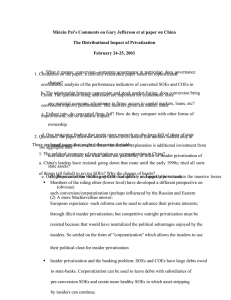

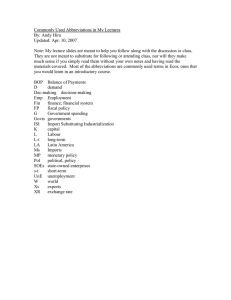

STATE-OWNED ENTERPRISE REFORM POLICY NOTES

advertisement