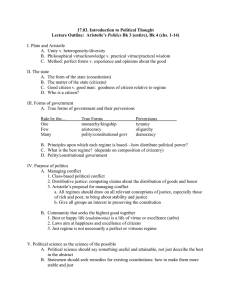

Standards and Market Entry Reiko Aoki Yasuhiro Arai Kyushu University

advertisement

Standards and Market Entry Reiko Aoki Kyushu University Yasuhiro Arai Kochi University 1 Introduction • Standards become beneficial when there are network effects • Consumer Value • Price of inputs Standards are pro-innovation • However, strategic use of standards is possible • Switching cost • Rival cost Standards may be antiinnovation What is the relationship between standards and innovation? 2 Standards and Innovation • Relationship between standards and innovation Patent pools and innovation Lampe and Moser (2012) Standards and innovation Farrell & Saloner (1985), Cabral & Salant (2013) • Entry Deterrence Entry Deterrence by Increasing standard inertia Farrel and Saloner (1987) Entry Deterrence by Increasing switching cost Klemperer (1987), Chen (1997) 3 Focus of this Paper • There is a standard in place. Incumbent Investment Standard Inertia Improve the Technology Entrant Investment Improve the Technology • • Incumbent in two things • Entrant Incumbentcan caninvest improve his technology to deteronly the invests entry. to improve 1. Increase standard inertia technology Investcan in installed baseto improve his technology to counter the • Entrant also invest Improve complementary technology deterrence. Increase switching cost 2. Improve the standard (technology) 4 Framework: Timing • Player Firm 0 :incumbent Firm 1 :new entrant Consumers • Timing of this game 1. Invest in technology (sequential) I. Firm 0 invests in technology II. Firm 1 invests in technology 2. Market competition (Bertrand competition) • We examine how investments relate to second stage subgame equilibria. 5 Framework: Consumer • Consumers are located over unit interval ( Hotelling ) The surplus of a consumer 𝑥 ∈ 0,1 is given by 𝑣0 − 𝑝0 − 𝑡𝑡 :when he purchases from firm 0 𝑣1 − 𝑝1 − 𝑆 − 𝑡 1 − 𝑥 :when he purchases from firm 1 𝑣𝑖 : the value of products 𝑝𝑖 : price of the product 𝑆: cost of changing to different standard (switching cost). 