Finance User Group Meeting Minutes

advertisement

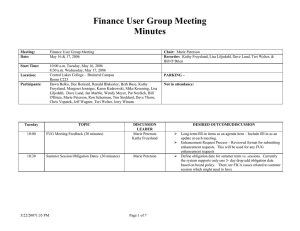

Finance User Group Meeting Minutes Meeting: Date: Start Time: Location: Participants: Finance User Group Meeting June 6, 2002 8:00 a.m. Rochester Community and Technical College East Hall Room EA103 Jan Ahmann, Century College; Dawn Belko and Rita Schulz, North Hennepin CC; Craig Erickson, Normandale CC; Connie Garrahy, Dakota County TC; Denis Kelly, St Paul TC; Deb Kerkaert, Southwest SU; Larry Margolis, Inver Hills CC; Dennis Paesler, Northland CC/TC; Ruth Siefert, Rochester CC/TC; Steve Smith and Jan Marble, Minnesota State University, Mankato; Rick Straka, South Central TC; Jeff Wagner, St Cloud SU; Jim Schneider, Campus Assistance; Rosalie Greeman, Assoc. Vice-Chancellor-Financial Reporting; Lisa Liljedahl, Finance Business Analyst; Dave Lund, Finance Business Analyst; Teri Welter, Finance Business Analyst TIME (min.) Thursday 8:00 8:45 TOPIC ISRS Current Status Web On-line Payments Update DISCUSSION LEADER Lisa Liljedahl, Dave Lund Teri Welter Dave Lund Teri Welter Chair: Recorder: Not in attendance: DESIRED OUTCOME/DISCUSSION 9:15 Break Jim Schneider Teri Welter Update on status of ISRS projects. See Document below. Discussed the possibility of an Early Billing that would include estimated financial aid included on the statement. The group agreed that this would be something to possibly pursue in the future but agreed that it is not a priority at this time. Pilot at Inver Hills CC is occurring on a limited basis. Five-second response time is being experienced for the time payment is entered to get a response. Minor problems have been identified and fixed. Full operation will begin at Inver in the next week or two. Campuses will need to contact Dave Lund to be signed up. It can take a significant amount of time to get a new merchant ID with the bank. Campuses are encouraged to begin this process as soon as possible if they are anticipating use on line Address verification – We will add this functionality so campuses can have this option available on a case by case basis. 9:30 10:00 10:15 10:45 11:00 Policies/Procedures ACC_5_5 Alliss Tuition Waivers funded from Alliss Foundation grant Capturing of revenue in Customized Training fund 120 Construction Project Managment Assesment Cost Alloca guidelines 2-02 revised JS Fiscal Calendar Gift Certificates sales Grant Indirect and Administrative cost reimbursement Institutional Finance- work plan Internal Sales Survey Loan transactions PeopleSoft 8.0 PR Module 1. W-2 and 1042-S Reprints at the Institution 2. A change to the Timesheet MAPS FUND Code Changes for MnSCU Future Meeting Dates August 15-16 @ Rochester College (?) Jim Schneider Rosalie Greeman/Lisa Liljedahl Lisa Liljedahl Margaret Jenniges Cost Allocation procedure will be strongly recommended to get into ISRS for FY02. This is final. Cost allocation program will not work for subsidized indirect cost because the program records this to cash. FR will review the impact of indirect Closing Fiscal Year – Need to post June 28 payroll, close transactions, update batch, do month end update prior to 6/30 midnight. Laptop programs can be moved out of the general fund but the Department of Finance must approve it. It appears that the interface to SEMA4 will still be available for MnSCU with the upgrade. Some SCUPPS changes will be needed. This upgrade will take place Spring of 2003. 1. Group agreed that reprints should continue to be done at the METE regional center rather than modifying ISRS to print a duplicate. 2. Timesheets are being modified. FUG members should get feedback to Lisa by 6/14. Information regarding this change and the affect on campuses will be given to CFFO’s at their meeting on 6/7. Recommendation is to combine June and January FUG meetings with CFFO Conference and invite others to sit in on the meeting. Next meeting will be October 10th @ Mankato SU. This will be the last meeting before members are rotated off and new members are added on the committee. Tasks Assigned as Action Items # Originatio n Date 1. 02/23/01 2. 05/24/01 3. 08/09/01 4. 11/15/01 Critical Due Date Description Assigned to Status Need an AG opinion on whether or not we are obligated to follow 16A.49 “Refunds of $1 or less”. – Will be included in AR Collections project. User Group would like a total on the AC0450UG. Al agreed to put together some possible rules as to what makes sense for different transaction types. Add as a discretionary maintenance item. Set up task force to discuss statements for bills – add Denis Kelly to the group. Rosalie Note sent to AG on May 2. Al Finlayson/Teri Welter Added as a Discretionary Maintenance Project Teri Welter This will be done when business rules are defined for AR Collections –Phase II Will get query out on web Third party receivable balance by TP customer and student query moved to replicated query library Jim Schneider 5. 