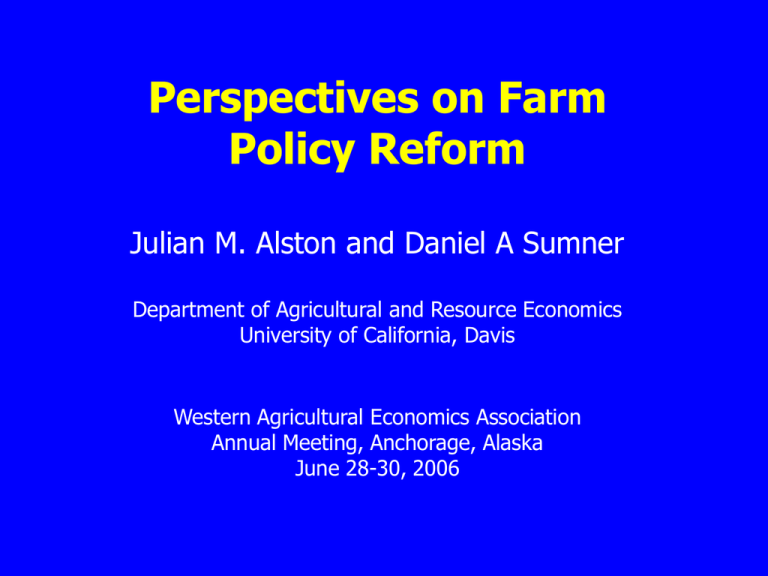

Perspectives on Farm Policy Reform Julian M. Alston and Daniel A Sumner

advertisement

Perspectives on Farm Policy Reform Julian M. Alston and Daniel A Sumner Department of Agricultural and Resource Economics University of California, Davis Western Agricultural Economics Association Annual Meeting, Anchorage, Alaska June 28-30, 2006 Reform? Reform? Are things not bad enough already? Attributed to Justice John Astbury, 1926 Chronological Landmarks • 1994 – Uruguay Round Agreement on Agriculture (URAA) • 1996 – Federal Agricultural Improvement and Reform (FAIR) Act • 2002 – Farm Security and Rural Investment (FSRI) Act • 2001 – Doha Round of WTO begins . . . • 2007 – New Farm Bill Outline • Recent history of farm commodity policies • Current status and prospects • Effects of farm subsidies on Western agriculture • Policy reform in Australia and New Zealand • Facilitating policy reform Main Provisions of URAA Implementation Period Negotiated Change Market Access Average tariff cuts, all ag. products Minimum tariff cuts per tariff line Developed Countries (1995-2000) Developing Countries (1995-2004) – Percent – -36 -15 -24 -10 -20 -13 -36 -21 -24 -14 Aggregate Support Total cuts in AMS Export Subsidies Value cut by product Volume cut by product Farm Bill Policies • 1996 FAIR Act – eliminated annual set-asides and crop price supports – replaced deficiency payments with “direct payments” – continued marketing loan payments • Ad hoc supplement to direct payments – 50 % in 1998 – 100% in 1999-2001 • 2002 FSRI Act – – – – converted ad hoc payments to countercyclical payments continued direct payments extended both to additional crops, including soybeans introduced updating of program base acreage and yields Program Crop Revenue under 2002 Farm Bill Government payments vary in share of total revenue Target Price CCP Loan Rate Market Price Fixed payments MLG/LDP Market Receipts } } Not required to currently produce program crop to get these payments } Paid per unit of production (Based on a figure from Joe Outlaw Texas A&M) Critical Trade Disputes – U.S. Cotton WTO panel and appellate body ruled that U.S. • Step 2 subsidies entail GATT illegal – domestic content subsidies – export subsidies • Export credit guarantees = illegal export subsidies • Marketing loan and CCP programs – depressed world prices resulting in – serious prejudice to interests of Brazilian cotton growers • Support includes direct payments & crop insurance – are these “amber box” and part of AMS? – has U.S. exceeded AMS limits? Doha Round WTO Negotiations • Current framework implies – Elimination of all export subsidies including • credit subsidies • STE subsidies • commercial substitute food aid – Substantial reductions in domestic subsidies • new blue box (smaller cuts for “almost” green box programs) – Substantial expansion in access • reductions in tariffs • expansion of TRQs • exceptions for sensitive products (U.S. sugar? Korean rice?) • If no consensus on parameters by June 30? U.S. Farm Program Expenditures 35.0 billion dollars 30.0 25.0 20.0 15.0 10.0 5.0 0.0 1996 1997 1990 FACT Act 1998 1999 2000 1996 FAIR Act 2001 2002 2003 2004 2005 2002 FSRI Act 2006 Farm Support in OECD Countries [Total US$ 280 billion in 2004] (Source OECD Stefan Tangermann) 70 60 PSE (%) 50 40 30 20 10 OECD EU USA Japan 0 1986 1989 1992 1995 1998 2001 2004p he at M O ai th ze er G ra in s R ice O ils ee ds Su ga r M Be ilk ef /V ea Pi l g m ea t Po ul try Eg gs To ta l W PSE (%) PSEs by Commodity EU and US, 2004 80 70 60 50 40 30 20 10 0 EU US Current Status and Prospects • Strong support for status quo • Forces for change – Budget deficit – Environmental groups – Publicity about beneficiaries – Growers of non-program crops – Doha round – URAA rules and WTO rulings – Economic evidence Western Agriculture Shares of U.S. Value of Production, 2004 Other Program Crops Poultry All Other Commodities Cotton Cattle & Calves Total Agriculture Wheat Nursery & Greenhouse Dairy Hay Fruits, Nuts, & Vegetables 0% 10% 20% 30% Western US 40% 50% 60% 70% Non-Western US 80% 90% 100% Western Agriculture Shares of U.S. Value of Production, 2004 Non Western Western Major Horticulture 11% Program Crops 33% 50% 29% 10% Total: $179.3 billion 44% Dairy Other Livestock and Crops 16% 7% Total: $69.9 billion Subsidies Harm Unsubsidized Producers • Directly through competition for – resources – consumers • Indirectly because they – consume public funds – consume attention of policymakers – slow increases in market access Policy Reform in Australia and NZ 45 OECD 40 New Zealand Australia 35 PSE (%) 30 25 20 15 10 5 0 1986 1989 1992 1995 1998 2001 2004p Key Ingredients of Reforms • Systematic, economy-wide approach – Driven by financial crisis in NZ – Part of general industrial policy in Australia • Transparency institutions – Australia’s Industries Assistance Commission • Adjustment assistance – Australia’s Rural Adjustment Scheme • Compensation Facilitating Policy Reform • Systematic, economy-wide approach • Transparency institutions • Adjustment assistance • Compensation Conclusion • Pressures for policy change from – – – – Budget deficit WTO (both Doha and URAA) Environmental groups “Other” agricultural interests • Institutional innovations may help – Transparency institutions – Adjustment assistance – Buy-outs