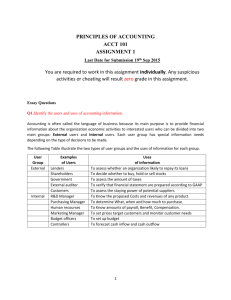

Cases (Guidance Concept to Cases) Session 13 Matakuliah

advertisement

Matakuliah Tahun : F0142 / Akuntansi Internasional : 2006 Session 13 Cases (Guidance Concept to Cases) 1 International Accounting Differences and Financial Statement Analysis • The key question – How do differences in accounting affect earnings and cash flow assessments? • These assessments are important to – Investors – Corporations concerned with foreign direct investment • Many companies are listing on international exchanges (London, New York) 2 International Accounting Differences and Financial Statement Analysis • A tendency exists to looks at earnings from a home country perspective – This tendency may ignore accounting differences • A need exists to better understand foreign accounting principles in the context in which they are derived • International comparability is important in considering alternative investments 3 Major Differences in Accounting Principles Around the World • Inventory measurement – Generally based on “lower of cost or market” with market defined as either • Net realizable value • Replacement cost – LIFO is permitted for tax purposes in U.S. and Japan, but not in the EU • Construction contracts – Wide usage of percentage-ofcompletion method – Completed contract method – Switzerland, China, Japan 4 Major Differences in Accounting Principles Around the World • Measurement basis used – Historical cost is used in the U.S., Brazil, Switzerland, China, and Japan. – More flexible approach with some restatements to market value or replacement cost – U.K., Holland • Depreciation accounting – Useful economic life concept – U.S. and EU – Accelerated methods – France, Germany, Switzerland, Japan 5 Major Differences in Accounting Principles Around the World • R&D costs – Expensed immediately in Anglo-American and Germanic countries – Brazil has a more flexible approach – Some countries allow capitalizing the borrowed cost of assets • Retirement benefits – Generally accounted for on the basis of accrued and/or projected benefits payable to employees – Pay-as-you-go approach in Brazil and China 6 Major Differences in Accounting Principles Around the World • Taxation – Accounting income strongly influenced by the tax system in France, Germany, Brazil, Switzerland • Business Combinations – Varies with allowance of pooling-of-interests – Purchase method is generally required – Goodwill is amortized in Brazil, China, and Japan – Goodwill impairment tests are used in U.S., U.K. 7 Major Differences in Accounting Principles Around the World • Intangibles – Generally are capitalized and subject to amortization or impairment tests – Exception – Switzerland • Foreign Currency Translation – Choice between average or closing rate – Generally flexible; actual or average rate allowed • Big Question: Do these differences matter? 8 The Impact of U.S.-U.K. Accounting Differences Index of conservatism (Gray, 1980) 1 – [RA – RD / l RA l] Where RA = adjusted earnings (or returns) RD = disclosed earnings Therefore, 1 – [U.S. GAAP Earnings – U.K. GAAP Earnings / l U.S. GAAP Earnings l] If index value > 1, U.K. GAAP earnings are less “conservative” If index value < 1, U.K. GAAP earnings are more “conservative” 9 The Impact of U.S.-U.K. Accounting Differences Example 1 Example 2 U.K. earnings U.K. earnings £90 million £110 million U.S. earnings U.S. earnings £100 million £100 million Index 1 – [100-100]/100 = 1.1 Index 1 – [100-90]/100 = 0.9 10 The Impact of U.S.-U.K. Accounting Differences It is possible to establish the relative effect of individual adjustments with partial indices of adjustment Partial index of “conservatism” 1 – [partial adjustment / l U.S. GAAP Earnings l ] 11 The Impact of U.S.-U.K. Accounting Differences Example Millions of Pounds U.K. GAAP earnings Adjustments for U.S. GAAP: Deferred taxation Goodwill amortization Adjusted earnings per U.S. GAAP Overall index of ‘conservatism’ Partial index for deferred taxation 15/100] = 1.15 Partial index for goodwill 120 (15) (5) (100) 1.2 1 – [1 – [-5/100] = 1.05 12 The Impact of U.S.-U.K. Accounting Differences • Differences between methods are illustrated in the Form 20-F report • Form 20-F can be used to test how conservative U.S. and U.K. GAAP are in comparison with each other • Form 20-F is reliable because it is provided by the company itself • Research findings show U.K. GAAP to be less conservative 13 A Global Perspective on Earnings Management • How do Anglo-American earnings compare with continental Europe and Japan? • Continental Europe – Gray (1980) compared French and German companies to British companies • Insert Exhibit 5.8, 5.9 • French and German earnings are more conservative than British earnings – Weetman and Gray (1991) found that • Netherlands was less conservative that Sweden, U.K. • Swedish methods were more conservative than U.S. GAAP 14 A Global Perspective on Earnings Management • Japan – Earnings are relatively understated compared to the U.S. (33.9%, according to Aron (1991) – Historically high PE ratios were deflated by adjustments for reserves, consolidation practices, depreciation, cross-holdings, and differences in capitalization (Morgan Stanley) – Higher levels of gearing (leverage) and shortterm payables are tolerated because of longterm relationships with bankers and suppliers – Emphasis tends to be on long-term growth rather than instant profitability 15 Factors Influencing Measurement Differences • U.S. and U.K. – Stock market is the dominant influence • Information needs of investors encourage a more “optimistic” view of earnings and higher share prices – – – – Accounting principles are flexible Accounting profession is independent Tax rules have a limited influence Cultural values motivate a less conservative approach to measurement 16 Factors Influencing Measurement Differences • Continental Europe and Japan – Taxation and sources of finance are influential – Tradition of commercial codes and accounting plans – Tendency to report lower earnings for tax purposes 17 Factors Influencing Measurement Differences • Continental Europe and Japan – Users of financial information may