Document 14232953

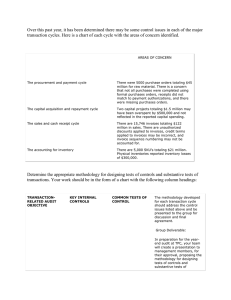

advertisement