Toward Asian KLEMS Kyoji Fukao Kyoji Fukao Hitotsubashi University and RIETI

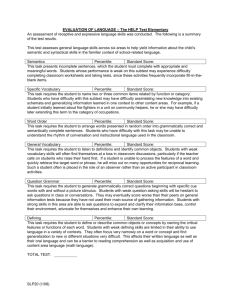

advertisement

Toward Asian KLEMS Kyoji Fukao Kyoji Fukao Hitotsubashi University and RIETI 1 Ideas about analytical use of the Asian KLEMS data Since many Asian countries are under dynamic Since many Asian countries are under dynamic development process, it is interesting to analyze changes of industrial structure and capital h fi d t i l t t d it l deepening. • For example, labor productivity growth might be mainly caused by change of industrial structure (Of course, usually capital deepening occurs g ) behind this change.) . • Does capital deepening occur within each industry or though expansion of capital intensive industry or though expansion of capital intensive sectors? 2 25,000 Per capita GDP (1990 Int. GK$) China h India d 20,000 Japan p 15 000 15,000 10,000 5,000 2007 2004 2001 1998 1995 1992 1989 1986 1983 1980 1977 1974 1971 1968 1965 1962 1959 1956 1953 1950 0 3 Comparison of sectoral labor productivity (primary=1) 6 5 4 3 Secondary Tertiary 2 1 0 Notes: Subsidiary occupations are taken account of for periods before the Second World War. Data before 1965 are on a per worker basis. Data from 1973 are on a man-hour basis. The primary sector consists of agriculture, fishery and forestry. The secondary sector consists of mining, manufacturing and construction. The tertiary sector consists of all other sectors except imputed rent. Sources: Data for periods between 1885-1940 are from Osamu Saito and Tokihiko Settsu (2009), "Unveiling historical occupational structures and its implications for sectoral labour productivity analysis in Japan Japan’ss economic growth, growth," paper presented at INCHOS 2009, 28-30 July 2009, King’s College, Cambridge, p. 31, table 11. Data for periods between 1947-65 are from Ohkawa, K. and M. Shinohara, eds., (1979), Patterns of Japanese Economic Development: A Quantitative Appraisal (New Haven: Yale University Press), p. 41,Table2.12. Data for periods after 1970 are from the JIP Database 2009. 4 Distribution of Workers Across Sectors in Asian Countries 40.00 Agriculture 90.00 Manufacturing 55.00 Services 1952年 80.00 50.00 35.00 1960 年 70.00 1978年 60.00 45 00 45.00 30.00 2004 年 40.00 2006年 25.00 1958 35.00 50.00 2006年 20.00 40 00 40.00 Chi na 1952 1952-2006 2006 2006年 25.00 15.00 Indonesia 30.00 30.00 1978年 Korea 1963-92 20.00 Ma l aysia 20.00 10 00 10.00 Phi lippines 15.00 Ta i wang 10.00 5.00 1952年 1978年 10 00 10.00 Tha iland India 1960-2004 0.00 1952年 0.00 6.00 7.00 8.00 9.00 5.00 6.00 7.00 8.00 9.00 6.00 7.00 8.00 Source: The Conference Board and Groningen Growth and Development Centre, Total Economy Database, http://www.conference-board.org/economic) and World Bank World Development Indicators (2007). 5 9.00 Gross Investment‐GDP Ratio 60.0 China 50.0 China 2008 India Japan India 2004 h ,1993 1 China 1978 40.0 India 2008 30.0 1999 20.0 1955 10.0 1952 1950 Per capita GDP (1990 Int. GK$) $ 0.0 100 1,000 10,000 100,000 6 Decomposition of Increase of Capital Service‐Labor Service Ratio in Japan (annual average growth in Japan (annual average growth rate) 8.0% 7.0% 6.0% 5.0% 4 0% 4.0% 3.0% Total Within Between 2 0% 2.0% 1.0% 0 0% 0.0% ‐1.0% 70/75 75/80 80/85 85/90 90/95 95/00 00/05 05/06 7 Decomposition of Human Capital Accumulation in Japan (annual ( average growth rate) average growth rate) 1.6% 1.5% 1 4% 1.4% 1.2% 1.0% 1.2% 1.1% 1.0% Total 1.0% 0.8% 0.6% 0.4% 0.2% 0 0% 0.0% 0.7% 0 7% 0.7% 0.6% 0.6% 0.6% 0.6% 0.6% 0.5% 0.6% 0.6% 0.5% 0.4% 0 4% 0 3% 0.4% 0.3% 0.3% 0 3% 0.2% 0.2% 0 0% 0.0% Within Between 0.1% 70/7575/8080/8585/9090/9595/0000/0505/06 8 Analysis on impact of economic crisis Gross fixed capital formation/GDP ((at current prices) p ) 45.0% 40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 Capital Capital accumulation slowed down l dd sharply in crisis‐hit Asian p g developing economies Indonesia Philippines Thailand Malaysia Korea Japan Source: Asian Productivity Organization, APO Productivity Database. 