 347 40 199 316 46 285 663 6 754 799 42 281 074 49 035 873 The Bank renders administrative services to other Schroder Group’s companies in the areas of custody, operations and finance. For this insourcing business, the Bank charges fees which are reflected in the profit and loss account under the position “Other ordinary income” (see explanation in 4.1 General – Insourcing Business). 26 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.10 Information on the income statement 4.10.1 Result from trading operations and the fair value option CHF 1000 2015 2014 Foreign exchange trading operations with clients Total 5 937 5 937 7 414 7 414 4.10.2 Refinancing income and income from negative interest Negative interest on credit operations are disclosed as a reduction in interest and discount income. Negative interest on deposits are disclosed as a reduction in interest expense. CHF 1000 2015 2014 Negative interest on credit operations (reduction in interest and discount income) Negative interest on deposits (reduction in interest expense) ( 4 236 )0 14 0 4.10.3 Personnel expenses CHF 1000 2015 2014 Salaries (meeting attendance fees and fixed compensation to members o f the Bank’s governing bodies, salaries and benefits) – of which, expenses relating to share-based compensation and alternative forms of variable compensation Social insurance benefits Other personnel expenses Total 39 495 41 750 119 7 424 1 971 48 890 323 6 697 2 253 50 700 Salaries include expenses related to share-based and alternative forms of variable compensation (as explained in Note 4.8.14). In 2015, 12 930 shares were granted (4550 shares for governing bodies, 8380 for employees) for a total value of CHF 593k. 27 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 4.10.4 General and administrative expenses CHF 1000 2015 2014 Office space expenses Expenses for information and communications technology Expenses for vehicles, equipment, furniture and other fixtures, as well as operating lease expenses Fees of audit firm – of which, for financial and regulatory audits – of which, for other services Other operating expenses Telephone, telex, postage, electronic information systems, legal and other consulting fees, stationery and printing, courier services, property insurance, travel and entertainment, publication and advertising, other costs Total 2 949 4 438 4 871 4 325 268 505 409 96 675 600 450 150 8 718 16 878 6 969 17 440 4.10.5 Explanations regarding material losses, extraordinary income and expenses, as well as material releases of hidden reserves, reserves for general banking risks, and value adjustments and provisions no longer required Please refer to Note 4.8.11 for information on the Bank’s settlement with the U.S. Department of Justice. 4.10.6 Current taxes, deferred taxes, and disclosure of tax rate CHF 1000 2015 2014 Expenses for current taxes Average tax rate weighted on the basis of the operating result 28 (1 875) 10.8 % (4 788) 24.6 % S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 5 Disclosures regarding capital adequacy 5.1 Eligible equity CHF 1000 2015 2014 Eligible adjusted common equity Tier 1 capital (CET1) Eligible additional Tier 1 capital (AT1) Total Tier 1 capital (T1) Total Tier 2 capital (T2) Total eligible capital 126 610 0 126 610 0 126 610 118 872 0 118 872 0 118 872 5.2 Minimum required equity CHF 1000 2015 2014 Credit risk Valuation adjustments Non-counterparty related risks Market risk Operational risk Total minimum capital requirement 27 900 100 0 1 213 10 656 39 869 30 555 237 5 3 584 10 354 44 735 5.3 Capital adequacy ratios 2015 2014 CET1 ratio 25.4 % 21.3 % T1 ratio 25.4 % 21.3 % Total equity ratio 25.4 % 21.3 % Leverage ratio exposure (CHF 1000) 1 705 761 2 088 303 Leverage ratio 7.4 % 5.7 % FINMA defined minimum CET1 ratio 7.4 % 7.4 % FINMA defined minimum T1 ratio 9.0 % 9.0 % FINMA defined minimum total equity ratio 11.2 % 11.2 % 29 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 5.4 Liquidity Coverage Ratio (LCR) CHF 1000 2015 2014 Total stock of category 1 assets Total stock of category 2 assets before applying the cap Total stock of category 2 assets after applying the cap Total stock of high quality liquid assets plus usage of alternative treatment Total cash inflows before applying the cap Total cash inflows after applying the cap Total cash outflows Liquidity coverage ratio (LCR) 761 064 181 559 181 559 942 623 127 774 127 774 442 462 299.5 % 1 044 428 26 005 26 005 1 070 433 296 130 296 130 620 260 330.2 % Liquidity Coverage Ratio (LCR) quarterly average (based on month end figures) CHF 1000 2015 Q1 391.82 % Q2 341.91 % Q3 278.41 % Q4 259.02 % For consolidated figures of