WHITE PAPER ON OVERVIEW OF AUDITS WITHIN THE

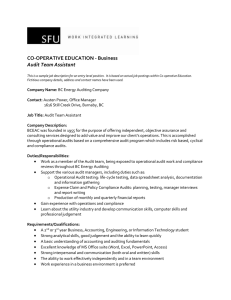

advertisement

WHITE PAPER ON OVERVIEW OF AUDITS WITHIN THE MINNESOTA STATE COLLEGES AND UNIVERSITIES FOR MINNESOTA STATE COLLEGES AND UNIVERSITIES CHIEF FINANCIAL OFFICERS CONFERENCE November 2012 External Audit Coverage System-wide Audited Financial Statements: Since fiscal year 2001, the Minnesota State Colleges and Universities have contracted for an external audit of the system financial statements. Currently, the external audit firm of CliftonLarsonAllen is under contract to provide audit services for the system-wide financial statements, Revenue Fund financial statements, and federal financial assistance. This was the third year that CliftonLarsonAllen provided these services. The Office of Internal Auditing is obligated by the current contract with CliftonLarsonAllen to provide staffing support for the system-wide financial statement and federal financial assistance audits. College and University Audited Financial Statements: Currently, three audit firms are under contract to provide audit opinions on the financial statements for 13 of the largest institutions in the system. (CliftonLarsonAllen, Kern, Dewenter, Viere, Ltd, and Baker Tilly Virchow Krause) Office of the Legislative Auditor: State law allows the Legislative Auditor to audit the Minnesota State Colleges and Universities. The OLA released a financial internal control and compliance audit of Metropolitan State University in January 2012. As of November 2012, no other audits have been scheduled. Colleges and Universities with Audited Financial Statements Bemidji State University Century College Hennepin Technical College Metropolitan State University Minnesota State Community and Technical College Minnesota State University, Mankato Minnesota State University Moorhead Minneapolis Community and Technical College Normandale Community College Rochester Community and Technical College St. Cloud State University Southwest Minnesota State University Winona State University Other Required Audits – Some special grants and other funding sources have certain audit requirements that must be satisfied. State law requires that we consult with the Legislative Auditor prior to executing contracts for audit work. Internal audit facilitates this consultation with the OLA. Examples of required audits include: Minnesota Job Skills Partnership (MJSP) grants: colleges and universities who receive these grants are required to have an external audit at the close of each grant. ISEEK: The operations of ISEEK are directed by a joint powers agreement which requires an annual audit. MnSCU is the fiscal agent for ISEEK and has contracted with CliftonLarsonAllen to complete annual audits. NCAA financial compliance: Division II institutions are required to have a financial agreed upon procedures review once every three years over athletic activities. Reviews Conducted by State and Federal Student Financial Aid Authorities – The Minnesota Office of Higher Education conducts periodic reviews of state financial aid programs administered by colleges and universities. Most colleges and universities are examined once every three years as part of that process. Also, the U.S. Department of Education conducts ad-hoc program reviews and investigations of federal financial aid programs. The department schedules its reviews based on a risk assessment process and does not schedule routine reviews of each college and university. We are not aware of any scheduled reviews for fiscal year 2013. Audits of Affiliated and Associated Organizations – Board Policy 8.3 requires periodic financial audits of affiliated foundations. Also, other related organizations, such as the statewide student associations submit annual audited financial statements to the system office. Office of Internal Auditing The Office of Internal Auditing is governed by Board Policy 1D.1. The Executive Director reports directly to the chair of the Audit Committee of the Board of Trustees. The Audit Committee approves an annual audit plan and oversees the offices operations. Internal auditing: is an independent, objective assurance and consulting activity designed to add value and improve an organization's operations. It helps an organization accomplish its objectives by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control, and governance processes. Internal Audit spends the majority of its time on assurance services which, depending on the Source: definition from the Institute of Internal Auditors scope of the audit, may focus on the quality and reliability of information, legal and policy compliance, and operational efficiency and effectiveness. Financial Internal Control and Compliance Audits: In fiscal year 2011, the Audit Committee undertook a comprehensive evaluation of the audit approach for the Minnesota State Colleges and Universities. One specific area that was included