Appendix 1

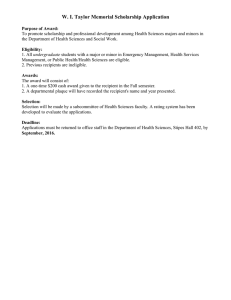

advertisement