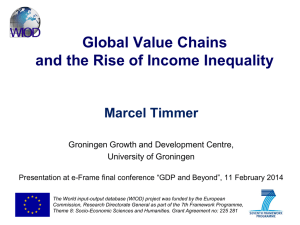

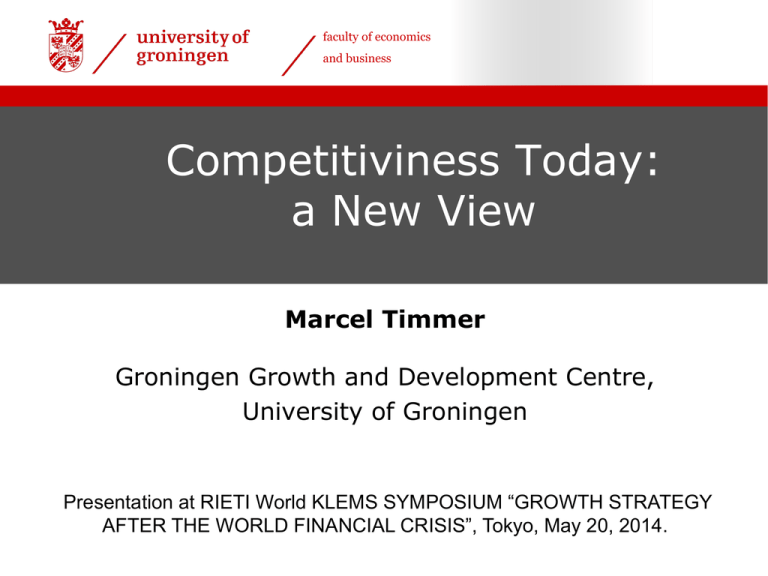

Competitiviness Today: a New View Marcel Timmer Groningen Growth and Development Centre,

advertisement

faculty of economics and business Competitiviness Today: a New View Marcel Timmer Groningen Growth and Development Centre, University of Groningen Presentation at RIETI World KLEMS SYMPOSIUM “GROWTH STRATEGY AFTER THE WORLD FINANCIAL CRISIS”, Tokyo, May 20, 2014. The OLD VIEW is based on PRODUCTS The OLD VIEW on Competitiviness is based on PRODUCTS E.g. increasing value of exports is taken as indicator of competitive strength of a country However International production fragmentation trend accelerating since China’s entry to WTO in 2001 The NEW VIEW “It is not about what you sell, but what you do” The NEW VIEW The NEW VIEW is on ACTIVITIES in GLOBAL VALUE CHAINS Pre-prod Production Post-prod Stylized Car GVC Metal Plastic Countriesindustries delivering value added Car body Engine Business services CAR Identify GVC by country and industry where last stage of production takes place Value added distribution of output of final product Country 1 Capital and labour Intermediate goods Foreign value added Domestic intermediate goods Country 2 Capital and labour Intermediate goods Domestic intermediate goods Country 3 Capital and labour Final goods for domestic and foreign demand Domestic value added Increasing international production fragmentation since 1995 .4 .6 .8 1 Foreign value added share in final output of each of 14 manufacturing industries in 40 countries in 1995 and 2008 0 .2 Source: Timmer et al. (JEP, 2014) 0 .2 .4 .6 foreign VA share 1995 .8 1 Fragmentation outside regions continuing after GFC in 2008 Note: Shares of regional (R) and global (G) foreign value added (FVA) in value chains of final manufactures (34 countries-of-completion in EU, East Asia and NAFTA); Source: Los et al. (2014), Journal of Regional Science Shares in world GVC income, all manufactures, 1995-2011 (%) 35.0 30.0 25.0 EU27 20.0 NAFTA Japan 15.0 China 10.0 BRIIAT 5.0 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 0.0 Note: Value added by regions in the production of final manufacturing goods. BRIIAT includes Brazil, Russia, India, Indonesia, Australia, and Turkey. EU27 includes all European countries that have joined the European Union. NAFTA includes Canada, Mexico and the US. Shares do not add up to 100% as the remainder is the share of all other countries in the world. Source: Timmer et al. (2014) Change in GVC Income by production factor, 2008-1995 1,000,000 HS + K LS + MS 750,000 500,000 250,000 0 -250,000 -500,000 US EU 27 Japan China BRIIMT Note: GVC Income by production factor (in million 1995 US$), change between 1995 and 2008, low- (L), medium- (M) and high-skilled (H) workers and capital (K), measured as value added by regions in the production of final manufacturing goods. Source: Timmer et al. (2014) Concluding remarks International fragmentation of production implies that countries compete on basis of activities, and no longer on basis of products or sectors. Implicates new thinking and policies, e.g. Trade policies: managing interdependencies between countries Social policies: managing effects of trade on income distributions Industrial policies: away from sectoral approach Statistical systems: new measures of competitiviness More information Timmer, Marcel P., Bart Los, Robert Stehrer and Gaaitzen J. de Vries (2013). “Fragmentation, Incomes and Jobs. An Analysis of European Competitiveness.” Economic Policy 28(76):613–661. Los, B., M.P. Timmer and G.J. de Vries (2014), “How global are Global Value Chains? A New Approach to Measure International Fragmentation”, early view, Journal of Regional Science, DOI: 10.1111/jors.12121 Timmer, M.P., A.A. Erumban, B. Los, R. Stehrer and G.J. de Vries (2014),"Slicing Up Global Value Chains", Journal of Economic Perspectives, Spring 2014, DOI:10.1257/jep.28.2.99 All data and tables are available at www.wiod.org Short summaries of the papers can be found at Voxeu website Global fragmentation dominates regional fragmentation RFVA and GFVA shares for selected countries (1995-2008, in %) Source: Los et al. (2014), Journal of Regional Science