Urban Environments in Low-Income and Lower Middle-Income Countries:

Urban Environments in Low-Income and Lower Middle-Income Countries:

Policy Performance Indicators at the

Subnational Level

Prepared for the Millennium Challenge Corporation

By

Colin Christopher

Rosina Estol-Peixoto

Elizabeth Hartjes

Angela Rampton

Pamela Ritger

Hilary Waukau

May 18, 2012

Workshop in International Public Affairs

©2012 Board of Regents of the University of Wisconsin System

All rights reserved.

For additional copies:

Publications Office

La Follette School of Public Affairs

1225 Observatory Drive, Madison, WI 53706 www.lafollette.wisc.edu/publications/workshops.html publications@lafollette.wisc.edu

The Robert M. La Follette School of Public Affairs is a teaching and research department of the University of Wisconsin–Madison.

The school takes no stand on policy issues; opinions expressed in these pages reflect the views of the authors.

Table of Contents

List of Tables and Figures .................................................................................. vii

Foreword ............................................................................................................... ix

Acknowledgments ................................................................................................ xi

Executive Summary ........................................................................................... xiii

Introduction ........................................................................................................... 1

I. What Do We Know About Economic Growth and Poverty in Urban

Areas?..................................................................................................................... 3

A. Urbanization ................................................................................................... 3

Regional Urbanization Trends ............................................................................ 4

Consequences of Rapid Urbanization ............................................................. 4

The Importance of Cities ................................................................................. 4

Definition of Urban Areas .................................................................................. 5

Causes of Urban Growth ..................................................................................... 5

Natural Urban Population Growth ................................................................. 5

Rural-to-Urban Migration .............................................................................. 5

Reclassification of Areas................................................................................. 6

B. Urbanization and Economic Growth .............................................................. 6

Drivers of Economic Growth .............................................................................. 7

Manufacturing and Services ............................................................................... 7

C. The Problem: The Urbanization of Poverty ................................................... 8

The Urban Poor and Slums ................................................................................. 8

Urban Poverty ..................................................................................................... 8

Housing ......................................................................................................... 10

Electricity, Water, and Sanitation ................................................................. 11

Public Transportation ................................................................................... 13

Environmental Degradation and Sustainability ........................................... 14

Health ............................................................................................................ 16

Education ...................................................................................................... 18

Financial Services ......................................................................................... 19

Crime............................................................................................................. 20 iii

II. Subnational Policies that Drive Economic Growth and Reduce Poverty in

Developing Countries.......................................................................................... 22

A. Decentralization ........................................................................................... 22

B. Economic Policies ........................................................................................ 23

Investment Promotion ....................................................................................... 23

Participatory Budgeting .................................................................................... 25

Reducing the Informal Sector ........................................................................... 25

Municipal Solid Waste Management Systems ................................................. 25

C. Infrastructure Policies .................................................................................. 26

Land Tenure and Property Rights ..................................................................... 26

Housing ............................................................................................................. 28

Housing Finance ........................................................................................... 28

Participatory Slum Upgrading Programs .................................................... 29

Property Taxes .............................................................................................. 30

Water and Sanitation ......................................................................................... 31

Condominial Water Supply ........................................................................... 31

Communal Sanitation Provision ................................................................... 31

Public-Private Partnerships in Urban Infrastructure Provision .................. 32

Electricity and Non-governmental Organizations ............................................ 33

Public Transportation ........................................................................................ 33

Traffic Calming ............................................................................................. 35

Bicycle Infrastructure ................................................................................... 35

Bus Rapid Transit ......................................................................................... 36

Additional Considerations ............................................................................ 37

D. Human Capital Policies ................................................................................ 37

Public-Private Partnerships ............................................................................... 39

PPPs and Education ..................................................................................... 39

PPPs and Health ........................................................................................... 39

Targeted School Fee Reduction .................................................................... 39

Conditional Cash Transfer Programs .......................................................... 40

Technical and Vocational Education and Training ...................................... 41

Provision of Iron Supplements and Deworming Drugs in Schools .............. 41

Community-Based Health Insurance ............................................................ 42

Microfinance and Health Education ............................................................. 43 iv

E. Financial Services ......................................................................................... 43

Collaboration and Usage of Pre-Existing Financial Networks ......................... 44

Life Insurance ................................................................................................... 45

Microcredit ........................................................................................................ 45

F. Corruption ..................................................................................................... 46

Types of Corruption .......................................................................................... 46

Corruption in Public Auctions ...................................................................... 46

Corruption in Police Forces ......................................................................... 47

G. Summary ...................................................................................................... 48

III. Policy Performance Indicators at the Subnational Level ......................... 50

A. Fiscal Decentralization Databases ............................................................... 50

B. Global City Indicator Facility ...................................................................... 51

Indicators .......................................................................................................... 51

Methodology ..................................................................................................... 53

Merits of GCIF .................................................................................................. 54

Drawbacks ........................................................................................................ 54

City Services ..................................................................................................... 56

Health ............................................................................................................ 56

Education ...................................................................................................... 58

Civic Engagement ......................................................................................... 59

Environment .................................................................................................. 60

Solid Waste.................................................................................................... 60

Water ............................................................................................................. 61

Wastewater .................................................................................................... 61

Electricity ...................................................................................................... 62

Finance ......................................................................................................... 63

Urban Planning ............................................................................................ 64

Transportation .............................................................................................. 64

Quality of Life .................................................................................................. 67

Economy ........................................................................................................ 67

Technology and Innovation ........................................................................... 67

Shelter ........................................................................................................... 68

v

C. Green City Index .......................................................................................... 69

Methodology ..................................................................................................... 69

Merits ................................................................................................................ 70

Drawbacks ........................................................................................................ 70

GCI Indicators ................................................................................................... 71

Energy and CO

2

............................................................................................ 71

Land Use and Buildings ................................................................................ 72

Transportation .............................................................................................. 72

Waste ............................................................................................................. 73

Water ............................................................................................................. 73

Sanitation ...................................................................................................... 74

Air Quality .................................................................................................... 74

Environmental Governance .......................................................................... 75

D. Doing Business Project ................................................................................ 75

Indicators .......................................................................................................... 76

Merits ................................................................................................................ 77

Drawbacks ........................................................................................................ 77

E. Additional Indicators .................................................................................... 78

F. Comparison of City-level Indicators, MCC Indicators, and Section II

Subnational Policies .......................................................................................... 78

Conclusions .......................................................................................................... 88

Appendix A: Population Trends and Urban Growth ...................................... 92

Appendix B: Definition of Urban Area ............................................................. 94

Appendix C: Emerging Health Issues in Urban Areas.................................... 95

Appendix D: Decentralization Databases and Comparison to MCC

Indicators and Section II Policies ...................................................................... 96

Appendix E: GCIF Indicators ........................................................................... 98

Appendix F: GCIF City Coverage in MCC Eligible Countries .................... 107

