EDUCATIONAL TALENT SEARCH From the Director’s Desk

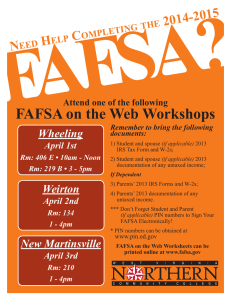

advertisement

EDUCATIONAL TALENT SEARCH We s t e r n K e n t u c k y U n ive r s i t y From the Director’s Desk INSIDE THIS ISSUE: From the Director 1 FAFSA Workshops 1 Choosing a College 2 ACT Information 2 Test Again? 2 FAFSA Step by Step 3 Field Trip Pics The time before the Holidays is always busy. For the ETS staff, it’s even busier as we finalize our yearly progress report for the U.S. Department of Education. We thought we’d share our (YOUR) success! ETS makes a tremendous difference in the lives of the students we serve. 99% of ETS students persisted on to the next grade level 100% of ETS seniors graduated last year 80% of ETS seniors graduated with a rigorous program of study (college prep) 85% of ETS seniors enrolled in postsecondary education (college, trade school, etc.) We served 781 students from ten counties 4-5 Paying for college 6 Budgeting Sites 6 That's the value of a college education... I don't know anywhere in the world where you can make an investment and make that kind of return. Gaston Caperton Encouragement of higher education for our youth is critical to the success of our collective future. Charles Rangel If you know of students who would benefit from participating in our ETS program, please let your Academic Coordinator know. We’re here to encourage, advise, and guide you to a successful career through continued education. Congratulations on another great year! Free Application for Federal Student Aid (FAFSA) ETS Academic Coordinators will be at the following schools to assist seniors and their parents with filling out the FAFSA. Please see you school guidance office to sign up for a time slot. Allen County Scottsville High: Thursday, January 22 from 10-5:00 PM Butler County High: Thursday, January 8 from 8-5:00 PM Cumberland County High: Friday, January 9 time 8-3:00 PM Edmonson County High: Monday, January 12 from 12-7:00 PM Hart County High: Wednesday, January 14 from 1-6:00 PM Logan County High: Tuesday, January 6 from 8-3:00PM Monroe County High: Thursday, January 15 from 9-2:00 PM Russellville High: Wednesday, January 7 from 9-4:30 PM Educational Talent Search Western Kentucky University Mission Statement 1906 College Heights Blvd. #11098 Educational Talent Search at Western Kentucky University engages qualified youth in grades eight through twelve in developmentally appropriate activities that will encourage persistence in high school, enrollment in postsecondary education and a lifelong pursuit of learning in order to be productive citizens of a global society. Bowling Green, KY 42101-1098 (270) 745-3757 www.wku.edu/ets ETS Newsletter December, 2014 Page 2 E duc a ti o na l T al e nt S e a r c h Important Factors in Choosing a College ACT: Should I Test Again? In choosing a college, the first things you'll probably consider will be the type of academic program and the availability of the major—or majors—you are most interested in. Here are some other things to think about as you compare colleges. How you rank these other factors will depend largely on your personal preferences and needs. Many students test twice, once as a junior and again as a senior. You should definitely consider retesting if you had any problems during testing, such as misunderstanding the directions, running out of time, or not feeling well. You may also want to consider retesting if you don't believe that your scores accurately represent your abilities, especially if you see a discrepancy between your ACT scores and your high school grades, or if you have completed coursework or an intensive review in the subject areas included in the ACT since you tested. If you test more than once, you determine which set of scores are sent to colleges or scholarship programs. Also remember, the higher your ACT score, the more KEYS money you’ll receive. Location distance from home Environment type of school (2-year or 4-year) school setting (urban, rural) location and size of nearest city co-ed, male, female religious affiliation Size enrollment physical size of campus Admission requirements deadline(s) test(s) required average test scores, GPA, rank special requirements Academics majors offered special requirements accreditation student-faculty ratio typical class size Financial aid deadline(s) required forms % of student population receiving aid scholarships part-time employment opportunities Housing residence hall requirements availability types and sizes food plans Facilities academic recreational other How will you do on a retest? Research shows that students from the 2013 graduating class who took the ACT more than once: Activities clubs, organizations sororities/fraternities athletics, intramurals other Campus visits when to visit special opportunities College expenses tuition, room and board estimated total budget application fee, deposits 57% increased their composite score on the retest 21% had no change in their composite score on the retest 22% decreased their composite score on the retest ACT Dates and Deadlines Each ETS member is eligible for one ACT fee waiver. Ask your ETS counselor for more information. Test Date Registration Deadline (Late Fee Required) February 7, 2015 January 9, 2015 January 10-16, 2015 April 18, 2015 March 13, 2015 March 14-27, 2015 June 13, 2015 May 8, 2015 May 9-22, 2015 Page 3 E duc a ti o n a l T a l e n t S e a r ch F i n a n c i a l A i d : A st e p b y s t e p g u i d e Step 1: Gather Documents. As with most things in life, you can save yourself time and aggravation by preparing in advance to fill out the FAFSA. Here’s what you’ll need: Your driver’s license. Your social security number. Your W-2 forms and any other record of income for the prior year. If you are married, you will need you and your spouse’s Federal Income Tax Return for the prior year. If you are a dependent student, you will need your parents’ Federal Income Tax Return for the prior year. Records for any untaxed income from the prior year. Your current bank statement. Investment mortgage information, self-employed