Grant Award and Contract Accounting 1

advertisement

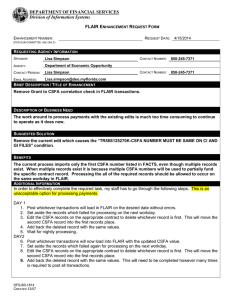

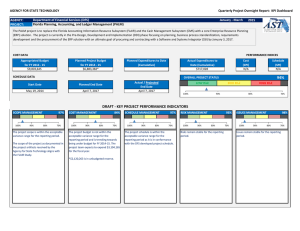

1 Grant Award and Contract Accounting 2 Overview on Grants • State Agencies are responsible for tracking both State and Federal Grants for audit and reporting purposes • Agencies can utilize a 5 digit grant number to record revenues and/or expenditures associated with a grant when posting transactions in FLAIR 3 Overview on Grants • There are no true “grant management” functions provided in the accounting system: 1. Development and processing of cost allocations 2. Ability to systematically identify eligible/ineligible activities, program outputs, constraints on funding (i.e., match, MOE, etc) 4 Federal Grant Requirements 5 Federal Expenditures By State Agency- FY11/12 ($40.6 Bil) Expenditures by State Entity AHCA $10,442,441,990.0 0 30% All Others $8,055,954,270.00 23% DCFS $6,480,102,074.00 19% AHCA DCFS DOE DEO DOT DOH All Others DOH $1,416,507,815.00 DOT 4% $2,319,676,928.00 7% DEO $2,939,198,717.00 8% DOE $3,024,355,305.00 9% 6 Federal Grants • Federal Grants are identified by a Catalog of Federal Domestic Assistance (CFDA) number and Federal Grant Reference number. • General Federal Regulations are in ▫ OMB Circular A-102 ▫ OMB Circular A-110 ▫ OMB Circular A-133. • Specific Grant Requirements can be found in the laws, Code of Federal Regulation and the provisions of contract or grant agreements pertaining to the program 7 Federal Grant Compliance Requirements for the Grant Manager • Monitoring of Allowed or Unallowed Activities for the grant ▫ Program requirements specify the activities that can or cannot be funded under a specific program ▫ Example: CFDA 93.053 – Nutrition Services Incentive Program (NSIP) State Agency may use funds for State Plan administration No nutrition services may be provided directly by the State Agency The Area Agency on Aging (Area Agency) may use funds for plan administration No nutrition services may be provided directly by an Area Agency Service Providers may use funds to provide home-delivered meals 8 Federal Grant Compliance Requirements for the Grant Manager (continued): • Adhering to Allowable Costs/Cost Principles ▫ OMB Circulars describe selected cost items, allowable and unallowable costs and standard methodologies for calculating indirect costs rates OMB Circular A-87 and OMB Circular A-21 • Optimizing Cash Management ▫ Minimize time elapsing between the drawdown of federal funds and disbursement ▫ Comply with Florida’s Cash Management Improvement Act (CMIA) 9 Federal Grant Compliance Requirements for the Grant Manager (continued): • Adhering to Eligibility Requirements ▫ Program requirements specify criteria for determining eligible participants of the program ▫ Example: CFDA 93.053 – NSIP Eligibility for Subrecipients – Service Providers may include profit-making organizations except that providers of case management services must be public or non-profit agencies 10 Equipment and Real Property Management • The federal agency must provide disposition instructions for real property that was acquired with federal awards and is no longer needed for federally supported programs. • Agencies must ensure that the title to equipment or real property acquired with federal awards vests with the state agency. • Agencies will include the grant number on the applicable property records for tracking/reporting purposes 11 Common Funding Requirements • Matching –contribution of a specified amount or percentage of non-federal funds to match the Federal Award • Level of Effort –provide specific level of service or expenditures for a period of time where Federal funds supplement and not supplant State funding of services • Earmarking – specifies the minimum and/or maximum amount or percentage of the program’s funding that must be used for a specific activity 12 Period of Availability of Federal Funds • When the funding period has been specified, only costs resulting from obligations incurred during the funding period specified and any authorized pre-award costs can be charged to the grant. ▫ Example: CFDA 93.053 – NSIP Funds are awarded annually to the State and must be obligated by the end of the Federal fiscal year in which they were awarded. The State has an additional two years to liquidate the obligations. • Unless specifically authorized, all unobligated funds must be refunded to the federal program. 