𝑡: the per unit transportation cost • We define the bench marks 𝑥�0 𝑝0 , 𝑥�1 𝑝1 and 𝑥� 𝑝0 , 𝑝1 by 𝑣0 − 𝑝0 − 𝑡𝑥�0 𝑝0 = 0 𝑣1 − 𝑝1 − 𝑆 − 𝑡 1 − 𝑥�1 𝑝1 =0 𝑣0 − 𝑝0 − 𝑡𝑥� 𝑝0 , 𝑝1 = 𝑣1 − 𝑝1 − 𝑆 − 𝑡 1 − 𝑥� 𝑝0 , 𝑝1 • We assume 𝑣𝑖 ≥ 2𝑡. 6 Hotelling Model • Then 𝑣0 − 𝑝0 𝑣1 − 𝑝1 , 1 − 𝑥�1 𝑝1 = , 𝑡 𝑡 𝑣0 − 𝑣1 − 𝑝0 + 𝑝1 + 𝑆 + 𝑡 𝑥� 𝑝0 , 𝑝1 = 2𝑡 𝑥�0 𝑝0 = • By definition, it must be that either or 7 Framework : Optimization in Market • Firm 0 chooses 𝑝0 to maximize his profit 𝜋0 = 𝜋0𝐴 = 𝑝0 𝑥�0 = 𝜋0𝐵 = 𝑝0 𝑥� = 𝜋0𝐶 = 𝑝0 𝑝0 𝑣0 − 𝑝0 𝑡 𝑝0 𝑣0 − 𝑣1 − 𝑝0 + 𝑝1 + 𝑆 + 𝑡 𝑡 for for for 𝑣0 − 𝑝0 ≤ 𝑡 − 𝑣1 + 𝑆 + 𝑝1 𝑡 − 𝑣1 + 𝑆 + 𝑝1 < 𝑣0 − 𝑝0 ≤ 𝑡 + 𝑣1 − 𝑆 − 𝑝1 𝑡 + 𝑣1 − 𝑆 − 𝑝1 < 𝑣0 − 𝑝0 • Firm 1 chooses 𝑝1 to maximize his profit 𝜋1 = 𝜋1𝐴 = 𝑝1 1 − 𝑥�1 = 𝜋1𝐵 = 𝑝1 1 − 𝑥� = 𝜋1𝐶 = 𝑝1 𝑝1 𝑣1 − 𝑆 − 𝑝1 𝑡 𝑝1 𝑡 − 𝑣0 + 𝑝0 + 𝑣1 − 𝑆 − 𝑝1 𝑡 for for for 𝑣1 − 𝑆 − 𝑝1 ≤ 𝑡 − 𝑣0 + 𝑝0 𝑡 − 𝑣0 + 𝑝0 < 𝑣1 − 𝑆 − 𝑝1 ≤ 𝑡 + 𝑣0 − 𝑝0 𝑡 + 𝑣0 − 𝑝0 < 𝑣1 − 𝑆 − 𝑝1 8 Framework : Optimization in Market • Firm 0’s best response correspondence 𝑝0 = 𝑅0 𝑝1 i. If 3𝑡 < 𝑣0 , 𝑡𝑡𝑡𝑡 𝑅0 𝑝1 = ii. 𝑣0 − 𝑣1 + 𝑆 + 𝑝1 − 𝑡 for 𝑣1 − 𝑆 − 𝑝1 ≤ 𝑣0 − 3𝑡 𝑣0 − 𝑣1 + 𝑆 + 𝑝1 + 𝑡 2 for 𝑣1 − 𝑆 − 𝑝1 ≥ 𝑣0 − 3𝑡 𝑣0 + 𝑣1 − 𝑆 − 𝑝1 − 𝑡 for 𝑣1 − 𝑆 − 𝑝1 ≤ 𝑡 − 𝑣0 − 𝑣1 + 𝑆 + 𝑝1 + 𝑡 2 for 𝑣1 − 𝑆 − 𝑝1 ≥ 𝑡 − If 3𝑡 > 𝑣0 , 𝑡𝑡𝑡𝑡 𝑅0 𝑝1 = iii. If 3𝑡 = 𝑣0 , 𝑡𝑡𝑡𝑡 𝑅0 𝑝1 = 𝑣0 − 𝑣1 + 𝑆 + 𝑝1 + 𝑡 2 for all 𝑣0 3 𝑣0 3 9 𝑣1 − 𝑆 − 𝑝1 ≥ 0 Framework : Optimization in Market • Firm 1’s best response correspondence 𝑝1 = 𝑅1 𝑝0 i. If 3𝑡 < 𝑣1 − 𝑆, 𝑡𝑡𝑡𝑡 𝑅1 𝑝0 = ii. 𝒗𝟏 − 𝑺 𝑜𝑜 𝑝0 − 𝑡 − 𝑣0 + 𝑣1 − 𝑆 𝟐 for 𝑡 − 𝑣0 + 𝑝0 + 𝑣1 − 𝑆 2 for 𝑝0 − 𝑡 − 𝑣0 + 𝑣1 − 𝑆 If 3𝑡 > 𝑣1 − 𝑆, 𝑡𝑡𝑡𝑡 𝒗𝟏 − 𝑺 𝟐 𝑅1 𝑝0 = 𝑣1 − 𝑆 − 𝑡 + 𝑣0 − 𝑝0 𝑡 − 𝑣0 + 𝑝0 + 𝑣1 − 𝑆 2 for for for for 𝑣0 − 𝑝0 ≤ 𝑡 − 𝑡− 𝑣1 − 𝑆 2 𝑣1 − 𝑆 < 𝑣0 − 𝑝0 ≤ 𝑣1 − 𝑆 − 3𝑡 2 𝑣1 − 𝑆 − 3𝑡 < 𝑣0 − 𝑝0 𝑣0 − 𝑝0 ≤ 𝑡 − 𝑡− 𝑡− 𝑣1 − 𝑆 2 𝑣1 − 𝑆 𝑣1 − 𝑆 < 𝑣0 − 𝑝0 ≤ 𝑡 − 2 3 𝑣1 − 𝑆 < 𝑣0 − 𝑝0 3 10 Framework : Optimization in Market • Firm 1’s best response correspondence 𝑝1 = 𝑅1 𝑝0 iii. If 3𝑡 = 𝑣0 , 𝑡𝑡𝑡𝑡 𝑅0 𝑝1 = 𝑡 − 𝑣0 + 𝑝0 + 𝑣1 − 𝑆 2 for all 𝑣0 − 𝑝0 ≥ 0 11 Market Equilibrium I. Only Firm 0 (Deter Entry): All consumers purchase from firm 0 II. Only Firm 1 (Standard Replaced): All consumers