2/21/02 Work with Atomic to determine what process would be used to verify credit card payments when Credit Card Company requests verification (proof). Dave Lund 6. 2/21/02 Note: Jan mentioned that two payments are getting processed so more is paid than the balance due. Need to determine how we would handle this in the On Line Web process. Hopefully we would not accept the payment. Dave Lund 7. 8. 2/21/02 2/21/02 Dave Lund Karen Kedrowski 9. 2/21/02 10. 2/21/02 11. 2/21/02 Need to document the reconciliation process as it pertains to voids. Discuss with Richard Tvedten regarding courses that end before 6/30 and what term they should be recorded in. (Summer vs. Spring) Investigate the possibility to have a summary option on MAPS interface report or summarize JC transactions on the interface program. Add the ability for Business Manager or Purchasing Head security levels to blank out the Ship to Bldg Code field. That way the institution’s address won’t appear on the P.O. and they can write special instructions to get it mailed to an off-campus site. For example, to a resort that they are having a conference at. Requestor would need to insert a memo on the memo screen with a request to have it changed. This will be added as a discretionary maintenance item. Allow users to record a comment in the transaction description field on general receipts. Explore the possibility of adding comments as a parameter option on the AC0531CP report. Check with internal audit as to whether campuses should be using positive pay. 12. 13. 2/21/02 14. 2/21/02 Explore the possibility of having the check confirmation report sent to a file so that it can be sent to the bank. Dave Lund Atomic reports that this has not been an issue – detail available through Merchant Console and description of our security should be sufficient. If a second payment were processed, the payment would not have a transaction in our system to match, so it would not result in a double posting to ISRS. A discrepancy between the totals of the two systems would result, and should be easily identified when reconciling. Will add as Discretionary Maintenance Project. Lisa Liljedahl Teri Welter Teri Welter Deb Winter Lisa Liljedahl Add as a discretionary maintenance project Add as a discretionary maintenance project Rosalie is trying to get copies of court cases from US bank to run by MnSCU General Counsel to try to determine who really is liable if we decline to go on positive pay 03-22-02 - sent an e-mail to Deb W. stating the fields on the AP0103CB report. I don’t think it has everything that the bank needs. 15. 6/6/02 Can other campuses get the report that Al did for the 6 campuses being audited? 16. 6/6/02 17. 6/6/02 How do the campuses get around the personal guarantee at Wells Fargo when Dave Lund setting up a new Merchant ID? Suggestion from group was to work with AG office to get this language removed from the contract. Follow up with Inver Hills and others for their experiences. Customized training revenues – not consistent – Does all customized revenue Jim Schneider have to be in fund 120. Need procedures for this. Can W-2 and 1042-S information be displayed on web? Lisa Liljedahl Office of the Chancellor Representatives: 18. 6/6/02 Campus Members: Jan Ahmann, Century College Dawn Belko, North Hennepin Community College Craig Erickson, Normandale Community College Connie Garrahy, Dakota County Technical College Denis Kelly, St Paul Technical College Deb Kerkaert, Southwest State University Larry Margolis, Inver Hills Community College Dennis Paesler, Northland Community and Technical College Ruth Siefert, Rochester College Steve Smith, Minnesota State University, Mankato Rick Straka, South Central Technical College Jeff Wagner, St Cloud State University Teri Welter Sent to Al on 6/10: Al, At the FUG the campuses asked whether or not they could get access to the aging report that you did for Winona and are going to do for the 6 campuses being audited? Rosalie Greeman, Assoc. Vice-Chancellor-Financial Reporting Karen Kedrowski, Program Dir. - Budget Lisa Liljedahl, Finance Business Analyst Dave Lund, Finance Business Analyst Jim Schneider, Campus Assistance Teri Welter, Finance Business Analyst Internal Audit Representative ISRS CURRENT STATUS Data Problems Balances in Object