TAXES Show me the Money!

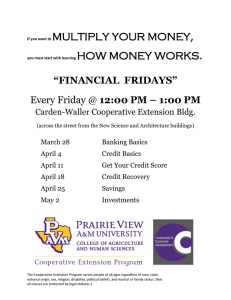

advertisement

TAXES Show me the Money! Thoughts on Taxes • “Taxes, after all, are dues that we pay for the privileges of membership in an organized society.” • ~Franklin D. Roosevelt Thoughts on Taxes • “Taxation with representation ain't so hot either.” • ~Gerald Barzan Thoughts on Taxes • “Income tax returns are the most imaginative fiction being written today.” • ~Herman Wouk Thoughts on Taxes • “I like to pay taxes. With them I buy civilization.” • ~Oliver Wendell Holmes, Jr. Thoughts on Taxes • " I understand that Congress is considering a socalled 'flat' tax system. How would this work?" Answer: "If Congress were to pass a 'flat' tax, you'd simply pay a fixed percentage of your income, and you wouldn't have to fill out any complicated forms, and there would be no loopholes for politically connected groups, and normal people would actually understand the tax laws, and giant talking broccoli stalks would come around and mow your lawn for free, because Congress is NOT going to pass a flat tax, you pathetic fool." ~Dave Barry Thoughts on Taxes • Only 2 things are certain in Life. Can you tell me what they are? • “Death and Taxes!” • Benjamin Franklin TAXES VOCABULARY • 1. WHAT IS A TAX? • Students??? TAX • 1. A TAX is money that people and businesses pay to support the government • Any $ paid to the government TAX Any money paid to the government • Antonym = Refund • Synonym = Payment or Tariff TAX VOCABULARY • 2. Regressive Taxes = A Tax that affects people with low income more than those with large incomes • Not based on a person’s ability to pay • EX: License Fees and property taxes TAX VOCABULARY • 2. Regressive Taxes • Bill Gates pays $50 for a marriage license and Darius pays $50 for a marriage license. • Which person lost a bigger piece of their income? • Any flat fees, fines, application fees are regressive TAX VOCABULARY • 3. Progressive Taxes = • Those taxes that vary with a person’s ability to pay • The tax rate goes up as a person’s income level goes up • EX: The US Income tax which taxes income from 10% to 39% TAX VOCABULARY • 3. Progressive Taxes = • Warren Buffet makes $200 million dollars in 2012 so his tax rate is 39.6% • Kenny makes $3000 in 2013 so his rate is 10% • Uncle Warren can afford to pay more in taxes TAX VOCABULARY • 4. Proportional taxes = • Those taxes on income that are assessed at the same rate for everyone • EX: Pennsylvania Income Tax rate is at 3.07% TAX VOCABULARY • 4. Proportional taxes = • Mr. Heinz makes $100,000 in 2013 and PA income tax at a rate of 3.07% • Nick makes $3000 in 2013 and pays PA income tax at a rate of 3.07% • Who pays a higher percent in state tax? TAX VOCABULARY • 5. Income Taxes = • Any tax that is levied (placed) on a person’s income received during the course of the year • US Income tax is Progressive TAX VOCABULARY • 6. Corporate Income Taxes = Taxes levied (placed) on the income of a corporation / business during the year. TAX VOCABULARY 7. Taxable Income = A person’s total income (from all sources) minus certain deductions and personal exemptions. This is the amount the government taxes you on each year. WITHHOLDING • The money held from a person’s income to pay for their income and social insurance taxes. SOCIAL INSURANCE TAXES • Money the federal government collects to pay for major social programs to help the elderly, the ill and the unemployed • An employer and employees share equally in this tax. The employer withholds (deducts) the tax from an employee’s paycheck and matches it. The Treasury Department holds the money in a special account under that SSN. SOCIAL INSURANCE TAXES • EX: Social Security – Govt sponsored retirement program and medical care for retired persons • MEDICARE – Govt sponsored medical care program for retired persons • UNEMPLOYMENT COMPENSATION – Combined federal and state program of financial assistance to the unemployed STATE INCOME TAX • A state tax that charges every income earner the same % of their income • PA Income tax Rate is 3.07% • Some states use a progressive tax and others