Taxation of Income under Amended Sec. 56(2)

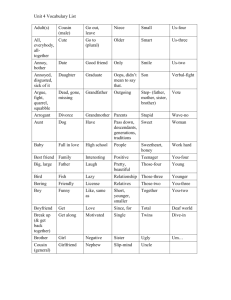

advertisement

Taxation of Income under Amended Sec. 56(2) C.A. Bhupendra Shah 3/601, Navjivan Society, Lamington Road, Mumbai- 400008. 9322507220 bhupendrashahca@hotmail.com Join globalindiancas@yahoogroups.com for daily updates Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 SECTION 56—INCOME FROM OTHER SOURCES Section 56 reads as under: Income from other sources.—(1) Income of every kind which is not to be excluded from the total income under this Act shall be chargeable to income-tax under the head "Income from other sources", if it is not chargeable to income-tax under any of the heads specified in section 14, items A to E. (2) In particular and without prejudice to the generality of the provisions of sub-section (1), the following income shall be chargeable to income-tax under the head "Income from other sources", namely :— (i) dividends ; (ia) income referred to in sub-clause (viii) of clause (24) of section 2; (ib) income referred to in sub-clause (ix) of clause (24) of section 2; (ic) income referred to in sub-clause (x) of clause (24) of section 2, if such income is not chargeable to income-tax under the head "Profits and gains of business or profession"; (id) income by way of interest on securities, if the income is not chargeable to income-tax under the head "Profits and gains of business or profession"; (ii) income from machinery, plant or furniture belonging to the assessee and let on hire, if the income is not chargeable to income-tax under the head "Profits and gains of business or profession"; (iii) where an assessee lets on hire machinery, plant or furniture belonging to him and also buildings, and the letting of the buildings is inseparable from the letting of the said machinery, plant or furniture, the income from such letting, if it is not chargeable to income-tax under the head "Profits and gains of business or profession". (iv) income referred to in sub-clause (xi) of clause (24) of section 2, if such income is not chargeable to income-tax under the head "Profits and gains of business or profession" or under the head "Salaries". (v) where any sum of money exceeding twenty-five thousand rupees is received without consideration by an individual or a Hindu undivided family from any person on or after the 1st day of September, 2004, but before the 1st day of April, 2006, the whole of such sum: Provided that this clause shall not apply to any sum of money received— (a) from any relative; or (b) on the occasion of the marriage of the individual; or globalindiancas@yahoogroups.com***9322507220 Page 2 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 (c) under a will or by way of inheritance; or (d) in contemplation of death of the payer. (e) from any local authority as defined in the Explanation to clause (20) of section 10; or (f) from any fund or foundation or university or other educational institution or hospital or other medical institution or any trust or institution referred to in clause (23C) of section 10; or (g) from any trust or institution registered under section 12AA. Explanation : For the purposes of this clause, "relative" means— (i) spouse of the individual; (ii) brother or sister of the individual; (iii) brother or sister of the spouse of the individual; (iv) brother or sister of either of the parents of the individual; (v) any lineal ascendant or descendant of the individual; (vi) any lineal ascendant or descendant of the spouse of the individual; (vii) spouse of the persons referred to in clauses (ii) to (vi). (vi) where any sum of money, the aggregate value of which exceeds fifty thousand rupees, is received without consideration, by an individual or a Hindu undivided family, in any previous year from any person or persons on or after the 1st day of April, 2006, but before the 1st day of October, 2009 the whole of the aggregate value of such sum : Provided that this clause shall not apply to any sum of money received — (a) from any relative; or (b) on the occasion of the marriage of the individual; or (c) under a will or by way of inheritance; or (d) in contemplation of death of the payer; or (e) from any local authority as defined in the Explanation to clause (20) of section 10; or globalindiancas@yahoogroups.com***9322507220 Page 3 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 (f) from any fund or foundation or university or other educational institution or hospital or other medical institution or any trust or institution referred to in clause (23C) of section 10; or (g) from any trust or institution registered under section 12AA. Explanation : For the purposes of this clause, "relative" means— (i) spouse of the individual; (ii) brother or sister of the individual; (iii) brother or sister of the spouse of the individual; (iv) brother or sister of either of the parents of the individual; (v) any lineal ascendant or descendant of the individual; (vi) any lineal ascendant or descendant of the spouse of the individual; (vii) spouse of the person referred to in clauses (ii) to (vi). (vii) where an individual or a Hindu undivided family receives, in any previous year, from any person or persons on or after the 1st day of October, 2009,— (a) any sum of money, without consideration, the aggregate value of which exceeds fifty thousand rupees, the whole of the aggregate value of such sum; (b) any immovable property, without consideration, the stamp duty value of which exceeds fifty thousand rupees, the stamp duty value of such property; (c) any property, other than immovable property,— (i) without consideration, the aggregate fair market value of which exceeds fifty thousand rupees, the whole of the aggregate fair market value of such property; (ii) for a consideration which is less than the aggregate fair market value of the property by an amount exceeding fifty thousand rupees, the aggregate fair market value of such property as exceeds such consideration : Provided that where the stamp duty value of immovable property as referred to in sub-clause (b) is disputed by the assessee on grounds mentioned in sub-section (2) of section 50C, the Assessing Officer may refer the valuation of such property to a Valuation Officer, and the provisions of section 50C and sub-section (15) of section 155 shall, as far as may be, apply in relation to the stamp duty value of such property for the purpose of sub-clause (b) as they apply for valuation of capital asset under those sections : globalindiancas@yahoogroups.com***9322507220 Page 4 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 Provided further that this clause shall not apply to any sum of money or any property received— (a) from any relative; or (b) on the occasion of the marriage of the individual; or (c) under a will or by way of inheritance; or (d) in contemplation of death of the payer or donor, as the case may be; or (e) from any local authority as defined in the Explanation to clause (20) of section 10; or (f) from any fund or foundation or university or other educational institution or hospital or other medical institution or any trust or institution referred to in clause (23C) of section 10; or (g) from any trust or institution registered under section 12AA. Explanation : For the purposes of this clause,— (a) "assessable" shall have the meaning assigned to it in the Explanation 2 to sub-section (2) of section 50C; (b) "fair market value" of a property, other than an immovable property, means the value determined in accordance with the method as may be prescribed; (c) "jewellery" shall have the meaning assigned to it in the Explanation to sub-clause (ii) of clause (14) of section 2; (d) "property" means the following capital asset of the assessee, namely :—means— (i) immovable property being land or building or both; (ii) shares and securities; (iii) jewellery; (iv) archaeological collections; (v) drawings; (vi) paintings; (vii) sculptures; * * * * (viii) any work of art; or globalindiancas@yahoogroups.com***9322507220 Page 5 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 (ix) bullion (e) "relative" shall have the meaning assigned to it in the Explanation to clause (vi) of sub-section (2) of this section; (f) "stamp duty value" means the value adopted or assessed or assessable by any authority of the Central Government or a State Government for the purpose of payment of stamp duty in respect of an immovable property; (viia) where a firm or a company not being a company in which the public are substantially interested, receives, in any previous year, from any person or persons, on or after the 1st day of June, 2010, any property, being shares of a company not being a company in which the public are substantially interested,— (i) without consideration, the aggregate fair market value of which exceeds fifty thousand rupees, the whole of the aggregate fair market value of such property; (ii) for a consideration which is less than the aggregate fair market value of the property by an amount exceeding fifty thousand rupees, the aggregate fair market value of such property as exceeds such consideration : Provided that this clause shall not apply to any such property received by way of a transaction not regarded as transfer under clause (via) or clause (vic) or clause (vicb) or clause (vid) or clause (vii) of section 47. Explanation : For the purposes of this clause, "fair market value" of a property, being shares of a company not being a company in which the public are substantially interested, shall have the meaning assigned to it in the Explanation to clause (vii); (viii) income by way of interest received on compensation or on enhanced compensation referred to in clause (b) of section 145A. globalindiancas@yahoogroups.com***9322507220 Page 6 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 Sr Query W.E.F. Solution No 1. What is the scope of Amendments made to Sec. 56(2) recently? 2. What is meaning 1/9/04 of, “Any sum of 31/3/06 money without consideration u/s 56(2)(v)”? 3. What are the exceptions to above? 