Appendix G: Doing Business Coverage and Methodology ........................... 109

Appendix H: Additional Databases and Comparison with MCC Indicators and Section II Policies ....................................................................................... 111

Works Cited ....................................................................................................... 121 vi

List of Tables and Figures

Figure 1. World Urban Population and Economic Performance, 1970-2010 ......... 6

Table 1. Urban Poverty: Challenges and Opportunities ......................................... 9

Table 2. GCIF City Service and Quality of Life Categories ................................. 52

Figure 2. Summary of GCIF Categories, Themes, and Indicators ........................ 53

Table 3. Comparison of GCIF with MCC Indicators and Section II Policies ...... 79

Table 4. Comparison of Green Cities Index with MCC Indicators and Section II

Policies .................................................................................................................. 83

Table 5. Comparison of Doing Business with MCC Indicators and Section II

Policies .................................................................................................................. 87

Table 6. Evaluation of MCC Indicator Preferences with City-Level Databases .. 89

Figure A1. Population Estimates: Total, Rural, and Urban, 2000-2030 ............... 92

Table A1. Urban Population Percentages by Geographic Region, 1950-2050 ..... 93

Table A2. Average Annual Rate of Change of the Urban Population by

Geographic Region, 1950-2050 ............................................................................ 93

Table C1. Emerging Urban Health Issues: Notional Variation with Urban

Development ......................................................................................................... 95

Table C2. Urban Health Risks .............................................................................. 95

Table D1. Global Observatory on Local Democracy and Decentralization

Database Comparison ........................................................................................... 96

Table D2. World Bank’s Decentralization and Subnational Regional Economics

Database Comparison ........................................................................................... 97

Table E1. GCIF Profile Indicators ........................................................................ 98

Table E2. GCIF Performance Indicators .............................................................. 99

Table E3. Future GCIF Indicators ...................................................................... 104

Table F1. GCIF City Coverage in MCC Eligible Countries ............................... 107

Table G1. Doing Business Indicators and Geographic Coverage ....................... 109

Table H1. UN-HABITAT Urban Development Index ....................................... 112

Table H2. UN-HABITAT Urban Governance Index ......................................... 114

Table H3. Local Governance Barometer ............................................................ 115

Table H4. Local Integrity Initiative .................................................................... 116

Figure H1. Multidimensional Poverty Index Indicators ..................................... 119 vii

viii

Foreword

The La Follette School of Public Affairs at the University of Wisconsin–Madison offers a two-year graduate program leading to a Master of Public Affairs or a

Master of International Public Affairs degree. In both programs, students develop analytic tools with which to assess policy responses to issues, evaluate implications of policies for efficiency and equity, and interpret and present data relevant to policy considerations.

Students in the Master of International Public Affairs program produced this report for the Millennium Challenge Corporation. The students are enrolled in the

Workshop in International Public Affairs, the capstone course in their graduate program. The workshop challenges the students to improve their analytical skills by applying them to an issue with a substantial international component and to contribute useful knowledge and recommendations to their client. It provides them with practical experience applying the tools of analysis acquired during three semesters of prior coursework to actual problems clients face in the public, non-governmental, and private sectors. Students work in teams to produce carefully crafted policy reports that meet high professional standards. The reports are research-based, analytical, evaluative, and (where relevant) prescriptive responses for real-world clients. This culminating experience is the ideal equivalent of the thesis for the La Follette School degrees in public affairs. While the acquisition of a set of analytical skills is important, it is no substitute for learning by doing.

The opinions and judgments presented in the report do not represent the views, official or unofficial, of the La Follette School or of the client for which the report was prepared.

Melanie Frances Manion

Professor of Public Affairs and Political Science

May 2012 ix

x

Acknowledgments

We would like to thank Andria Hayes-Birchler of the Millennium Challenge

Corporation for her helpful insight and direction. We would also like to acknowledge Professor Melanie Manion, our faculty advisor, for her encouragement and guidance throughout the semester. Finally, we would like to recognize Karen Faster, Publications Director at the La Follette School of Public

Affairs, for her assistance in editing the report. We are exclusively responsible for the content and recommendations stated in this report. xi

xii

Executive Summary

Increasing levels of urbanization present unique opportunities and challenges for economic growth and poverty reduction for cities located in low-income countries

(LICs) and lower middle-income countries (LMICs). In this report, we assess: 1) whether the Millennium Challenge Corporation (MCC) should provide aid to cities; 2) which subnational policies can successfully reduce poverty and increase economic growth; and 3) whether city-level indicators are available to appropriately measure a city’s policy performance. We find that available citylevel data does not adequately satisfy all MCC indicator requirements, but ongoing collection efforts will likely result in a comprehensive set of useful indicators within the next five years. With more complete data for cities in LICs and LMICs, MCC can potentially use these indicators to distribute aid to cities.

Given the potential of city-level policies to reach large numbers of urban residents and the influence of these policies on national economic and social outcomes, we recommend MCC consider funding initiatives at a municipal level.

In Section I, we review the literature on economic growth and poverty reduction in urban areas of LICs and LMICs. We discuss urbanization, economic growth, and challenges specific to the urban poor. In Section II, we provide an overview of successful subnational policies that drive economic growth and poverty reduction in LICs and LMICs. In Section III, we identify and analyze databases and city-level indicators that measure cities’ performance across a wide spectrum of issues and policies that can drive economic growth and reduce poverty in LICs and LMICs. We also compare city-level indicators with MCC indicators and summarize their relationship to subnational policies reviewed in Section II. We conclude with our recommendations.

Subnational funding would allow MCC to award aid directly to urban areas, where poverty is increasing at a faster rate than in rural areas. Cities also provide excellent opportunities to stimulate economic growth due to urban circumstances, such as agglomerations and knowledge spillovers. Depending upon the policy and context, outcomes related to economic growth and poverty reduction require different levels of fiscal and political decentralization within countries.

The nearly 200 indicators we analyzed that are available to MCC are not yet sufficiently developed or adequately comprehensive in city coverage to allow for the cross-city comparisons needed for a city-level grant selection process. In the coming years, databases of city-level indicators will continue to improve in city coverage and number of indicators available. We estimate that MCC will be able to start conducting city-level selection processes within the next five years. With improved indicator data, MCC would be able to distribute aid to cities that have good policy performance. We recommend yearly monitoring of updates made to the databases we identify in this report. xiii

xiv

Introduction

Created through the Millennium Challenge Act of 2003, the Millennium

Challenge Corporation (MCC) is an independent U.S. foreign aid agency focused on assisting low-income countries (LICs) and lower middle-income countries

(LMICs). In determining a country’s eligibility for funding, the MCC undertakes a rigorous evaluation process. Initially, eligible countries are required to meet the following two criteria: 1) fall within the World Bank’s gross national income

(GNI) per capita classifications for LICs (below $1,915 GNI per capita) or LMICs

(between $1,916 and $3,975 GNI per capita); and 2) meet eligibility requirements for assistance under part I of the Foreign Assistance Act of 1961. MCC then assesses eligible countries using publicly available, third-party indicators that measure a country’s policy performance related to economic growth, poverty reduction, and good governance. Evaluations of country performance are measured through 17 indicators under three categories: Ruling Justly, Investing in

People, and Encouraging Economic Freedom. Countries that meet the criteria for initial eligibility are evaluated using all of the MCC indicators, after which grants are given to countries that have shown a commitment to good governance, poverty reduction, and economic growth through their national policy decisions.

