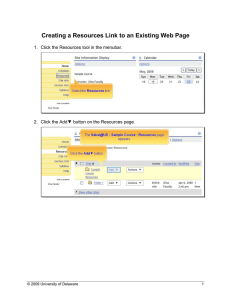

+ 2 (,1 1/,1(

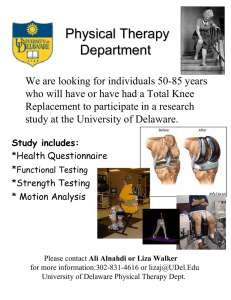

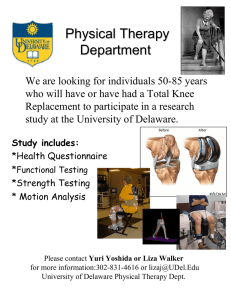

advertisement