Finance User Group Meeting

advertisement

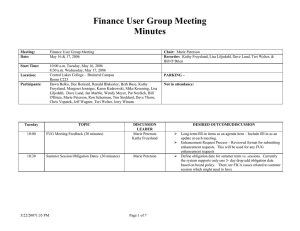

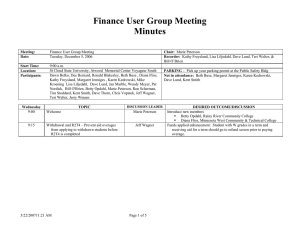

Finance User Group Meeting Minutes Meeting: Date: Start Time: Location: Participants: TIME (min.) 9:00 9:15 10:30 10:45 11:30 p.m. 12:15 1:00 Finance User Group Meeting November 15, 2001 9:00 a.m. St Cloud State University, James W. Miller Learning Resources Center, Rooms 114-115 Connie Garrahy, Rosalie Greeman, Larry Margolis, Craig Erickson, Teri Welter, Deb Kerkaert, Lisa Liljedahl, Dawn Belko, Dave Lund, Jan Ahmann, Karen Kedrowski, Ruth Siefert, Mellisa Premis, Jeff Wagner, Steve Smith, Denis Kelly, Jim Schneider TOPIC Welcome new Members ISRS Current Status Break ISRS Current Status (cont.) Lunch Web On-line Payments Update - Project Timelines - Cash Session Rules - Credit Card Code on Payments - Where to Debit Card Transactions on Cash Drawer Reports? (cash, check, EFT, Credit Card or it’s own category) Financial Reporting Updates - Planning for Next Years Audit - Financial Reporting System - Status of Current Year Audit Key Roles Facilitator: Recorder: Reflector: Not in attendance: DISCUSSION LEADER Dave Lund, Lisa Liljedahl, and Teri Welter Rosalie Greeman Teri Welter Deb Winter, Rick Halvorson, Rick Straka DESIRED OUTCOME/DISCUSSION Update on status of ISRS projects Dave Lund, Lisa Liljedahl, and Teri Welter Dave Lund/Teri Welter Rosalie Greeman Student Account Display - will be piloted by the end of November at three campuses with full implementation to follow shortly after. Issue: 1098T implementation is dependent upon account display being implemented. Issue: In order to implement the campus must convert to new web software. Online Payment – Scheduled for 1st Quarter in 2002. Cash Sessions – Keep current design because not many Cash Drawer Reports – E-Checks - record as Check. Needs to update all check tables same as through ISRS. Debit Card –. Record as separate category – need to be able to generate NSF. Current Year – will be completed by Nov 16. Had a good response from campuses. We will be getting an unqualified opinion. Next Year – Planning process has begun. A committee of campus and System Office staff will be reviewing audit firms for campus audits. FR System – System Office will be determining whether to purchase a new FR Reporting package if current system cannot easily be corrected. 1:15. Tax Issues - Addresses used on tax documents - Changes to 1098-T’s - 1042-S 2:00 2:15 Break Budget Update - Budget Module Task Force - Proposal for Waiving Non resident/Non reciprocity Tuition - Courses that end before June 30. - Tracking Reserves 2:45 Internal Audit Update Lisa Liljedahl Teri Welter Lisa Liljedahl Karen Kedrowski Mellisa Premis Addresses used on tax documents – User group changed the address priority order to (1) Permanent, (2) Housing, (3) Local. Changes to 1098-T include: ° Include eligible students in next tax year Spring Term; ° Expansion of eligible object codes; ° Summarize financial data on the 1098-T form; ° Include Taxable Grad Assistant Tuition Waivers as paid charges; ° Include reimbursements or refunds of qualified tuition and related expenses of prior term payments ° Remove Loans from Grants and Scholarships ° Allow campus staff to produce reprints ° Students are directed to college or university web site homepage for detailed financial information. NOTE: User group recommended that no back up plan is needed and campuses will need to be sure this is available for students. If not available, campus will need to respond to any questions on financial information. 1042-S – Fields displayed on a 1042-S were reviewed. Task force - New task force will be meeting at the end of the month. Waiving NR/NR- New board policy proposal will go to the board allowing NR/NR students to be charged resident rate. NOTE: Need to still code as non-resident with a special rate. Courses that end before June 30 – SDIG discussed concerns with recording theses courses to Spring Term rather than Summer Term. Tracking Reserve – Budget Unit suggested using a cost center with an activity code. User group felt that reserve is a general ledger activity and should be recorded as such. Suggestion made to designate a general ledger to record reserve using subsidiary ledger to transfer. ° New Internal Auditor for West Metro will begin work in Nov. ° Internal control review for financial audit – working with audit firm. ° Key indicators to Board – new project beginning in December. Looking at requirements (legal, board, etc.) for information to go to board – is it being reported, used, valid data? Not sure of methodology that will be used for this project. ° Follow-up and reporting to the Board on audit findings has been intensified. 