La Follette School of Public Affairs Do Youth Nonmarital Childbearing Choices

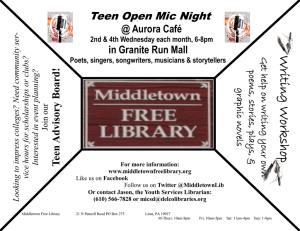

advertisement