9 1 80 1.80 Labor Productivity (Real GDP/total hours worked 1996=1) 1.60 A Large Drop and A Large Drop and 1.40 Slow Recovery in 1.20 Productivity 1.00 0 80 0.80 0.60 0.40 0.20 0.00 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 In Thailand and In Thailand and Indonesia, it took ten years for labor y productivity to recover to pre‐crisis levels. Indonesia Philippines Thailand Malaysia Korea Japan Notes: Labor productivity for Malaysia is measured as real GDP/total numer of workers. 10 A Large Drop and Slow Recovery in Recovery in Productivity TFP (1996=1) 1.50 1.40 1.30 1.20 1.10 1.00 0 90 0.90 0.80 0.70 0.60 0.50 1970 1971 1972 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 With regard to TFP the TFP, the recovery to pre‐ crisis levels in crisis levels in Thailand and Indonesia took Indonesia took even longer. Indonesia Philippines Notes: TFP data for Malaysia are not available. Source: APO Database 2010. Thailand Korea Japan 11 TFP Growth in the Market Sector: by Sector and by Country Manufacturing, excluding electrical machinery Electrical machinery, post and communication 3.0 3.0 10.0 9.0 8.0 7.0 60 6.0 5.0 4.0 3.0 2.0 1.0 0.0 Other goods-producing industries 2.5 2.0 2.0 1.0 1.5 -1.0 US Italy UK France F Geermany Korea US S Italy y UK K Francee US Italy UK France Germany Korea Japan -0.5 -1.0 Germany y 0.0 Japan 0.0 0.5 Korea a 19952005 1.0 Japan n 198095 -2.0 -1.5 -3.0 Other goods producing industries Finance and business services Distribution services 1.5 4.0 4.0 Personal and social services 1.0 3.0 3.0 0.5 2.0 -2.0 US Italy UK France F Geermany 40 -4.0 Korea -1.0 US Ittaly UK ance Fra Germany -1.5 0.0 -3.0 -5.0 -1.0 Japan US Italy UK France Germany Korea -2.0 Japan -1.0 1.0 Ko orea -0.5 0.0 Jap pan 0.0 2.0 1.0 -2.0 -2.5 25 -3.0 Source: Kyoji Fukao, Tsutomu Miyagawa, Hak K. Pyo and Keun Hee Rhee (2009), “Estimates of Total Factor Productivity, ICT Contributions and Resource Reallocation Effects in Japan and Korea.” 12 For this type of analysis, we need to harmonize For this type of analysis we need to harmonize our data. • Will EU KLEMS continue their service and Will EU KLEMS continue their service and expand their coverage of countries? • Industry classification? Don’t we need to take account of special characteristics of Asian countries? • Shall we use labor categories (age, education, Shall we use labor categories (age, education, etc.) of EU KLEMS? • Shall we use capital depreciation rates of EU Shall we use capital depreciation rates of EU KLEMS? 13 14 For international comparison of l b labor productivity and TFP, we need d ti it d TFP d PPP for output, intermediate input and PPP for output, intermediate input and investment goods. Will Groningen University provide us? 15 The Results of International The Results of International Comparison of TFP between Japanese, Korean and Chinese firms EALC Database • The Japan Center for Economic Research has been pursuing the revision and updating p g of the East Asian Listed Companies p Database (EALC) compiled in a collaborative effort with the Center for Corporate Competitiveness at Seoul National University (Prof. Keun Lee), Hitotsubashi University, and Nihon University. • The Th mostt recentt version, i EALC 2009 2009, iis composed d off th the necessary data for estimating the total factor productivity (TFP) of all companies listed on the stock exchanges in Japan, China, South Korea, and Taiwan as well as the TFP of each company adjusted for purchasing power parity. 