Code 9001 that do not balance to the students account. These items need to be complete prior to updating Fund Balance. Items in FY 2001 amounting to approximately $15,000 systemwide include: ° Missing JG’s on Waiver Corrections ° Check assurance issues ° Campuses with receivable balances in 2001 still needing to be rolled Resp.: Campus Assistance and Teri Welter Status: Complete ISRS Updates 1. AR Collections Resp.: Teri Welter Project Description This project is broken into two phases. ° Phase I which Includes - Write-off Process; identifying collection activities taken on a student; identifying students at outside collection agencies; identifying customers in bankruptcy; modify billing programs as needed to support business rules. Status: Development has begun with the focus geared for creating the Write Off Transaction. ° Phase II which Includes – DOF Quarterly reporting including a new Write Off Report; aging reports; billing changes, assessing late fees; assessing interest charges. Status: A majority of the business rules have been recorded into the Business Process Model. Billing changes appears to be the major piece that has not yet been defined. 2. PALS Interface Project Description: Provide an automated interface between the PALS library system and ISRS Accounts Receivable. On a nightly basis, a batch program will run which will place new library fine charges on student accounts, and will inform the PALS system of payments made against outstanding charges. Resp.: Dave Lund Status: Complete – Released and Notice was sent to campuses. 3. 01-TI-AR - AR Redesign General Project Status: AR Redesign Project – Phase I – “To prepare the ISRS 3-tier architectural framework that will support accounts receivable functions using a variety of business tools, including client/server and web. This will provide a solid foundation upon which accounts receivable functionality may be re-constructed and expanded.” Resp.: Teri Welter Status: This has been released to the On line payment pilot site – Inver Hills. Open Issue: Data management issues 4. 01-T1 - MnSCU Online Payments Student Account Display Resp.: Dave Lund Status: Online acceptance of credit card payments has begun at a pilot site. Initial testing appears successful, but will be evaluated through the entire process before the next step is taken. Testing will thorough. 5. 01-RM-PC Vendor Deletion Resp.: Lisa Liljedahl Status: PC0031UG, PC0048UG, AC0228UG, and some additional programs were rolled to QC and have been tested and are waiting to roll out to production but we don’t want them to roll out until Dept. of Finance has done the deletion process. We sent a test file to Dept. of Finance and we are waiting to hear back if it was successful or not. Then we need to receive a test from them and if everything goes well, Dept. of Finance estimates deleting vendors on 07-01-02. Also, the date changed. Previously, they were going to delete vendors that didn’t have any activity after 06-30-98 and this has been changed to 06-30-00. 6. 02-RM-AC Fiscal Year Calendar New Appropriation Object Code 9004 – This was added for FY2003. AC0410CB MAPS Interface Batch was modified so that the Appropriation is not interfaced to MAPS - it is only recorded in ISRS. Critical Date: 4/30/02 Status: Released to Production on 4/25/02 Updated Fund Balance – Includes FY 2001 data cleaned up, remaining AR balances rolled, data assurance programs run for all campuses and final fund balance program run to close FY01. Critical Date: 6/01/02 Status: Released to Production on 4/30/02 7. 01-RM-FC Facilities Condition Assessment Design and development work is underway for managing Facilities Condition Assessment (deferred maintenance) data and creating an ongoing Facilities Condition Assessment process. Phase I – Assessment entry and Maintenance Phase II – Project and Scenario Creation Phase III – Life Cycle Management Resp.: Dave Lund Status: Phase I is in production, with a few design corrections identified, and expected to roll to QC in June. Training is being conducted regionally, and the opportunity is being used to introduce some campus Facilities personnel to ISRS. For Phases II and III, Process modeling, database design, and initial screen design are progressing. 8. 01-RM-FC Systemwide Capitol Project Reporting The Facilities Individual Project entry screen (FC0500UG) and report (FC0501CP) are being reviewed for completeness and functionality with Facilities and our Trainer, Robyn Olson. When we are all satisfied with the functionality in the existing process, Robyn will work with those institutions with outstanding projects to get them trained and comfortable with the process. Once confirmed that the data being collected is correct, we will work to identify the system wide reporting needs, and develop a strategy to meet those needs. Resp.: Dave Lund Status: This project is now awaiting conclusions and direction from Facilities. 