3:00 Changes to the Minnesota State Grant Rules - Overview of new requirements - How to determine eligible fees Cynthia Mehoves Updated on new rules and the need to be able to calculate the eligible charges for grants during the aid applied process. Issues: ° How to calculate banded tuition when a portion of the courses is not eligible. ° How to recognize manually entered charges that are eligible charges to be considered. Because not all courses are eligible, how can these be attributed to a course to be considered. Users were asked to forward a list of types of course related charges that are manually entered. One that was identified was Non-Refundable charges 3:30 Miscellaneous: - Application Fee Procedure - update on task force progress Rosalie Greeman Rosalie Greeman - Round Table Update - Rules on Financial Aid Paper Checks - When should funds applied begin to use previous term Financial Aid to pay off a new terms charges? First day of Term or Total Obligation Date? Rosalie Greeman Teri Welter - Jim Schnieder Use of Scheduled Dates on Maps transactions Application Fee Procedure – meeting is being rescheduled to discuss this issue. Roundtable Update – Shared membership and role. Rules on FA Paper Checks – Less of an issue since most campuses get most via in EFT. User group agreed that it should stay as currently programed to pay off charges in the next term as of the first day of a term. Jim is going to follow with user that requested this enhancement to get the reason for the request. Do not modify deferments at this time. Teri Welter - 4:00 Defer Student Loans – Enhancements? (see task #3) Possible Future Meeting Dates - February 21-22 @ Inver Hills Comm College - May 16-17 @ MN State Univ, Mankato - August 15-16 @ Rochester College Cost Allocation Charges Group Not everyone is offsetting expenses but rather double counting revenue. Financial statements are overstating revenue and not able to identify what the adjusting entry would be. Decisions/Issues/Notes: Tasks Assigned as Action Items # Originatio n Date 1. 02/23/01 Critical Due Date Description Assigned to Status Need an AG opinion on whether or not we are obligated to follow 16A.49 “Refunds of $1 or less”. – Move to Collections. Deb Winter Note sent to AG. No response 2. 02/23/01 Student loans can not be deferred when 100% is used. This will be reported as a bug. Teri Welter The 100% is used in conjunction with the Defer Code. The deferment codes are: 01 - All Transactions for a FY OR Term 02 – Term Type of Transaction (T, F, B, N) 03 – Cost Center/Obj Code. 100% Deferment was never an option. Do we want to enhance this to include it? Or wait until Payment Plans are defined? 3. 02/23/01 4. 5. 02/23/01 02/23/01 6. 05/24/01 7. 05/24/01 8. 08/09/01 9. 08/09/01 10. 08/09/01 11. 12. 13. 08/09/01 08/09/01 08/09/01 14. 08/09/01 15. 08/09/01 16. 08/09/01 06/30/01 11/15/01 Check on printing ISRS reports to a file – Bring it to the BA/DVLP Staff meeting as an agenda item for August 14-15. Bank Account Maintenance Rules Get a group together to define rules for recording awards for third party aid and how to notify FA of changes. User Group would like a total on the AC0450UG. Al agreed to put together some possible rules as to what makes sense for different transaction types. Add a discretionary Maintenance item for “Request to change the number of days to open a cash session from 5 days to 10 days” Verify that campuses want to change to 10 days for reopening a cash session. Or is it a current cash session? Dave Lund Need a parameter on the AC0521CP for detail on closed years (same options as AC0581CP). Need cost center for Admin. cost rate in order to reconcile because it is by program code. Campuses are not able to load the table for financial statements Teri Welter Set up task force to discuss statements for bills – add Denis Kelly to the group. Report back why we can’t record our AR in MAPS. Need to discuss the acceptance of foreign credit card via the web with the Customized Training Units. Need to review the statement on the student bill to determine if % has changed. Is it possible to charge a convenience fee for accepting credit cards on the web? Research how SCUPPS handles vacancies and how it would impact the salary/fringe projections. Teri Welter Deb Winter Dave Lund Deb Winter Teri Welter Al Finlayson Teri Welter 7/26/01 – 02-DM- AR AR0138UG Cash Session - Requested clarification of business rules from system office staff) It appears that the request related to both options Deb Winter Deb Winter Karen Kedrowski The control needs to be maintained by the staff completing the financial statements. It has been changed. Deb Winter Lisa Liljedahl You can record vacancies on the HR0021UG screen. It does project fringe benefits. 