Statewide Financial Statements Guidance Revised June 16, 2015

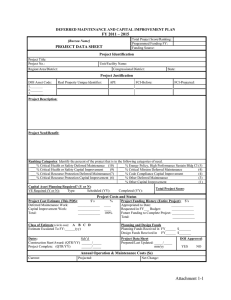

advertisement