in the review was how to obtain financial internal control and compliance audit coverage given that a contractual relationship with the Office of the Legislative Auditor ended in fiscal year 2010 that provided much of this past coverage since the merger in 1995. It was concluded, given limited resources, that coverage be obtained by Internal Audit doing limited individual institution audits and focusing more heavily on functional areas. Audits approved in the fiscal year 2013 audit plan were: Bemidji State University and Northwest Technical College – Bemidji Banking and cash controls Document imaging Purchasing cards Follow-up on Prior Audit Findings: It is important that the Board of Trustees, Chancellor, and presidents have confidence that any problems revealed by any audit receive appropriate attention. Internal Audit monitors progress toward implementing audit finding recommendations from both internal and external audits. Internal Auditing provides status reports on prior audit findings to presidents twice a year. The Chancellor is informed about any unresolved audit findings as part of the annual presidential performance evaluation process. Fraud Inquiry and Investigation Support: Internal Audit assists with conducting fraud inquiries and investigations. As required by Board Policy 1C.2, when evidence of fraud is identified it must be dealt with appropriately. Board policy also states that every employee has a responsibility to report suspected fraud in a timely manner. Internal Audit works closely with fraud contacts at each college and university. The results of most fraud inquiries and investigations are reported to affected presidents or the Chancellor for action. Board policy requires that significant violations of board policy or law, be communicated to the Board of Trustees. The Executive Director of Internal Auditing advises the Chair of the Audit Committee about fraud investigations and reported potential fraud incidents to the Legislative Auditor, as required by state law. In these times of great uncertainty and change, we have seen an increase in the number of issues that require inquiries and investigations. Information Technology Audits: Recognizing that information technology now transcends all aspects of the system and institutions could not function without technology, it is important to provide leaders with independent assurance that critical information technology operations are efficient, effective, and secure. In the past year, we have begun to implement an information technology audit strategy for the system. Audits approved in the fiscal year 2013 audit plan were: ImageNow and ISRS Database Security. Studies with System-wide Interest: In past years, Internal Auditing has scheduled a study of a topic of major system-wide interest. Depending on priorities and available resources the office plans to begin these types of audits in the future. Advisory Services: The Institute of Internal Auditing allows internal auditors to provide advice and guidance to management through consulting or advisory services. These services can be Selected Past System-wide Studies o o o o o o Undergraduate Student Credit Transfer (2010) Auxiliary and Supplemental Revenues (2009) Affiliated Foundations (2008) Student Success (2007) Underrepresented Student Populations (2004) Post-Secondary Enrollment Options (2001) invaluable to management when transforming an area to help ensure that appropriate risks and controls are built in up front rather than waiting until an assurance service engagement. In providing these services, it is important that management is responsible for decisions or actions that are taken as a result of the advice or guidance provided. Specific areas that Internal Audit is engaged include: Providing professional advice to colleges, universities, and system office staff on various topics. Common questions pertained to compliance with board policies, system procedures, and best practices. Participating on task forces and other committees including: Security Steering Committee, Finance User Group, Financial Aid Directors, and Chief Information Officers. Planning activities of the campus services cooperative. College and University Responsibilities A few suggestions for colleges and universities to keep in mind to make audits go smooth: Implement a program to periodically assess risks to determine if adequate controls are in place to address those risks. Ensure familiarity with state law, board policy, system procedures, and contractual obligations. Ask questions when uncertain about a particular requirement or transaction. We are a large system and we should not hesitate to seek advice from others. Do not be afraid to challenge or ask questions of auditors when you see a draft report with inaccuracies or recommendations you do not understand. Fix known deficiencies in a timely manner. Submitted by Beth Buse, Executive Director – Internal Audit