MCC grants are intended for poor, well-governed countries, but there are varying levels of poverty and government quality within those countries. For this reason,

MCC asked us to explore the feasibility and advisability of evaluating city-level policy performance. MCC wanted the assessment to address whether it would be possible for MCC to conduct comparative assessments of the quality of governance in cities in LICs and LMICs and whether an urban environment would be more or less inviting for investments aimed at promoting economic growth and reducing poverty. In short, should MCC grants be awarded to wellgoverned cities? If so, are there appropriate mechanisms to make these evaluations at the subnational level? Our analysis is divided into three parts, summarized below. We conclude the report with our recommendations.

In Section I, we conduct a literature review on the prospects and obstacles related to economic growth and poverty reduction in urban environments. We categorize the most important opportunities and challenges for economic growth and poverty reduction into the following issue areas: housing; electricity, water and sanitation; public transportation; environmental degradation and sustainability; health; education; financial services; and crime.

In Section II, we use our findings from Section I to investigate potential subnational and city-level policies that can contribute to economic growth and poverty reduction in urban areas. Where possible, we identify the subnational conditions ideal for successful project implementation at the municipal level. We discuss city-level and other subnational policies within the categories of economic growth, infrastructure, human capital, financial services, and corruption.

1

In Section III, we identify city-level indicators that successfully measure policies and important outcomes related to economic growth and poverty reduction. Three databases stand out: the Global City Indicators Facility (GCIF), the Green City

Index (GCI), and the Doing Business project. Once it is made publicly available,

GCIF will be the largest annually updated database of city-level indicators. To date, 73 cities in 20 MCC eligible countries provide data for GCIF’s expanding dataset. These cities are uniformly measured according to 33 core indicators that are divided into 20 categories. GCI provides publicly available qualitative and quantitative city-level indicators with a social and environmental focus. Cities included in the GCI are ranked intra-regionally by 20 indicators across eight categories, and 22 of the 54 cities examined are in MCC eligible countries. The

Doing Business project provides useful measures on the ease of doing business and compares cities globally and within countries. We also identify institutions that publicly provide individual indicators measuring specific categories at the urban and subnational level. In total, our analysis identifies close to 200 indicators and provides direction on evaluating policies and outcomes between countries and cities.

2

I. What Do We Know About Economic Growth and

Poverty in Urban Areas?

In this section, we review the literature on economic growth and poverty in urban areas of developing countries.

1,2 Sub-section A describes regional urbanization trends, defines the concept of urban area, and analyzes the predominant drivers of urban growth. Sub-section B examines the relationship between urbanization and economic growth. Sub-section C presents eight issue areas that represent challenges for the urban poor in developing countries. Sub-section C also discusses opportunities to address these eight challenges and improve the welfare of people living in urban poverty and briefly introduces general policy opportunities targeting urbanization issues.

A. Urbanization

Global urbanization levels have increased rapidly during the twentieth century.

Thirteen percent of the world’s population lived in urban areas in 1900, rising to

29 percent in 1950 and reaching 51 percent in 2010. Most projections show urbanization reaching 60 percent by 2030 (see Figure A1 and Table A1, Appendix

A). Urbanization rates in the developed world have largely stabilized, and over 90 percent of the increase in the world’s urban population will occur in developing countries (see Table A2, Appendix A). The increasing urbanization trend is also accompanied by a slowing of rural population growth rates in developing countries (UNEP 2002).

1 Throughout the first section, we use the phrases “developed countries” and “developing countries” for purposes of continuity. Section I offers a literature review of economic growth and poverty reduction in urban areas from a variety of academic fields, and a diverse vocabulary is used to describe what is meant by “developing countries.” Examples include: “The Global South,”

“poor countries,” “low-income countries,” “low-middle-income countries,” “middle-income countries,” “highly-indebted countries,” “third-world countries,” “developing countries,” and

“the developing world.” In sections II and III, we use terminology that specifically describes the macroeconomic conditions of MCC program-eligible countries: “low-income countries” and

“low-middle-income countries.”

2 With MCC’s focus on economic growth and poverty reduction, in the following section we discuss positive outcomes related to economic growth, poverty reduction, or both. In our evaluations, we do not identify when specific types of economic growth lead to increased poverty or when examples of poverty reduction also stagnate economic growth. The literature demonstrates that economic growth is a necessary, but insufficient condition for poverty reduction, and suggests additional government-based policies related to income distribution that best address relative and absolute poverty (Kakwani et al. 2004; WRI 2005; UNDP 2006; Foster

2012). In Section III, we briefly discuss the Gini coefficient indicator as part of the Global Cities

Indicator Facility, and we explain its relevance to measuring inequalities that may arise from some policies that promote economic growth.

3

Regional Urbanization Trends

The most urbanized area in the world is the Latin American and Caribbean region.

This region is characterized by a high number of megacities; large urban agglomerations of 10 million people or more (Fay 2005, 1; Cohen 2004, 29;

Henderson 2002, 89). Urbanization in Africa is characterized by uneven population distribution, concentration of investments in larger cities, and extensive slum areas. The East Asian and Pacific region and the sub-Saharan

African region both have high rural-to-urban population ratios and the highest rates of urbanization during the last decade according to World Development

Indicators (World Bank 2008). In Asia, national policies and investments played an important role in urban growth and significantly contributed to the area’s economic growth. National governments often determine which cities and regions will benefit the most from public resources and then promote their development above others. In other cases, local authorities and other actors, including the private sector, foster urban growth (UN-HABITAT 2008, 15).

Consequences of Rapid Urbanization

While urbanization can result in social improvements and a better quality of life for urban residents, the urbanization process in many developing countries is accompanied by many negative externalities such as increased inequality, health risks, and marginalization of the urban poor. Rapid urbanization and inadequate urban planning also contribute to poor air and water quality, excess mortality associated with the urban heat island effect, increased motor vehicle and pedestrian injuries, and increased violent crime (Campbell-Lendrum and Corvalán

2007, 113; McMichael 2000, 1117-1116). Without an appropriate governmental response to rapid urbanization, the urban poor often find themselves living in overcrowded and polluted environments without basic services (de Snyder et al.

2011, 1184).

