E INV 1 AM 11 Name:_________________ INTEREST

advertisement

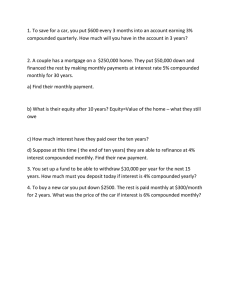

E INV 1 AM 11 INTEREST Name:_________________ There are two types of Interest : ____________________ and _____________________. SIMPLE INTEREST The formula is ________________ I is _____________________________________________________________________ P is ____________________________________________________________________ r is _____________________________________________________________________ t is _____________________________________________________________________ NOTE: For 8% use r = _____, for 12% use r = _____, for 2.5% use r = _____ NOTE: For 6 months use t = _____ (half a year), for 1 month use t = _____ = _____ For 3 months use t = _____. For 1 day use t = _____. NOTE: Per annum means ______________. It is sometimes written as p.a. EXAMPLE: What is the simple interest on $500 @ 5% p.a. for 3 years? What is the total amount after this time? SOLUTION: ___________________________________ Simple Interest = ____________ The total amount is ___________________________________ Total Amount = ____________ QUESTIONS FOR STUDENTS: Students should do INVESTIGATION 1: Simple Interest on page 250 from the text. In each part of this Investigation students should write down what they multiply to get their answers. Students should also calculate the Total Amount for each calculation. Fill in the answers below: 1. 1 year Interest______________ Total Amount_____________ 2. 2years Interest______________ Total Amount_____________ 5years Interest______________ Total Amount_____________ 10years Interest______________ Total Amount_____________ 3. 6months Interest______________ Total Amount_____________ 3months Interest______________ Total Amount_____________ 1month Interest______________ Total Amount_____________ 4. 40days Interest______________ Total Amount_____________ COMPOUND INTEREST With Compound Interest the interest is added onto the principal after every calculation period. Look at the example below. EXAMPLE: What is the Total Amount earned if $1000 is invested at 8% p.a. compounded 4 times a year for 1 year? What is the Interest? NOTE: 8% per year must be considered as ___________________________ per period. Fill in the table below: Period Principal Rate per period 2% Interest Amount 1 2 3 4 ANSWER: The Amount after 1 year is __________. The Interest must be ________________ NOTICE: a) __________________________________________________________________ __________________________________________________________________ b) __________________________________________________________________ __________________________________________________________________ c) __________________________________________________________________ __________________________________________________________________ d) __________________________________________________________________ __________________________________________________________________ __________________________________________________________________ QUESTIONS FOR STUDENTS 1. Give the rate per period and the decimal to be used for the following: (The first one is done for you.) Decimal 0.03 a) 12% , 4 times a year Rate per period 12/4 = 3% b) 16% , 2 times a year Rate per period____________ Decimal________ c) 6% , 3 times a year Rate per period____________ Decimal________ d) 10% , 4 times a year Rate per period____________ Decimal________ e) 5% , 4 times a year Rate per period____________ Decimal________ f) 10% , 12 times a year Rate per period____________ Decimal________ g) 10%, every month Rate per period____________ Decimal________ 2. Calculate the number of periods for the following: The first is done for you. a) 4 times a year for 6 years Number of periods b) 12 times a year for 2 years Number of periods _____________ c) 3 times a year for 4 years Number of periods _____________ d) Twice a year for 8 years Number of periods _____________ e) Every month for 5 months Number of periods _____________ f) Every month for 5 years Number of periods _____________ g) Every day for 1 year Number of periods _____________ NOTE: There are special names given for certain periods. Every three months = 4 times a year is called QUARTERLY Every six months = 2 times a year is called SEMIANNUALLY Every year once a year is called ANNUALLY Every month = 12 times a year is called MONTHLY 4 x 6 = 24 3. Fill in the following tables to calculate the Amount and Interest for the following questions. (Follow the example from