4. N.A to Relatives Wife/ Husband Pati/Patni Brother / sister of indi. Brother/sister Bhai/Behen 7. Brother/sister of spouse Husband’s brother/sister Wife’s brother or sister Jeth/Devar/Nanad Saala/Saali 8. Brother/Sister of parents of indi. Father’s brother/sister Mother’s brother/sister Tau or Chacha/Buaa Mama/Mausi 9. .Lineal ascendant Father/mother/Grandfather/gran / descendant of indi. dmother/son/daughter/grandson/gra nd daughter /great grandfather/great grandmother etc Pita/Maata/Daada/Daadi/Putra/Putri /Pautra/Pautri/Par dada/Par daadi etc 10. Lineal ascendant/descendant of spouse of indi. Sasur Saas Daada Sasur Daadi Saas Par Sasur (bade dada sasur) 5. Spouse individual 6. of Wife/Husband 's Father Wife/Husband's Mother Wife/Husband's Grand Father Wife/Husband's Grand Mother Wife/husband's Great Grand Father globalindiancas@yahoogroups.com***9322507220 Page 7 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 Wife/Husband's Great Grand Mother 11. Spouse of the person from 2 to 6 12. Gifts received by minors from a donor, who is not a brother or sister of either of their parents. 13. Who are Non relatives? Who are relative of HUF? Can definition of relative be reversed? When assessee fails to substantiate source of deposits in brothers’ NRI accounts, payments received as gift can be subjected to tax? Money received by minor child of assessee from grandmother’s brother What 1/0 Amendments were 4/06 to carried out to Sec. 1/10/09 56(2)(v)? Limit of Rs 50.000/- 14. 15. 16. 17. 18. 19. 2. spouse of Brother/sister 3.spouse of Husband’s brother/sister Wife’s brother or sister 4. spouse of Father’s brother/sister Mother’s brother/sister 5.spouse of son /daughter/grandson Par Saas (badi dadi saas) Bhabhi/Jija Jethani/Devarani/Nanadoi Saalaveli/Saadhubhai Chachi/Phufa Mami/Mausa Bahu/Javai/Pautra vadhu globalindiancas@yahoogroups.com***9322507220 Page 8 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 Are Interest free __ loans covered u/s ____ 56(2)(v)? 21. What about Sum received by assessee for giving up his rights to contest a Will? 22. What is the meaning of property? 23. Immovable 1/1 property u/s 0/09 56(2)(vii) 24. Property other 1/1 than immovable 0/09 property u/s 56(2)(vii) 25. Whether Private specific trust are covered by this amendment? 26. Shares of Closely 1/1 Held Company 0/10 (CHC) only u/s 56(2)(viia) 27. Whether the provisions of sub-clause (viia) of Section 56(2) of the Act would apply to convertible debentures? 28. Whether Family Settlements wherein the shares are allotted inter-se amongst family members to avoid disputes would be covered by the aforesaid provisions. 29. What would be the position of shares received through “Will” by a firm or a company? 30. How would be the provisions of sub-clause (viia) of Section 56(2) of the Act apply to transfer of right of shares or receipt of bonus shares. 20. 31. o Initial allotment of shares globalindiancas@yahoogroups.com***9322507220 Page 9 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 32. Right shares 33. Preference share allotment 34. Shares to non-employees under ESOP 35. SWEAT Equity to Non employee 36. Allotment of share otherwise that cash 37. Conversion of debt into shares 38. Shares against warrants 39. Shares allotted under part ix 40. A firm or a proprietary concern may hold the shares of a closely held company. On conversion into a company all the Assets of Firm/Proprietary concern become the assets of the company. On such conversion, if shares are received by the company at less than the specified value, would the provisions of Section 56(2) (viia) be attracted. Likewise, what would be the position of a partner contributing shares of a closely held company as his capital contribution on becoming partner of a firm? 41. Company “A” has issued Bonus shares in the ratio of 1:1. Prior to the issue of Bonus the price of each share is Rs.2000/- and Ex. Bonus the price is Rs.1100/-. In such a case the value of two shares (original and Bonus) is Rs.2200 as against cost/pre Bonus of Rs.2000/. The actual benefit is only Rs.200/. The Assessing Officer suppose contemplates to adopt the FMV of the Bonus shares i.e. Ex. Bonus he may consider income of Rs.1100/- per Bonus Share ignoring the fact that the price of original share has diminished by Rs.900/- per share due to issue of Bonus shares. What would be the position? 42. S. 56(2)(viia) receipt of shares without consideration- Shares of quoted company.( S. 92 to 92F). globalindiancas@yahoogroups.com***9322507220 Page 10 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 43. Whether nonresidents are covered under this amendment? 44. What is the meaning of adequate consideration? 45. Period of holding and indexation Rule 11U/UA Sr. No. Fair Market Value of shares and securities Controversy 2. 1. Bound washing transactions Sr No 1. 2. u/s 94(1)-94(6) 94(7) globalindiancas@yahoogroups.com***9322507220 Page 11 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 globalindiancas@yahoogroups.com***9322507220 Page 12 Issues u/s 56(2) of the Income Tax Act. By CA Bhupendra Shah***bhupendrashahca@hotmail.com***9322507220 globalindiancas@yahoogroups.com***9322507220 Page 13