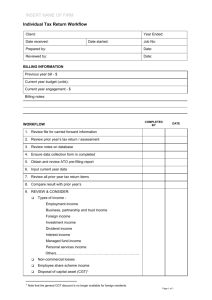

Retirement Benefits and Unemployment Insurance:

advertisement