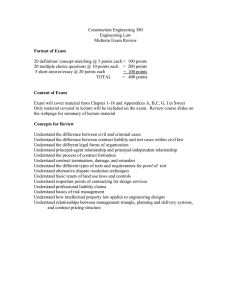

USC RISK MANAGEMENT - INSURANCE POLICY OVERVIEW

advertisement

USC RISK MANAGEMENT - INSURANCE POLICY OVERVIEW NOTE: This is a basic overview of insurance coverage, it is not all inclusive. If you have specific questions, please contact Risk Management @ 777-2828 Overview: The University of South Carolina’s Risk Management program is part of the Environmental Health and Safety department, which reports to Business Affairs. The Risk Management program supports the Columbia campus, satellite campuses and other associated entities. A comprehensive Risk Management program is currently in place, which incorporates the fundamentals of risk identification, risk evaluation, risk control and risk financing alternatives in reducing loss potential and ensuring continuous improvement of the overall program. The University mitigates the financial consequences of physical, human and financial losses through the purchase of insurance. As mandated by state law, the majority of these insurance policies are purchased through the State Budget and Control Board, Office of the Insurance Reserve Fund. As needed, the Insurance Reserve Fund’s policies are supplemented by the purchase of insurance policies through the private market. Insurance Policies: The various types of Property insurance policies maintained by the Risk Management include: Building and Personal Property, Inland Marine, Data Processing Equipment, Business Interruption, Automobile Property Damage, and Builders’ Risk. Additionally, Risk Management maintains a variety of Casualty insurance policies, which include Automobile Liability, Aircraft Liability, Tort Liability, Medical Professional Liability, and Student Workers’ Compensation Insurance. Building and Personal Property: • Personal property (contents) means furniture and fixtures, machinery and equipment and all other personal property owned by the organization and used in the business. • The property of “others” is generally not covered. The property of “others” would have to be under our care, custody and control before it would be covered. Inland Marine: • These policies are devoted to protecting works of art, construction and grounds equipment, field scientific equipment and objects that are removed from university buildings. These policies apply to property moving, capable of being moved, or aiding in the movement of property. General Tort Liability: • This policy provides financial loss protection for the University, its’ employees and volunteers who may be held legally liable to third parties who sustain damages (as a result of actual or alleged negligence) while in the performance of their assigned job duties. • Coverage follows you wherever you go, as long as you are permanently domiciled in the United States. • Coverage is automatic for newly assigned personnel and is classified into six major categories: Law Enforcement Personnel, Directors and Executive Managers, Maintenance Personnel, Clerical Personnel, Volunteers and Others. • Coverage is provided for students who participate in work study, distributive education, apprentice, or similar programs on the premises of private companies, but only during the course of their employment in such programs. If working outside of the United States, coverage applies to work with private, governmental and non-profit organizations. Data Processing Equipment: • This is a blanket policy that provides coverage for the direct physical loss and damage to computer equipment. • USC computer equipment consists of machines and components capable of accepting information and processing it according to plan and producing desired results. It includes air conditioning, fire protection equipment and electrical equipment used exclusively in your computer operations. However, it does not include data and media that we do not own or are not legally responsible. • Media is defined as material on which data is recorded, such as magnetic tapes or disk packs. Data is defined as facts, concepts or instructions in a form usable for communications, interpretations or processing by automatic means. This includes computer programs. Automobile Insurance: • Two separate policies are in effect: Liability and Physical Damage. The liability policy provides coverage for bodily injury losses caused from the operation and maintenance of all University vehicles. The Physical Damage policy provides financial loss protection for physical property damage losses caused from the University’s operation of select automobiles. • Liability coverage is maintained for all vehicles operated by the University. • Non-owned university automobile liability coverage is provided for employees using their privately owned vehicles in the performance of their duties. However, this coverage is in excess over any insurance coverage (employee’s insurance). Builders’ Risk: • This policy protects the university from financial losses associated with the direct physical loss of, or damage to new structures during the building process and to existing structures undergoing substantial renovation. • Provides coverage for buildings under construction and fixtures, machinery, equipment, building materials and supplies within 100 feet of the building (if intended to become a permanent part of the structure). Workers’ Compensation Insurance: • The University purchases Worker’s Compensation benefits for off campus nonpaid student interns through the State Accident Fund (SAF). Risk Management reports information to the SAF related to all off campus non-paid student interns who are performing work as part of their degree program. Medical Professional Liability (Medical Malpractice): • Coverage provided for USC health care professionals involved in “hands-on” care of individuals. Includes coverage for pharmacists, therapists, trainers, social workers, counselors, nurses, students, instructors, physicians, nurse practitioners, etc. Business Interruption Policy (Combined Business): • This policy protects the university from actual financial losses associated with business income and/or extra expenses due to the necessary suspension of operations caused by direct physical loss of, or damage to covered property.