17 Source of Data (China) • Output and Material Deflator – Output: From NBS( the National Bureau of Statistics), except output deflator for agriculture and service sectors which are from output deflator for agriculture and service sectors, which are from China Statistical Yearbook – Material: Estimated based on data form NBS and Input‐Output T bl 2002 Table 2002 • Labor hours – The numbers of employee; from CSMAR The numbers of employee; from CSMAR – Industry average labor hour: Estimated based on the data from Population Survey 1995 and Yang(2003) • Capital cost – Interest rate: from PBC (The People’s Bank of China) – Corporate tax rate from CSMAR C f CSMAR – Deflator: Estimated based on data from NBS and Input‐Output Table 2002. We use the average price of capital goods, and they Table 2002. We use the average price of capital goods, and they are machinery, tools, vehicle, and building and structure. – Depreciation rate: from Harry Wu (2002) Labor Cost Share in the manufacturing industry 1985 1990 1995 2000 2004/5 Japan 0.153 0.145 0.169 0.164 0.158 Korea 0.133 0.148 0.132 0.118 0.087 0 062 0.062 0 053 0.053 Chi China Capital Cost Share in the manufacturing industry 1985 1990 1995 2000 2004/5 Japan 0.058 0.061 0.046 0.038 0.034 Korea 0.058 0.069 0.054 0.042 0.022 0 092 0.092 0 087 0.087 Chi China Intermediate input Cost Share in the manufacturing industry 1985 1990 1995 2000 2004/5 Japan 0.789 0.794 0.785 0.798 0.807 Korea 0.808 0.783 0.814 0.840 0.891 0 846 0.846 0 860 0.860 Chi China Labor Cost Share in the non‐ manufacturing industry 1985 1990 1995 2000 2004/5 Japan 0.183 0.173 0.176 0.165 0.162 Korea 0.156 0.156 0.144 0.119 0.072 0 075 0.075 0 056 0.056 Chi China Capital Cost Share in the non‐ manufacturing industry 1985 1990 1995 2000 2004/5 Japan 0.114 0.111 0.079 0.055 0.047 Korea 0.138 0.155 0.112 0.085 0.026 0 152 0.152 0 121 0.121 Chi China Intermediate input Cost Share in the non‐manufacturing industry 1985 1990 1995 2000 2004/5 Japan 0.703 0.716 0.745 0.780 0.791 Korea 0.605 0.589 0.644 0.795 0.802 0 773 0.773 0 823 0.823 Chi China TFP Growth Rate in Manufacturing Industry (% per annum, Japan, Korea and China) 19851990 19901995 19952000 20002004 Japan 1.07% 0.59% 1.58% 1.77% Korea 4.04% 5.62% -0.75% 2.73% China Chi 7.19% TFP Growth Rate in non‐manufacturing Industry (% per annum, Japan, Korea and China) 19851990 19901995 19952000 20002004 Japan 1.97% -1.25% 0.92% 2.14% Korea -0.04% 1.23% 0.93% 3.31% Chi * China* *except for Oil and Gas Extraction Industry 8.14% TFP Growth Rate by Industry (Manufacturing Industry, China) p.a. 1999 19992004 Industrial Name 1999 2000 2001 2002 2003 2004 6 Food and kindred products 0.02 0.05 0.00 0.05 0.13 0.08 0.05 7 Textile mill products 0.02 0.02 -0.01 0.03 0.02 0.02 0.02 8 Apparel 0.02 0.07 0.00 0.02 0.05 0.06 0.04 9 Lumber and wood 10 Furniture and fixtures 0.00 0.13 0.12 -0.11 -0.13 -0.07 -0.01 11 Paper and allied 0.02 0.05 -0.03 0.02 0.05 0.08 0.03 12 Printing, publishing and allied 0.01 0.00 0.01 0.02 -0.10 -0.01 -0.01 13 Chemicals 0.03 0.03 0.04 0.13 0.11 0.08 0.07 14 Petroleum and coal products 0.00 0.10 -0.03 -0.01 0.02 0.11 0.03 15 Leather 0.00 -0.04 -0.02 -0.01 0.01 0.00 -0.01 16 S Stone,clay,glass l l 0 04 0.04 0 15 0.15 0 15 0.15 0 12 0.12 0 19 0.19 0 20 0.20 0 14 0.14 17 Primary metal 0.01 0.03 0.05 0.08 0.11 -0.01 0.05 18 Fabricated metal 0.16 0.23 0.25 0.22 0.09 0.30 0.21 19 Machinery non elect Machinery,non-elect 0 04 0.04 0 04 0.04 0 06 0.06 0 07 0.07 0 11 0.11 0 16 0.16 0 08 0.08 20 Electrical machinery 0.02 0.04 0.05 0.09 0.14 0.16 0.08 21 Motor vehicles 0.01 -0.01 -0.01 0.03 0.08 0.14 0.04 22 Transportation equipment & ordnance 0 02 0.02 0 01 0.01 0 07 0.07 0 11 0.11 0 14 0.14 0 18 0.18 0 09 0.09 23 Instruments 0.07 0.13 0.12 0.08 0.13 0.19 0.12 24 Rubber and misc plastics 0.01 0.02 -0.02 0.06 0.06 0.07 0.03 25 Misc. manufacturing 0.08 0.11 