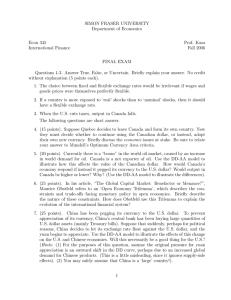

The United States and Globalization Chapter 18 Globalization

advertisement

The United States and Globalization Chapter 18 I. Globalization – increasing unification of the world’s economic order through the reduction of trade barriers to international trade. A. Is it still the main trend? 1. No, largely confined to Western Europe, North America, and the Pacific Rim. 2. Even here, many barriers still exist. B. Is it desirable? 1. Generally speaking yes, because lower income countries will benefit, but the real poor are still out of it. C. Is it stable? 1. Only as long as world markets stay open. 2. Only U.S. leadership can keep world trade open, but Bush turned protectionist. II. What is a Dollar Worth? A. Dollar is the world’s reserve currency – world standard for money, used in most trade deals. B. Hard to define exchange rate – How much one currency buys of another. 1. Fixed exchange rate – One currency buys a set number of other currencies. Ex. China 2. Floating exchange rate – One currency buys a varying number of currencies, depending on the market for them. Ex. United States a. Bubble – When the market goes to high. 3. Rates are important because: a. If a country’s currency is undervalued, your exports will be more attractive because the price would be lower. b. If the currency is overvalued, it is easier to purchase imports, but the price of your exports will be higher III. Lessons of the Great Depression A. Keynesian economics – Theory of British economist John Maynard Keynes that governments should spend money to fight depressions even if it means going into debt. B. Bretton Woods 1. 1944 agreement to fix exchange rates to the dollar backed by gold. (1 oz. = $35). 2. Nixon ended the gold-backed dollar in 1971. 3. Money supply cannot be increased on gold standard 4. Americans bought cheaper German and Japanese products and became a debtor nation C. International Monetary Fund (IMF) a. Keep exchange rates stable and help countries pay their debts. b. Located in Washington, D.C. c. 1st world dominates. D. World Bank a. Makes low-interest loans to developing countries if they practice austerity and hold down inflation. b. Both IMF and World Bank are opposed by anti-globalists. E. G20 a. Group of 20 wealthiest nations in the world b. Account for over 80% of world’s output c. Meet annually to discuss issues and “support growth” IV. The Biggest Debtor A. US imports 1/3 more than it exports B. World’s biggest importer and exporter C. Countries have developed fear recently in US deficit and sold US dollars D. Decreased value is not bad, just makes products cheaper E. What if $ decreases too rapidly? 1. Europe dislikes unstable dollar, proposed euro 2. Danger if everyone is linked to unstable dollar F. Oil addiction 1. Through WWI, US was biggest oil producer and consumer 2. Persian Gulf oil was even cheaper 3. US built inefficient cars, homes, factories, etc. 4. Biggest consumer = most susceptible to price hikes or cutoffs 5. Stagflation – Slow economic growth plus inflation (19731979, incomes were the same, but gas rose tremendously in price) V. Globalization and Its Enemies A. Takes jobs away from richer countries B. Increases pollution C. Exploitation of workers in sweatshops VI. Defending globalization A. Jobs pay better than the ones they are used to B. New technologies are introduced C. Environmental standards would prevent Global South from competing D. Most jobs lost are low-paying, low-skilled jobs (not always true) VII. NAFTA A. North American Free Trade Agreement B. Eliminated tariffs between US, Canada, and Mexico C. Not as complex as the European Union D. Arguments against a. US and Canada were already main trading partners b. US and Canada have to compete with low-wage Mexicans c. Mexico then lost their advantage as Chinese were paid even less d. World Trade Organization (WTO) renders this useless if it reduces tariffs around the world which is its goal VIII. Trade Wars A. Is free trade a zero-sum game or a win-win situation? IMF – International Monetary Fund – Keep exchange rates stable and help countries pay their debts. Located in Washington, D.C. 1st world dominates. World Bank – Makes low-interest loans to developing countries if they practice austerity and hold down inflation. Both IMF and World Bank are opposed by anti-globalists. FTAA G7 G20