purchase from firm 1 12 III. Two firms co-exist in the market (unique equilibrium): and 𝑣0 − 𝑣1 + 𝑆 + 3𝑡 ∗ 𝑣1 − 𝑣0 − 𝑆 + 3𝑡 , 𝑝1 = 3 3 2 1 𝑣0 − 𝑣1 + 𝑆 + 3𝑡 1 𝑣1 − 𝑣0 − 𝑆 + 3𝑡 𝜋0∗ = , 𝜋1∗ = 2𝑡 2𝑡 3 3 𝑝0∗ = p1 p0 = v0 − v1 + S + p1 + t 2 R0 2 p0 = v0 − v1 + S + p1 − t R1 p1 = t − v0 + p0 + v1 − S 2 v1 − S + t − v0 13 p1 = p0 + v1 − S − t − v0 v1 − S − t − v0 0 p0 IV. Two firms co-exist in the market (multiple equilibria): 𝑝0∗ 𝑣0 + 𝑣1 − 𝑆 < 3𝑡 3 − 𝛼 𝑣0 = − 1−𝛼 3 p1 𝑣1 − 𝑆 𝑡− 3 p0 = , 𝑝1∗ = v0 − v1 + S + p1 + t 2 v1 − S + t + v0 R0 p1 = 𝑣0 2 + 𝛼 𝑣1 − 𝑆 −𝛼 𝑡− 3 3 where 𝛼 ∈ [0,1] t − v0 + p0 + v1 − S 2 t − v0 + v1 − S 2 R1 0 p0 If we also assume that the entrant is sufficiently efficient 𝑣1 − 𝑆 ≥ 2𝑡 , then this regime never occurs. Market Equilibrium ν1 − S Standard Replaced Regime II Only Firm 1 Co-existence (Unique equilibrium) 3t Regime III Regime I Only Firm 0 Regime IV Standard Upgraded Co-existence 0 3t ν0 15 Iso-consumer surplus curve ν1 − S ν1 − S CS increases Regime II 3t Iso-social surplus curve SW increases Regime II 3t Regime III Regime III Regime I Regime I 0 Regime IV 3t ν0 0 Regime IV 3t ν0 Investment • We examine how investments relate to second stage subgame equilibria. Firm 0 (Incumbent) can invest in technology, Δ0 𝑣0 = 𝑣̅ + Δ0 (Upgrade) max 𝜋0 Δ0 , Δ1 , 𝑆 − 𝐶0 Δ0 Δ0 Firm 1 (Entrant) can invest in technology,Δ1 𝑣0 = 𝑣̅ + Δ1 (Replace) max 𝜋1 Δ0 , Δ1 , 𝑆 − 𝐶1 Δ0 Δ1 Costs of investment are 𝐶0 Δ0 𝛿Δ20 𝛿Δ21 = , 𝐶1 Δ1 = 2 2 17 Subgame • For simplicity, we assume that 𝑣̅ > 3𝑡 • If there is no investment Δ0 = Δ1 = 0 , 𝑣0 = 𝑣1 = 𝑣̅ and regime (III) will transpire • There are two possible regimes after Firm 0 has its investment choice. 𝛥0 + 𝑆 > 3𝑡 ν1 − S ν1 − S Replacement Regime II 3t Regime III Regime IV 0 𝑣̅ , 𝑣̅ − 𝑆 3t 𝛥0 + 𝑆 < 3𝑡 Replacement Regime II 𝛥0 3t Regime I Upgrade ν0 Regime III Regime IV 0 𝛥0 𝑣̅ , 𝑣̅ − 𝑆 3t Regime I Upgrade ν0 18 Subgame • The final outcome depends on firm 1’s investment choice. Next Proposition shows the equilibrium outcome of this game. Proposition 2 In equilibrium, if 𝛿 ≤ 1/3𝑡 or 9𝑡 3𝑡𝑡 − 1 / 9𝑡𝑡 − 1 < 