VIRGINIA JOURNAL BARZUZA

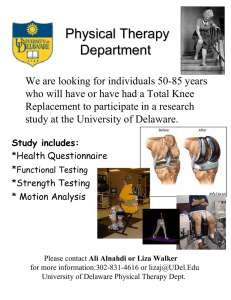

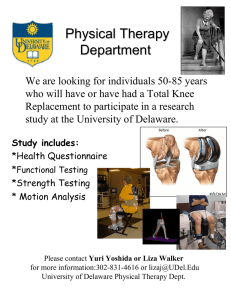

advertisement