17. 08/09/01 18. 08/09/01 19. 08/09/01 20. 21. 08/09/01 08/09/01 22. 23. 24. 25. 08/09/01 08/09/01 11/15/01 11/15/01 26. 11/15/01 27. 11/15/01 28. 29. 30. 11/15/01 11/15/01 11/15/01 31. 11/15/01 Campus Members: How can campuses change the vendor number for parking deductions so it comes EFT. System office will investigate with our AG who is liable if campuses do not use the positive pay. Investigate whether check information is available to support positive pay immediately after Checkwriter process or not until after batch is run. Deb Winter/Marie Peterson Deb Winter Lisa Liljedahl No need to research until the System Office gets a response from the AG Office. Publish the plan for implementing the new warehouse and Brio. Gerry Rushenberg Send a message over the Accounting Listserv to find out who is using the Deb Winter current warehouse? Gerry feels most users are using the Replicated Databases. Modify the AR_16 group to have a high and low level. Teri Welter Define Business Rules for Drop vs. Waive Deb Winter AR0560CP – Check on status with time process bug Teri Welter Third party receivable balance by TP customer and student query moved to Al Finlayson replicated query library Add flag to AR0185UG that customer is TP and change documentation to Teri Welter inform users how to manually correct via the AR0119UG. Reported that tuition calc is required whenever aid applied is manually run. Teri Welter Follow up with Denis Kelly Data Integrity Issue – Housing vs. Local active addresses. SDIG Determine who is aware of the EBF3 upgrade that is needed on the campus. Dave Lund CA module – Financial reporting unit will review campus data and work with Dave/Rosalie Dave to determine what is occurring or needs to be modified. Dave will check into what it would take to summarize CA transactions so not Dave as many transactions are generated to MAPS. Office of the Chancellor Representatives: Connie Garrahy, Dakota County Technical College Larry Margolis, Inver Hills Community College Craig Erickson, Normandale Community College Deb Kerkaert, Southwest State University Dawn Belko, North Hennepin Community College Jan Ahmann, Century College Ruth Siefert, Rochester College Rick Halvorson, Lake Superior College Jeff Wagner, St Cloud State University Steve Smith, Minnesota State University, Mankato Denis Kelly, St Paul Technical College Rick Straka, South Central Technical College Rosalie Greeman, Assoc. Vice-Chancellor-Financial Reporting Deb Winter, System Dir.-Campus Accounting Teri Welter, Finance Business Analyst Lisa Liljedahl, Finance Business Analyst Dave Lund, Finance Business Analyst Karen Kedrowski, Program Dir. - Budget Internal Audit Representative CURRENT STATUS Data Problems 1. Balances in Object Code 9001 that do not balance to the students account. These items need to be complete prior to updating Fund Balance. Items in FY 2001 amounting to approximately $15,000 systemwide include: ° Missing JG’s on Waiver Corrections ° Check assurance issues ° Campuses with receivable balances in 2001 still needing to be rolled Resp.: Campus Assistance and Teri Welter Status: Campus assistance is working with campuses to reconcile receivable roll errors. Needed transactions on other data issues have been identified and will be communicated to campuses prior to input by development. 2. There are many FY 0000 balances that appear to be bad data, such as bad SALES_TAX_CODE, bad CUST_PO and mismatches on terms. Resp.: Campus Assistance and Teri Welter Status.: Teri is going through them to determine what the problems are. Campus assistance unit will contact campuses to work on some of these problems. 