be more concerned with balance sheet information • Black and White (2003) findings – Balance sheet info is more informative in Germany, Japan – Income statement is more relative in the U.S. – Professional influence is low due to legal requirements related to accounting – Cultural values motivate a more conservative approach 18 Six National Financial Accounting Systems France • Plan Comptable General (national accounting code) in September 1947. • A revised plan came into effect in 1957. • A further revision in 1982 under the influence of the Fourth Directive of The European Union (EU). • In 1986 the plan was extended to implement the requirements of the EU Seventh Directive on consolidated financial statements, and it was further revised in 1999. • The Plan Comptable General provides : • • • • • Objectives and principles of financial accounting and reporting Definitions of assets, liabilities, shareholders’ equity, revenues and expenses Recognition and valuation rules. A standardized chart of accounts Model financial statements and rules for their presentation. Six National Financial Accounting Systems France • A feature of French accounting is : – – • dichotomy between individual company financial statements and those for the consolidated group. The law allows French companies to follow International Financial Reporting Standards (IFRS) or US GAAP in their consolidated financial statements. Major organizations are involved in setting standards : – – – – – – Counseil National de la Comptabilite or CNC (National Accounting Board) Counseil National de la Comptabilite or CNC (National Accounting Board) Comite de la Reglementation Comptable or CRC (Accounting Regulation Committee) Autorite des Marches Financiers or AMF (Financial Markets Authority) Ordre des Experts Comptables or OEC (Institute of Public Accountants) Compagnie Nationale des Commissaires aux Comptes or CNCC (National Institute of Statutory Auditors) Six National Financial Accounting Systems France • French companies must report the following – – – – – Balance Sheet Income Statement Notes to Financial Statements Directors’ Report Auditor’s Report • Listed companies must provide half yearly interim reports and starting in 2003, the results of their environmental activities. Information must be given on : – – – – Auditor’s Report Water, raw material and energy consumption, and actions taken to improve energy efficiency Activities to reduce pollution in the air, water, or ground, including noise pollution and their costs, and Amount of provisions for environmental risks. Six National Financial Accounting Systems Germany • In 1965 Corporation Law moved the German financial reporting system toward British American ideas. • The fourth, seventh and eighth EU directives all entered German law through the Comprehensive Accounting Act of December 19, 1985. • The fundamental characteristic of German accounting : – Creditor protection as embodied in the commercial law – The determination principle states that taxable income is determined by whatever is booked in a firm’s financial records. – Its reliance on statutes and court decisions Six National Financial Accounting Systems Germany • The 1985 Accounting Act specifies the content and format of financial statements, which include : – – – – – Balance Sheet Income Statement Notes Management Report Auditor’s Report • A feature of the German financial reporting system is a private report by the auditors to a company’s managing board of directors and supervisory board. The report comments on the company’s future prospects and especially factors that may threaten its survival Six National Financial Accounting Systems United States • Accounting in the United States is regulated by – A private sector body (FASB) – A governmental agency (SEC) • Generally Accepted Accounting Principles are comprised of all financial accounting standards, rules, and regulations that must be observed in the preparation of financial report. • The Sarbanes Oxley Act was signed into law in 2002, significantly expanding US requirements on corporate governance, disclosure and reporting and the regulation of the audit profession. • Among its more important provisions is the creation of the PCAOB, a new non profit organization overseen by the SEC. Six National Financial Accounting Systems United States • A typical annual financial report of a large US corporation includes the following : – Report of management – Report of independent auditors – Primary financial statements (income statement, balance sheet, statement of cash flows, statement of comprehensive income and statement of stockholders’ equity) – Management discussion and analysis of results of operations and financial condition – Disclosure of accounting policies – Notes to financial statements – Five or ten year comparison of selected financial data – Selected quarterly data Summary of Significant Accounting Practices Items Business Combination, Purchase or Pooling Goodwill Affiliated Companies Foreign Currency Translation Current Rate Method Temporal Method Asset Valuation Depreciation Charges France Germany Japan Netherlands UK USA Purchase Purchase Purchase Purchase Purchase Purchase Capitalize & Amortize Capitalize & Amortize Capitalize & Amortize Capitalize & Amortize Capitalize & Amortize Capitalize & Impairment tested Equity Method Equity Method Equity Method Equity Method Equity Method Equity Method Autonomous Subsidiaries Autonomous Subsidiaries All Subsidiaries Autonomous Subsidiaries Autonomous Subsidiaries Autonomous Subsidiaries Integrated Subsidiaries Integrated Subsidiaries Not Used Integrated Subsidiaries Integrated Subsidiaries Integrated Subsidiaries Historical & Current Cost Historical & Current Cost Historical Cost Historical Cost Historical Cost Historical Cost Economic Based Taxed Based Taxed Based Economic Based Economic Based Economic Based Not Used Not Used Not Used Not Used Not Acceptable Used Finance Leases Not Capitalized Not Capitalized Capitalized Capitalized Capitalized Capitalized Deferred Taxes Accrued Accrued Accrued Accrued Accrued Accrued Used Used No Some Some No LIFO Inventory Valuation Reserves for Income Smooting 26