%mmwi0A-4- iBlIiolttENTs m MAY

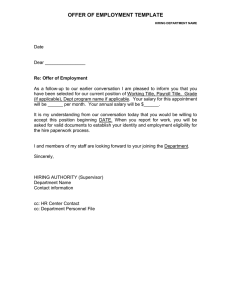

advertisement