0.04 -0.03 -0.02 0.03 0.04 TFP Growth Rate by Industry (Non‐manufacturing Industry, China) pa p.a. 19992004 Industrial Name 1999 2000 2001 2002 2003 2004 1 Agriculture 0.05 0.11 -0.04 -0.05 -0.04 -0.09 -0.01 2 Coal mining 0.03 0.03 -0.07 -0.18 -0.20 -0.32 -0.12 3 Metal and non-metallic mining 0.02 -0.06 -0.11 -0.23 -0.19 -0.12 -0.12 4 Oil and gas extraction 0.05 -0.20 -0.31 -0.57 -0.21 -0.78 -0.34 5 Construction 0.03 -0.01 -0.05 -0.01 -0.04 -0.05 -0.02 26 Transportation 0.04 0.09 0.18 0.20 0.19 0.29 0.16 27 Communication 0 04 0.04 0 08 0.08 0 10 0.10 0 08 0.08 0 17 0.17 0 29 0.29 0 13 0.13 28 Electric utilities 0.03 -0.05 -0.04 -0.04 -0.01 0.00 -0.02 29 Gas utilities 0.01 0.0 0.06 0.08 0.03 0.06 0.12 0. 2 0.06 30 Trade 0.04 0.06 0.11 0.10 0.14 0.12 0.09 31 Finance Insurance and Real Estate 0 07 0.07 0 09 0.09 0 10 0.10 0 14 0.14 0 14 0.14 0 15 0.15 0 11 0.11 32 Other private service 0.06 0.22 0.16 0.09 0.08 0.15 0.13 33 Public service 0.00 Source: Motohashi (2006). Agriiculture Forestry F Fishing F Miining and qu arrying Foood, drink & ttobacco Textiles T Clothing C Leeather and foootwear Woodd & productts of wood annd cork Pulp, papeer & paper prroducts Priinting & pubblishing Mineeral oil refiniing, coke & nnuclear… Chem micals Rubber & pplastics Non-metalllic mineral prroducts Basicc metals Fabricaated metal prroducts Mechhanical enginneering Office macchinery Insulatted wire Other electrrical machinnery and… Electronnic valves an d tubes Telecommu nication equuipment T Radio and ttelevision reeceivers Sciientific instrruments Other instrruments Motor vvehicles Buillding and reppairing of sh ips and… Airccraft and spaacecraft Raailroad equippment and transport … Furniture, miscelllaneous… Electricity, gaas and waterr supply Consttruction Sale, mainteenance and reepair of … S Wholessale trade andd commissioon trade Retaail trade; reppair of personnal and… Hotels & ccatering Inland trransport Water traansport Air traansport Suppporting andd auxiliary transport … Communiications Finanncial intermeediation Insurance annd pension ffunding Activities auuxiliary to financial… Real estate acctivities R Rentinng of machinnery and equuipment Computer annd related acctivities C Researcch and develoopment Legal, techniical and adveertising L Other business activitiies, nec Pubblic adminisstration and ddefence … Eduucation Heaalth and sociaal work Other com mmunity, soccial and… Fig.3 Estimation of China's Purchasing Power Parity on a Production (RMB/US$) 8 00 8.00 7.00 6.00 5.00 4.00 3 00 3.00 2.00 1.00 29 • EALC 2009 shows that South Korean firms are catching up with Japanese firms in machinery. .5 5 Electrical machinery 電気機械器具製造業 韓国 日本 0 Japan P lnTFP -.5 中国 本 日本 -1 中国 Korea 韓国 -1.5 China 1985 1990 1995 Year 中国 韓国 2000 2005 日本 30 自動車・同付属品製造業 Automobile 0 日本 韓国 日本 lnT TFP -.5 5 Japan 中国 中国 韓国 Korea -1 China 1985 1990 1995 Year 中国 韓国 2000 2005 日本 本 31 • But the catching‐up process is slow in some other industries, such as primary metal. p y .2 Primary metal 一次金属製造業 次金属製造業 Japan 0 日本 lnTFP P -.4 -.2 日本 韓国 韓国 中国 -.6 Korea 中国 -.8 8 China 1985 1990 1995 Year 中国 韓国 2000 2005 日本 本 32 -1 -.5 lnTFP P 0 .5 1 Trade 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.5 0 lnTFP P .5 1 Transportation 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.5 0 lnTFP P .5 1 1..5 Construction 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.4 -.2 lnTFP P 0 .2 .4 .6 6 Food and kindred products 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.8 -.6 lnTFP P -.4 -.2 0 .2 2 Textile mill products 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 - .5 lnTFP P 0 .5 5 Apparel 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.2 0 lnTFP P .2 .4 .6 Lumber and wood 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 -.5 lnTFP P 0 .5 5 Furniture and fixtures 