The Importance of Cities

The positive externalities of urbanization include increased efficiency and productivity from agglomeration, economies of scale, innovation, and specialization (Zhang 2011, 4). People are attracted to cities because of the availability of diverse opportunities, access to goods and services, and the potential for a higher quality of life (St. Pierre Schneider et al. 2009, 281). Cities are traditionally the drivers of innovation, employment, and country-level economic growth (Spence, Annez, and Buckley 2009, x; Henderson 2002).

Historically, no country has ever “achieved sustained economic growth or rapid social development without urbanizing” (UN-HABITAT 2010b, x). Urbanization has the potential to stimulate economic growth and attract more residents to cities.

Political and economic power may shift from the national level to the local level as individual cities can more easily “break away from the fate of their national economies” due to factors including globalization and the corresponding increased economic influence of urban areas (Cohen 2004, 37).

4

Definition of Urban Areas

No consensus exists in the literature about what constitutes an “urban area,” and some definitions are contradictory (Cohen 2006, 65). Classifications of urban areas differ by country, region, and international organization (see Appendix B).

Taking these variances into consideration, we define an “urban area” as:

1.

A locally delineated agglomeration of people with both formal and informal boundaries that has population densities consistent with national standards, and

2.

an agglomeration that is legally administered by a local government, governing body, or council, and

3.

an agglomeration of at least 2,500 people that satisfies conditions 1 and 2.

Causes of Urban Growth

Current literature attributes the increases in urban growth to three processes: natural urban population growth, rural-to-urban migration, and reclassification of rural areas as urban areas (Sheng 2002, 3).

Natural Urban Population Growth

Natural urban population growth occurs when birth rates surpass death rates in a given period of time (UN-HABITAT 2006a).

Rural-to-Urban Migration

Push and pull factors drive urbanization. Push factors are unfavorable rural conditions that drive rural residents to urban areas. Pull factors are positive urban conditions that attract people to migrate to urban areas (University of Michigan

2006; Oglethorpe et al. 2007). Unemployment, lack of educational facilities, limited infrastructure and health services, land scarcity, and low wages are the most common push factors contributing to urban migration. Additionally, unpredictable environmental conditions increase instability for rural residents.

Climate change has resulted in diminished agricultural capacity and increased frequency of floods and droughts. Political instability and conflict have also caused many rural residents to relocate to urban centers. On the other hand, pull factors that attract people to cities include educational and employment opportunities, better health services, greater variety of cultural offerings, and the provision of public and financial services (University of Michigan 2006).

Rural-to-urban migration is generally considered beneficial for both rural migrants and their extended family members who remain in rural areas. The potential benefits of rural-to-urban migration—connectivity to the “outside world,” remittances, and status—are believed to exceed relocation costs— disconnected families, travel expenses, and a general sense of displacement.

Information asymmetries, however, can undermine migration benefits, as migrants’ decisions may be based on inadequate or inaccurate information.

During periods of economic recession, high numbers of rural residents may be forced to move in search of jobs and better living conditions, but few cities and

5

towns have sufficient housing, infrastructure, employment opportunities, and services to absorb the inflow of migrants. In the absence of sufficient infrastructure, migrants end up living in crowded conditions and working in the informal labor market. The result is an increasing urban population with deteriorating living conditions (Sheng 2002).

Reclassification of Areas

As cities expand and spill over municipal boundaries into surrounding rural areas, nearby rural settlements are converted into urban settlements. This transition makes urbanization both an administrative process and a demographic process

(Sheng 2002). For example, in China during the last decade, urban growth has been accompanied by the state-led replacement of rural space by urban space through the creation of provincial level municipalities, the expansion of existing municipalities, and the reclassification of counties to municipalities (McGee

2008, 161).

B. Urbanization and Economic Growth

The literature is mixed regarding the relationship between economic growth and urbanization. Many of the developing countries that urbanized most rapidly in the last two decades also demonstrated more rapid economic growth (Zhang 2011, 1).

We see this trend for developing countries in the East Asian and Pacific region which experienced urbanization and increased levels of economic growth.

Moreover, at a global level, there is a positive association between larger urban population and higher gross domestic product (GDP) per capita. Figure 1 shows this relationship based on the World Development Indicators.

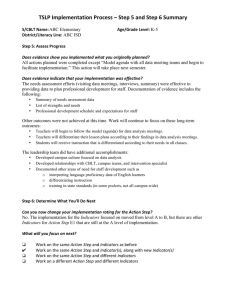

Figure 1.

World Urban Population and Economic Performance, 1970-2010

6,500

6,000

5,500

5,000

4,500

4,000

2010

3,500

3,000

1,000

1970

1,500 2,000 2,500 3,000 3,500

Urban population (millions)

Source: World Bank 2008. 2008 World Development Indicators .

4,000

6

Although economic growth and urbanization are positively associated, urbanization can occur in the absence of economic growth. Many countries in sub-Saharan Africa experienced sizable increases in urbanization over the last 20 years, yet they did not benefit from economic development to the same extent as other urbanizing developing countries (Briggs and Yeboah 2001, 18-26). Whether urbanization exacerbated the poverty rates in these sub-Saharan countries is unknown (Spence et al. 2009, 8). However, it is possible that urbanization and economic growth policies can also result in the unintended consequence of higher inequality (Dudwick et al. 2011, 90).

Drivers of Economic Growth

Economies of scale and agglomeration in urban areas make economic development possible through industrialization. Urban economic growth can facilitate development through remittances, new markets, and increased human capital. Cities play an important role as providers of employment, services, cultural offerings, educational opportunities, and technological development

(WHO and UN-HABITAT 2010, iv). While evidence suggests that countries urbanize as they grow, more gradual urban growth permits higher standards of living during the transition phase. By contrast, countries with unrestrained growth experience lower standards of living.

Manufacturing and Services

Urbanization per se does not drive economic growth; rather the development of an urban manufacturing sector promotes higher levels of productivity, which in turn can stimulate economic growth (Henderson 2003, 47-71). Productivity gains are derived from technological innovations, investments in human capital, and knowledge spillovers. Knowledge spillovers are usually related to spatial proximity and the geographic distribution of firms. The shift to urban areas has created the opportunity to exploit scale economies of local agglomeration

(Henderson 2002, 90). High urban densities reduce transaction costs and shorten distances, facilitating the acquisition and diffusion of knowledge. Industry

“clusters” concentrate firms, workers, and skills in a given area. Knowledge spillovers in the form of information exchange among firms create positive externalities that generate growth. Greater urban productivity raises family incomes and, consequently, the demand for products and services (International

Housing Coalition 2009, 3).

In some countries, much of the economic growth has been attributed to the growth of industries and services. The demand for services has been growing in developing countries as a percentage of total production. As cities develop, urban residents demand more health, education, water, electricity, and other services to improve their quality of life. At the same time, the greater the availability of services in urban areas, the higher the likelihood rural residents will migrate to urban areas. This process reinforces urbanization and further increases the demand for services.