compound interest.) a) Invest $2000 @ 12% p.a. compounded 2 times a year (semi-annually) for 2 years. Period Principal 1 2000 Rate 6% 0.06 Interest Amount 2 3 4 Amount _________________ Interest_________________ b) Invest $ 10 000 @ 12% p.a. compounded quarterly for 1 year. Period Principal Rate Interest Amount 1 2 3 4 Amount _________________ Interest_________________ c) Invest $1000 000 @ 10% p.a. compounded monthly for 5 months Period Principal Rate Interest 1 2 3 4 5 Amount _________________ Interest_________________ Amount E INV 2 AM11 COMPOUND INTEREST USING THE FORMULA Name:____________ COMPOUND INTEREST FORMULA: There is a compound interest formula which calculates the amount directly. A = _________________________ P = _________________________ r = __________________________ n = __________________________ t = __________________________ The value of n The value of t Annually n = ______ For time given in years _______________ Semi-annually n = ______ For time given in months _______________ Quarterly n = ______ For time given in days _______________ Monthly n = ______ Daily n = ______ EXAMPLE 1: Use the formula to calculate the Amount and Interest for an investment of $1000 @ 6% p.a. compounded quarterly (4 times a year) for 2 years. SOLUTION: In this example: P = ________ The rate is 6% p.a. so r = ________ Compounded quarterly so n = ________ The time in years is 2 years so t = ________ The Amount = _______________________ To get the answer press the following: ______________________________ This comes to _______________________ ANSWER: The Amount is __________________________ The Interest is __________________________ EXAMPLE 2: Find the amount and interest using the compound interest formula for an investment of $1000 000 compounded semi-annually at 8% p.a. for 18 months. SOLUTION: In this example: P = ______________ The rate is 8% p.a. so r = ________ Compounded semi-annually so n = ________ The time in years is 18 months so t = ________ The Amount = _______________________ To get the answer press the following: ______________________________ This comes to _______________________ ANSWER: The Amount is __________________________ The Interest is __________________________ QUESTIONS FOR STUDENTS Use the formula A = P ( 1 + r/n)nt to calculate the following: Principal 1. $2500 Rate p.a. 4% Time Compounded 3 years Annually 2. $3500 r= 5% t= 2 years n= Semi-annually 3. $13000 r= 2.5% t= 2 years Monthly 4. $5500 r= 12.5% t= 10 years n= Quarterly 5. $15200 r= 6.2% t= 2 years n= Daily 6. $5500 r= 10.5% t= 30 days n= Daily 7. $10 000 r= 8% t= 6 months n= Monthly 8. $4500 r= 12% t= 9 months n= Semiannually 9. $1000 000 r= 8% t= 6 months n= Monthly r= 8% t= 1 day n= Daily r= t= n= n= 10. $1000 000 Amount Interest FURTHER QUESTIONS Calculate the Amount and Interest for the following: a) $4000 @ 10% p.a. compounded semi-annually for 5 years Amount _____________ Interest______________ b) $10 000 @ 8% p.a. compounded quarterly for 3 years Amount _____________ Interest______________ c) $8000 @ 10% p.a. compounded monthly for 6 years Amount _____________ Interest______________ d) $2000 @ 10% p.a. compounded semiannually for 12 years Amount _____________ Interest______________ e) $1 000 000 @ 10% p.a. compounded monthly for 1 month (hint 1 month = 1/12 years) Amount _____________ Interest______________ E INV 3 AM11 INVESTMENTS EXAMPLES: Name:________________ 1. Find the amount and interest if $10 000 is invested @ 8% p.a. for 5 years compounded annually 2. Find the amount and interest if $10 000 is invested @ 8% p.a. for 5 years compounded semi-annually 3. Find the amount and interest if $5 000 is invested @ 12 % p.a. for 5 months compounded annually 4. Find the amount and interest if $4 500 is invested @ 12 % p.a. for 9 months compounded semi-annually 5. Find the amount and interest if $8 000is invested @ 7.8 % p.a. for 60 days compounded semi-annually. 