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.8 -.6 lnTFP P -.4 -.2 0 .2 2 Paper and allied industries Paper and allied 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 - .5 lnTFP P 0 .5 5 Printing, Printing publishing and allied industries publishing and allied 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 - .5 lnTFP P 0 .5 5 Chemicals 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.5 0 lnTFP P .5 1 Petroleum and coal products 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.5 0 lnTFP P .5 1 1..5 Leather 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 - .5 lnTFP P 0 .5 5 Stone, clay, glass Stone clay glass 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.8 -.6 lnTFP P -.4 -.2 0 .2 2 Primary metal 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.4 -.2 lnTFP P 0 .2 .4 4 Fabricated metal 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 - .5 lnTFP P 0 .5 5 Machinery (non-electrical) Machinery non-elect 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1.5 -1 lnTFP P -.5 0 .5 5 Electrical machinery 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 lnTFP P -.5 0 Motor vehicles Motor Vehicles 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 - .5 lnTFP P 0 .5 5 Transportation equipment and ordnance 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 -.5 lnTFP P 0 .5 5 Instruments 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.6 -.4 lnTFP P -.2 0 .2 .4 4 Rubber Rubber and miscellaneous plastics and misc plastics 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1 - .5 lnTFP P 0 .5 5 Miscellaneous manufacturing Misc manufacturing 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -2 2 -1.5 lnTFP P -1 -.5 0 .5 Communication 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.5 5 lnTFP P 0 .5 Electrical utilities 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -3 -2 lnTFP P -1 0 1 Gas utilities 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -1.5 -1 lnTFP P -.5 0 .5 5 Finance, insurance estate Finance Insuranceand andreal Real Estate 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 -.5 0 lnTFP P .5 5 1 1..5 Other private services 1985 1990 1995 Year China Korea 2000 Japan Note: The shaded areas show 10-90 and 25-75 percentile bands. Note:10-90 percentile band andthe 25-75 percentile band are shaded areas. Median values are on the thicker line The thicker lines represent the median values. 2005 Chemicals .5 TAKEDA PHARMACEUTICAL CO.,LTD. ln nTFP 0 MITSUI CHEMICALS,INC. MITSUBISHI CHEMICAL CORP CORP. DONG-A PHARMACEUTICAL CO.,LTD. -.5 LG CHEM CO.,LTD. SAMSUNG FINE CHEMICALS CO.,LTD. , -1 SHANGHAI PHARMACEUTICAL CO CLTD p Yizheng g Chemical Fibre Company p y Limited Sinopec SHANGHAI CHLOR-ALK ALI CHEMICAL CO.,LTD 1985 1990 1995 Year 2000 2005 .2 Primary metal NIPPON STEEL CORP. ln nTFP -.2 0 KAW ASAKI STEEL CORP. -.4 4 POSCO CO.,LTD. DONGKUK STEEL MILL CO.,LTD. -.6 ANGANG NEW STEEL COMPANY LIMITED 1985 1990 1995 Year 2000 2005 .5 Electrical machinery LG ELECTRONICS INC. SAMSUNG ELECTRONICS CO.,LTD. 0 MATSUSHITA ELECTRIC INDUSTRIAL CO.,LTD. TOSHIBA CORP. CORP -1.5 -1 ln nTFP -.5 QINGDAO HAIER CO. CLTD. KOUKA GROUP COMPANY CLIMITED 1985 1990 1995 Year 2000 2005 .2 Motor Vehicles 0 TOYOTA MOTOR CORP. HONDA MOTOR CO.,LTD. HYUNDAI MOTOR COMPANY CO.,LTD. , -.4 ln nTFP -.2 KIA MOTORS CORPORATION CHONGQING CHANGAN AUTOMOBILE CO., LTD. -.8 -.6 Dongfeng Automobile Co.,LTD 1985 1990 1995 Year 2000 2005 Issues in our comparison calculation Issues in our comparison calculation • Problems in estimation for relative p p y intermediate price should be fixed, especially industry use imported intermediate goods heavily. heavily • Since a firm usually produces heterogeneous goods, its deflated sales by a common fl l b industry price index can be a misleading proxy for output.