9. 01-RM-FC Space Utilization Report Development of Space Utilization Report modeled after Paulien Study, for use by campuses and system office. Resp.: Dave Lund Status: This project has been re-prioritized to follow other identified projects. Completion of the conversion project, and training of campus personnel to keep the data current, will allow extraction of the necessary data to have Paulien do the processing. This is not an ideal long term solution, however, as the campuses are not able to run the reports themselves to take advantage of the management tools, nor is the System Office able to run different variations on demand, to meet Board and Legislative reporting requests. 10. 02-RM-SR Financial Reporting Changes to ISRS Priorities have been submitted to support financial reporting 1. Fundware Implementation includes the following: 2. 3. 4. 5. 6. 7. 8. a) Write programs for loading Chart of Accounts - Complete b) Installation of Fundware - Complete c) Create new tables in ISRS to support Fundware COA - Complete d) Write program to load balances from FY01 financial statements – In Development e) Write program to reverse financial statement entries - In Development f) Write programs for data extracts from ISRS- In Development Equipment Modifications includes the following: a) Modify depreciation calculation - Complete b) Modify system to enforce rules for equipment and fund determination – In QC c) Clean up Equipment data according to the business rules d) Modify equipment reports as needed for module changes Modify the Grant/Project Screen - to record additional grant information including: Advance or Reimbursement; Match Required; Match % or amount; Sub Recipient; Sub Recipient Name. Critical Date 5/31. Complete Occurrence Date Edits - Modify various transaction screens that will be identified by the system office so that Occurrence Date default is modified either to not default any date or add logic to default a more realistic date. Critical Date 6/15. In QC. Labor Distribution Modification: Modify the current labor distribution process to post an entry to the payroll clearing general ledger that debits Object Code 8199 and credits Object Code 8110. Critical Date - none. Done Manually until released AP Assurance report verifies object code 8600. Critical Date – none. Run old Rebuild Lease Screen to include additional information for leased facilities. Critical Date 6/30 Extract aged receivables by customer for six colleges being audited. Critical Date 7/31. Status: Winona was run – waiting for FR feedback. Resp.: Teri Welter Status: See individual items above in bold. 11. 02-RM-AC Modify CITA interface Modify the MAPS CITA interface to NOT add the dash and two digit number to the invoice field when there are multiple lines for a vendor. Evidently, this is causing a lot of the problems for the vendors as they are trying to tie out EFT payments. Resp.: Teri Welter Status: Complete 12. 02-RM-FA Heso – Minnesota State Grant Changes Awards will now be calculated based on actual tuition and fees. Manual charges entered into AR may relate to a course but this is not reflected in the system. Because not all courses are eligible under the MN St Grant rules, the manual charge cannot be identified as to whether it is eligible. Modify the Accounts Receivable module to support the calculation of the Minnesota State Grant Financial Aid awards by: 1. Non- Refundable Course Fees – These fees are recorded manually because the tuition calc program will remove any associated course fees if the student drops the course prior to the total obligation date. In order to allow users to automate this charge the suggested changes are needed. This will allow the aid applied process to identify these as eligible or non-eligible charges because the course id is associated with the fee. a) Add a field to AR_SPL_FEES table to identify a course fee as Non-Refundable. b) Modify the Tuition Calc program to read whether the fee is Non-Refundable. If yes, do not remove fee if course is dropped. The question was raised whether this practice was within the MnSCU refund policy. After further investigation into the type of fees this was to support, it was determined that the fees were not always refundable. This has been removed from scope and the campus was advised to use a different business practice for charging these fees. Laptop fees – Some of these fees are eligible. Campuses are now assigning a course to laptop rental and registering the student in the course. Should Laptop Fees be considered an Administrative Fee? What screen should we generate this fee from? Issue: How to identify which admin fees are eligible? Issue: Test out fees - were identified as fees that could be eligible. Currently there is not a uniform process for recording these fees. Until a process is defined, these will not be included in this project. Resp.: Teri Welter Status: Business Rules being defined. 