Enrollment Guide 6 Health Plans

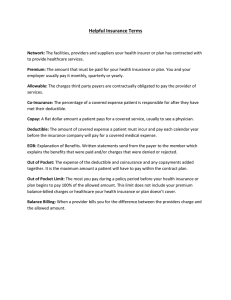

advertisement