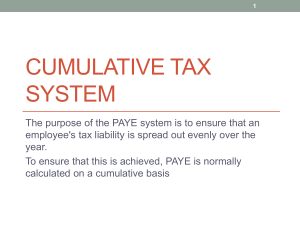

15 The Pay-As-You-Earn Tax on Wages Koenraad van der Heeden

advertisement