Disequilibrium as the Origin and ... (1967) Microfoundations of Monetary Theory

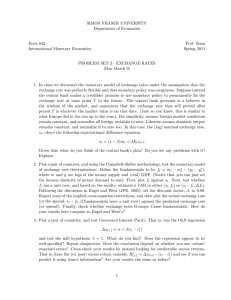

advertisement