7

Even though manufacturing and services have the potential to promote economic growth, negative spillovers from urbanization, including congestion, may discourage firms from locating in larger cities. Moreover, the higher concentration and higher demand for services, in the absence of adequate infrastructure and service provision, may also lead to deteriorating living conditions.

C. The Problem: The Urbanization of Poverty

Urbanization can serve as a catalyst for economic growth and long-term poverty reduction at the national level while also stimulating increased rates of localized urban poverty in the short-term (Banks 2011, 1). One of the detrimental effects of rapid urbanization is that urban poverty has grown faster than rural poverty

(Léautier 2006, ix). The incidence of absolute poverty, however, remains higher in rural areas (UNFPA 2007, 16). Therefore, it is important to stimulate both urban and rural poverty reduction and the provisions of adequate housing; infrastructure; educational systems; and health, safety, and other basic services

(Zhang 2011, iii).

The Urban Poor and Slums

Urban growth and expansion in developing countries is frequently characterized by informality, illegality, and unplanned settlements referred to as slums

(Moreno, Oyeyinka, and Mboup 2010, x). Inhabitants of slum settlements are disadvantaged by the poor social services, health outcomes, and housing conditions in their communities. They are also negatively affected by the lack of basic amenities, security, and stable incomes and livelihoods (Zulu et al. 2011,

186). These inequities can lead to rising violence, environmental degradation, and underemployment (Moreno and Warah 2006, v). Martine and Marshall (2007, 16) estimate that one in three city dwellers worldwide, or approximately one billion people live in slums. The burden of slums is particularly prevalent in Asia which has 60 percent of the world’s slum dwellers (DFID 2010, 2).

Estimates of slum population growth vary. The United Kingdom’s Department for

International Development estimates that there will be two billion people living in slums around the world by 2030 (2010, 2). Moreno and colleagues (2010, xii) estimate, however, that the total number of slum dwellers will decrease from the current estimate of one billion to 889 million by 2020. Over the past ten years, the absolute number of slum dwellers in the developing world has increased even though the proportion of the urban population living in slums decreased during the same period (Moreno, Oyeyinka, and Mboup 2010, xii). Therefore, while establishing a consensus on the absolute number of slum dwellers in the coming decades is difficult, it is clear that if the population growth in urban slums outpaces slum reduction efforts, the total number of slum dwellers will increase.

Urban Poverty

Urban poverty is associated with limited access to employment and income, inadequate housing and services, limited access to health and educational

8

opportunities, unhealthy environments, and limited social protection mechanisms

(Léautier 2006, ix). The urban poor are more integrated into the market economy than the rural poor. Therefore, urban poverty is more responsive to economic growth and more vulnerable to economic fluctuations. For the urban poor, the transmission of macroeconomic shocks usually occurs through the labor market, and job loss is an important consequence (Fay 2005, 3). In addition, inept or corrupt governance at the city level impairs the ability of poor residents to benefit from global opportunities and contribute to city- and country-level economic growth (Léautier 2006, ix). While local governments are charged with providing health and human services to all residents, this does not occur in most developing countries. Studies of the urban poor in sub-Saharan Africa show higher morbidity rates, lower access to health services, higher rates of mortality, and a higher incidence of risky sexual practices when compared to their rural poor counterparts

(Zulu et al. 2011, 186). These challenges limit the ability of the urban poor to escape poverty.

We categorize the most important challenges and opportunities associated with urban poverty in developing countries into the following eight issue areas: housing; electricity, water, and sanitation; public transportation; environmental degradation and sustainability; health; education; financial services; and crime.

Table 1 summarizes these challenges and opportunities.

Table 1.

Urban Poverty: Challenges and Opportunities

Issue Areas Challenges

Housing

Insecure property tenure; incremental building; spatial inequality; inefficient land and housing markets; poor urban planning

Opportunities

Settlement upgrading projects; increase land tenure security; greater provision of government services; economic gains in the property markets

Electricity,

Water, and

Sanitation

Public

Transportation

Capital-intensive; legal and physical barriers to expand services; low demand and ability to pay; under-provision of services

Large up-front costs; lack of political will; lack of public support; opportunities for corruption

Economies of scale in expansion and operation; higher willingness to pay compared to rural areas

Decreased travel time; greater equity of mobility; sustainable environmental improvements

9

Issue Areas

Environmental

Degradation and

Sustainability

Health

Poor municipal waste management; e-waste disposal; contaminated surface and groundwater supply; emissions; flooding

Challenges Opportunities

NGOs role in raising public awareness of pollution; broadbased benefits to investing in better waste management and climate change mitigation strategies

Communicable diseases; noncommunicable diseases; traffic accidents/injuries; health inequity

Multisectoral interventions; public health campaigns

Education

Financial

Services

Crime

Limited funding; privatization of primary education; lack of attention to quality of classroom learning

Early childhood education has highest rates of return among vulnerable populations; increase economic growth with higher educated population

Barriers to formal financial services: rigorous documentation requirements, high rates of financial illiteracy, lack of trust in financial institutions

Income inequality; weak institutions; corruption; large youth population; proliferation of gangs

Source: Authors.

Provide combination of private and government financial services; increase savings ability and financial literacy

Reduce corruption; support effective law enforcement

Housing

The primary urban housing challenges discussed in the literature are insecure property tenure, incremental housing construction, and spatial inequality.

Insecure Property Tenure

While property ownership problems can arise in both rural and urban areas, urbanization provides a distinct set of challenges for poor residents who often lack property rights or protections. Slums and unauthorized housing develop outside of planned urban zoning areas, and residents are, thus, considered illegal occupants.

Urban poor who are legally entitled to their property may lack official documentation for their homes and are vulnerable to eviction by landlords or corrupt government officials. The few residents who have official documentation remain highly vulnerable to the preferential treatment of wealthier, established interests through what are often inconsistent and corrupt judicial systems (UNDP

2008).

The lack of stability resulting from poorly defined property rights has many negative consequences. Evictions may come from landlords without reason,

10

justification, or prior notification (Struyk and Giddings 2009). The government can conduct unexpected evictions through eminent domain laws whereby they seize property without the owners’ permission. Eminent domain laws are often poorly developed or advertised in developing countries. If the government chooses to confiscate land, residents receive no prior notification and lack an appeals process. These unpredictable conditions make it difficult for the urban poor to hold down jobs or to complete school. Some evidence suggests that many residents curtail their work hours and keep children home from school to safeguard ownership of their home through constant occupancy (Field 2005, 5).

Decreases in productivity and unanticipated costs resulting from forced evictions tend to increase fiscal instability among the urban poor.