𝑆 , Δ∗0 + 𝑆 > 3𝑡 and Δ∗1 = 0 Final outcome is regime I (Upgrade) if 𝛿 > 1/3𝑡 and 9𝑡 3𝑡𝑡 − 1 / 9𝑡𝑡 − 1 > 𝑆 , Δ∗0 + 𝑆 < 3𝑡 and Δ∗1 > 0 Final outcome is regime III (Co-existence) 19 Conclusion • Policy (competition, standardization ) should be technology life cycle dependent • Incumbent improving technology (upgrade) always makes consumer better-off • Investment in installed base can reduce consumer surplus • When technology is in infancy, entry deterrence (upgrade, switching cost) and persistence of single standard • When technology matures, co-existence of new and old standards • There will never be replacement in equilibrium (entrant never dominates) 20 Appendix:Dual Investment • There is a standard in place. Incumbent Entrant Investment Investment Increasing Standard Inertia Improve the Technology Improve the Technology • Incumbent can invest in two things • Entrant only invests to improve 1. Increase standard inertia technology Invest in installed base Improve complementary technology Increase switching cost 2. Improve the standard (technology) 21 Appendix:Dual Investment • We examine how investments relate to second stage subgame equilibria. Firm 0 (Incumbent) can invest in 1. Technology improvement, (Upgrade) 2. Installed base = increase switching cost Firm 1 (Entrant) invests in technology, (Replace) Costs of investment are 22 Subgame • For simplicity, we assume that 𝑣̅ > 3𝑡 • If there is no investment Δ0 = Δ1 = 𝑆 = 0 , 𝑣0 = 𝑣1 = 𝑣̅ and regime (III) will transpire • There are two possible regimes after Firm 0 has its investment choice. 𝛥0 + 𝑆 > 3𝑡 ν1 − S ν1 − S Replacement Regime II 3t 0 Replacement Regime II Regime III 3t Regime I Upgrade Regime IV 3t 𝛥0 + 𝑆 < 3𝑡 ν0 Regime III Regime I Upgrade Regime IV 0 3t ν0 23 Subgame • The final outcome depends on firm 1’s investment choice. Next Proposition shows the equilibrium outcome of this game. Proposition 2 In equilibrium, if 𝛿 ≤ 1/3𝑡, if 𝛿 > 1/3𝑡, Δ∗0 + 𝑆 ∗ ≡ Δ∗ > 3𝑡 and Δ∗1 = 0 Final outcome is regime I (Upgrade) Δ∗0 + 𝑆 ∗ ≡ Δ∗ < 3𝑡 and Δ∗1 > 0 Final outcome is regime III (Co-existence) 24