6. Find the amount and interest if $1 000 000 is invested @ 9.5 % p.a. for 7 days compounded daily PRACTICE QUESTIONS 1. Find the amount and interest if $10 000 is invested @ 5% p.a. for 6 years compounded annually Amount___________________________ Interest__________________ 2. Find the amount and interest if $10 000 is invested @ 5% p.a. for 6 years compounded semiannually Amount___________________________ Interest__________________ 3. Find the amount and interest if $10 000 is invested @ 5% p.a. for 6 years compounded quarterly Amount___________________________ Interest__________________ 4. Find the amount and interest if $10 000 is invested @ 5% p.a. for 6 years compounded monthly Amount___________________________ Interest__________________ 5. Find the amount and interest if $10 000 is invested @ 5% p.a. for 6 years compounded daily Amount___________________________ Interest__________________ 6. Find the amount and interest if $10 000 is invested @ 8% p.a. for 5 months compounded semiannually Amount___________________________ Interest__________________ 7. Find the amount and interest if $10 000 is invested @ 8% p.a. for 5 months compounded monthly Amount___________________________ Interest__________________ 8. Find the amount and interest if $10 000 is invested @ 8% p.a. for 5 months compounded daily Amount___________________________ Interest__________________ 9. Find the amount and interest if $10 000 is invested @ 8% p.a. for 10 days compounded semi-annually Amount___________________________ Interest__________________ 10. Find the amount and interest if $10 000 is invested @ 8% p.a. for 10 days compounded daily Amount___________________________ Interest__________________ CALCULATING TIMES FOR INVESTMENTS EXAMPLES: 1. How long for $1000 to reach $1200 at 7% p.a. compounded semi-annually? 2. How long for $1000 to reach $1200 at 7% p.a. compounded monthly? PRACTICE: 1. How long for $3000 to reach $4200 at 6% p.a. compounded MONTHLY? 2. How long for $1000 to reach $2000 at 5% p.a. compounded SEMIANNUALLY? 3. How long for $5000 to reach $6700 at 8% p.a. compounded MONTHLY? 4. How long for $1000 to reach $1200 at 7% p.a. compounded DAILY? 5. How long for $1000 to DOUBLE at 7% p.a. compounded MONTHLY? CALCULATING RATES FOR INVESTMENTS EXAMPLE: What rate is needed for $1000 to reach $1200 if it is compounded semi-annually for three years? PRACTICE 1. What rate is needed for $1500 to reach $2500 if it is compounded semi-annually for five years? 2. What rate is needed for $2000 to reach $4000 if it is compounded monthly for three years? 3. What rate is needed for $3000 to reach $4000 if it is compounded annually for four years? 4. What rate is needed for $10 000 to reach $15 000 if it is compounded quarterly for six years? E INV 5 AM11 INVESTMENTS: FURTHER QUESTIONS Name:___________ EXAMPLE A: Lump Sum → Find the time taken Determine the time taken for an investment of $2000 @ 9.3% p.a. compounded monthly to double in value. Answer in years. ANNUITIES Determine the final amount for an investment of $200 paid at the end of every quarter @ 6% p.a. compounded quarterly for 2 years. Period 1 2 3 4 5 6 7 8 TOTAL ANNUITY FORMULA: There is an anuuity formula which calculates the amount directly. A = _________________________ R = _________________________ i = __________________________ n = __________________________ t = __________________________ Annuity → Find the monthly payment Determine how much you would need to pay twice a year @ 7% p.a. compounded semiannually to save $1 000 000 in 20 years. A: Lump Sum Investment. Find the time taken in years. 1. Determine the time taken for an investment of $3000 @ 5.3% p.a. compounded monthly to reach $4000. 2. Determine the time taken for an investment of $10 000 @ 4.5% p.a. compounded semi-annually to reach $12 000. 3. Determine the time taken for an investment of $2500 @ 7.5% p.a. compounded quarterly to reach $3000. 4. Determine the time taken for an investment of $6000 @ 5.5% p.a. compounded monthly to double in value. Answer in years. B: Annuities. Determine the final amount. 5. Determine the final amount for an investment of $300 paid at the end of every month @ 5% p.a. compounded semi-annually for 3 years. 6. Determine the final amount for an investment of $100 paid every month @ 7.5% p.a. compounded quarterly for 5 years. 7. Determine the final amount for an investment of $250 paid every month @ 8% p.a. compounded monthly for 2 years. 8. Determine the final amount for an investment of $200 paid quarterly @ 6% p.a. compounded semi-annually for 3 years. 9. Determine the final amount for an investment of $200 paid at the start of every month @ 4.5% p.a. compounded semi-annually for 2 years. 10. Determine the final amount for an investment of $300 paid semi-annually @ 7.6% p.a. compounded semi-annually for 6 years. C: Calculate regular payments. Determine the payment. 11. Determine how much you would need to pay each month @ 7% p.a. compounded monthly to save $10 000 in 10 years. 12. Determine how much you would need to pay each year @ 8% p.a. compounded annually to save $5 000 in 5 years. 