Spatial Inequality

Urban spatial inequality in developing countries is more than a reflection of income inequalities among individual households. Multiple factors come into play, including inefficient land and housing markets, ineffective financial mechanisms, and poor urban planning. Socioeconomic disparities and the larger processes of urban development, governance, and institutionalized exclusion of specific groups also contribute to the spatial inequalities. For example, slum dwellers may have to endure longer commuting times and higher transportation costs if the slum is isolated and disconnected from the urban network. Some argue that the physical and social distance between poor and rich neighborhoods creates a spatial poverty trap. A spatial poverty trap is comprised of six challenges: 1) severe job restrictions; 2) high rates of gender disparities; 3) deteriorated living conditions; 4) social exclusion and marginalization; 5) lack of social interactions; and 6) high incidence of crime (Moreno, Oyeyinka, and Mboup 2010, xiii). An absence of policy coordination between national and local governments limits a city’s ability to manage urban development and implement strategies to mitigate the negative impacts of spatial inequality.

Opportunities for Urban Housing

Settlement upgrading projects are one type of opportunity to improve low-income housing and slums in urban areas. This type of urban renewal focuses on improving property tenure security and on greater provision of government services. Regularization of land tenure is important because residents who possess a housing plot with a formal land title are more inclined to invest and make improvements to their property (Choguill 1999, 299; Bredenoord and van Lindert

2010, 281; Field 2005). This investment in turn improves the real estate markets in lower income areas and can drive local economic growth (Field 2006). Business development in the form of home-based micro-enterprises is more feasible once a slum begins to receive government services such as electricity, water, sewage, and garbage collection. In fact, slums are frequently the primary location of informalsector businesses in developing countries (Majale 2008, 271).

Electricity, Water, and Sanitation

While the absolute need for electricity, water, and sanitation is greater in rural areas, the rapid pace of urbanization is threatening recent gains made by cities

11

in provision of these services. Moreover, the greater economies of scale present in cities allows for more cost-effective extension of services to the urban poor rather than expanding access to rural areas.

In terms of access to improved water and sanitation, the need remains greatest among rural populations. However, due to rapid urban population growth between

1990 and 2010, the number of urban residents lacking access to improved water and sanitation actually increased. By contrast, the number of rural residents lacking access to improved water and sanitation only declined (WHO/UNICEF

JMP 2012, 12, 23). Therefore, although many more rural residents use unimproved water sources and sanitation than do urban residents, the worldwide trend of rapid urbanization necessitates attention to cities to ensure that prior improvements in urban areas are not lost.

Electricity is less critical to poverty reduction than access to water and sanitation, largely due to adverse health outcomes that result from the latter two services.

Even so, lack of access to modern energy services is still a serious hindrance to economic and social development, and 85 percent of those without access to electricity live in rural areas (OECD/IEA 2010, 17). Although urban residents have greater access to electricity, 40 percent of those residents obtain it illegally.

Therefore, the challenge of electricity in rural areas is one of access, whereas in urban areas, challenges relate to illegal hookups and reducing the financial losses to providers that result from theft.

Opportunities for Provision of Electricity, Water, and Sanitation Services

Generally, the concentration of population, activities, and industrial productivity in cities leads to a declining effective price of infrastructure, including power and water supply (Mitra and Mehta 2011, 171). For water services, economies of scale decrease costs for water treatment and bill collection, and the willingness to pay for services is often higher in urban areas (Satterthwaite and McGranahan 2007, 32).

Similarly, providing legal electricity to urban slum dwellers can be profitable because providers can take advantage of the high densities of urban dwellers and reduce losses from theft (Baruah 2010, 1016-1017). Theft of electricity through illegal connections can account for 50 percent of electricity losses to providers

(Sawin and Hughes 2007, 93). As electric power industries are among the most capital-intensive industries in an economy and drain the scarce financial resources of developing country governments, it is important that electricity providers be able to recuperate capital expenditures (Humanitarian Technology Challenge 2010).

Moreover, entities that exist in cities, such as municipal committees, can help to structure popular participation in local governments. Such civil society participation promotes greater interaction between “government institutions, social agents and market agents to promote social inclusion and participation in the implementation of more adequate and socially just urban policies” (Costa et al. 2009, 3133).

12

Public Transportation

Well-designed urban public transportation systems can be highly effective economic and social equalizers (ITDP 2009). Although some public transportation projects have large net benefits, other projects have favored a minority of wealthier commuters using high-cost rail and bus options at the expense of the poorer majority who walk, bike, and use less expensive means of transportation (Ahmed et al. 2008). The most successful urban public transportation infrastructure developments have considered the local demographics, environmental consequences, project feasibility, and medium- to long-term economic benefits of project designs (Wang, Lu, and Peng 2008, 85).

Public transportation infrastructure costs range considerably and largely depend upon the urban area, project design, and administrative capacity. Depending upon the goals and resources of urban areas, solutions to congestion, pollution, and connectivity can vary from small neighborhood-specific initiatives to large-scale regional projects. Extensive public transportation networks often have large upfront costs. Urban areas in developing countries also have difficulty setting user fees at levels that sustain operating costs but remain appropriately priced for most potential riders (Ahmed et al. 2008, 126). Diverting traffic during construction can limit mobility and, subsequently, have a negative effect on financial activity.

Public transportation infrastructure construction can also result in damages to short-term air and water quality.

Political feasibility is often the greatest barrier in planning and implementing public transportation projects. Large-scale projects make both public and private land reclamation difficult. Gaining bureaucratic consensus and mobilizing public support for public transportation can be difficult in urban areas with expanding motor-vehicle usage. Finally, it is difficult to convince the general public that an alteration or reduction of road space for public transportation is physically possible and beneficial overall, despite net benefits for a large portion of potential low-income users (Ahmed et al. 2008, 136-138). In the end, political constituencies or business interests may have more influence on design and implementation than the efficiency or equity of the project. Some of the easiest and most profitable forms of corruption are associated with infrastructure projects

(Johnston 2005, 27).

Opportunities for Public Transportation

Intra-city connectivity and widespread access to public transportation have contributed to economic growth in urban areas of developing countries (World

Bank 2006a, 16). The planning, design, and implementation stages can lead to short- and medium-term employment opportunities. Although most are laborintensive positions, projects have also led to an increase in long-term, higher skill employment opportunities associated with the maintenance and expansion of existing infrastructure.

13

In comparison to the status quo, increased modes and volume of public transportation are associated with shorter travel times, improved intra-city connectivity, a reduction in stress, greater social cohesion, and improved health conditions from sustainable reductions in carbon emissions (Ahmed et al. 2008,

126; Evren and Murat 2001, 800; Woodcock et al. 2009). Health improvements and increased income are positively associated with well-designed urban public transportation projects. Urban infrastructure improvements also have significant spillover effects (Woodcock et al. 2009), as cities have copied the successful design and implementation strategies of nearby cities (Cernansky 2011). Some urban infrastructure projects have resulted in better governance and greater accountability (Hossain 2008; Hironori et al. 2010). Although expanding public support for public transportation infrastructure can be challenging, a re-framing of its purpose at the core of the planning stage could garner widespread support for issues of equity that are often ignored by the political elite (Wilsson 2001).