like PA use a PROPORTIONAL Rate TAX VOCABULARY • 8. Estate Tax = This type of tax is placed by the federal government on the estate (assets) of a deceased (dead) person • Rate – 18% to 40% on assets over $5 million TAX VOCABULARY • 9. Inheritance Tax = This tax is imposed by state governments on the value of assets that a person (beneficiary) receives from another deceased person • Rate varies DEATH V. INHERITANCE TAXES ESTATE TAX INHERITANCE TAX 1. Federal Death Tax 2. Tax on value of a decedent’s estate 1. State Death Tax 2. Tax on value of a beneficiary’s gift 3. Spouse – No Tax due 4. No tax on first $5million and then it is progressive starting at 18% and moves up to 40% on everything over $5 million 3. Spouse – No tax due 4. Rates - 4.5% on lineal descendants (kids and grandkids and parents) 12% on collateral beneficiaries (Siblings) 15% on other relatives 21% to non-family beneficiaries TAX VOCABULARY • 10. EXCISE TAX = A federal tax on the manufacture, transportation, sale, or consumption of goods or services (Gasoline, alcohol, cigarettes) • States call this a Selective Sales Tax (Amusement Tax) TAX VOCABULARY 11. Sales Tax = This is a tax imposed on a broad range of items that people buy (nonnecessities) • EX: Processed foods McD’s • Currently 6% in PA. • Can also be an Amusement or selective sales tax LICENSE TAXES • Money paid to the states for the right to do things • A REGRESSIVE TAX • EX: Driver Licenses, motor vehicle registration, occupation licenses • Which license fee brings in the most Revenue $$$? TAX VOCABULARY • 12. Severance Tax = This type of tax is imposed by a state on the removal of natural resources intended for use in other states • EX: Natural Gas drilling in PA TAX VOCABULARY • 13. Property Tax = This type of tax is imposed by local government bodies on the assessed value of the real property (land) a person owns TAX VOCABULARY • 14. So what in the name of Jimmy the Greek is a LOTTERY? TAX VOCABULARY • 14. A LOTTERY is state sponsored gambling. • EX: Powerball / MegaMillions / Horsetrack / etc. I. TAX BASICS • 1. What are the 2 most important things that a Legislative Branch does? I. TAX BASICS • 1. Passing Laws to Raise Money and Passing Laws to Spend Money! I. TAX BASICS • 1. Congress works in a 2-step process: • Step 1 = Authorize a program • Step 2 = Appropriate (Spend) Money to pay for the program. 1. TAX BASICS • 2. Why do the people of the United States pay taxes? • BRAINSTORM I. TAX BASICS • A. PRODUCTIVTY – The Government uses tax money to provide goods and services to help people • EX: Schools, roads, hospitals, the military I. TAX BASICS • B. EQUITY – The government uses tax revenue to redistribute income form the rich to the poor. • Robin Hood Complex I. TAX BASICS • C. ELASTICITY – The government uses tax revenue in times of crisis. • EX: Gulf Oil Spill and Hurricane Katrina • Hurricane Sandy I. TAX BASICS • 3. Any money paid to the government for any reason is a TAX. I. TAX BASICS • 4. What does the US Constitution say about the power to tax? I. TAX BASICS • 4. Article I, Section 8 : “The Congress shall have the power to lay and collect taxes, duties, imposts and excises, to pay the debts and provide for the common defense and general welfare of the United States. . . I. TAX BASICS • 4. 16th Amendment (1909): “The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration.” I. TAX BASICS • 5. Understand that the US Budget is currently running a year to year deficit and the national debt exceeds $17 trillion. • States are also in a budget crisis at this time. I. TAX BASICS • 5. National Debt • http://www.usdebtclock.org/ I. TAX BASICS • 6. Congress does not have control over all spending by the USA. There is no control over ENTITLEMENTS. • Over 70% of the yearly US budget is money for ENTITLEMENT PROGRAMS where there is little discretion. I. TAX BASICS • 6. An ENTITLEMENT is a required government expenditure that must be made year to year • EX: Social Security / Medicare / Interest on the National Debt / Payments to Government contractors I. TAX BASICS • 6. ENTITLEMENTS I. TAX BASICS • 6. ENTITLEMENTS