13. 02-RM-PR Grad Asst/Supp Tax A process to handle the graduate assistants’ tuition waivers. Also, there are some earnings types that should be taxed based on the supplemental tax method and currently they are being taxed based on the tax tables. Resp.: Lisa Liljedahl Status: Had a taskforce meeting to come up with the procedure to handle graduate assistant tuition waivers. Modified the existing Award ID 10072 to be used for nontaxable tuition waivers and added a new Award ID 10189 to be used for taxable tuition waivers. I need to work on getting the BPM documented and the implementation rules completed. Review with Development and then give to the taskforce to review. 14. Nonresident Alien Student Employee Modifications and bugs that were discovered after reporting 1042-Ss to the IRS for the first time. Also, changes that came up during the training sessions. 1. 2. 3. 4. 5. 6. 7. 8. Multiple Visa records – look at most recent Visa record. Multiple Port of Entry records – look at oldest Port of Entry record. Student at multiple colleges in a CYR – need to combine 1042-S earnings from all institutions when checking if earned more than max treaty amount. If 8233 year is deleted – change all the earnings to go to a W-2 instead of a 1042-S. When checking earnings against max treaty amount we need to only look at 1042-S gross earnings and not W-2 earnings. Once this is rolls out then we will need to see if any students were changed to have taxes deducted out before earning the max treaty amount. If nonresident alien then should be FICA/Medicare exempt and don’t allow the user to override this. Once this rolls out then we will have to see if any nonresident aliens had FICA/Medicare deducted and inform the institution to complete a FICA/Medicare refund. If the nonresident alien has a F-2 or J-2 Visa then in most cases they aren't eligible for treaty benefits. So, just warn the user if they try to set as exempt. Nonresident alien student employees need to have an active passport to be an employee. Put an edit in so you can’t activate on the PR0021UG unless they have an active passport. Also, this audit process will run during the final payroll process. Warn the users that the passport is going to expire in 6 months. 9. When changes are made on the PS0016UG or PS3001UG screen after final payroll has been processed then it could change what tax form the earnings should be reported on. So, it could change it from going to a 1042-S to a W-2 (we are only concerned with the ones that would be changed from a 1042-S to a W-2 since they would have to have a 8233 Form on file to have the earnings on a 1042-S and this should be entered in the PR Module). Since we are assigning which form (W-2 or 1042-S) they go to during the final payroll process, if changes are made after the final payroll process then we need a process to catch these and change them to a W-2 instead. So, when final payroll is processed run a program to look for any changes that would cause the person to go from a 1042-S Form to a W-2 Form. For example, PS0016UG was changed from nonresident alien (02) to resident alien (03) with an effective date of 03-08-02 but it was changed after final payroll for PPE 0312-02 was processed so the PPE 03-12-02 earnings are assigned to go to a 1042-S but now they should go to a W-2. Change the earnings to go to a W-2. Write an informational audit message to the PR0120UG screen. Then send an e-mail to the user. Users will need to fill out their e-mail address on UT3020UG. This screen will be available for users who have a PR_01H or PR_02H rights identifier. Resp.: Lisa Liljedahl Status: BA Testing – almost ready to go to QC. 15. MAPS FUND Codes The Department of Finance has requested MnSCU to be moved to their own funds in MAPS. In ISRS the MAPS fund codes will be changed on 6/30. More information will be sent to staff working in MAPS regarding the impact this will have on the activity in the document listing and MnSCU to MAPS reconciliation’s. Note – this will not impact the MAPS General Fund 105. Discretionary Maintenance 1. CI000010 – Issue Inquiry Revision To provide a better method of retrieval of job information, especially by Buyer Cost Center and Job Level Reverence number. Project Description: Modify existing query. Resp.: Dave Lund Status: In development, low priority. 