THE MONETARY ECONOMY AND THE ECONOMIC CRISIS* DAVID LAIDLER

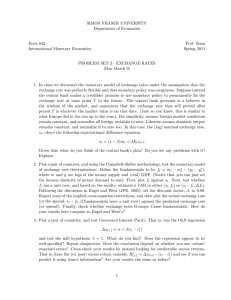

advertisement