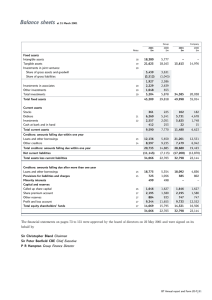

Notes to the financial statements

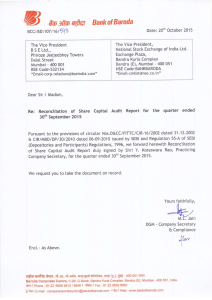

advertisement