2. CA000010 – Posting Duplicate Avoidance Modify programs to prevent posting of duplicate accounting transactions. Project Description: 1. Move posting program into Accounting batch runstream, which would prevent it from being run more than once each day. Resp.: Dave Lund Status: In development, low priority. 3. 02-DM- AR AR0138UG Cash Session At the user group meeting it was requested to "change the number of days to open a cash session from 5 days to 10 days". This will include the ability to back date or forward date a new session and reopen a previous session 10 days Resp.: Teri Welter Status: In design – low priority. 4. 02-DM-AR Modifications to AR0720 – ° Add totals to the bottom of this report for Columns "Aid Applied" , "Funds Applied", "Funds Not Applied". if Multiple terms are requested include a subtotal by term with a grand total for all terms. If this isn't possible, one Total including all terms will be acceptible. ° Add parameter option for report to be e-mailed. Resp.: Teri Welter Status: Complete – 2/25/02 5. 02-DM-AC Changes to AC0514CP ° Add a Grand Total Revenue and Grand Total Expense to the bottom of the report ° Add a blank line after Total Expense when multiple Cost Centers are displayed so that the report is easier to read. ° Add " User Field Parameter" as an optional parameter to the report ° Add the option to have the report E-mailed. Resp.: Teri Welter Status: Complete 6. 02-DM-AR AR0390CB - Remove Business Office Holds Release of Business Office Holds when Funds are Applied Proposed Implementation Rules: a) b) c) d) Funds applied is run for a number of students and we know specifically which students had funds applied transactions. Look to see if any of these students have a 0031 - business office hold on their account. Any student that has a 0031 hold should have the hold program (CT1010CB) run by calling the hold program similar to the on line screens This will NOT cause new holds to be created if we only look at students that currently have a hold. Resp.: Teri Welter Status: Complete. 7. 02-DM-AR Modify AR_16 Security AR_16 Security is used for setting up Students to receive Third Party Awards and to assign Third Party customers to awards. Users that do not have security to record this activity often have a need to review it in order to respond to student questions or analyize financial aid issues. Modify AR_16 security to include a High and Low security per security standards. Low rights will not have any update rights. Resp.: Teri Welter Status: Submitted to development as a low priority. 8. 02-DM-AC AC0521CP – New Parameters Detail on closed years similar to the AC0581CP. Any additional parameters needed? ° Ability to run the trial balance for a given date so you don’t have to be present on the last day of the month to run it? ° E-mail report? Resp.: Teri Welter Status: Requirements being defined. 9. 02-DM-AR SSN field on AR0119UG for Third Party Customers The AR0119UG screen includes the student SSN number in the grouping so that campuses can identify which student they are applying payments to. More and more Customized Training departments are using the Third Party process often they do not have students SSN #s when they record them in the system and ISRS doesn't require it. For third party customers, if there is no SSN available to be displayed in the "3rd Pty/SSN" field, display the student tech ID instead. Resp.: Teri Welter Status: Complete 5/20/02 10. 02-DM-PR MW-R Create a MW-R audit process in the PR Module. For a student employee who claims to have states taxes withheld from a state other than MN and the state has a reciprocity agreement with MN then he/she needs to have a MW-R Form on file each calendar year. If the employee had a MW-R Form on file for the previous calendar year then there is a grace period to get the MW-R Form on file for the new calendar year. The grace period is until February 28th. After February 28th, if the employee doesn’t have a MW-R Form on file for the new calendar year then the employee’s federal and state W-4 allowances stay the same but the state the withholdings are being deducted for changes to MN instead of the reciprocity state. Resp.: Lisa Liljedahl Status: BA Testing – almost ready to go to QC.