13. Determine how much you would need to pay at the end of each month @ 9% p.a. compounded monthly to save $10 000 in 6 years. 14. Determine how much you would need to pay twice a year @ 10% p.a. compounded semiannually to save $6 000 in 3 years. 15. Determine how much you would need to pay quarterly @ 7.5% p.a. compounded quarterly to save $10 000 in 4 years. 16. Determine how much you would need to pay each month @ 5% p.a. compounded monthly to save $1000 000 in 25 years. E INV 8 AM 11 Investments PRACTICE QUESTIONS Name:_______________ 1. to calculate the amount (Future Value) of the following investments: a) $1000 invested at 6% per annum compounded semi-annually for 5 years. b) $ 800 invested at 4.8% per annum compounded semi-annually for 3 years c) $ 600 invested at 8% per annum compounded quarterly for 3 years. d) $1200 invested at 6.8% per annum compounded quarterly for 10 years. e) $2500 invested at 12% per annum compounded monthly for 4 years. f) $10 000 invested at 5.4% per annum compounded monthly for 8 years. 2. Determine the following times. Answer in years. a) How long will it take an investment of $1 000 to reach $1 200 at 6.5% p.a. compounded monthly? Answer in years. b) How long will it take an investment of $35 paid at the end of each month at 6.5% p.a. compounded monthly to reach $1200. 3. Determine the following times. Answer in years. a) How long will it take for an investment of $5 000 at 5.6% p.a. compounded quarterly to double in value? b) How long will it take for an investment of $10 000 at 9.5% p.a. compounded semiannually to triple in value? c) How long will it take for an investment of $3 000 at 8.2% p.a. compounded annually to reach $5 000? 4. to find the future value for the following: a) A bank offers an interest rate of 10% p.a. compounded annually. Pay $2400 at the end of each year for three years. b) A bank offers an interest rate of 5.7% p.a. compounded quarterly. Pay $500 invested at the end of each quarter for two years. c) A bank offers an interest rate of 6.8% p.a. compounded monthly. Invest $ 100 every month for ten years. d) Invest $200 every month at an interest rate of 8% p.a. compounded monthly for 20 years. 5. Determine the following times a) How long will it take an investment of $500 paid each month at 6 % p.a. compounded monthly to reach $1000 000? b) How long will it take an investment of $500 paid each month at 12 % p.a. compounded monthly to reach $1000 000? c) How long will it take an investment of $200 paid each month at 9.5 % p.a. compounded monthly to reach $250 000? 6. Determine: a) What amount must be invested monthly from age 20 to age 55 at 8.5% p.a. compounded monthly in order to accumulate $1000 000? b) What amount must be invested quarterly from age 20 to age 60 at 6.4% p.a. compounded quarterly in order to accumulate $500 000? c) What amount must be invested daily from age 20 to age 55 at 7.4% p.a. compounded daily in order to accumulate $1000 000? 7. Determine: a) When you are born, your parents invest $50 a month at 6.8% p.a. compounded monthly in a non-taxable Registered Education Savings Plan for your college education. How much will be accumulated by the time you reach 18? b) When you are born, your parents invest $2 a day in an RRSP at 8% p.a. compounded daily for you. How old will you be when you have $10 000? E LN 1 AM11 INTRODUCTION TO LOANS Name:______________ 1. What is the monthly payment on a loan of $1000 at 8% p.a. compounded annually for 4 years? What is the total cost of the loan? What is the finance charge? Period 1 2 3 4 TOTAL Monthly Payment Total Cost of Loan Finance Charge _______________________________________________________________________ 2. What is the semi annual payment on a loan of $2000 at 5% p.a. compounded semiannually for 5 years? What is the total cost of the loan? What is the finance charge? Period 1 2 3 4 5 6 7 8 9 10 Monthly Payment Total Cost of Loan Finance Charge LOAN FORMULA: There is a loan formula which calculates the amount directly. P = _________________________ R = _________________________ i = __________________________ n = __________________________ t = __________________________ E LN 2 AM11 LOANS PRACTICE QUESTIONS Name:_______________ Calculate the payment, the total paid and the finance charge for the following: 1. $ 5000 loan paid monthly @ 7.5% p.a. compounded monthly for 6 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ 2. $ 8000 loan paid monthly @ 4.5% p.a. compounded semi-annually for 4 