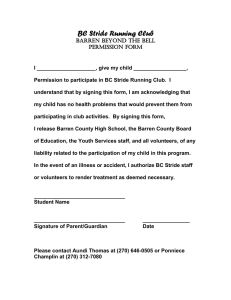

BARREN COUNTY BOARD OF EDUCATION _________

advertisement