FINANCING AGREEMENT

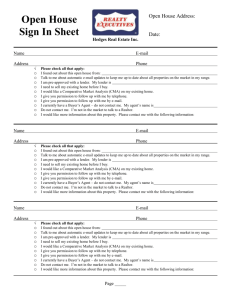

advertisement