Section 10 FUNDRAISING, ADMINISTRATION AND FINANCIAL REPORTING

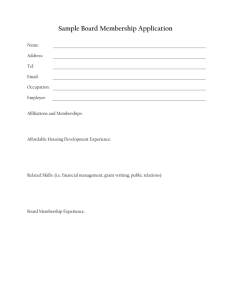

advertisement