2. Miscellaneous Data Problems. ° AR0120UG used the wrong G/L for the E2_ACCT_NBR. One transactions at Mn TC SE and two at Moorhead. ° A JC (presumable entered on AC0230UG) used the wrong G/L for the E2_ACCT_NBR. One transaction at Moorhead ° AR0150UG used a G/L instead of a cost center for the E2_ACCT_NBR, but used the appropriate Fy. The institution happened to have Cost Centers and General Ledgers with the same number so the system processed the transaction as a valid cost center. 11 transactions at Anoka Hennepin TC. There are known missing JGs with A/R, but don't know the extent of the problem. ° Resp.: Teri Welter Status: Being reviewed by development staff to fix the E2_ACCT_NBR and re-balance the system. Some of the transactions affect closed fiscal years. ISRS Updates 1. CI000010 – Issue Inquiry Revision To provide a better method of retrieval of job information, especially by Buyer Cost Center and Job Level Reverence number. Project Description: Modify existing query. Resp.: Dave Lund Status: In development, low priority. 2. Nonresident Alien Student Employee Setting the appropriate tax status for nonresident alien student employees based on tax treaties. Resp.: Lisa Liljedahl Status: Rolled to production on 11-05-01. The design corrections time period will go until 01-04-02. Work Permit Dates - Minnesota State University, Mankato requested that the work permit dates are stored in ISRS. According to Mankato’s International Student Office, nonresident aliens are given work permits which include dates that the student can work within. So, can’t work before the start date or after the end date. Implementation: • This process will be an optional process. • The work permit dates will be stored on the PS3001UG screen and in most cases will be maintained by the International Student Office. • If an institution selects to use this process then when a work authorization is approved the system will verify the work authorization’s begin and end dates are within the work permit’s dates. If not, the work authorization will be set to inactive status. Also, this audit process can be run manually on the PR0121UG screen and if any work authorizations fail then will be set to audit status. Nonresident Alien report - If the nonresident alien student employee is enrolled in classes than he/she can only work 20 hours per week and if the student isn’t enrolled in classes than can work 40 hours per week. Implementation: • Create a report to show the number of hours worked for a PPE. The fields will be Tech ID, Name, Hours, and Message. • This report can be used for all employees and not just for nonresident alien employees. There will be a parameter that allows you to print just nonresident alien employees, all employees except for nonresident alien employees, or all employees. • Based on what you inputted in the Hours parameter then the report would print employees who worked more hours than the value entered. • There will be an Object Code parameter where you can enter an object code and it would print only employees under this object code. 8233 Form - Each calendar year, need to have a 8233 Form on file to be exempt. In the PR Module, store if the 8233 is on file for the calendar year. Implementation: • On the PR0021UG screen add the following two fields. 8233 Year - Only allow entry if the student is a nonresident alien. The user would enter the calendar year the 8233 applies to. • • 3. Next CYR 8233 - Only allow entry if the student is a nonresident alien. This would be a check box field. The user would check this if they have next year’s 8233 form on file. This is needed because to be exempt for the first PPE of the next calendar year the nonresident alien needs to get the 8233 for the next calendar year on file before final payroll is processed for that PPE. The system will check to see if the nonresident alien has a 8233 form on file and if so then set her/his tax status to be exempt from Federal and State taxes. If he/she doesn’t have a 8233 form on file then when being ran from the PR0021UG screen the tax status will default to Federal S-0 and State S-0 (MN). When being ran from the final payroll process if the employee fails then put the employee in audit status. Add a new audit process to the PR0121UG screen. This audit process will be used to find out the students that have a current calendar year 8233 form on file but don’t have a 8233 form on file for the next calendar year. This is needed so the users know which students they need to contact to tell them they need to get a new 8233 form on file to remain exempt in the next calendar year. International Persons from Canada - What do they need to come into the U.S.A.? So, do