the Schroder Group please refer to the Group’s website at http://www.schroders.com/en/investor-relations/shareholders-and-governance/disclosures/pillar-3-disclosures/ 30 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 Report of the statutory auditor on the financial statements As statutory auditor, we have audited the financial presentation of the financial statements. We believe that the statements of Schroder & Co Bank AG, which comprise audit evidence we have obtained is sufficient and appropri- the balance sheet, income statement, statement of ate to provide a basis for our audit opinion. changes in equity and notes (pages 6 – 28 ), for the year ended 31 December 2015. Opinion In our opinion, the financial statements for the year ended Board of Directors’ responsibility 31 December 2015 comply with Swiss law and the compa- The Board of Directors is responsible for the preparation ny’s articles of incorporation. of the financial statements in accordance with the requirements of Swiss law and the company’s articles of incorpo- Report on other legal requirements ration. This responsibility includes designing, implementing We confirm that we meet the legal requirements on licensing and maintaining an internal control system relevant to the according to the Auditor Oversight Act (AOA) and independ- preparation of financial statements that are free from mate- ence (art. 728 CO and art. 11 AOA) and that there are no rial misstatement, whether due to fraud or error. The Board circumstances incompatible with our independence. of Directors is further responsible for selecting and applying appropriate accounting policies and making accounting In accordance with art. 728a para. 1 item 3 CO and Swiss estimates that are reasonable in the circumstances. Auditing Standard 890, we confirm that an internal control system exists which has been designed for the preparation Auditor’s responsibility of financial statements according to the instructions of the Our responsibility is to express an opinion on these financial Board of Directors. statements based on our audit. We conducted our audit in accordance with Swiss law and Swiss Auditing Standards. We further confirm that the proposed appropriation of avail- Those standards require that we plan and perform the audit able earnings complies with Swiss law and the company’s to obtain reasonable assurance whether the financial state- articles of incorporation. We recommend that the financial ments are free from material misstatement. statements submitted to you be approved. An audit involves performing procedures to obtain audit evi- PricewaterhouseCoopers AG dence about the amounts and disclosures in the financial Stefan Keller Wyss, statements. The procedures selected depend on the au- Daniel Müller, Audit expert, Auditor in charge Audit expert ditor’s judgment, including the assessment of the risks of material misstatement of the financial statements, whether Zurich, 11 March 2016 due to fraud or error. In making those risk assessments, the auditor considers the internal control system relevant to the entity’s preparation of the financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control system. An audit also includes evaluating the appropriateness of the accounting policies used and the reasonableness of accounting estimates made, as well as evaluating the overall 31 S c h r o d e r & C o B a n k AG — A n n u a l R e p o r t 2 015 Board and senior staff (as of 11 March 2016 ) Board of Directors Executive Board External Auditors Philip Mallinckrodt Adrian Nösberger PricewaterhouseCoopers AG, Zurich Chairman Chairman, Dr Stefan Mäder Vice-Chairman Marc Brodard Dr Martin Eckert Jean-Claude Marchand Markus Rütimann Chief Executive Officer Member, Head Private Clients Geneva David Dowse Member, Chief Financial Officer Dr Ariel Sergio Goekmen Member, Head Private Clients Zurich Oliver Oexl Member, Head Legal, Compliance and Risk Peter Thüring Member, Chief Operating Officer 32 Head Office Branch Office Subsidiary Companies Schroder & Co Bank AG Schroder & Co Banque SA Schroder Trust SA Central 2, 8001 Zürich 8, rue d’Italie, 1204 Genève 8, rue d’Italie, 1204 Genève Postfach, 8021 Zürich Case postale 3655, 1211 Genève 3 Case postale 3655, 1211 Genève 3 Tel +41 (0)22 818 41 11 Tel +41 (0)22 818 41 22 Fax +41 (0)22 818 41 12 Fax +41 (0)22 818 41 28 Schroder & Co Bank AG Pfingstweidstrasse 60, 8005 Zürich Postfach 2222, 8031 Zürich Schroder Cayman Bank and Trust Company Limited Tel +41 (0)44 250 11 11 P. O. Box 1040, Harbour Centre Fax +41 (0)44 250 13 12 Grand Cayman KY1-1102, B.W.I. www.schroders.ch Tel +1 345 949 28 49 contact@schroders.ch Fax +1 345 949 54 09