13 Program Income • Income is revenue received that is directly generated by the federally funded program during the grant period. • Unless specified, program income shall be deducted from program expenditures • Other specified uses of program income are: ▫ Add to program budget ▫ Meeting Match Requirements • Example: CFDA 93.053 – NSIP ▫ Service Providers are required to provide an opportunity for voluntary contributions from individuals being served ▫ These contributions must be used to expand the service from they are collected 14 Reporting • Recipients use standard financial reporting forms as authorized by OMB • Program outlays and income are reported on a cash or accrual basis as prescribed by the Federal awarding agency 15 Reporting (continued) • The Federal Funding Accountability and Transparency Act (FFATA) legislation requires information on federal awards (federal financial assistance and expenditures) be made available to the public via a single, searchable website, which is www.USASpending.gov. • The FFATA Subaward Reporting System (FSRS) is the reporting tool Federal grants recipients use to capture and report subaward and executive compensation data regarding their first-tier subawards to meet the FFATA reporting requirements. 16 Grant Reporting • Schedule of Expenditures of Federal Awards (SEFA) – OMB Circular A-133, Section .310(b) ▫ The schedule shall include: A list of the individual Federal programs by Federal Agency The name of the State Agency(aka pass-through entity) & identifying number assigned by the State Agency The Total Federal awards expended for each Federal program and the CFDA number Notes that describe the significant accounting policies used in preparing the schedule The amounts provided to subrecipients from each Federal program 17 Sub-recipient Monitoring • Any agreement for the sub-award of federal financial assistance is subject to the rules applicable to the grant. • Recipients must monitor sub-recipient activity to provide reasonable assurance of compliance ▫ Example: CFDA 93.053 – NSIP State Agency develops policies to govern all aspects of programs operated under the State Plan and monitors their implementation. Area Agencies oversee the activities of service providers with respect to services, reporting, and voluntary contributions. • Recipients must classify sub-recipients of a federal award (Recipient Type Code). 18 State Grant Requirements 19 State Expenditures by Agency – FY11/12 ($1.3 billion) AHCA $110,208,341.51 8% AHCA DEO DEP DEO $98,752,091.59 8% DEP All Others $294,074,508.57 22% $120,395,386.21 9% DJJ DOE DOT All Others DOT $411,454,934.46 31% DOE $197,185,231.13 15% DJJ $91,924,570.88 7% 20 State Financial Assistance Process • The Single Audit Act of 1999, Section 215.97,F.S., Required the Creation of the Catalog of State Financial Assistance (CSFA) Numbers. • For new appropriations, State agencies complete the State Project Determination Check List to determine if the funds will be classified as “state financial assistance” • Department of Financial Services (DFS) will . . . ▫ Establish CSFA Numbers for “state financial assistance” funds ▫ Identify the Type or Class of Financial Assistance for each CSFA Number ▫ Create a Vendor vs. Recipient/Sub-recipient Checklist form ▫ Maintain the codes for identifying the types of organization that is receiving state financial assistance (Recipient Type Code) 21 State Financial Assistance Process • State Agencies record the CSFA number on appropriate grant or contract in FLAIR. The grant and/or contract is then recorded on applicable transactions. • State Agencies are responsible for completing the Vendor vs. Recipient/Sub-recipient Checklist for each contract that is expending state financial assistance. ▫ If the Agency determines that the service provider is a subrecipient, then the provider will have to adhere to the singe audit act reporting requirements and any specific grant restrictions identified in the state project compliance supplement, pursuant to Section 215.97 22 Recipient and Sub-recipient Requirements • Must identify the State Agency that has provided Financial Assistance and the appropriate CSFA number. • Audit Threshold – Must have expended more than $500,000 in State Financial Assistance for a fiscal year. • When a State Agency provides state financial assistance to a sub-recipient, the State Agency must inform the sub-recipient of the Florida Single Audit Act requirements. 