Environmental Degradation and Sustainability

Two main issues need to be addressed when discussing environmental degradation. The first is municipal solid waste management and the second is the impact of climate change. Both issues have ramifications for health, education, infrastructure, economic growth, and poverty. Further, urban populations are susceptible to a “double-exposure” whereby particular developing regions, sectors, or populations are confronted by the impacts of both climate change and economic globalization (O’Brien and Leichenko 2000, 227).

Municipal Solid Waste Management

Urban population growth will greatly increase the amount of solid waste generated. As cities grow, subnational and municipal governments will need to adjust solid waste management to address this increase. Municipal solid waste management has impacts on health, surface and groundwater supplies, riparian and littoral ecosystems, and agriculture. It also has significant environmental health implications across income groups, although the poor tend to be disproportionately harmed (Ahmed and Ali 2004, 468). On average, cities in developing countries spend approximately 30 percent of their budgets on solid waste management, while only 50 to 70 percent of solid waste is actually collected (Henry, Yongsheng, and Jun 2006, 94). The remainder is tossed into open-pit landfills that are inadequately maintained and a major source of pollution and disease (Gowda et al. 1995, 157).

When local governments cannot sufficiently collect and dispose of their solid waste, informal economies emerge to fill the void. This informal sector is an important source of income for urban populations as well as a form of trade among the urban poor; items salvaged from local landfills and trash pits are re-sold to lower-income populations (Wilson, Velis, and Cheeseman 2006, 797). This informal economy can be divided into four sectors: itinerant waste buyers, street waste collectors, municipal waste collection crews, and dump collectors (Wilson, Velis, and

Cheeseman 2006, 798). Itinerant waste buyers buy recyclable materials from

14

households; street waste collectors collect waste thrown into the streets before municipal collection; municipal waste crews recover material with municipal solid waste vehicles; and dump collectors reclaim usable or recyclable waste from landfills. Economically and socially marginalized groups typically complete the informal collection of municipal solid waste (Ahmed and Ali 2004, 469). While informal employment opportunities arise in the waste management sector, participants frequently lack basic provisions to protect themselves from shards of glass, pieces of metal, disease, and bacteria present in the piles of solid waste.

An issue pertaining to the informal waste management sector is electronic waste

(e-waste) disposal and recycling. In urban areas of developing countries, the recycling and trade of e-waste is especially profitable because valuable materials, such as copper, gold, silver, and aluminum can be extracted and resold. Many developed countries are exporting their e-waste to developing countries for processing or disposal as a part of aid programs for the poor, or because of prohibitions against dumping e-waste in landfills in developed countries

(Osibanjo and Nnorom 2007, 494). Many e-waste recyclers, however, are informal operations administered by the urban poor with little concern for the environmental and health impacts of processing (Osibanjo and Nnorom 2007,

496; Nnorom and Osibanjo 2008, 855). Many processing methods in urban areas in developing countries involve sky incineration, cyanide leaching, and smelting.

The waste materials are then dumped into local open sewers or pit landfills, which can contaminate water supplies.

Opportunities for Municipal Waste Management

The issue of waste management can be addressed at a subnational if not urban level. Waste management is typically a local issue with very few tangible impacts outside of the immediate urban area, at least in the short-term. For example, nongovernmental organizations (NGOs) have been instrumental in bringing attention to the impacts of dumping hazardous chemicals and materials into local water supplies (El-Fadel et al. 2001, 296). Investing in waste management at the local level would be an efficient way to alleviate these problems while helping all income classes, and particularly the urban poor.

Climate Change

Urban populations in developing countries are increasingly contributing to and being affected by climate change. Emissions impact assessments (IPAT) 3 show that as developing countries continue to urbanize, CO

2

emissions will increase

(Martinez-Zarzoso and Maruotti 2011, 1351). Recent estimates attribute 800,000 deaths to urban air pollution worldwide per year (Campbell-Lendrum and

3

IPAT calculations are a way to measure the impacts of a given environmental policy. They are typically used for assessing the impact of greenhouse-gas emissions and anthropogenic emissions over a given period of time. The (I) stands for “Impact,” (P) is for “Population,” (A) is for

“Affluence,” typically measured as gross domestic product (GDP)/capita, and (T) is for

“Technology,” typically measured as Energy/GDP, or Emissions/GDP. The equation is thus:

I = P * A * T.

15

Corvalán 2007, 113). Higher greenhouse gas emissions are attributable to both increased transportation and industrialization and larger amounts of cities’ organic solid waste, which produces methane (Couth and Trois 2010, 2336).

Climate change will disproportionately affect the poorest urban residents of developing countries. They will be most affected by rising sea levels, outdoor air pollution, water scarcity, urban heat islands, population density, and rural-tourban migration (Campbell-Lendrum and Corvalán 2007, 109). Rising sea-levels and more powerful storms will lead to flooding in coastal urban areas where the poor bear the brunt of the damage (Knutson and Tuleya 2004, 3493; Campbell-

Lendrum and Corvalán 2007, 113).

Populations living in water-stressed areas will be particularly affected as uncertainty about the future availability of water due to climate change could lead to a number of political issues and conflicts which will disproportionately affect the urban poor (Kivaisi 2001, 546). Moreover, as rainfall becomes less predictable and less abundant due to climate change, sustaining agricultural livelihoods will be increasingly difficult (Barrios, Bertinelli, and Strobl 2006, 358). Less rainfall reduces crop yields in developing areas that lack effective irrigation (Parry et al.

2004, 63), leading to more urban migration (Adger et al. 2003, 189).

Opportunities Arising from Climate Change

Both urban and rural areas are affected by climate change. Access to clean water is a shared concern of urban and rural areas. CO

2

and greenhouse gas emissions from factories and automobiles are of greater concern in urban areas (Kundzewicz et al. 2008, 7). Therefore, strategies to address the causes and impacts of climate change will likely encompass both national and subnational policies.

Health

The global transition from rural to urban living has both positive and negative impacts on population health. Among the negative urban impacts are a triple threat of communicable diseases, non-communicable diseases, and accidents/ injuries (Friel et al. 2011, 861). Access to health services in urban areas is typically better than in rural areas (Fay 2005, 9). The availability of health care services, however, does not ensure affordability and the timely utilization of health services (WHO and UN-HABITAT 2010 iv). Inequalities in the social distribution of health care can be observed at a country level (the urban-rural divide) and at a city level (the rich-poor divide) (Friel et al. 2011, 861). Social inequalities and various forms of exclusion exacerbate health risks in urban areas.

Despite important improvements in health indicators among urban populations over the past century, the unequal health distribution in cities can result in worse health outcomes among the urban poor compared to the rural poor (Friel et al.

2011, 862).

Urban populations are often thought to have better access to health care services than their rural counterparts. In fact, the high level of inequality found in cities in

16

developing countries contributes to a variety of additional challenges for the urban poor. These challenges include an inability to pay for goods and services, a lack of social support systems (Pridmore et al. 2007), unhealthy and unsafe living and working conditions (Kjellstrom et al. 2007), exposure to crime and violence

(Campbell and Campbell 2007, 59), limited food choices (Dixon et al. 2007, 119), isolation (Pridmore et al. 2007), and powerlessness (Burris et al. 2007). In an attempt to remedy these challenges of the urban poor, some governments have focused on improving access to services and increasing spending on health care.

