Document 14232955

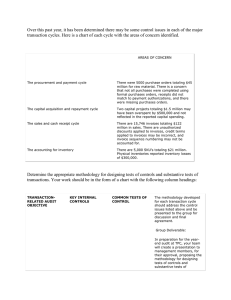

advertisement