they need a passport, Visa, and/or I-94? Canadians don’t need a passport or a visa but they do need an I-94 form. Need to modify the PS3001UG. Implementation: • PS3001UG screen - if student employee’s country of citizenship is Canada then require the I-94 and the Port of Entry sections and the visa type field to be filled out. Modify the program to only look at active nonresident aliens on PS0016UG - currently we look at all nonresident aliens so if the student was a nonresident alien in the past but is now a resident alien then the PR Module shouldn’t be auditing them like they are nonresident aliens. There are effective dates on the PS0016UG screen that needs to be looked at. FICA/Medicare Audit Process modifications. • Change it so that if the student isn’t registered for enough graduate or undergraduate credits to be exempt from FICA/Medicare then sum the number of graduate and undergraduate credits together and compare this to the minimum amount of undergraduate credits you need to be FICA/Medicare exempt. • Don’t include withdrawn credits when coming up with the total number of registered credits. • For nonresident alien student employees, the visa doesn’t have to be active to be exempt. The student just needs to have the appropriate visa. PS3001UG modifications. • Modify it so Birth City, Resident Alien ID, Number of Dependents, and the Resident Alien Date are optional fields. Previously, one of these fields were required to store the screen. • There is a parent/child relationship between the Passport, Visa, and I-94 Information sections. For example, if you want to store Visa information then you need to input Passport information. Break this relationship and if data is entered in the Visa Information section then require all fields in this section to be filled out but don’t require the user to have the Passport Information section filled out. The same with the Passport and I-94 Information sections. • Allow the user to modify the Passport, Visa, and I-94 Id fields. PALS Interface Project Description: Provide an automated interface between the PALS library system and ISRS Accounts Receivable. On a nightly basis, a batch program will run which will place new library fine charges on student accounts, and will inform the PALS system of payments made against outstanding charges. Resp.: Dave Lund Status: Being piloted at Mankato – reports indicate it is working well. 2 or 3 additional institutions will be added one at a time to verify posting and distribution. Working with NWTech has resulted in a redefinition of how multi-campus institutions will be set up. These institutions under our current design, will have to set up the same as they are set up in the PALS system. 4. CA000010 – Posting Duplicate Avoidance Modify programs to prevent posting of duplicate accounting transactions. Project Description: 1. Move posting program into Accounting batch runstream, which would prevent it from being run more than once each day. Resp.: Dave Lund Status: In development, low priority. 5. 01-TI-AR - AR Redesign Resp.: Teri Welter Status: On Schedule for Oct-Nov Implementation General Project Status: AR Redesign Project – Phase I – “To prepare the ISRS 3-tier architectural framework that will support accounts receivable functions using a variety of business tools, including client/server and web. This will provide a solid foundation upon which accounts receivable functionality may be re-constructed and expanded.” Accomplishments through October ° Conversion plan is about 100% complete – (Convert data and implement new database table structure). ° ° ° ° Development of the 3-tier transaction posting service for cashier transactions has been written and is being tested. Development of the cashier service is near completion. The Cashier Engine (AR0398CB) is 99% complete. Test plans are being written and testing has begun on the database conversion plan. Note: Every process that produces or updates transaction must be tested. Risks: ° Inability to procure development resources in a timely way will put the project deadline dates at risk. To date we’ve had inadequate support in the conversion area. We’re now trying to catch up with this critical piece. 6. 