business forms, bonds or other investment records for you, your spouse if you are married, and your parents if you are a dependent student. If you are not a U.S. citizen, you need to provide your alien registration or permanent resident card. Step 2: Apply for a PIN. A PIN is a four-digit number that is assigned to you. Go to www.pin.ed.gov to apply for a PIN. (It takes one to three days for the number to be verified, but you can use that time to gather your documentation and begin filling out the web worksheet. This number allows you to: Sign your FAFSA. See the results of the FAFSA on the website. Apply for financial aid in future years. Access other federal financial aid websites. Deadline Alert You can submit the FAFSA starting on JANUARY 1st. If you’re applying before you file your taxes, you can use last year’s tax information as an estimate for this year. Don’t delay submit your FAFSA early. Step 3: Complete the Web Worksheet. Filling out the FAFSA Worksheet makes it a breeze to fill in the information online. In fact, you can pretty much just transfer the data from the worksheet to the online form. Go to http://www.fafsa.ed.gov/fotw1112/pdf/fafsaws12c.pdf Step 4: Fill Out the FAFSA Online. Go to www.fafsa.gov to fill out your form. The online format has calculators and help tools to assist you along the way. Step 5: Sign the Form Electronically with a PIN. Step 6: Get Your Results. Once you get your confirmation page, you know that your form has been submitted, and you just need to wait for the results. If you don’t want to wait, you can check the status of your application online. If you signed the FAFSA with a PIN, you can check the status just one week after submitting it. If you printed, signed, and mailed a hard copy of the signature form, you can check the status of your form two to three weeks after submitting the form. Step 6: Results. In about a month, you will get a paper copy of your Student Aid Report (SAR) or you will be e-mailed one if you have included your email address. The SAR (along with your EFC – Expected Family Contribution) will be sent to all the schools you indicated on the FAFSA. You can include more schools and get extra copies of your SAR online. Step 7: Make Corrections. Once you get the results from the FAFSA, you can make corrections. You may want to correct information that was not accurate on the original form or make changes if you family situation changes. Information taken from How to Pay for College: A Library How-To Handbook. E duc a ti o n a l T a l e n t S e a r ch Freshmen Frenzy and Senior Flash Forward Page 4 E duc a ti o n a l T a l e n t S e a r ch Freshmen Frenzy and Senior Flash Forward Page 5 P ARENTS P AGE Paying for College is a Family Affair THE SAD FACT is that many students who earn admission to college never go because they do not complete the financial aid process. THE GOOD NEWS is that there are lots of ways to pay for college and lots of information and help are available to students who honestly need financial aid assistance! Worth Noting: The earlier you begin to think about paying for college the better. Money is available to almost every student who attends college. No one gets financial aid by wishing! You need to apply and follow through. Even the most ambitious student will need assistance from the adults in the household in order to complete the financial aid application process. You do not need to pay anyone to help you apply for financial aid! Beware of anyone who offers a service for a fee Often the most expensive colleges have the “deepest pockets” and can help the very neediest students to make college affordable. In a perfect world, families begin thinking about college finances when their children are still in grade school. But we all know this is NOT a perfect world. So—the time for you to start thinking about paying for college is TODAY! There is a lot of money available to students with need: While it is true that college costs increase almost yearly, it is also true that there is more financial aid available than ever before- according to the College Board, more than $199 billion. This money comes from the following sources: US Government programs, which provide more than $146.5 billion a year in grants, loans and work-study assistance. State grant and loan programs. College and university grant, loan and scholarship programs. Scholarships given by foundations, corporations and community organizations Sources of Financial Aid: Grants and scholarships: Also called “gift aid,” grants are based on financial need and do not need to be repaid. Scholarships are most-often awarded on the basis of strong academic achievement, a special talent or ability, or personal characteristics. Work-study: This option gives students the opportunity for part-time employment either on campus or off campus at a private, non-profit organization or public agency to help them meet their financial need. Loans: These are offered to students or parents and must be repaid. Loans that are awarded based on financial need are low-interest loans, usually sponsored by the federal government. Interest on these loans is paid by the government for students with the greatest need. Repayment does not begin until 6 months after completion of the college program and may be deferred until a later date under some special circumstances. The article above can be found at WWW.nacacnet.org. Check out the website for additional information on college-prep info. Budget Balancing Tools Balancing a family budget is a difficult task, especially when needs are many and funds are few. Be leery of websites that want you to “consolidate” your debts. While they may contain some reasonable budgeting information, their bottom line is to make money off of you. Check out some of these “legitimate” recommended websites below: www.mint.com—A financial tool that pulls all your financial information into one place. youneedabudget.com—Free online classes and tools to help you set up a budget and stick to it. www.daveramsey.com—Contains tools to keep you on track to get out of debt and stay that way.