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ 3. $ 2000 loan paid monthly @ 8.5% p.a. compounded quarterly for 3 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ 4. $ 5000 loan paid quarterly @ 5% p.a. compounded semi-annually for 5 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ 5. $ 7000 loan paid quarterly @ 6% p.a. compounded quarterly for 3 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ 6. $ 20 000 loan paid monthly @ 7% p.a. compounded semi-annually for 10 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ 7. $ 100 000 loan paid monthly @ 7.5% p.a. compounded annually for 20 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ 8. $ 120 000 loan paid monthly @ 5.5% p.a. compounded semiannually for 25 years Payment ___________________________________ Total Paid ___________________________________ Finance Charge ___________________________________ E LN 3 AM11 MORE LOANS Name:_________________ Example 1: What interest rate compounded monthly is needed for a loan of $5 000 to be paid off over 3 years with regular payments of $150 per month? Example 2: How long is needed for a $4 000 loan compounded monthly at 5.8% to be paid off with payments of $80 per month? PRACTICE: 1. What interest rate compounded monthly is needed for a loan of $8 000 to be paid off over 6 years with regular payments of $160 per month? 2. What interest rate compounded monthly is needed for a loan of $4 000 to be paid off over 4 years with regular payments of $90 per month? 3. What interest rate compounded monthly is needed for a loan of $5 000 to be paid off over 5 years with regular payments of $100 per month? 4. What interest rate compounded monthly is needed for a loan of $4 500 to be paid off over 3 years with regular payments of $130 per month? 5. What interest rate compounded quarterly is needed for a loan of $3 000 to be paid off over 5 years with regular payments of $60 per quarter? 6. How long is needed for a $5 000 loan compounded monthly at 8 % to be paid with payments of $100 per month? off 7. How long is needed for a $3 000 loan compounded monthly at 6.2% to be paid off with payments of $200 per month? 8. How long is needed for a $10 000 loan compounded monthly at 10.5% to be paid off with payments of $200 per month? 9. How long is needed for a $20 000 loan compounded quarterly at 5.8% to be paid off with payments of $800 quarterly? 10. How long is needed for a $4 000 loan compounded semi-annually at 7.5% to be paid off with payments of $400 semiannually? E LN 5a AM 11 Practice Name:___________ BUYING CARS New Cars: The tax is_____________ Used Cars: The tax is ____________ EXAMPLE: 1. You wish to buy a new car for $45 000. You trade in your old car for $5 000. The dealership offers a loan for 2% p.a. to be paid monthly over 4 years, compounded semiannually. a. What is the tax on the new car? What is the total cost of the new car? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 4 years? e. What is the finance charge? PRACTICE: 1. You wish to buy a new car for $60 000. You trade in your old car for $10 000. The dealership offers a loan for 1.5% p.a. to be paid monthly over 5 years, compounded semiannually. a. What is the tax on the new car? What is the total cost of the new car? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 5 years? e. What is the finance charge? 2. You wish to buy a new car for $70 500. You trade in your old car for $12 000. The dealership offers a loan for 0.9 % p.a. to be paid monthly over 4 years, compounded semiannually. a. What is the tax on the new car? What is the total cost of the new car? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 4 years? e. What is the finance charge? 3. You wish to buy a new car for $120 000. You trade in your old car for $20 000. The dealership offers a loan for 1.8% p.a. to be paid monthly over 3 years, compounded semiannually. a. What is the tax on the new car? What is the total cost of the new car? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 3 years? e. What is the finance charge? 4. You wish to purchase a used car for $10 000. You have a $3 000 down-payment. You borrow from the bank at 6.8% to be paid monthly over 5 years, compounded semiannually. a. What is the tax on the car you wish to purchase? What is the total cost? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 5 years? e. What is the finance charge? 5. You wish to purchase a used car for $8 000. You have a $1 000 down-payment. You borrow from the bank at 8.8% to be paid monthly over 3 years, compounded semiannually. a. What is the tax on the car you wish to purchase? What is the total cost? