FINAL REPORT ASSESSMENT OF THE OPTIONS TO IMPROVE THE MANAGEMENT OF

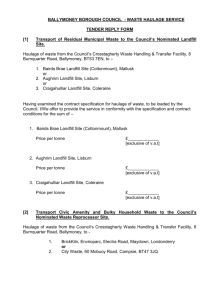

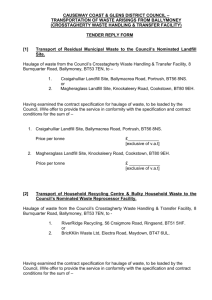

advertisement