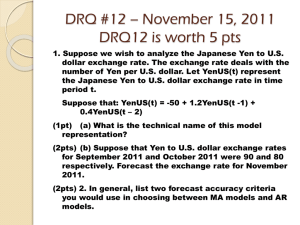

La Follette School of Public Affairs Macroeconomic Management and Financial

advertisement