Our objectives are aligned with

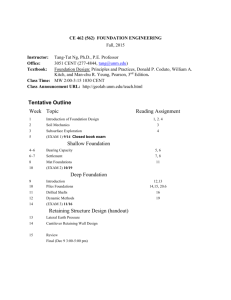

advertisement

Strategy Our objectives are aligned with those of our clients and shareholders – to create sustainable value over the long term. We deliver long-term value by: Delivering consistent and above-average performance Building close relationships with clients Measurable by: Targeting at least 60 per cent. of assets under management to outperform benchmark or peer group over rolling three-year periods. Levels of gross sales; and levels of net new business. Benefits: Superior investment performance* creates value for our clients and is a driver of growth in new business. eveloping the investment products D and solutions which meet our clients’ needs will lead to increased new business opportunities and greater longevity of client relationships. Risks: Performance can fall short of targets. Products that do not meet their objectives can put client relationships at risk. Results: 72% The percentage of assets under management that outperformed over three years to 31 December* 84.1bn 13.0bn £ £ Gross sales Net new business (2014: £92.0bn) (2014: £24.8bn) (see 2, page 12) (2014: 78%) (see 1, page 12) Our Markets were challenging in 2015 expectations with macro factors driving volatility, for 2016: particularly in the second half of the year. Over the 12 months to 31 December 2015, 53 per cent. of assets (2014: 59 per cent.) outperformed benchmark or peer group. This may impact our performance statistics for the three years to 31 December 2016. * See Glossary. 10 Schroders | Annual Report and Accounts 2015 In 2016, net new business may be impacted by market conditions. Volatility can weigh upon sentiment, particularly in the Intermediary channel. However, with a broad product set and highly diversified global business, we expect to continue to grow our business in a more challenging environment. Strategic report Strategy & Business review Ensuring operational efficiency Retaining and developing a deep pool of talent Investing in future growth opportunities argeting a cost:net revenue ratio T of 65 per cent. and a compensation cost:net revenue ratio of between 45 and 49 per cent. depending on market conditions. Developing our employees and retaining talent. Investment in both organic growth and acquisition opportunities; and seed capital deployed to support the development of new investment strategies. We will generate high levels of profit after tax enabling increased dividends and continued organic investment in our business. Retaining and developing talent is key to organisational stability and long term success. Building shareholder value over the long term. In weaker markets, the ratios may be higher than our long-term target. Talented people are frequently targeted by competitors seeking to build their business. In the short term, particularly during periods of market weakness, profitability can be adversely affected. 63% 94% £ £ Investment capital Seed capital investments Cost:net revenue ratio (2014: 64%) (see 5, page 13) 44% Compensation cost:net revenue ratio (2014: 44%) (see 6, page 13) Employee retention (highly rated) (2014: 94%) 93% Employees who are proud to be associated with Schroders (Employee Opinion Survey) 942m (2014: £725m) 229m (2014: £163m) (2014: n/a) We are budgeting a 45 per cent. compensation to net revenue ratio in 2016. Retention rates have been high in recent years but could be affected if competitors recruit more actively. Capital deployed in seeding new investment strategies increased to £229 million in 2015. Weak markets could lead to short term losses on investment capital, although we are well positioned for the long term. Schroders | Annual Report and Accounts 2015 11