Although this is a crucial element of improving the health of the urban poor, real health outcome improvements also require the reduction of urban poverty on a broad scale.

Women and children living in slums bear the largest burden resulting from poor sanitation and housing conditions and poor-quality or unaffordable health services. These children have low rates of vaccination and high levels of malnutrition and infectious disease (Zulu et al. 2011, 195). Van de Poel,

O’Donnell, and Van Doorslaer (2007, 1992) found that urban children in developing countries are 40 percent more likely to be at risk for stunted growth and mortality than rural children. African children living in informal settlements in sub-Saharan cities are more likely to die from easily preventable respiratory and waterborne diseases than their rural counterparts (Moreno and Warah 2006,

51). Key health challenges for women living in slums are vulnerability to HIV infection, high maternal mortality rates, and inadequate access to reliable family planning services and products (Zulu et al. 2011, 195-196). A woman’s ability to limit the size of her family also directly affects the educational opportunities for her daughters because girls from smaller households have a higher likelihood of staying in school (UNFPA 2005, ix).

Non-communicable diseases and injuries are increasingly important population health problems among the urban poor (Campbell and Campbell 2007). Noncommunicable diseases with a significant impact on residents of informal settlements include obesity, diabetes, cancer, chronic heart diseases, stroke, and hypertension (Mercado et al. 2007, 10). Addo, Smeeth, and Leon (2007) found that the urban poor have higher levels of hypertension compared to rural populations in lower-middle income countries. There has also been an increasing level of obesity among socially marginalized city dwellers (Kjellstrom et al. 2007,

86-97). Moreover, the incidence of non-communicable diseases generally increases with decreasing social status in urban environments (Fleischer et al.

2008). The urban poor also comprise large proportions of the pedestrians, bus and truck passengers, and cyclists in poor countries, resulting in a higher rate of morbidity and mortality from traffic injuries (Nantulya and Reich 2003) (see

Table C1 in Appendix C for a list of emerging urban health issues and the variation in burden by key features in urban growth and Table C2 for a breakdown of urban health issues by type of health risk).

17

Opportunities for Urban Health

Urban governance structures that support participation, social capital, social accountability, and social inclusion can lead to public health improvements which can in turn serve as a significant stimulus in ameliorating urban poverty. Public health campaigns with a focus on urban poverty as an urgent public health issue can create a policy window to increase levels of equity and overall health in cities in developing countries (Mercado et al. 2007, 8). Additionally, the World Health

Organization (WHO) finds that public health campaigns and other types of interventions with a goal of increasing health equity and health outcomes “can unite individuals, communities, institutions, leaders, donors, and politicians from divergent sectors, even in complex and hostile contexts where structural determinants of health are deep and divisive” (Mercado et al. 2007, 11). Although the health challenges of the urban poor are sizable, an increased focus on improving urban health equity could have positive resonating effects throughout a country’s economy and society.

Education

Developing countries have the potential to benefit from large social and private returns to primary education (Psacharopoulos and Patrinos 2004, 16). The large spillover effects from increasing the coverage and quality of primary urban education include reduced crime, improved health, and increased civic participation (Hanushek and Woessmann 2008, 615). Nevertheless, factors such as poverty, gender inequity, disability, child labor, and minority group status can exclude children from schooling. Decisions to attend school are highly responsive to education costs and subsidies. Social networks and sporadic economic shocks also influence decisions about sending children to school or into the labor market

(Kremer and Holla 2009). Improving access to education is important as it is a significant driver of economic growth and poverty reduction (UNESCO 2012).

Developing countries spend less than half of the GDP per capita on primary education when compared to developed countries, even though a higher fraction of the population in developing countries is of school age (Kremer and Holla

2009, 531). Further, many developing countries fund public education at half of the required levels needed to generate the highest rates of return (Psacharopoulos and Patrinos 2004, 24). Early childhood education and primary education bring about the greatest social returns in developing countries, but often receive smaller expenditures than higher education (Kendall 2011).

Successful urban education in developing countries has been a broad-based effort to offer primary, secondary, community, technical, and vocational education to both children and adults, but significant barriers to access and quality learning remain (UNESCO 2012). Insufficient expenditure in education has accounted for low teacher salaries, high student-teacher ratios, limited instructional resources, and poor school facilities. Low PISA (Programme for International Student

Assessment) test scores suggest that children learn remarkably little in many developing countries (Hanushek and Woessmann 2008, 658). This presents a

18

serious challenge as scores are indicative of cognitive skills that predict individual earnings, income distribution, and economic growth (Hanushek and Woessmann

2008, 657). In response, low-income families may spend up to half of their income on private education opportunities or take out large loans with high interest rates to pay for higher quality private schooling (Kendall 2011). Many developing countries are involving the private sector to improve a small number of high-quality schools (World Bank 2011a, 15). These efforts have undercut the national public education system and ignored the most vulnerable urban populations who would bring about the greatest social and private returns from higher quality primary education (World Bank 2011a, 3, 15).

Opportunities for Education

Increased access and higher quality instruction are the two most important factors for improving urban education. Early childhood education targeted at the most vulnerable urban populations, especially girls, has the greatest social returns for urban areas (AusAID 2011). A mother’s education level, more than any other factor, influences a child’s future education and earnings (Nguyen 2008, 43).

Governments providing quality, context-appropriate education for both children and adults in formal and non-formal settings increase economic growth and reduce poverty. Low-cost initiatives, such as information campaigns that educate poor urban populations about the high private returns to education, can increase enrollment rates (Jensen 2010), lower attrition rates, and help students achieve higher test scores (Nguyen 2008, 1).

Financial Services

For decades, international financial institutions have focused on structural readjustment policies as engines of economic growth and poverty reduction

(Banerjee and Duflo 2004). Income divergence between and within countries has led to a rethinking of economic strategies and increased efforts to integrate the poor into formal financial structures through financial services at the individual level (Deininger and Squire 1997, 38-41). More than half of the poorest residents of developing countries do not rely on the formal financial sector for savings, credit, and other services. The poorest 20 percent of urban dwellers largely operate outside of the formal financial system (Gopinath Oliver, and Tannirkulam

2010). Economic shocks related to the loss of employment, sudden deaths of family breadwinners, and emergency health care costs are the most common financial challenges that face the poor (Christopher 2011). Despite better financial collaboration between public and private sectors, poor families utilizing formal financial services are not guaranteed increased welfare (Rajan 2009). As an example, microcredit has received a great deal of attention from international aid organizations, but studies have shown that the use of microcredit services alone can drive poor families into higher levels of debt and poverty (Sriram 2010, 1-4).