23 Grant Accounting in FLAIR 24 FLAIR Provides Three Functions for Grant Management: • Grant Information File • Federal Catalog No. – Titles • State Catalog No. – Titles • Beginning in April 2014 FLAIR will provide limited grant accounting information 25 Grant Information File • Grant Information is established by each Agency and is recorded at the agency’s operating level (OLO). ▫ Results in duplicate grant numbers across the agencies and difficult to track grants that may cross agencies. • Provides a limited number of fields for recording information related to a grant. • The Grant Information File is static in nature and can not be used for grant management or cost accounting functions. 26 Grant Information File 27 Recipient Type Code - FLAIR Used to identify the type of organization that is receiving state or federal financial assistance 28 Other Grant Functionality • Agencies use various field in FLAIR for tracking grant expenditures and revenue. ▫ ▫ ▫ ▫ Grant Number Other Cost Accumulator Contract Number Project Number • FLAIR provides Master Balance Files for Contracts, Grants and Projects. • The Master Balance Files provide Month to Date, Year to Date and Life to Date totals. 29 Other Grant Functionality (continued) • Statewide Cost Allocation Plan (SWCAP) ▫ Authority/Guidance Section 215.195, Florida Statutes OMB Circular A-87 (now codified 2 CFR Part 225, Appendix C, Appendix D, Appendix E) • The SWCAP and the Agency Indirect Cost Rate Proposals are the Federally approved methods that allow for the recovery of central service costs related to Federal grants. ▫ Indirect Costs – Costs that are incurred by agencies for implementing Federal programs. (Administrative functions) ▫ Central Service costs – Costs that can be allocated or billed to agencies for services provided by an enterprise entity (i.e., State Data Centers, State Purchasing, DFS Division of Accounting and Auditing). 30 Contracts 31 Contracts • During the 2011 Legislative Session, Section 215.985. F.S. was amended (Chapter 2011-49 Laws of Florida) requiring the CFO to implement a contract tracking transparency website. • The Department’s transparency system: Florida Accountability Contract Tracking System (FACTS) was implemented in June 2012 https://facts.fldfs.com/Search/ContractSearch.aspx • Agencies are required to input their contract and grant disbursement agreements into FACTS 32 Contracts • FLAIR provides nightly files for update of the validation tables in FACTS for the following data elements: ▫ OLO ▫ Contract ID ▫ Vendor ID ▫ Commodity/Service Type ▫ CFDA/CSFA ▫ Recipient Type • FLAIR also sends payment data associated with a valid 5-digit contract number to FACTS. 33 Contracts (continued) • FACTS sends contract records to FLAIR’s Contract Information (CI) File. The CI file stores the following data elements from FACTS: ▫ OLO ▫ Contract ID ▫ Short Title ▫ Long Title ▫ CFDA/CSFA (first occurrence, if multiple) • FLAIR will add the Contract ID to the title files, allowing agencies to use the Contract ID on FLAIR transactions. 34 Contract Entry in FACTS • State Agencies enter information for their active contracts in FACTS via entry webpages: ▫ Add New Contract Agreement ▫ Add New Grant Disbursement Agreement ▫ Add Budgetary Funding of the contract/grant agreement ▫ Add vendors/recipients/sub-recipients of the contract/grant disbursement agreement ▫ Add deliverables of the contract/grant disbursement agreement 35 FACTS – Add New Contract Agreement 36 FACTS – Add Grant Disbursement Agreement 37 FACTS – Add Budget 38 FACTS – Add Vendor Information 39 FACTS – Add Deliverables