01-T1 - MnSCU Online Payments Resp.: Dave Lund Status: The vendor selection process was completed and a contract has been signed with Atomic Software. Separate from the agreement with this provider, an additional agreement will need to be made with a processor to handle online check processing. “PINless” debit card (check card) processing remains an additional possibility that is being explored through the selected provider. Required changes to the A/R system are being pursued. Web screen development is in process, with the first phase, online student account display, to be piloted at three institutions in the very near future. 7. 01-RM-PC Vendor Deletion Resp.: Lisa Liljedahl Status: Dept. of Finance still hasn’t given us a firm date on when the vendor deletion will take place. They stated they won’t be able to give us a firm date until after their unit testing takes place. Dept. of Finance changed the tentative date from 08-20-01 to 11-26-01. They said once unit and system testing is successful then it should go pretty fast. PC0031UG, PC0048UG, AC0228UG, and some additional programs were rolled to QC and have been tested and are waiting to roll out to production but we don’t want them to roll out until Dept. of Finance has done the deletion process. 8. AR000027 - AR0302CP - Bill History Changes to the student bill program to support AR Collections Project and correct problems with student selection report parameters. 1. Migrate the Student Bill program to write billing history to AR_BILL_HISTORY and AR_BILL_HISTORY_DETAIL tables that were developed to record various collection activities. This will also correct a continuous problem with using (‘N’ew) parameter to bill students who have not yet been billed for a specified term. 2. Add a new parameter “Report Only (Y/N)”. Change program to write to Bill History tables only when it is run for purposes of billing the student (‘N’). Question: If the student is being billed for the same term but a different Due Date is used, what is recorded in the Bill History Tables? a) change the original due date for the previous term billing to the new Due Date? b) Add a new record to the bill history tables for the term indicating the new Due Date. This indicates that charges created after the first billing have a different due date. If b), what does this mean as far as aging? Charges billed after the first term billing have the new Due Date? 1. 2. Add a new parameters to the “Student Selection Type” Remove parameter “Invoice given Term [Y/N?]” and “Housing Students only (Y/N)”. These parameters were incorporated with new options into the “Student Selection Type” parameter described above. Resp.: Teri Welter Status: To production on September 24. 10. 01-RM-AC Fiscal Year Calendar Modify the AR0335CB Accounts Receivable Roll Program 1. Add a parameter: “Print Error’s Only”. ‘Y’ = Yes, ‘N’ = No. Default = ‘Y’. When the ‘Y’ is used for this parameter – the report should: Display error messages for any receivable balances that cannot be rolled. Do not list the receivable transactions that will be posted when the program is run centrally. When the program is run in update mode – this parameter should maintain the default setting = ‘Y’. 2. Add an edit to not roll any third party customers that have any receivable balances that have a null invoice number. Produce an error message “Third Party Customer # XXXX has Null Invoice Number – Run the AR0250CP 3rd Party Invoice”. Resp.: Teri Welter Status: Released to production on 6/10/01. Open Issues: 1. 2. Should the date be changed on the Year Term Calendar for rolling receivable balances? Currently balances are set to roll on the last day of the fiscal year. Very few campus balances are completely rolled without errors. Currently the Receivable Roll Program only uses the crosswalk table as follows: a. b. c. d. Determine cost center for receivable balance Write the new RE to the same cost center If cost center is not valid in the new FY, use the cost center found on the crosswalk If no cost center found, produce error message The question was asked if it could or should be changed to the following: a. b. c. d. e. Determine cost center for receivable balance Review the crosswalk table to see if there is an entry for the identified cost center If yes, write receivable balance to the new cost center If no, write receivable balance to the current cost center If not valid in the new fiscal year, produce error message. Modify the AC0581CP MnSCU vs MAPS Trial Balance Add a parameter “Print Detail on Closed FYs” ‘Y’ = Yes, ‘N’ = No. Default = ‘N’ When the ‘Y’ is used for this parameter – the report will: Include the detail for ALL fiscal years even those that have been closed. Do not include the transactions that update fund balance for the closed fiscal years or the report will not be accurate. Resp.: Teri Welter Status: Released to production on August 7. 