EFFECTS OF A FEDERAL VALUE-ADDED TAX Jim Nunns and Eric Toder

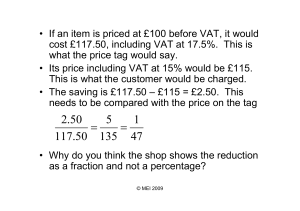

advertisement