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 3 years? e. What is the finance charge? 6. You wish to purchase a used car for $15 000. You have a $4 000 down-payment. You borrow from the bank at 7.5% to be paid monthly over 4years, compounded semi-annually. a. What is the tax on the car you wish to purchase? What is the total cost? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 4 years? e. What is the finance charge? 7. You wish to purchase a used car for $6 000. You have no down-payment. You borrow from the bank at 5.5% to be paid monthly over 2 years, compounded semi-annually. a. What is the tax on the car you wish to purchase? What is the total cost? b. What is the amount borrowed? c. What is the monthly payment? d. What is the total payment over 2 years? e. What is the finance charge? E LN 6a AM 11 Name:_____________ BUYING A HOUSE DEFINITIONS: 1. Mortgage (p.434) 2. Down-payment (own words) 3. Amortization Period (p.423) 4. Annuity (p.264) 5. Fair Market Value (p.430) 6. Assessed Value (p.237) 7. Mill Rate (p.434) 8. Property Tax (p.237) EXAMPLE: The fair market value for a house is $140 000. You have a minimum down-payment of 10% of the fair market value. The assessed value of the house is 80% of the fair market value. The mill rate is 20 mills. Calculate the following: a) The down-payment b) The amount of the mortgage c) The monthly payment at 6.8% p.a. compounded semi-annually for 25 years d) The annual property tax e) The amount needed each month to cover the tax f) The total needed each month for mortgage plus property taxes g) The amount owing (balance) after 10 years h) The finance charge over 25 years i) The monthly payment on the original loan if the mortgage was taken out for 15 years instead of 25 years. j) The finance charge over 15 years PRACTICE 1. The fair market value for a house is $180 000. You have a minimum down-payment of 25% of the fair market value. The assessed value of the house is 80% of the fair market value. The mill rate is 25 mills. Calculate the following: a) The down-payment b) The amount of the mortgage c) The monthly payment at 5.5% p.a. compounded semi-annually for 25 years d) The annual property tax e) The amount needed each month to cover the tax f) The total needed each month for mortgage plus property taxes g) The amount owing (balance) after 10 years h) The finance charge over 25 years i) The monthly payment on the original loan if the mortgage was taken out for 15 years instead of 25 years. j) The finance charge over 15 years 2. The fair market value for a house is $200 000. You have a minimum down-payment of 15% of the fair market value. The assessed value of the house is 85% of the fair market value. The mill rate is 22 mills. Calculate the following: a) The down-payment b) The amount of the mortgage c) The monthly payment at 6.5% p.a. compounded semi-annually for 25 years d) The annual property tax e) The amount needed each month to cover the tax f) The total needed each month for mortgage plus property taxes g) The amount owing (balance) after 10 years h) The finance charge over 25 years i) The monthly payment on the original loan if the mortgage was taken out for 15 years instead of 25 years. j) The finance charge over 15 years E LN 6b Name:______________ MORTGAGES EXAMPLE: You wish to borrow $120 000 to buy a house. Calculate the monthly payment, the total borrowed, and the finance charge for an interest rate of 7% p.a. compounded monthly over 25 years. Monthly payment Total Amount Finance Charge A. Investigate what happens when the interest rate is changed If the same mortgage of $120 000 is taken out at 7.5% p.a. compounded monthly for 25 years, give the monthly payment, total amount, and finance charge. Monthly payment Total Amount Finance Charge How much do you save on your monthly payment at 7% instead of 7.5% p.a.? How much do you save on your finance charge at 7% instead of 7.5% p.a. ? B. Investigate what happens when the years of the mortgage is changed If the same mortgage of $120 000 is taken out at 7% p.a. compounded monthly for 10 years, give the monthly payment, total amount, and finance charge. Monthly payment Total Amount Finance Charge How much do you save on the monthly payment if the time is 25 years instead of 10 years? How much do you save on your finance charge if the time is 10 years instead of 25 years? All mortgages are paid monthly and compounded monthly