11. 02-DM- AR AR0138UG Cash Session At the user group meeting it was requested to "change the number of days to open a cash session from 5 days to 10 days". This will include the ability to back date or forward date a new session and reopen a previous session 10 days Resp.: Teri Welter Status: In design – low priority. 12. 02-DM-AR Modifications to AR0720 – ° Add totals to the bottom of this report for Columns "Aid Applied" , "Funds Applied", "Funds Not Applied". if Multiple terms are requested include a subtotal by term with a grand total for all terms. If this isn't possible, one Total including all terms will be acceptible. ° Add parameter option for report to be e-mailed. Resp.: Teri Welter Status: Submitted to development as a low priority. 13. 02-DM-AC Changes to AC0514CP ° Add a Grand Total Revenue and Grand Total Expense to the bottom of the report ° Add a blank line after Total Expense when multiple Cost Centers are displayed so that the report is easier to read. ° Add " User Field Parameter" as an optional parameter to the report ° Add the option to have the report E-mailed. Resp.: Teri Welter Status: Submitted to development as a low priority. 14. 02-DM-AR AR0390CB - Remove Business Office Holds Release of Business Office Holds when Funds are Applied Proposed Implementation Rules: a) Funds applied is run for a number of students and we know specifically which students had funds applied transactions. b) Look to see if any of these students have a 0031 - business office hold on their account. c) Any student that has a 0031 hold should have the hold program (CT1010CB) run by calling the hold program similar to the on line screens d) This will NOT cause new holds to be created if we only look at students that currently have a hold. Resp.: Teri Welter Status: Submitted to development as a low priority. 15. 01-DM-AR-New Paramter AR0370CP Non Student Balance Due Report a) The users would like the Cost Center Parameter Added. The E1_ACCT_NBR on persons with a balance due will contain the cost center. b) Add the option to have this report e-mailed. Resp.: Teri Welter Status: Submitted to development as a low priority. 16. 01-RM-FC Load Bldg and Room Inventory Work was completed in late October in the cleanup of problem data in ISRS, loaded from multiple sources, and crosswalk of data from Paulien study into ISRS. This work precedes our development of our own Space Utilization report(s) and the Facilities Condition Assessment process. Resp.: Dave Lund Status: Complete 17. 01-RM-FC Facilities Condition Assessment Design and development work is underway for managing Facilities Condition Assessment (deferred maintenance) data and creating an ongoing Facilities Condition Assessment process. Resp.: Dave Lund Status: Process modeling, database design, and initial screen design are progressing. Projecting rollout of first phase in 4th quarter. 18. 01-RM-FC Systemwide Capitol Project Reporting The Facilities Individual Project entry screen (FC0500UG) and report (FC0501CP) are being reviewed for completeness and functionality with Facilities and our Trainer, Robyn Olson. When we are all satisfied with the functionality in the existing process, Robyn will work with those institutions with outstanding projects to get them trained and comfortable with the process. Once confirmed that the data being collected is correct, we will work to identify the system wide reporting needs, and develop a strategy to meet those needs. Resp.: Dave Lund Status: Initial review has begun. A bug resulting in “Store” errors was discovered, and should be corrected quickly. If large changes are not needed to collect different data, this should be completed in the 4th quarter. 19. 01-RM-FC Space Utilization Report Development of Space Utilization Report modeled after Paulien Study, for use by campuses and system office. Resp.: Dave Lund Status: This project has been re-prioritized to follow other identified projects. Completion of the conversion project, and training of campus personnel to keep the data current, will allow extraction of the necessary data to have Paulien do the processing. This is not an ideal long term solution, however, as the campuses are not able to run the reports themselves to take advantage of the management tools, nor is the System Office able to run different variations on demand, to meet Board and Legislative reporting requests. 