Credit Cards for the Poor Ronald Mann Discussion by Adair Morse

advertisement

Credit Cards for the Poor

Ronald Mann

Discussion by

Adair Morse

University of Chicago

Vissing-Jorgensen, 2007

Hypothesis

• “…the products offered and taken up by

LMI households… differ significantly from

those used by middle-class households.”

– Compare characteristics of LMI households to

affluent ones for differences that support

different [uses]

– The paper contrasts profiles of use and users

of cc by income quintile

• Hard to get to endogenous provision of features by

cc

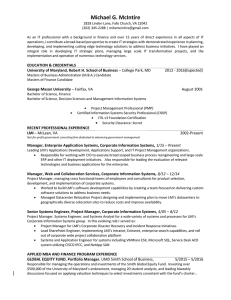

CC Companies

Bank

Outstandings

( $ millions)

$134,700

# Active Accounts

(1,000s)

Citigroup

115,850

47,880

MBNA (B of A)

82,118

21,119

Bank America

61,093

18,773

Capital One

53,024

24,429

JP Morgan Chase

42,996

(transactions)

(gimmicks + mix)

(“subprime”)

- Akers, Golter, Lamm, Solt 2005 FDIC Banking Review

Frame Question: Supply

Two types of Credit Cards

1. Transactions revenues

•

Still the lion share of income

2. Fee-based revenues

•

•

•

Would not offer card if depend on interest rate & transaction fee

Relieves some credit constraints

Gross Souleles (2002) $1000 added liquidity => $130 spending

– Penalty fees (Hammer Consulting Survey 2004)

•

•

•

$13 billion

39% of cc income

Increasing (Furletti Ody 2006)

– Massoud Saunders Scholnick 2006

•

•

Interest rates and fees are substitutes

(model) Cards differentiate based on demand preferences &

default probabilities

Frame question: Demand

Why do LMI use credit card debt?

1. Consumption smoothing / income shocks

2. High (inconsistent?) discount rate: tilting life

cycle consumption profile

3. Being manipulated (targeting by cc’s)

•

•

(Angie Littwin – poor borrowers have few choices)

– Does this belong in set?

– Or do cc’s offer products that { profit maximize with

respect to, market to, understand, all of these } groups

(1), (2) or both

I don’t think we even know (1) from (2), much less (3)

Not clear (1) and (2) need/use same cc features

e.g., Relating to profiles

• Age: more borrowing by young (life cycle)

• Education:

– Greater slope in income = more borrowing

early in career (life cycle)

– Sophistication = less (consumption; targeting)

or more borrowing (life cycle)

– More educ = more availability (targeting)

Empirical Thoughts

• Agarwal, Chomsisengphat, Liu, Souleles 2005

• Consumer mistakes in not taking up cc offers is a small-dollar

effect in most cases

• Data: ideally a panel of individuals

– (Ravina 2005 individual credit card balances)

– Understand their credit use “type”

– Observe patterns of spending and paying

interest/fees

– Policy: See if credit cards extract undue rents from

LMI or if fee structure is optimal way around cc “fear”

of offering high interest rate products

SCF ideas

• Characterizing income smoothers

– Normal income vs current income

• Group all those with x% lower current than normal income

– Vulnerability

• % of income that is used up in basic expenses

– Repaying balances

• Sometimes vs (always or never)

– Shop around, use of CC for vacation, jewelry

• Targeted & Temptation consumption types

– Is it important to distinguish these? Yes if there is a

distinction

– Been turned down?

– Use geography? Where do cc send most mailings?

Things to know, Differencings

– Relate (i) variance of normal to current income and (ii)

vulnerability % to (a) interest rate paid & (b) credit limit

– What is the size & rate for the balance for smoothers

• Relative to same type & income individuals who sometimes

pay off balances

• Relative to same income individuals of temptation targeting

type

– Test: estimate a propensity to default. Do a diff-in-diff

for matched group on the cost of debt.

– Who are cc targeting?

• Are lower quintile borrowers purely temptation/targeting types?

– Evidence of purely fee play?

– Want to know education levels, race, age, etc