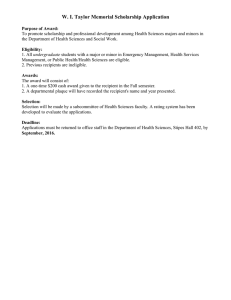

Appendix 1

advertisement