20. 01-RM-PR 1042-S This is a new process starting in calendar year 2001. MnSCU will send 1042-S tax forms to nonresident alien student employees who were covered under a tax treaty (exempt from federal and state taxes). Resp.: Lisa Liljedahl Status: I completed part of the project specification. I would say I’m about 75% done with the project specification. I have reviewed the project specification with Pat Martagon and Valerie Ingram and they approved. Development has started to work on the portion I have completed. At this time, we plan to display the 1042-S information on the PR0005UG screen (Employee W-2 Information). Also, we plan to add the 1042-S reprinting process to the PR0005CP report (W2 Reprinting). Milestones 11-21-01 - Project specification done. (ITS) 12-17-01 - PR0001UG, PR0005UG, PR0005CP, PR0005GR, and PR0905GR rolled to QC. (ITS) 12-31-01 - Cancelling of PR checks for CYR2001 completed. (Institutions) 12-31-01 - FICA/Medicare Refunds for CYR2001 completed. (Insitutions) 12-31-01 - Taxable graduate assistant stipends sent in. (Institutions) 01-04-02 - Graduate assistants stipends entered into ISRS. (ITS) 01-07-02 - Roll PR0001UG and PR0905GR to production. 01-09-02 - Balancing of W-2 and 1042-S records completed. (Pat Martagon and Valerie Ingram) 01-14-02 - Start printing W-2s and 1042-Ss. (ITS) 01-14-02 - Roll PR0005UG, PR0005CP, and PR0005GR to production. (ITS) 01-17-02 - W-2s and 1042-Ss sent to Central Mail. (ITS) 03-01-02 - IRS tape delivered to Pat and Valerie. (ITS) 21. 02-RM-PR W-2 Student employee W-2 process. Status: Changes due to 1042-S project. Milestones 12-17-01 - PR0001UG, PR0005UG, PR0005CP, PR0005GR, and PR0905GR rolled to QC. (ITS) 12-31-01 - Cancelling of PR checks for CYR2001 completed. (Institutions) 12-31-01 - FICA/Medicare Refunds for CYR2001 completed. (Institutions) 12-31-01 - Taxable graduate assistant stipends sent in. (Institutions) 01-04-02 - Graduate assistants stipends entered into ISRS. (ITS) 01-07-02 - Roll PR0001UG and PR0905GR to production. 01-09-02 - Balancing of W-2 and 1042-S records completed. (Pat Martagon and Valerie Ingram) 01-14-02 - Start printing W-2s and 1042-Ss. (ITS) 01-14-02 - Roll PR0005UG, PR0005CP, and PR0005GR to production. (ITS) 01-17-02 - W-2s and 1042-Ss sent to Central Mail. (ITS) 01-22-02 - W-2 tape for WI delivered to Pat and Valerie. (ITS) Might not be able to make this date since so close to the end of the printing process, will be delivered by 0128-02 at the very latest. 02-14-02 - W-2 tapes for IRS, MI, MN, and ND delivered to Pat and Valerie. (ITS) 22. 02-RM-PC 1099 Vendor 1099 process. Status: No changes this year. Milestones 12-10-01 - 1099 preview report submitted to Pat Martagon and Valerie Ingram. (ITS) 01-07-02 - Adjustments can be made on the SR0200UG screen. (Pat and Valerie) 01-17-02 - Done with adjustments by the end of the day. (Pat and Valerie) 01-22-02 - Start printing 1099s. (ITS) 01-23-02 - 1099s sent to Central Mail. (ITS) 02-14-02 - 1099s tapes/forms for IRS and MN delivered to Pat and Valerie. (ITS) 23. 02-RM-SR 1098T 1098-T Tuition Payment Statement A task force met to address concerns and questions raised after the Calendar Year 2000 1098-T’s were issued. Changes to the business rules have been completed and approved. Changes include: - Include eligible students in next tax year Spring Term; - Expansion of eligible object codes - Summarize financial data on the 1098-T form - Include Taxable Grad Assistant Tuition Waivers as paid charges - Include reimbursements or refunds of qualified tuition and related expenses of prior term payments - Remove Loans from Grants and Scholarships - Allow campus staff to produce reprints - Enhancements for use of additional address types. Resp.: Teri Welter Status: Business rules were drafted and submitted to Financial Reporting and Development Supervisor. Program changes are being made and preliminary testing has occurred. Outstanding Issues: 1. Need final approval on the object codes used for determining eligible charges. System office has submitted recommendation to legal counsel. 2. Students will be directed to use the On-line Student Account Display to view detailed financial information. Currently this is not available and has been delayed due to a web upgrade. It is also dependent upon campus IT staff to implement.